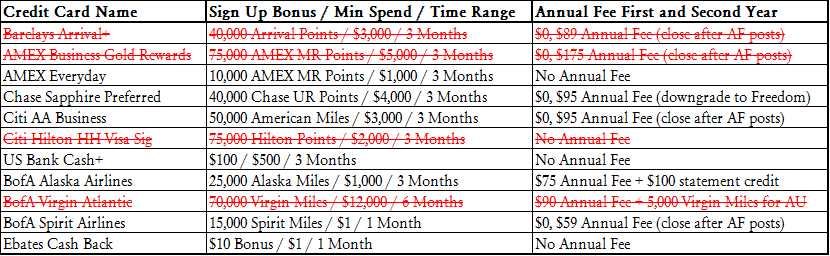

Good morning everyone, I hope you all had a great weekend. I quickly wanted to thank everyone who joined me at my Mountain View meetup yesterday – it was great speaking with you all and I will set up another Mountain View meetup soon. Last August, I wrote July App-O-Rama Update: Several Reconsideration Calls Required to be Approved for 6 New Credit Cards. In that post, I shared my successes and failures of applying for the following 7 credit cards:

I was eventually approved for the following 6 credit cards:

- AMEX Everyday – 10,000 AMEX Membership Reward points

- Citi American Airlines Business – 50,000 American Airlines miles

- US Bank Cash+ – $100 cash back

- Bank of America Alaska Airlines – 25,000 Alaska Airlines miles

- Bank of America Spirit Airlines – 15,000 Spirit Airlines miles

- Ebates Cash Back – $10 cash back

Of the above credit cards, 3 have annual fees that just posted recently:

- Citi American Airlines Business – $95

- Bank of America Alaska Airlines – $75

- Bank of America Spirit Airlines – $59

I also have a US Bank Club Carlson Business Credit Card that just posted a $60 annual fee (originally opened in July 2014). Of the 4 credit cards with annual fees, which ones are worth keeping and paying the annual fee? Which credit cards did I decide to close?

Let’s start with the Citi American Airlines Business Credit Card. I met the minimum spend requirements easily and received 50,000 American Airlines miles as a sign up bonus. After that, I never used the credit card again. When the $95 annual fee came due, I called Citi and asked them to waive the $95 annual fee (not possible), then I asked if they could provide a $95 statement credit to offset the $95 annual fee (not offered), so I ultimately ended up closing the credit card.

Up next, let’s look at the Bank of America Alaska Airlines Credit Card. I met the minimum spend requirements easily and received 25,000 Alaska Airlines miles and a $100 statement credit as a sign up bonus. After that, I never used the credit card again. The $75 annual fee just posted. I am now waiting for the Alaska Airlines Companion Ticket code to post to my Alaska Airlines account. Then I will call Bank of America, ask for a retention offer, or close the credit card. I’m just curious, has anyone recently converted a Bank of America credit card to the Bank of America Better Balance Rewards Credit Card?

Up next, let’s look at the Bank of America Spirit Airlines Credit Card. I met the minimum spend requirements easily and received 15,000 Spirit Airlines miles as a sign up bonus. After that, I set up an automated $5 Amazon allowance payment each month to ensure that my Spirit Airlines miles would not expire (they have a 3 month expiration period if you do not earn or redeem Spirit Airlines miles). A full year has passed and I still haven’t found a redemption for my Spirit Airlines miles. When I originally applied for the credit card, I had *dreams* of booking off-peak awards for only 2,500 Spirit Airlines miles each way. I later found out that booking the off-peak awards is very tricky and requires a completely flexible schedule. When the $59 annual fee came due, I called Bank of America and asked them to waive the $59 annual fee (not possible), then I asked if they could offer a $59 statement credit to offset the $59 annual fee (not offered), so I ultimately ended up closing the credit card. I’m currently sitting on 25,615 Spirit Airlines miles that are set to expire on November 5, 2016. Any ideas of what I should do with the miles? I’m tempted to book an award ticket for someone, just to use the miles…

Last but not least, let’s look at the US Bank Club Carlson Business Credit Card. I’ve had this credit card for 2 years and it was great when the Club Carlson “Last Night Free” promo was available. This credit card does offer 40,000 Club Carlson points as an anniversary bonus, but I wanted to see if US Bank could waive the $60 annual fee as well. I called US Bank and asked them to waive the $60 annual fee (not possible), then I asked if they could offer a $60 statement credit to offset the $60 annual fee (not offered), but the rep offered me 2,500 Club Carlson points to keep the credit card open. I accepted the retention offer and kept the credit card open. In exchange for paying the $60 annual fee, I will earn 42,500 Club Carlson points. I think that is a good trade off since I can probably get $150-$250 in value from those Club Carlson points.

As an extra bonus, I decided to call Citi and ask about retention offers on my Citi Prestige Credit Card. I expressed my frustration and disappointment about the upcoming changes to the credit card, but since the changes do not go into effect until next July, the rep did not have any retention offers available. I told the rep that I would keep the credit card open. I will try back again in a few months and report my findings.

If you have any questions about any of the credit cards listed above, please leave a comment below. Have a great day everyone!

Grant: I converted two Alaskan credit cards a few months ago. One to Cash Rewards and one to Travel Rewards. I was told I could convert to Asianna as well, but not Better Balance. If $100,000 plus to invest in taxable or IRA, the Merrill Edge $300/$600 bonus is very good and, as you know, you get 75% bonus on rewards, making the Cash Rewards good for $2,500 per quarter MS and Travel Rewards a great everyday spend card at 2.625%. You even get the 3.5% grocery bonus at Costco with Visa now.

Thank you for the data points, Jedi. I’m only interested in the Better Balance Rewards Credit Cards, but maybe the other 2 cards will be useful to some people. I don’t have an IRA that is quite that large either. Thanks for sharing :)

You can always fly me out to your meet up lol hate to see the miles go to waste or better yet to Boston your blog more -have a contest to win 25,000 spirit miles

Or you can fly me out to San Fran meet up

I like the contest idea, it might be blog post material worthy :)

Computer re-typed -supposed to say boost your blog not Boston your blog

Haha I was able to figure out what you meant :)

Don’g you not get a free hotel night you got with your business card. It posts a couple months after the fee is paid. Too bad you never got to use that spirit card, it sounded good.

The free night on the US Bank Club Carlson Business Credit Card is only for domestic hotels after you spend $10,000 on the credit card annually.

Pingback: Alaska Airlines Companion Pass Code Posted 16 Days after Annual Fee is Billed | Travel with Grant

Grant, My Citi Premiere AF is due.. I have 80k pts. I’m not very interested in keeping the card, the xfer partners are not working out for me the way I expected. Any best place to park those points, based on flexibility, once I close the card? Id go Hilton since I use them enough, but it seems like such a weak use of those points.

You can downgrade to Citi Preferred but I believe your points are only worth 1.25 CPP toward paid travel. The best use is KLM (SkyTeam) or Singapore (Star Alliance). You can split your bets by transferring points to various travel partners.