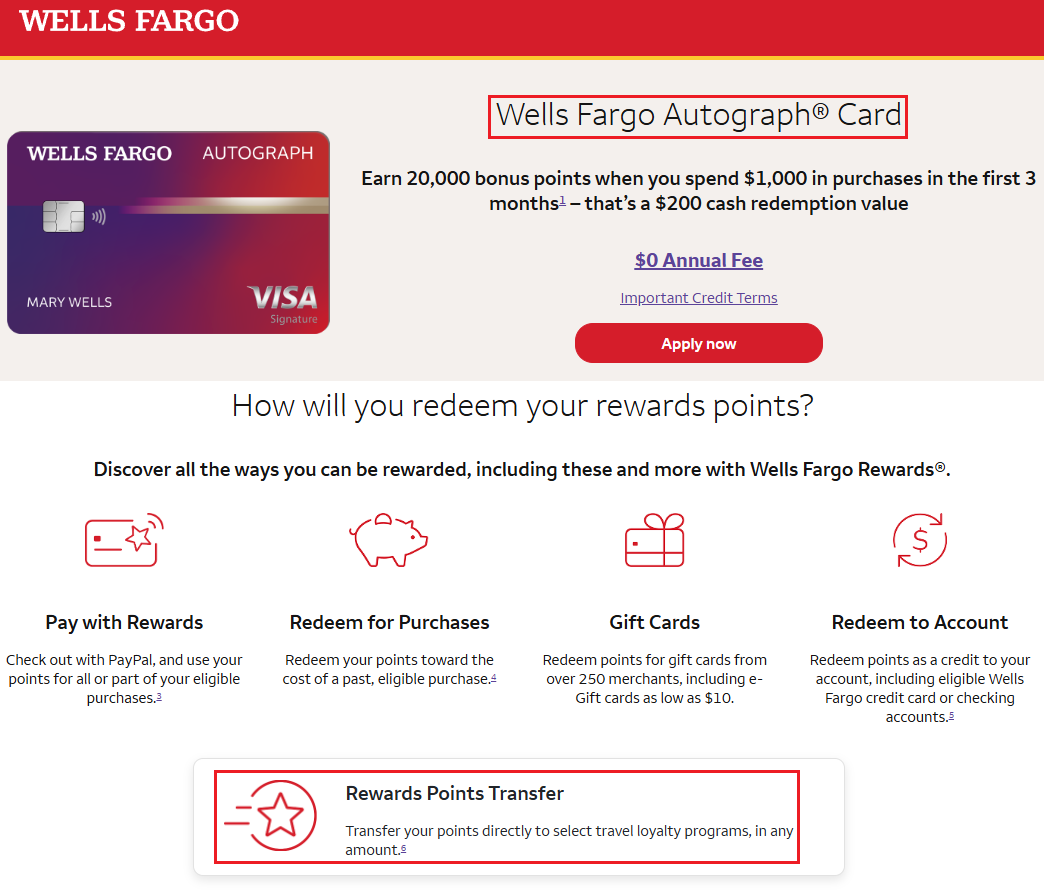

Good afternoon everyone and happy Friday! A warm welcome to any former Bilt Card 1.0 members who may have found their way here. By now, you’ve likely received your no annual fee Wells Fargo Autograph Credit Card and are wondering: What should I do with this card, should I keep it?

While the Wells Fargo Autograph offers decent bonus categories, my favorite feature is something far less flashy, but far more useful to me: you can earn transferable points and move them to airline and hotel partners without paying an annual fee. This is a huge deal if you ever need to top off an account with fewer than 1,000 points. There are no minimum transfer amounts, which means no orphaned points stranded after a redemption. That combination is wonderful, but not very common in the miles / points space.