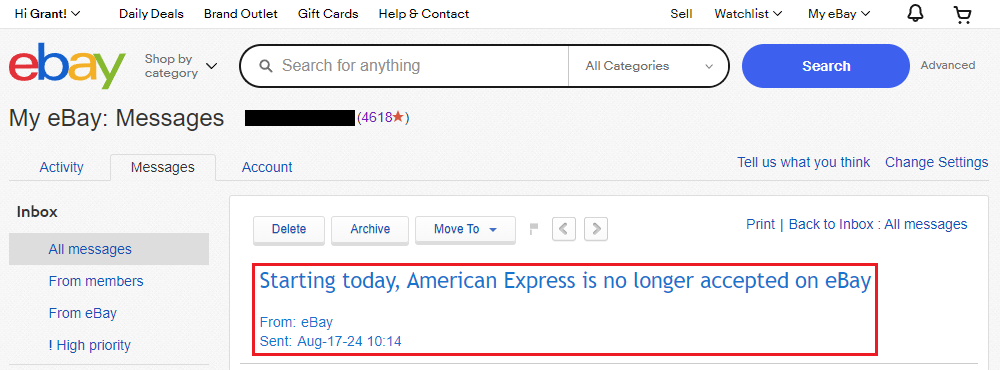

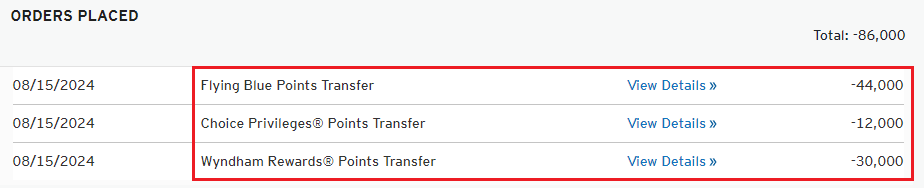

Updated 8/15/24 at 2pm PT: With 2 Citi ThankYou Points (TYPs) transfer bonuses set to expire in 2 days on August 17, I decided to take advantage of them before the deadline. As a reminder, here are the transfer bonuses:

-

- 25% transfer bonus to Air France / KLM Flying Blue (expires August 17, 2024)

- 20% transfer bonus to Wyndham Rewards (expires August 17, 2024)

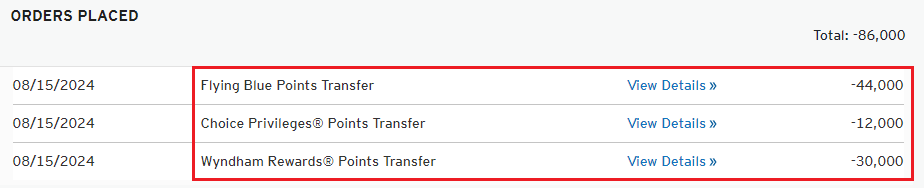

I was lucky enough to snag one of the Super 8 promo packages (15,000 Wyndham Rewards Points for $8.88), so I currently had 45,000 Wyndham Rewards Points. I wanted 90,000 points for 6 nights at the 15,000 point pricing or 3 nights at the 30,000 point pricing (which I will probably use to book a 3 night Vacasa vacation rental up to $500 / night). Since I also have a Barclays Wyndham Rewards Earner Business Credit Card, I get a 10% discount on award bookings, so instead of 90,000 points, I only need 81,000 points. Here is the math: 81,000 points – 45,000 points = 36,000 points / 1.2 (for the 20% transfer bonus) = 30,000 points. I transferred 30,000 TYPs into 36,000 Wyndham Rewards Points and combined with my existing 45,000 points, so my new balance is 81,000 points.

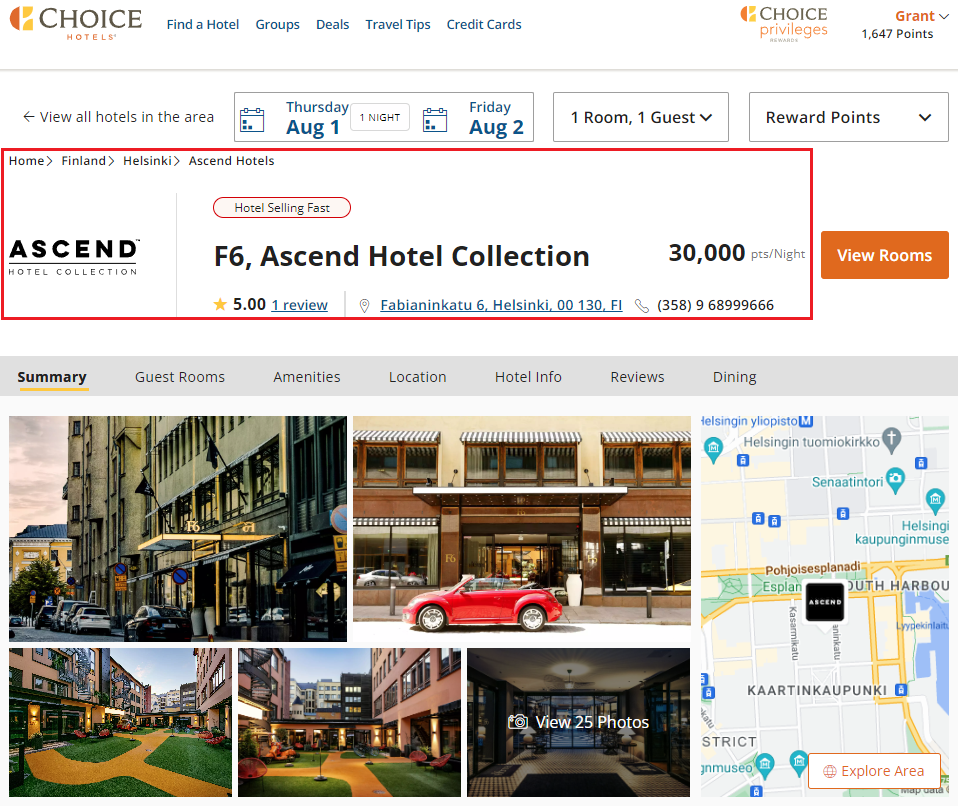

I needed to book a hotel for 1 night and found a Radisson hotel for 25,000 Choice Hotels Points. I currently had 1,000 points, so I transferred 12,000 TYPs into 24,000 Choice Hotels Points (thanks to the 1,000 : 2,000 transfer ratio). 24,000 points + 1,000 points = 25,000 points.

Lastly, I wanted to use up the remaining expiring TYPs for a transfer to Air France / KLM to take advantage of the 25% transfer bonus. I had 43,370 expiring TYPs, so I transferred 44,000 TYPs into 55,000 Air France / KLM Flying Blue Miles which I hope to use for a business class award to / from Europe next Summer.

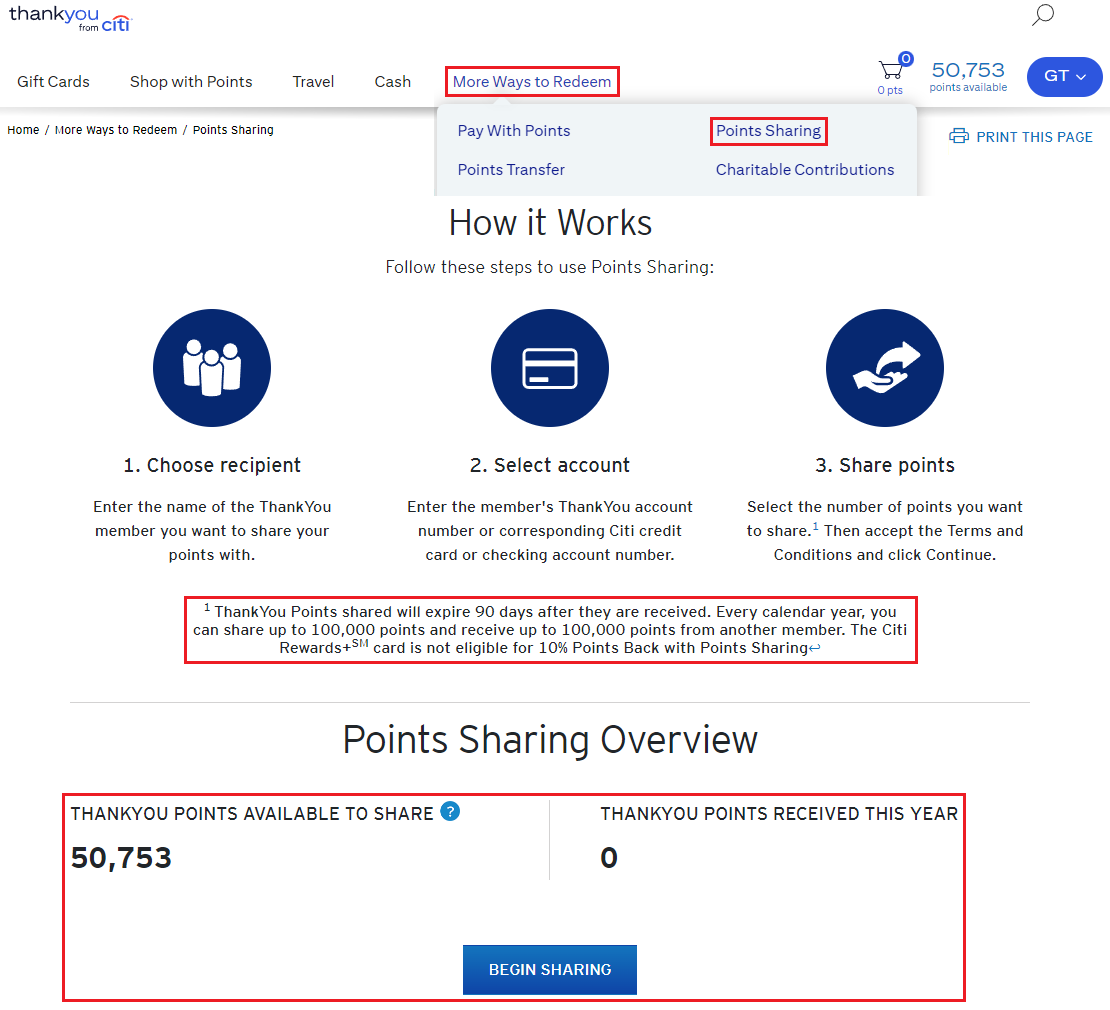

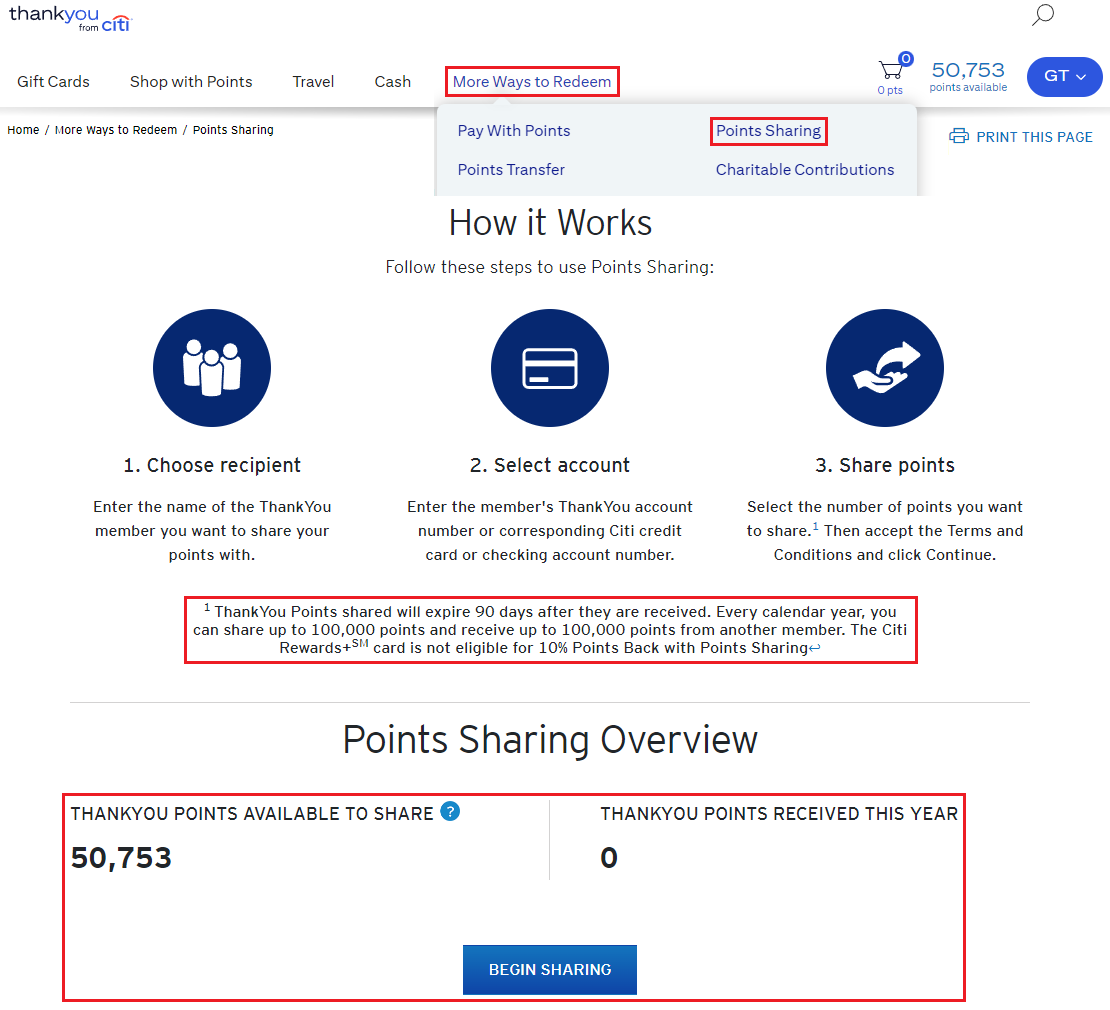

Good afternoon everyone. A few weeks ago, Laura transferred all 85K Citi ThankYou Points (TYPs) to my account in preparation of converting her Citi Strata Premier Credit Card into a no annual fee Citi credit card. Now I have 85K TYPs that I need to use / redeem within 90 days before they expire. In this post, I will walk you through the transfer process, show you how to find your points expiration date, and share my thoughts on how I plan to use the TYPs before they expire.

To get started, here is how you transfer your TYPs to another user. Sign into your TYP account, click on More Ways to Redeem, and click on Points Sharing. As mentioned above, once you transfer the TYPs, the recipient has 90 days to use the points before they expire. Each calendar year, you can transfer out up to 100K TYPs and you can receive up to 100K TYPs. You can transfer any amount of points from 1 point up to your entire balance. Lastly, you will not earn a 10% rebate by transferring points to another user if you have the Citi Rewards+ Credit Card.

Continue reading →