Good afternoon everyone, I hope your week is going well. I’m kicking off a new series on the blog called Miles & Points Mantra, where I’ll be sharing the personal “rules” I follow when it comes to using airline miles, hotel points, credit card rewards, and all things travel. I try to follow these rules 100% of the time, but I have been known to break the rules from time to time. Whether you’re brand new to travel hacking or a seasoned pro, I’d love to hear if you agree or disagree with these “rules.” I have a long list of mantras to share, but if you have one you swear by (or want me to cover), please share it in the comments section below. Let’s get started…

Miles & Points Mantra #2: “Book Flights Now, Then Set Up Google Flights & Points Path Alerts”

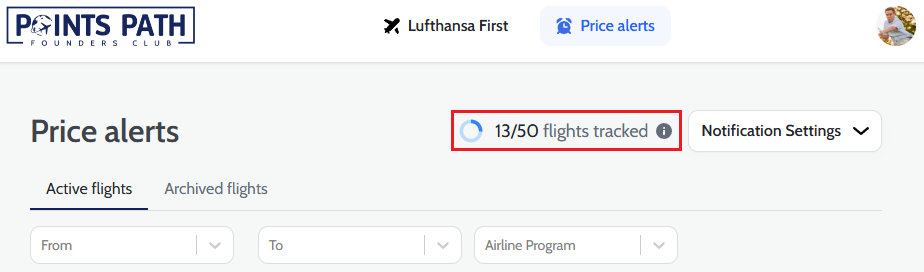

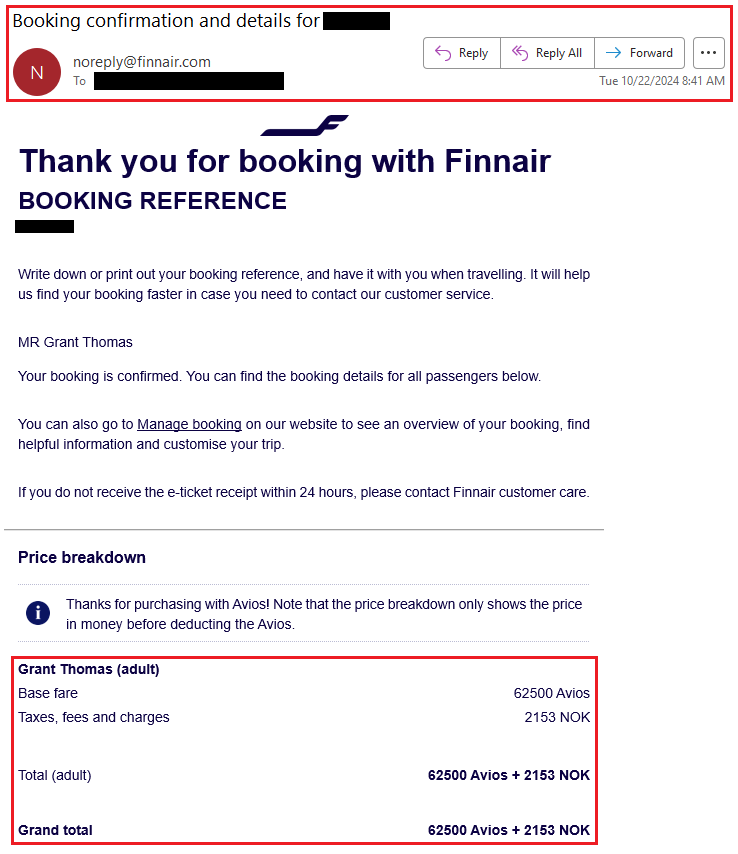

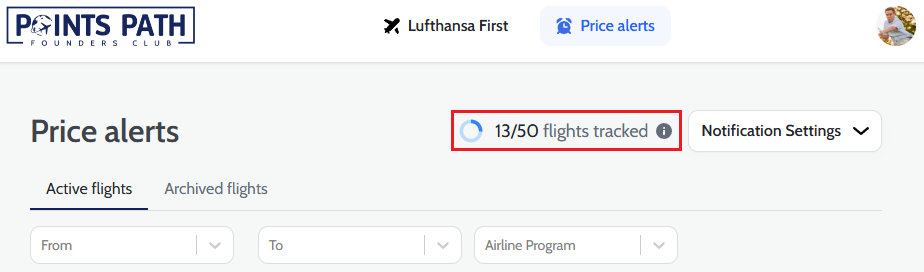

Whenever I am looking for paid or award flights, the first place I start is at Google Flights. Most of the time, I know exactly where I want to go and have a preferred departure time in mind. In a perfect world, my preferred flight will be the cheapest option, but in reality, it is usually not. In addition to Google Flights, I use Points Path, which is an awesome browser extension that runs on top of Google Flights and displays the cheapest award price option next to the cheapest paid option. As a paying Points Path Founders Club subscriber, I have the ability to set up 50 award alerts that run simultaneously that I use to track specific flights and I receive email alerts whenever the award price increases or decreases (this happens almost daily).

Continue reading →