Good morning everyone, I wanted to respond to Frequent Milers’s post (My manufactured spend strategy) and share my own MS strategy. You will probably be surprised by my strategy, maybe inspired, and maybe even disappointed. Let’s get started…

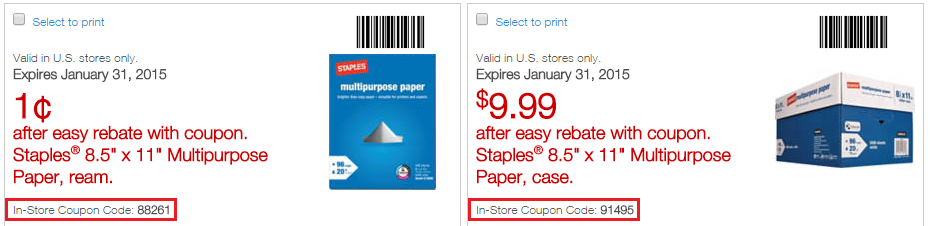

Every Sunday, Staples releases their latest Easy Rebate offers/coupons here. This week, we have more paper on sale and a few smaller deals, like $5 off food and tape.

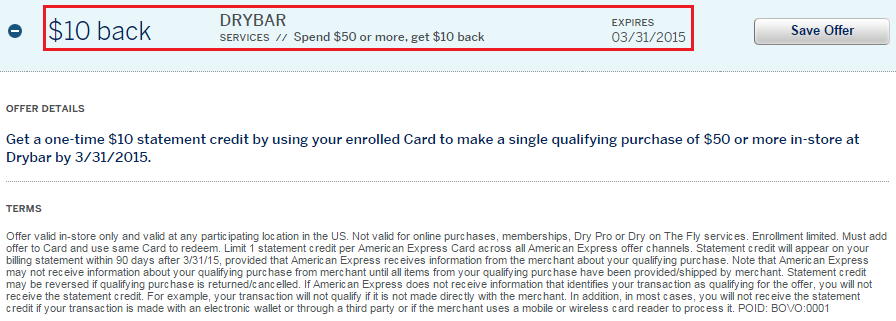

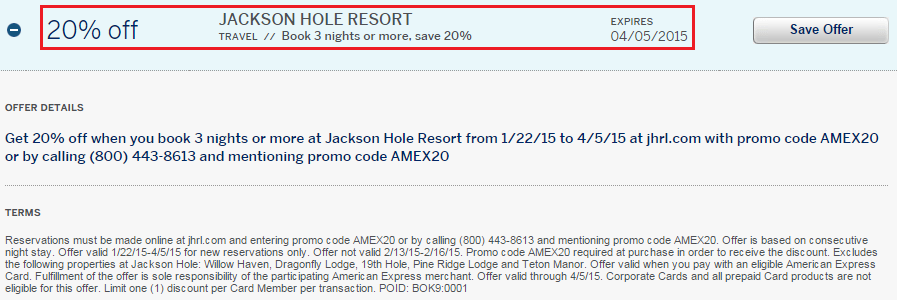

I check American Express Offers twice a day (first thing in the morning and last thing I do at night). Here are the 2 newest offers I found in my American Express account:

I then check my Chime Card to see if there are any new offers, then skim through Fat Wallet Forum and Slick Deals. I haven’t found anything great there yet. Now I will compare my MS strategy with Frequent Miler’s strategy. Greg recommends creating a strategy, such as this:

My goals

I’ll probably elaborate on my 2015 goals in a future post, but for now here’s a short list, specific to manufactured spend:

- Continue to qualify for high level Delta elite status for myself and my wife (see “How to manufacture Delta elite status”).

- Sign up for the best credit card offers and meet minimum spend requirements.

- Take advantage of category bonuses and spend bonuses such as the Chase Freedom and Discover It quarterly 5X categories, and the occasional targeted offer (for example, my wife was recently offered 15,000 bonus miles if she spends $500 per month for 3 months with her US Airways credit card).

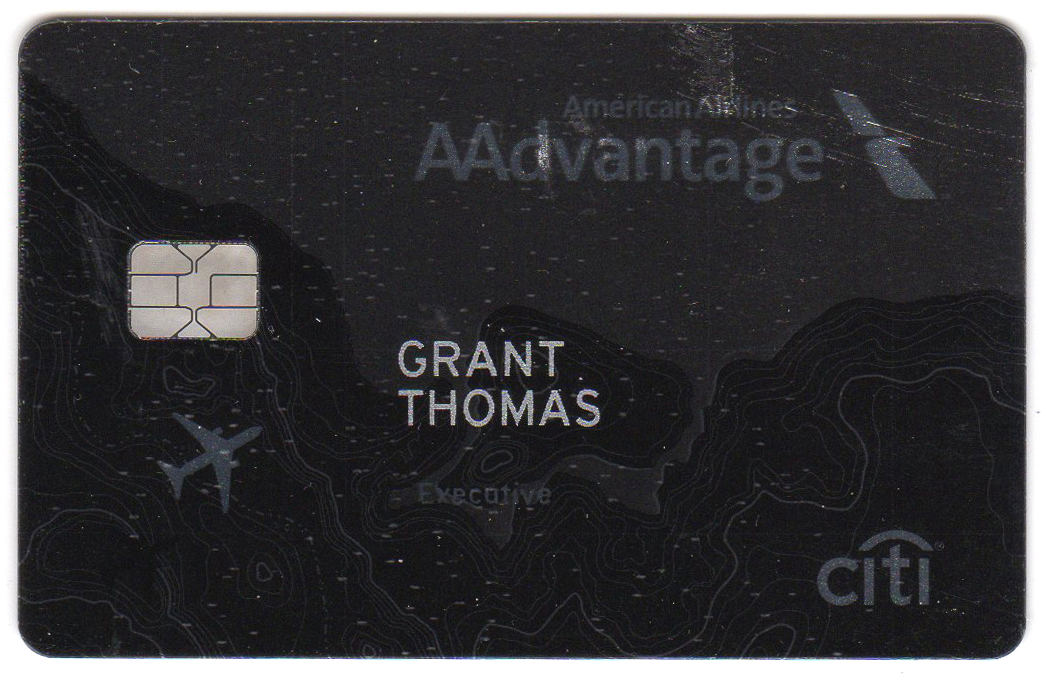

- Consider spending $40,000 on an AA Executive card to earn 10,000 elite qualifying miles

It’s worth pointing out some things that are not on the list:

- Earn cash back

- Maximize all avenues of manufactured spend

I agree with some of Greg’s goals, except for achieving Delta elite status (never going to happen for me) and spending $40,000 on the Citi AA Exec card to achieve 10,000 AA EQMs (never going to happen for me). As you can probably guess, I don’t care about airline elite status, I am a free agent and love it. I also like that Greg said that he does not MS solely for cash back and does not maximize all avenues of MS.

Old Blue Cash

I have an active OBC card, but only spend about $1,000 / week at pharmacies and grocery stores (some real purchases, but mostly MS). Since the OBC card has a $50,000 yearly cap on 5% cash back categories, spending about $1,000 per week for 52 weeks should reach the max toward the very end of the year. The cash back I earn on the OBC is used to offset other MS expenses (mainly $6.95 gift card activation fees for $200 Staples Visa Gift Cards).

Greg wrote a post a few months ago called Quickest spend to real stays. In that post, he compared the cost to MS the number of required hotel points for a mid tier hotel stay in comparison to MSing on a 5% cash back card. In all cases, MSing cash back was cheaper than MSing for hotel points, assuming a $300/night hotel stay. Even though the math is clear, it would be extremely hard for me to justify spending $300/night on a hotel. I mean, there has got to be a cheaper Courtyard Marriott, Hilton DoubleTree, or Holiday Inn Express around the corner, right?

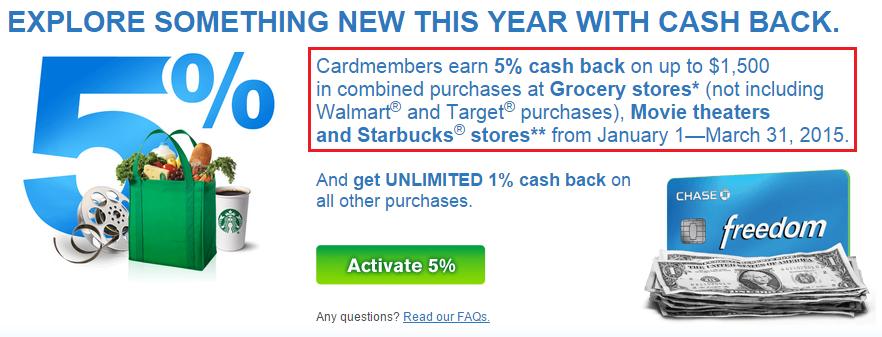

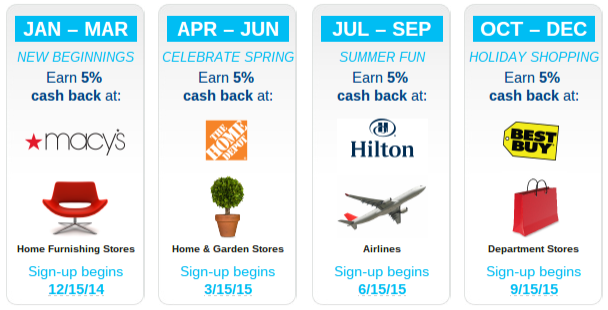

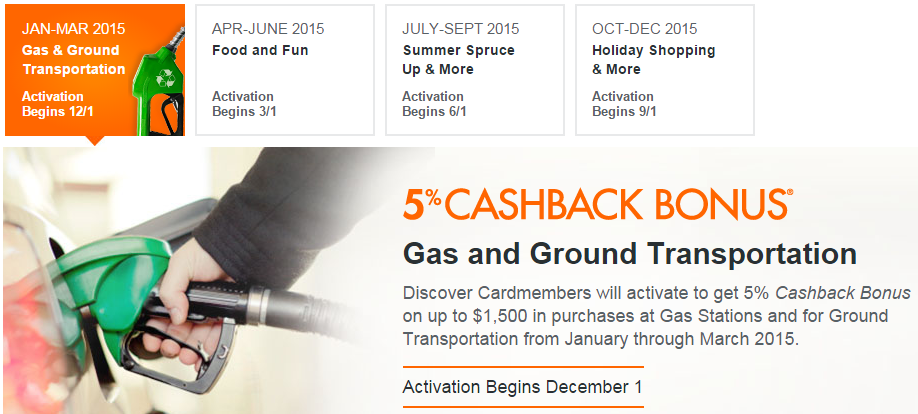

Chase Freedom, Citi Dividend, and Discover It Cash Back Cards

I have a page devoted to these 3 credit cards and try to keep the cash back categories up-to-date. These 3 cards sit in my desk drawer until I use them at a 5% cash back category. For the Chase Freedom, I maxed out the $1,500 grocery store purchase on January 1 (post). For the Citi Dividend, I won’t use it at all this quarter. And for Discover It, I am buying BART tickets to qualify for the public transportation category.

Credit Card Sign Up Bonuses and Minimum Spending

I am a big fan of credit card sign up bonuses. I currently have 27 open credit cards (see complete list) and most are travel-related credit cards. If I had only 1 hour a month to devote to the miles and points world, I would just sign up for 2-3 credit cards every 3 months and work on meeting the minimum spend requirements through everyday spend and easy online MS.

Bluebird / Serve / Redbird Cards

Back in the day, I had 3 Bluebird Cards (me, mom, and dad). Then Serve came out and changed everything (online credit card loads). I have always had an iPhone, so I never dabbled in the ISIS / Softcard world. I’m happy for you Android users. Then Redbird came out and changed the game again. I got a temp Redbird Card from a friend in another state (thx N) and registered it in my brother’s name (he never had a reloadable card in his name). Loading and unloading the Redbird is a breeze. On my recent trip to Colorado, I picked up 2 more temp Redbird Cards. I recently closed my Serve and my dad’s Serve Cards and registered for 2 Redbird Cards. When I get those new Redbird Cards, I will have 3 Redbird Cards (me, dad, and brother) and 1 Serve Card (mom). If I get my hands on another temp Redbird Card, I will convert my mom’s Serve Card to a Redbird Card. I also have 2 AMEX Target Cards (lamer version of the Redbird Card) which I probably will never use again once my 2 new Redbird Cards arrive.

Redbird Loading Strategy

Redbird basics: you can load $2,500/day and $5,000/month at Target. You can load with credit cards, debit cards, and gift cards (PIN not required). I load my Redbird Card with direct credit card loads (great for meeting minimum spending), but you can also use a Chase Freedom / Sapphire Preferred / Ink (5,000 UR Points), Citi Double Cash ($100 cash), AMEX SPG (5,000 SPG), Citi/AMEX Hilton (15,000 Hilton), US Bank Club Carlson (25,000 Club Carlson), US Bank FlexPerks (10,000 FlexPerks = about $200 in airfare).

I also load a bunch of $200 Visa Gift Cards to my Redbird Card. Assuming I did the full $5,000 with $200 Visa Gift Cards, that would require 25 gift cards x $6.95 = $173.75 in activation fees, but that would net me 25,875 Chase UR Points. That comes out to 0.67 CPP. I know that 0.67 CPP is a lot more than 0.00 CPP, but as long as you get greater than 0.67 CPP when you redeem Chase UR Points (super easy), you come out ahead. It would take 5 months or 5 Redbird Cards to get the same 25,000 Chase UR Points, but would require more trips to Target.

Another approach is to buy $500 Visa Gift Cards at a pharmacy or grocery store. You would need to buy 10 $500 Visa Gift Cards, which would cost about $50 in activation fees. Those purchases would generate about $250 in cash back, for a net profit of $200 cash back.

In reality, I do about half and half direct credit card and gift card loading. It depends if Staples, Office Max, or Office Depot is running any gift card promos at the time or if my local grocery store is running a gift card promo of their own.

If you have any questions, please leave a comment below. I gotta run and grab another temp Redbird Card. Part 2 is coming tomorrow morning… Have a great weekend everyone!

Are there limits to what amex cards will get rewards for Redbirds loads? Specifically will cards with cash back categories on grocery stores (loaded at a target coded as grocery store) get bonus cash back/ 1% cash back or nothing at all because amex can clearly see what the transaction is?

AMEX doesn’t code Target as a grocery store, only Visa does. You will probably get 1x or 1% cash back for Redbird reloads.

Thanks for clarifying, Grant!

Does Chase always code Target as grocery store?

Visa codes most Target stores as a grocery store and most Chase credit cards are issued as Visa.

How do you get around tax ramifications when loading your $ onto relative’a (other than your spouse) BB/S/RCs? Wouldn’t the IRS consider all those gifts (back and forth), which after a limit, are taxed to the giver? Has anyone in the MS world given thought to tax issues when loading someone else’s account?

There are no tax issues with card reloads, as far as I know.

I stopped loading 4 relatives cards for the tax reason mentioned. If my relatives are audited the IRS will absolutely see those deposits into their accounts as it’s tied to their SSN’s. At that point, they will have to explain where that money came from as the suspicion would be that it’s money received from a taxable event yet no tax has been paid. Honesty would be the best policy here. They would/should say that their account was used as a pass-through. Not for laundering, just as a way to work around an individual limit. That’s legal. One of three things will happen at that point. The least likely is that the IRS will simply yawn. Most likely they will either tell my relative that it has to be regarded as a gift, with the gift flowing back and forth, or the needle will point completely at the source (me) and I’ll be asked to explain huge sums of money coming back to me. I honestly don’t know what they would do at that point.

Here’s a KEY point: The IRS does not consider cash back money or goodies from credit card spend to be taxable. It’s regarded as a rebate on price. I checked with my accountant on this. They do regard cash back from opening a bank account to be income. But not credit cards. For instance, if you generate $6K in cash back on the old blue, it’s all non-taxable. The best mechanism for disposing of more than your personal limit, without putting your relatives in peril (or you), is to create low-cost money orders and deposit the money directly into your own account. There is no limit on this. It’s legal. And as long as you keep your paper trail, you’re clean. You can deposit a million dollars a year of rebated money, and as long as you kept your paper, zero tax. The banks may raise a huge eyebrow as money orders are frequently fraudulent, but again, yours are legal and clean. I do big deposits with Chase and B of A and have not gotten any questions. Wells asked me where I was generating them and I told them. They looked at me strangely, but let me continue to deposit.

Right now I’m nervous about all the loads I did in 2014 on relatives cards.

I’m not worried about the IRS at all. I would just print out the last couple months of my credit card statements and show all the MS purchases. I’ve got nothing to hide.

It’s not a question of hiding. It’s a question of the rules of the IRS. If you put $5K in a month in your mom’s account, the IRS regards that as her putting that money in her account. It’s then accountable to her. Even with a reasonable and true explanation, procedurally, you gave $5K to your mom and she gave $5K back to you. Talk with your accountant. I’m 98% sure you’ll find that to be true and that it creates taxable events.

I didn’t think of this until I spoke with my accountant.

I would be ecstatic to find out I’m wrong. Seriously.

Just to add to this discussion, there was a recent thread in FT about the length of time one should retain MO receipts and gift card receipts. Personally, once I load the gift cards to Redcard (or in the past, after loading VRs to bluebird), I get rid of the receipts and the gift cards. These days, I hold on to them until the bill payment clears from Redcard. I am a very low volume MSer, but I am scared of an audit.

I keep all my VRCs, PPMCCs, and gift cards just in case. Every 6 months or so, I go through and check to see if any have a balance, if not, then I toss them out. I don’t keep receipts. I can view my purchases on my credit card statements and I bet Incomm and find info on each purchase based on card information.

Would adding relatives as authorized users to the credit accounts used for MS be a way of circumventing the possible IRS rules on gifting?

If the redbird loads were made using an authorized user card with the same name of the relative’s RB account, and then the CC bill was paid directly from the RB account, I don’t see how the IRS could consider this a gift as all transactions occur in a closed loop where the relative is listed on both accounts.

I really don’t think this is an issue. Has anyone been audited recently by the IRS for any MS activity? I think they have bigger things to focus on than us miles and points collectors.

Hi Grant,

I am very confused and have few questions:

1. If you can load credit card directly why bother to buy GC?

2. Why just buy $500 GC instead of $200 unless some promotion?

3. After you load your credit card or GC to Redbird how to get back your money?

4. Why it is better than BB except you can load credit card directly?

Hi Hoang, it just depends what credit card rewards you want. You can pay bills with Redbird’s billpay. I prefer going to Target instead of Walmart too.

“I prefer going to Target instead of Walmart too.” I’m with you there!

Headed to Colorado in 2 weeks and will have to make a stop at Target!

Excellent, there should be shortage of temp Redbird Cards available.

@Hoang, I think I can answer some of ur questions.

1. If you have a credit card like The old Blue Cash back which earns 5% cash back at grocery and pharmacy stores it makes sense to buy $500 GC with a 5.95 activation fee. U will earn about $19 profit after factoring in 5.95 fee.

2. Can help with this since I don’t buy $200 GC

3.Redbird has bill pay feature. You can use funds to pay off the credit card. Can also take money out through atm but there are fees involved.

4. Better since you no longer have to deal with walmart. I always get funny looks when trying to load GC @walmart, way easier process at Target. Also don’t have to deal with GC if you are only loading redcard with credit card.

Great advice Raul!

Got OBC in Nov 2014. Just done with the 6.5k spend on it. So should I expect 5% CB for pharmacy and grocery purchases from now on? Also, my CVS may sell one vanilla, but I can’t load them in Walmart anymore. So will that be a good option to use OV GC to load Redbird?

You should get 5% cash back going forward on pharmacy and grocery store purchases. You can load OVGCs to Redbird, no problem.

Please explain the temp Redbird strategy. If you have to go to another state to get a temp card, doesn’t that mean that your state (CA) doesn’t allow loads since they’re not setup for Redbird? You’re loading in-store, right?

Some stores in CA do have temp Redbird Cards. You can load Redbird at any Target store in any state.

Do you have any specific reports of Redbirds available in Northern California stores? I’m just a bit northwest of you in the Sacramento area.

Er… I meant northEAST

I don’t know any stores in the Sacramento area. Call your local Target stores and ask the customer service area if they have any temp cards.

Do you know of any in the bay?

Yes, there is at least one store in the Bay Area that has Redbird Cards. I picked up one on Tuesday night. I need to go back and get another one soon.

Seth, as long as it’s purchases the gc at a grocery store it will get the bonus points.

Hoang, you get gift cards from grocery store or staples when there’s a promo and you get more points than Traget. Then to offload the gift cards you put it on the red card. From. Red card you can then pay bills, withdrawal cash, transfer to checking. It’s better than BB because direct credit card load. No more buying gift card to load.

Sam, you should. And one vanilla should work to offload.

Hi Grant,

Thanks. You can’t have both BB and Redbird that’s why you have to cancel the BB? When you load credit card directly to Redbird, do you have to pay any fees?

You can only have one or the other, not both. No fees to load Redbird with any payment method.

Prince, thanks for the reply. I should be more specific. I’m talking about doing a direct load to redcard from a cash back amex card at a target that is coded as a grocery store. No gift cards used.

You will only get 1% cash back on your AMEX credit cards.

Thank you Prince, great advice.

Prince, thanks. I have been MS by buying Simon Visa GC with cost $3.95/$500GC. I want to get my wife earn companion pass for 2016 since she already earns 2014/2015. I need another 30K so with Redbird I would save $200 and done in one place.

1. Which type gift cards do you recommend to buy at grocery stores (krogers)?

2. Do u purchase the gift cards at self check out, aisle cashier, or customer service (grocery store)?

3. What is maximum amount you recommend to purchase on per visit at grocery stores?

Any Visa Gift Card will do, look for US Bank or Metabank issued gift cards. Buy 1 $500 card per trip. You might get a fraud alert on tge card, so be prepared for that.

Question regarding ReLoadIts on REDBird – can you do this? I know on Serve you can, it counts as a cash load.

I have never tried to load a Reloadit to my Redbird Card. If you try it, can you let me know if it works? Thanks Tony.

I don’t have a REDBird yet! Picking one up in 2 weeks while in Colorado.

Congrats Tony!

Hi Grant,

Are you in East Coast now? When will you be back to the bay area?

By the way, what are your Redbird loading strategies at Target. Do you always load $2500 in 3 swipes of 1000,1000, and 500 in single visit at Target?

I’m in the Bay Area now, haven’t been to the East Coast since early December for FTU. It just depends on the vibe I get from customer service and how busy the line is. I personally go with one Redbird Card and ask to do a $1,000 load. Then I ask to do another $1,000 reload.

Hi Grant,

I’m a little confused about the use of multiple Redcards. As an example, can you load your Dad’s Redcard (that is in his name/SS#/DOB/address etc) DIRECTLY with a credit card in your name?

Or do you have to create an AU in your Dad’s name of one of your credit card accounts, and then use that AU card (Dad’s name) to load your Dad’s Redcard?

Also, does the rest of your family not care about points/miles? Seems like you are lucking out with so many nice relatives :)

Thanks!

You can load anyone’s Redbird Card with your credit card. Target cashiers do not car. They may ask for ID when using your credit card to pay, but most cashiers do not. My parents don’t have much time to travel, but I hook them up with deals and help them with credit card rewards and meeting minimum spends.

Sweet, thanks for the info!

No problem, the Redbird Card is awesone.

Ok so me and the wife have serve and don’t want to give them up since target is 20 miles away. I do however still want a RB. I can pit it in my mother in laws name. So if I do this what options do I have in getting my money out? ATM? What are the atm fees?

Best thing to do is use bill pay to pay off the credit cards u used to load redcard. fees on atm will depend on what Atm u use.

I have an even easier solution, just send the money from your mother’s Redbird to your Serve account or you can do bill pay from her account to any of your accounts.

Wow thanks Grant, your the best!

Do you mean using redbird to billpay into serve?

I have a very similar MS method as you, but much smaller scale. :) I got my own Redbird (registered in my mom’s name) from a friend in Colorado, then picked up a few more Redbirds for friends from a Target in the East Bay when they started carrying them there (currently out of stock though), and usually load it at the same exact Target because if I go anywhere else they usually ask me to go to CS, which has a long line, even when I try to coach them that it can be done at the register. I just keep moving to a different register until they let me do it at the register…but the Target that carried them doesn’t bat an eyelash and just loads them quickly. Love the 5% off Target too, Target got itself a new customer thanks to the Redbird! I used to NEVER go to Target, but now that I have to go there to load Redbird, I actually buy some household goods and groceries there. Good job Target! ;) I then use my Redbird to pay mortgage, HOA fees, PG&E bill, and then bill pay the rest to pay off some credit card (usually my Paypal Extras MC).

I only go to OfficeMax when they’re running a gift card promo. Otherwise, I don’t even bother going. I have a ton of $200 GCs to offload onto Redbird now. I’m also maxing out the Chase Freedom at Safeway with the $500 Visa GCs.

I also occasionally get Paypal Cash cards at CVS with Barclay Arrivals+, since I can’t find a 7-11 that takes CC. I use it to pay back friends when we go out, because they always want to get their cashback on their CCs, so I volunteer to Paypal one of them and it’s a win-win situation and we all get cashback. ;)

I have a Bluebird card in my name that I only use when I need physical checks. Some places are old-fashioned (DMV, speeding tickets, other governmental agencies, wedding photographers, etc) so I find the physical checks useful to carry around. I have Serve in my husband’s name but don’t really see the point of keeping it anymore with Redbird around. Next time I can get another Redbird, I’ll probably cancel his Serve. It is nice to set up a weekly automatic CC load and forget about it though…

I had the OBC for a week and then cancelled it. It didn’t seem practical for me to spend $6500 before getting 5%. Btw I think you’re using the wrong image for the OBC up there, it should have the “<" symbol right? I think the one you have up is the new Blue Cash or Blue Cash Preferred?

Look forward to your Bay Area meetup! :)

Thanks for sharing your MS strategy, looks like great minds think alike. You’re right, I used a BCP image, I couldn’t find an OBC image in my photo archives. I was planning to get another temp Redbird in East Bay, I’ll call Target to see if they have any in the back.

What eastbay Target has Redbirds?

South of Walnut Creek.

Thanks Grant! I’ll have my friend pick one up or I’ll check the Sacramento stores.

Good luck, I hope you can find one.

Hi Star,

Thank for sharing your MS experience and it’s always nice to meet you as a fellow points and miles enthusiast in Bay Area. By the way which Target in Bay Area that carry Redbird that you bought from? I have couple questions regarding MS around Bay area especially since I just started and I hope you don’t mind, you can email me at iluvramen at gmail. Appreciate your help.

star, why did you cancel the OBC? you could have just kept it and used it for Amex offers and small business saturday. Otherwise, all excellent MS strategies.

Yes, I think closing the OBC was a mistake. Even if the $6,500 takes a while to meet, there is no annual fee on the card and the cash back is great.

I guess I’m impatient and lazy. :) I’d rather put that $6500 somewhere else that doesn’t require frequent trips to a store. I already have like 8 other Amex cards for the Amex Offers and Small Business Saturday. Maybe you guys can re-convince me on OBC when we meet up, but I think with all the other cards/strategies available, I don’t see the point. I forget, do OBC points count as MR points if you have an MR-earning card, or can it only be redeemed as cashback? I slightly prefer earning points over cashback nowadays.

OBC is strictly cash back. I love miles and points as much as the next guy, but I look at cash back as a way to offset the fees of generating miles and points.

I tend to feel that to make $6,500 on OBC, it’s a bit of an effort, although with Redbird I could probably do it on a weekday afternoon driving to all the different Targets that have opened in the area. Still, I’m waiting for a good deal on an SPG Amex, or maybe budget some time for small transactions for Amex Everyday Preferred.

why not just use money orders when you need to pay the DMV and other places that prefer checks? my guess is that you don’t have to make payments that often to those places so is it really worth keeping bluebird for?

Isn’t there a fee to buy an MO (I just load my bluebird with my Paypal debit card whenever I need to use it), and don’t you have to go somewhere like Walmart or the post office to buy one, so you need to know the amount you need before you use it? I’m talking about those situations when you don’t know how much something is going to cost until they you get up to the counter, and then you need to write a check right then and there on the spot. Or when you need to write a check at home and enclose a form with it (like an HSA contribution, for example) so you can’t use Billpay unless you mail it to yourself first, which wastes time if you have deadlines to meet.

So yes, for those rare cases I need checks (once every 2-3 months, but during my wedding planning it was more like every week), it is worth keeping bluebird for. I don’t see the appeal of keeping a serve though. So having redbird + bluebird works best for me right now. And no, I don’t make it a point to max out bluebird b/c it’s not MS for me. It’s just to get my 1% cashback on things I otherwise wouldn’t be able to.

Does paypal debit card give you 1% back?

Yes, 1% cash back for all signature purchases. No cash back on PIN-based transactions.

Are you able to load someone else’s redcard with any credit card? I know Serve requires the credit card to be under your own name.

You can use your credit card to load someone else’s Redbird Card. No problem.

Hey Grant, do you load multiple $200 or $500 gc up to $2500 at target in 1 transaction? How do you go about doing that? feels like it’ll hold up the line if I were to do that.

You can only do $1,000 per swipe, so I ask for a $1,000 load, then after loading, I ask for another $1,000 load. Use your judgement with regard to the length of the line.

Agreed. I want to be considerate to other shoppers, and I hate holding up the line and people judging me for what I’m doing. I go at off-peak times like during dinner time, pick the second row of lines that people tend not to pay as much attention to, and pick young cashiers that look like they’re fast on their machines and won’t take forever. :)

Sometimes I warn the person behind me that although it looks like I’m only buying 1 thing, that this might take a little longer than usual, and sometimes I’ll let them go ahead of me if they only have a couple items too.

I try to go early in the morning right when Target opens and it is never a problem.

I’m trying to understand the load limits and process using Debit GC purchased from office supply stores. I see from the comments that it’s possible, and reading other information that there are online debit card limits, but how does it work using the Debit GC when you go into Target to load the REDCard? Thanks!

I only use my PPBDC to load Serve/Redbird online. Technically you could use PPBDC to load Redbird in-store, but I prefer to use a miles/points-earning credit card. The in-store loading limits are $2,500/day and $5,000/month, so you could max it out by the second of the month.

From what I’ve read I’m only able to load $200 GC to REDBird per day, correct?

I do have my PPBDC paired with my Serve card so until I’m able to get a REDBird I’ll load from there.

Thank you!

Apparently, you cannot use a PPBDC to load your Redbird Card online, the system keeps blocking the charge.For online debit card loads, you can do $200/day, $1,000/month. For in-store reloads, you can do $2,500/day and $5,000/month, you can use many $200 VGCs, not just one.

Great post Grant. Very informative.

Thanks Don, have a great weekend.

I have one Redbird… I load at 2 registers… $1000 and $1000. I pick the emptiest line, swipe, go shopping, or just loop around to the next cashier, and swipe again. It’s been VERY easy. I’ve never had a cashier who has seen the Redcard, but it has been easy and smooth. I know my loads will require 3 trips to Target, or I could loop around one more time and get another $500 on the card.

I max out my Redbird monthly loads pretty early in the month. I don’t mind going to Target a few times.

Hi Grant,

You have any issues since your Target does not sell the temp card so cashiers do not know how to load the money?

The customer service / returns department never gives me a problem. Most know how to load the AMEX Target, the process is identical.

Hi Grant…did you use your brother’s address or did you use your address when setting up the permanent card?

Thanks!

Well, I put our home address, which is the same for both of us.

I want to get a card in my inlaws names. They do not live with me. When I set it up can I have the card mailed to my address? Can I load it with my chage and then pay my own bills with that red card even if it is in their name?

Yes, you can get the card in your in-laws’ names and have the Redbird Card sent your address. You just need to get their DOB and SSN. You can load it with your own credit card and pay any bills you want.

If you have a red card already and are getting another one with someone else’s info do you need to use a new email or could you you the same email twice?

You need to have a different email for each Redbird Card you have.

Anyone still buys go from local gas station for 2x reward?

Can you repeat your question? Thanks Jung.

Excellent Post so many question answered

You’re welcome, I have part 2 scheduled for tomorrow, which reminds me I need to finish that post before I go to bed. Glad you liked the post.

Sorry for grammar , no idea what I was typing either earlier….what I meant to say is if gas station like Valero still selling my vanilla reloadable card or Paypal from cvs etc still may be considering as ms for you?

Yes, I am still buying PayPal My Cash Cards at CVS with my OBC. I haven’t seen any gas stations that sell VRCs with a credit card.

Grant,

Nice little post on MS here. I have watched your blog for some time now and I have never gotten involved in the office supply store game you enjoy. Recently, I became curious about it though. So, you get merchandise with rebates nearly “free”. Please explain how that translates into miles, points and/or money. Do you have a warehouse full of reams of copy paper?

Good morning Brant, I don’t have a “warehouse” full, maybe just a small corner in my bedroom. Staples has paper deals pretty much every week. For single reams, the price after coupon and Staples Easy Rebate will be between 99 cents and 1 cent. For larger 5 ream or 10 ream cases, the price after coupon and rebate will be between $5-$10 normally.

Whatever price you pay with your Chase Ink Bold/Plus will earn 5x. So if a ream of paper is $7.99 retail (total rip off), there might be a $3 coupon which will bring the price down to $4.99. If you use your Chase Ink Bold/Plus, you will pay $4.99 and earn 5x = 25 Chase Ultimate Rewards Points. At the checkout counter, your receipt will print out a rebate that will give you $4 back in the form of a check. You can do the Staples Easy Rebate online and get a $4 check in about 5-6 weeks. That is the basic premise of Staples Easy Rebates.

Sometimes, Staples has gift card Easy Rebates, where if you purchase $300 or more in Visa Gift Cards, you get $20 back as a Visa Gift Card. Assuming you bought 2 $200 Visa Gift Cards, your total would be $206.95 x 2 = $413.90. You pay that much with your Chase Ink Bold/Plus, earning 2,070 Chase Ultimate Rewards Points. After completing the Easy Rebate, your $20 Visa Gift Card will essentially give you a $6.10 profit plus 2,070 Chase Ultimate Rewards Points for free. Let me know if you have questions, have a great day.

Great explanation about office supply spend. Thanks Grant

You’re welcome Brant.

Pingback: Part 2: My Manufactured Spend Strategy with PayPal, Chime, Meetups, Reselling, and More! | Travel with Grant

Pingback: Travel Challenge: Could you MS During the Week to Pay for a Weekend Trip? | Travel with Grant

@Grant

intersting, but…

liquidating GCs via redbird has an opportunity cost of at least 2% (if simply used a 2% cash back card via redbird)…. + the 3.475% GC fee ( 6.95/200)…for a total of 5.475%..aka less than then 5% you received for buying the GCs.

what do you think?

thanks

Gene, your calculations are right on. I am essentially giving up 5.5% cash back by going with 5x Chase Ultimate Rewards Points. I value Chase Ultimate Rewards Points at 1.5 cents, so my “return” is 7.5%, I’m not sure if I should subtract my 3.5% GC fee from those calculations though.

gotcha. i also manufac UR points instead of cash back (:

round-world trip 2015 awaits!

Sounds great Gene, you can certainly do a lot of travel with Chase Ultimate Rewards Points!

How do you liquidate the $ after loading to redbird? Use it to just pay bills, etc?

99% to pay bills and 1% shopping at Target to get a 5% discount on goods.

Hey Grant, what are your thoughts on using someone else’s redbird to pay cc bills in your name? I manage a redbird in my sis’ name.. but sorta reluctant to use it to pay my bills… not sure if my paranoia is justified.

I “manage” my dad and brother’s Redbird Cards and pay bills in my name. Never had any problem. I’ve been doing that since Bluebird and Serve allowed bill payments.

Victor and Grant,

How about sending the money from her/his account to your Redbird account and pay the bill?

You can do that too, but I think you can only send/receive $2,500 per account per month.

Hi Grant,

When you closed BlueBird or Server and open RedBird you had to use different email or you did as Frequentmiles suggested by at “.” in gmail?

I was able to use the exact same email with Redbird that I had with Serve.

definitely only able to send $2500 a month using acc to acc…and $5k using billpay.

I think there is also a $10,000/month bill pay limit, but I have gone past that a few times…

Victor,

Most my money just went to my regular bank and no problem so far with BB.

I’m confused about something:

“I also load a bunch of $200 Visa Gift Cards to my Redbird Card. Assuming I did the full $5,000 with $200 Visa Gift Cards, that would require 25 gift cards x $6.95 = $173.75 in activation fees, but that would net me 25,875 Chase UR Points.”

If you did the full $5000 a month limit using gift cards, how did that end up being 25,875 Chase UR points?

Each $200 VGC earns 1,035 Chase UR Points. You need 25 $200 VGCs to max out the $5,000 monthly limit. 25 x 1,035 = 25,875 Chase UR Points.