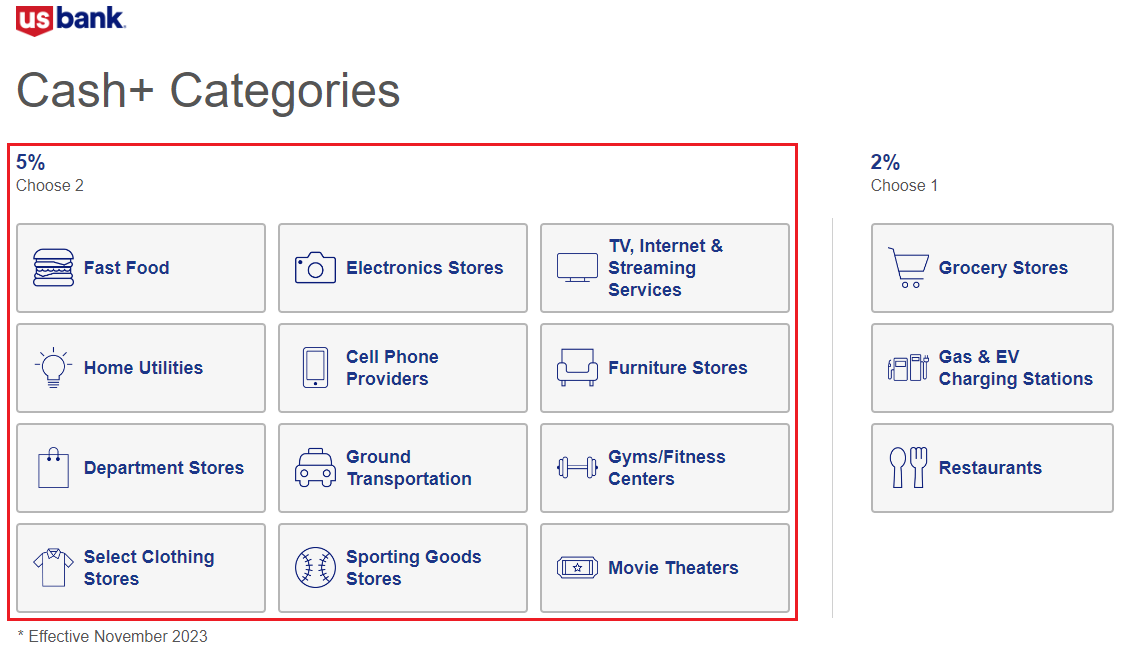

Good evening everyone. I spend a lot of time with my credit cards and banking apps (probably more time than most normal people should), but I wanted to share a quirk I noticed with the US Bank Cash+ Credit Card. I love this credit card so much (I have 2 of them), because of the ability to select 2 different 5% cash back categories each quarter, and you can select the same 2 categories each quarter.

The 2 categories that I have picked lately are Home Utilities (which covers water, gas, electricity, trash, etc.) and TV / Internet / Streaming Services (which covers all the well known and niche streaming services I have tried). Now, this is where the quirkiness comes in…