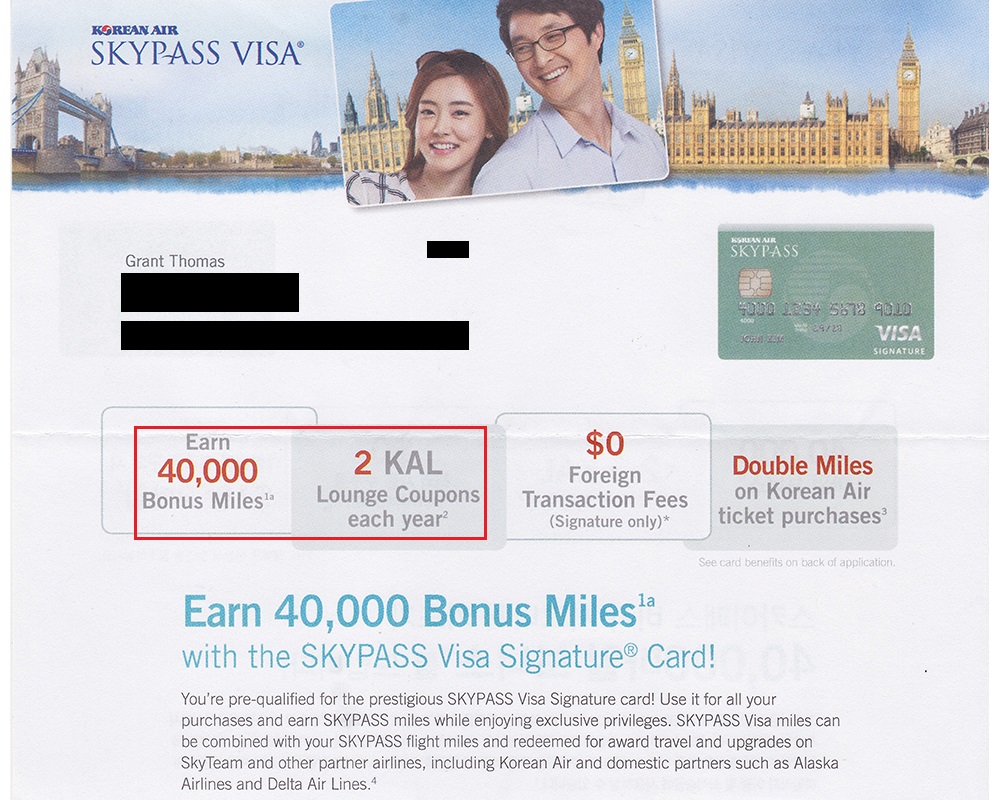

Good morning everyone, I hope you had a great Father’s Day weekend. It’s been about 3 months since my last (mini) App-O-Rama. I successfully got a Chase Ink Plus Business Credit Card and my second Citi Hilton HHonors Reserve Credit Card back in mid March. The sign up bonuses have both posted, so now it’s time to think about my next credit cards. I received the following targeted offer for the US Bank Korean Air Skypass Visa Signature Credit Card that comes with 40,000 Korean Air Miles after spending $2,500 in 3 months ($80 annual fee). What other credit cards am I considering? Scroll down to find out.

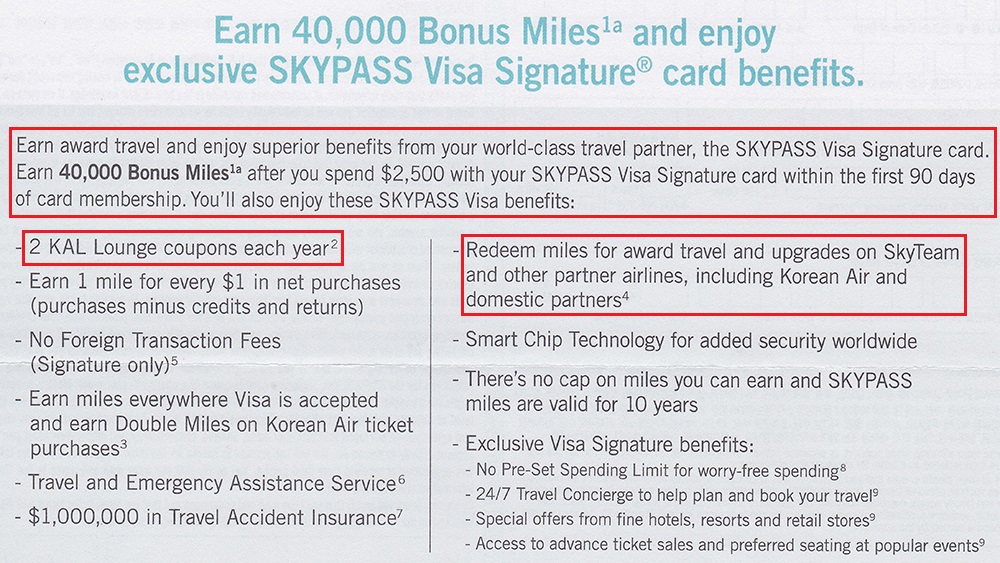

I never considered signing up for the US Bank Korean Air Skypass Visa Signature Credit Card before now, but here are the card benefits. I asked on Twitter if this was a newsworthy credit card offer and several people said it was the highest sign up bonus they have seen for this credit card.

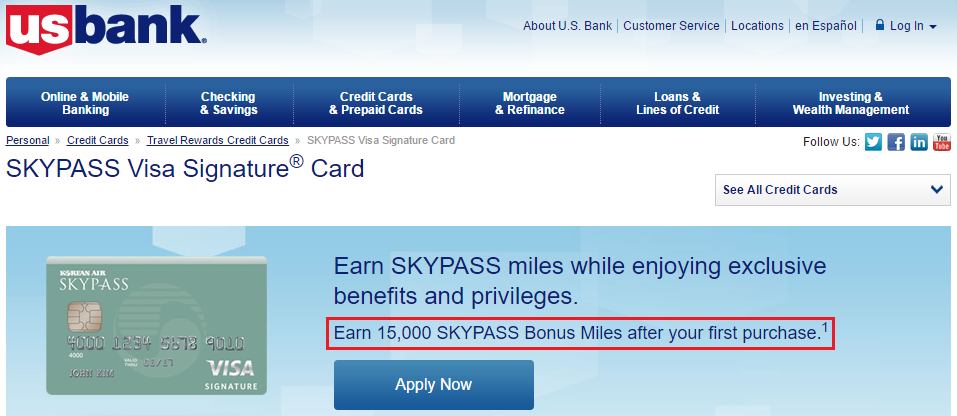

The currently available public offer is 15,000 Korean Air Miles after your first purchase, so 40,000 Korean Air Miles is a much larger sign up bonus. I’m not sure if the Korean Air award chart has had any/many devaluations in the last few years, but this Travel is Free post from 2014 has several great uses for Korean Air Miles.

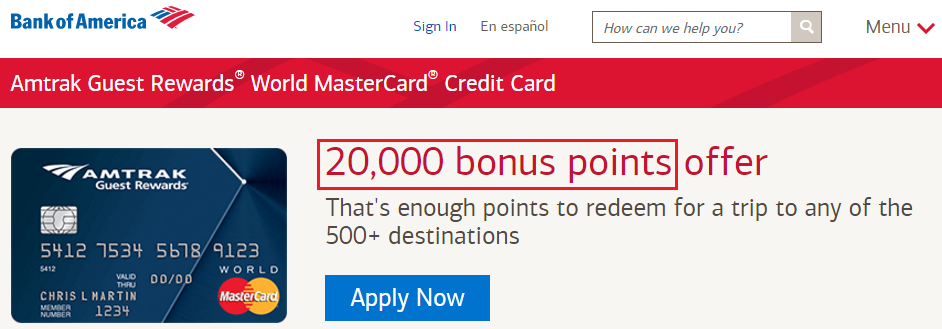

The next credit card I am considering is the Bank of America Amtrak Guest Rewards World MasterCard that comes with 20,000 Amtrak Points after spending $1,000 in 3 months ($79 annual fee). I went on 2 great Amtrak sleeper bedroom trips (Coast Starlight from Seattle to Los Angeles and California Zephyr from Denver to San Francisco) but I haven’t touched the new Amtrak Guest Rewards (AGR) 2.0 program. Since each Amtrak Point is worth 2.9 cents per point (CPP), the sign up bonus is worth $580 in Amtrak travel. I have my eye on the Empire Builder route from Seattle to Chicago (or vice versa).

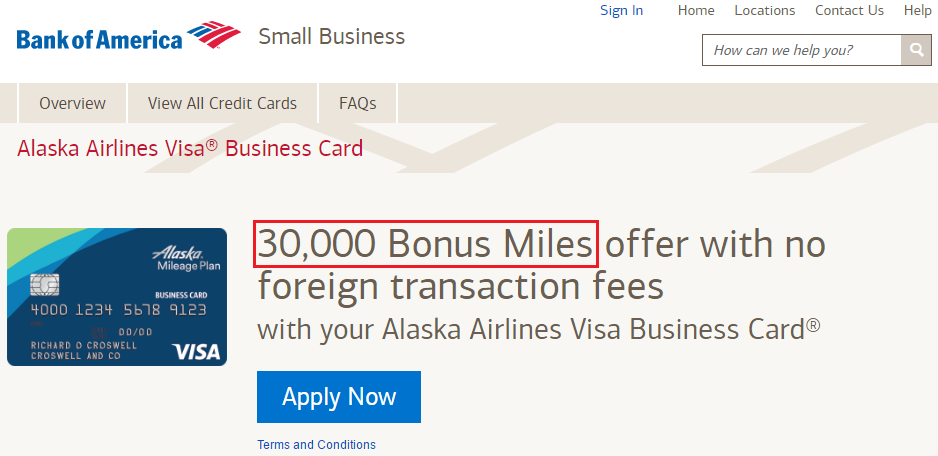

If I get instantly approved for the above credit card, I might go for the Bank of America Alaska Airlines Business Credit Card. I have 150,000+ Alaska Airlines Miles, so I am not in a big hurry to earn more, but if given the chance to earn 30,000 Alaska Airlines Miles, I will not turn down the opportunity.

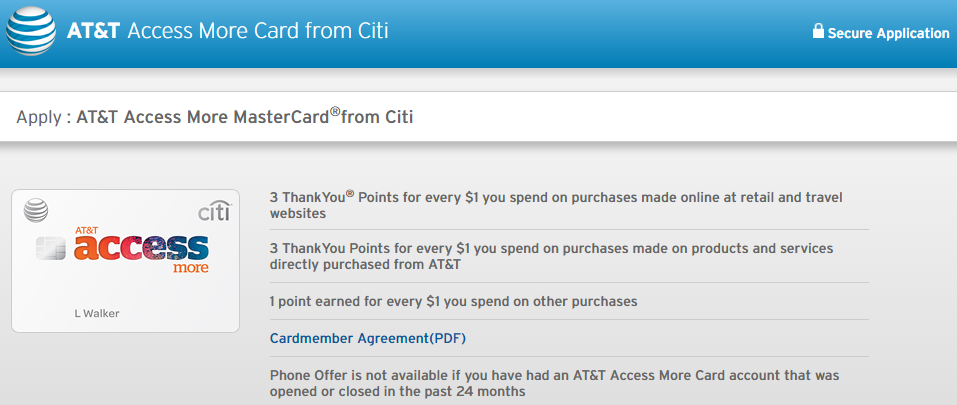

Since I have practically every Citi credit card available, my options are limited. I have had my eye on the Citi AT&T Access More MasterCard that comes with a $650 cell phone credit after spending $2,000 in 3 months ($95 annual fee). I currently have the iPhone 6S, but I know the iPhone 7 is coming out soon. Can I wait a few months to purchase the iPhone 7 after the initial 3 month sign up period ends or do I need to purchase the new phone during the first 3 month period? I don’t do much manufactured spend (MS) anymore, but the 3x online shopping might come in handy from time to time.

Update: thanks to Emery for the Flyertalk link. regarding the Citi AT&T Access More MasterCard. 14. Does the phone purchase offer expire?

The minimum spending requirement expires in 3 months. The phone purchase requirement is indefinite. It says “now or later”.

“You may redeem the Phone Offer using the link at any time after your Card account opening.”

“Offer is valid for a one time statement credit up to $650 for one eligible phone, is not transferrable and so long as your card account is open and current,does not expire.”

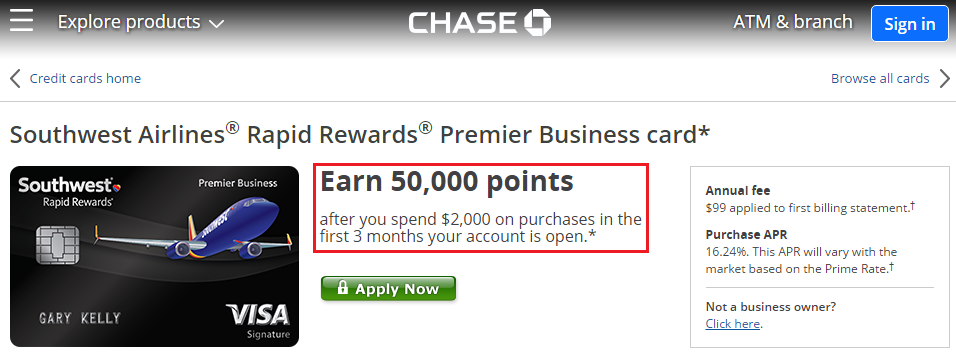

I was recently approved for a Chase Ink Plus Business Credit Card in mid March, but I am eyeing the Chase Southwest Airlines Premier Business Credit Card that comes with 50,000 Southwest Airlines Miles/Points after spending $2,000 in 3 months ($99 annual fee). Since Southwest Airlines Miles/Points are worth roughly 1.4 CPP, this sign up bonus is worth $700 in Southwest Airlines travel. Does anyone know if this Chase business credit card is affected by the Chase 5/24 rule?

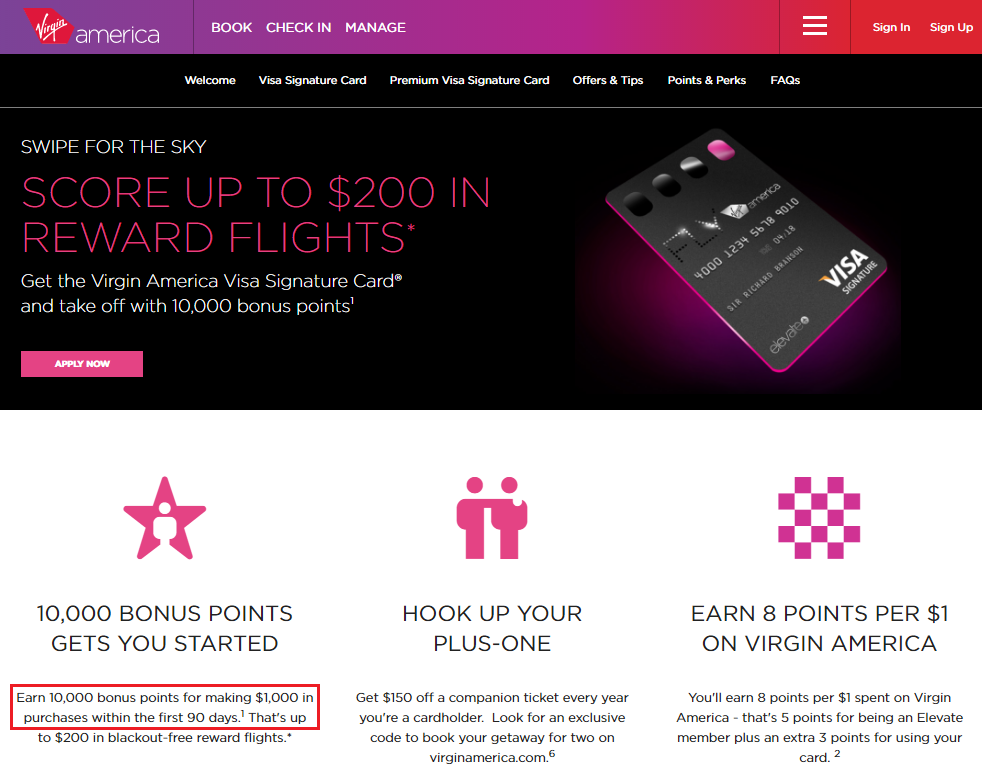

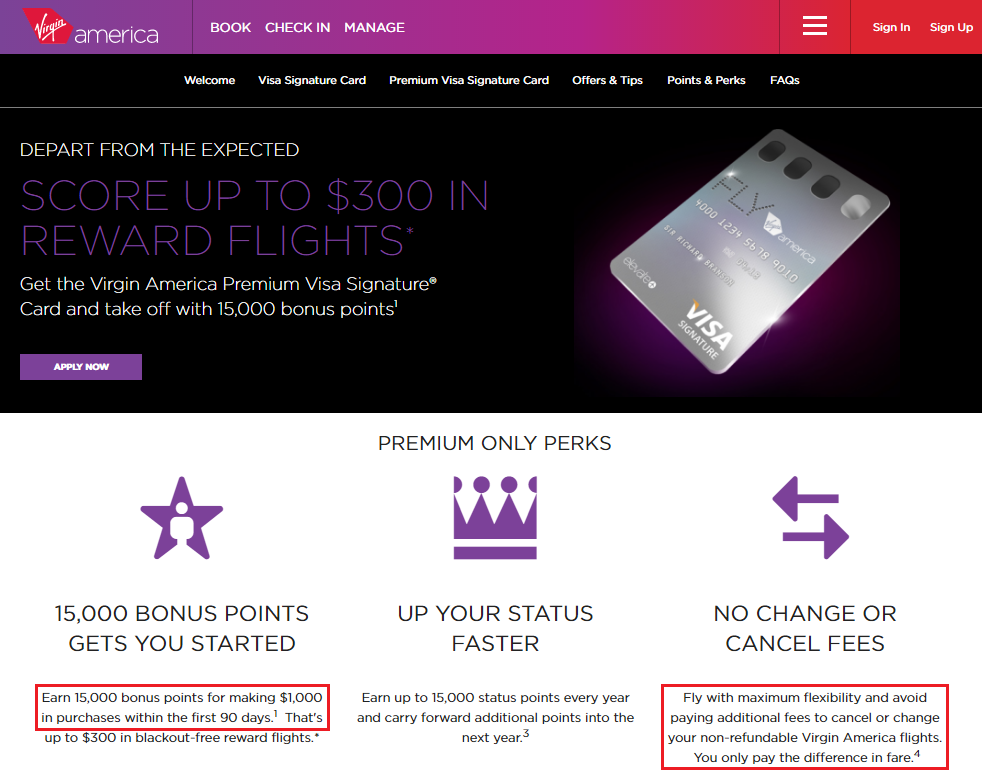

A few months ago, I did a status match to Virgin America gold elite status and have a few upcoming flights on Virgin America. I like their 2 credit cards issued by Comenity Bank, but I need to decide which credit card is better. For the record, each Virgin America Mile is worth 2.2 CPP. Here are the 2 credit card options:

- Comenity Virgin America Visa Signature Credit Card comes with 10,000 Virgin America Miles after spending $1,000 in 3 months ($49 annual fee) (10,000 Virgin America Miles = $220)

- Comenity Virgin America Premium Visa Signature Credit Card comes with 15,000 Virgin America Miles after spending $1,000 in 3 months ($149 annual fee) (15,000 Virgin America Miles = $330)

Both credit cards provide a $150 discount off a companion ticket every year and earn 3x on Virgin America flights. I don’t really care about elite status, so the status points do not mean anything to me. The one big perk of the premium credit card is the ability to cancel or change flights for free (you just pay the difference in airfare or have the canceled flights credit your Virgin America travel bank for future flights). Since the premium credit card has a 5,000 mile higher sign up bonus (worth $110) plus the ability to change or cancel flights for free makes the premium credit card worthy of the $100 higher annual fee.

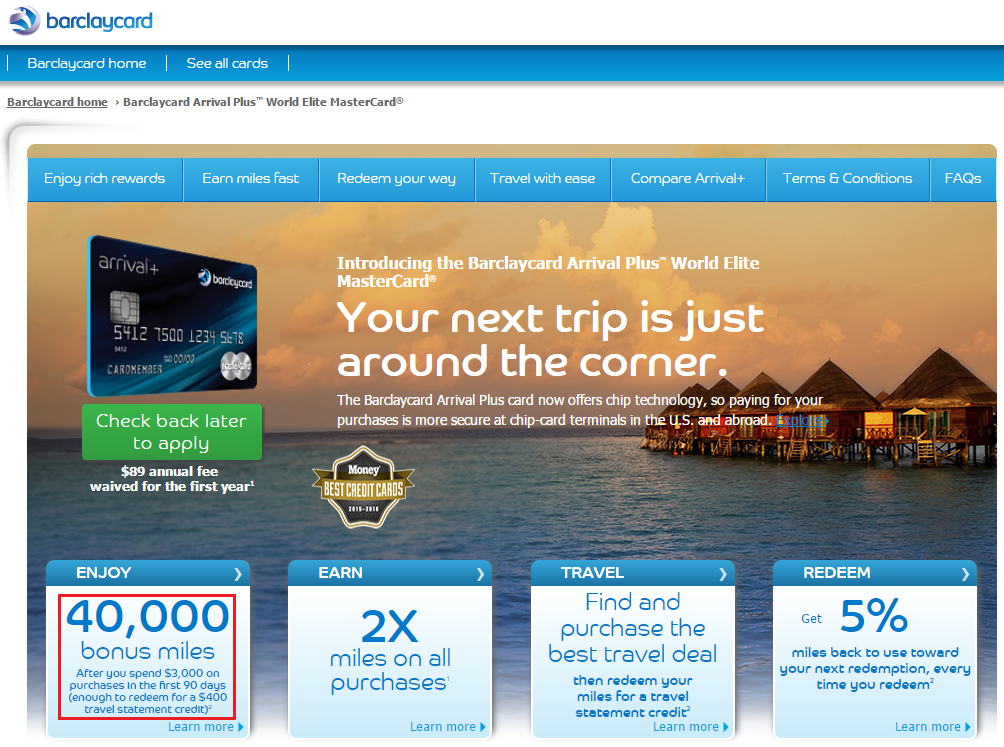

Last but not least, I am considering apply for the Barclays Arrival+ World Elite MasterCard. Why? I am 0/6 on Barclays credit card approvals, so I want to see if that streak can be broken. I need to spend $3,000 in 3 months to get the 40,000 Barclays Arrival points sign up bonus, which is worth $400 in travel (no annual fee the first year). Is this currently the best Barclays credit card to apply for?

I left out American Express since I am currently waiting for a good offer on the American Express Platinum Business Charge Card. I currently have the personal platinum charge card, but I have never had the business charge card. Is there any other increased sign up bonus I am missing? If you have any questions, please leave a comment below. Have a great day everyone!

P.S. If you are interested in applying for any of the credit cards mentioned in this post, please check out my credit card affiliate links. Thank you for your support and good luck with your application!

If you apply for SWA business premier I can send over a referal. Just let me know

Oh cool, thank you Brad. Do you know if that SWA biz CC is affected by the Chase 5/24 rule?

Doctor of Credit says that it is.

http://www.doctorofcredit.com/another-chase-card-isnt-affected-524/

Bummer, I guess the Chase SWA Biz CC is off the table then. Thanks for the link :)

Re Barclays:

Go instead for the LH card, not just are the points more valuable but maybe they’ll finally approve you for a partner card as opposed to their own card.

Ya that was my second choice from Barclays. The 50,000 mile sign up bonus is tempting (I applied for this card in the past and was rejected), but I might give it another shot. Thanks Mendel!

Reports are showing that the southwest card is affected by the 5/24 rule. Some increased bonus offers I’m looking at are the Amex Mercedes platinum which is at 75k, Amex no fee Hilton 75k, and Amex Hilton surpass 100k. The Mercedes offer expires in a couple of days and the Hilton at the end of the month

Bummer to hear that the Chase 5/24 rule affects the Chase SWA Biz CC. I’ve had/upgraded both Hilton AMEX cards and the MB Plat card too, so I don’t think I can get the bonus again. All are offering great sign up bonuses for first time card members. Good luck if you apply for those cards :)

If you aren’t doing a lot of MS, how do you manage to spend enough to meet all those minimum spends? I need lessons! MS is still a dilemma for me, too.

I can do $3200/month with Nationwide Visa Buxx and probably another $1000 from everyday spending. I doubt I will be able to get every CC mentioned in the post, so I think I’ll be able to do ~$10,000 in 3 months. Thanks Zippy!

Grant is it possible to fund Buxx with Wells Fargo or Citi cards with no CA fee? I’ve done so with BoA and Chase in the past but not sure about these two banks. Thanks.

Yes, it should code as a regular purchase. If you are worried, call Wells Fargo and have them lower your cash advance limit to $0.

2 weeks ago I took the Zephyr Denver/Sacramento/Portland in a Roomette. That was (was) great value. Today, not so much.

If memory serves me right, that used to cost 25k in a bedroom and 15k in a roomette, correct? I’m glad you enjoyed your trip :)

It was 15 for a 1 zone roomette. IIRC, it was 20 for a bedroom (mandatory with 2 people). Two in a roomette would be tight.

Gotcha, thank you for clarifying. With AGR 2.0, I need to find a super cheap route to use the Amtrak Points.

JETBLUE card has a 30,000 sign up bonus plus 5,000 points every year

6 x airfare and 2 x groceries and dining and few other perks

Jetblue is great for east coasters and not sure if it’s great for west coast peeps

Example. Fll to Columbia 5,000 plus 5.60 1 – way and they just had 1,800 poi n ts each way to Nassau , Bahamas

Fll to Barbados 5,000 1 – way flight was over 1600 miles

Jetblue has roomy seats and direct TV on all flights (free)

Grant it just may not be a great deal for west coast people but on the east coast it’s a sleeper that few talk about

I just did an app o Roma last week. I signed up Amex Hilton HHomors 75k after spending $1000 and Amex Hilton Surpass 100k after spending $2000, and Hawaiian airline 50k after spending $1000 through dummy booking offer for my dad and myself.

Good work on your App-O-Rama! I believe the Hawaiian Airlines CC is from Barclays, correct?

BOA and Citi has been inquiry sensitive lately to me. I have a strong feel lijg like if I apply any more cards with them I will get denied. If you have more than 10 inquiries on your CR, I suggest you to be careful with BOA and Citi. Recon department is not nice as before.

Hmm, that’s good to know. I have had really good luck with Citi recon department in the past and I closed a few BofA CCs in the last few months to free up some credit for an instant approval (hopefully). I’ll share my data points later on.

I did recent app o Rama

Approved for boa Alaska

Approved for Amex delta gold

Chase Denied United

Thanks for the datapoints, Manhar. Bummer about your Chase United CC application.

Your second Citi Hilton Reserve? Do you still have the first one or did you have to cancel it?

I still have my first Citi Hilton HHonors CC open.

Wow! So, you put $10K in spending on each card and you will get two weekend nights free? That is incredible

Yes, thats the plan. The $10,000 per card is over the entire cardmember year, plus you earn at least 3 Hilton points per dollar on the card.

Always useful posts, thanks.

My recent AOR was to get a replacement Amex Platinum Ameriprise since the wife’s card just hit the year limit and don’t want to pay the $450 + $175 fees (first and AU for me). We use these for the Centurion lounge access. Pretty good for free. I’m assuming you can get this card AGAIN even if you’ve had it before, and still get the first year fee waived, but haven’t tested that myself yet personally. I’ve had the Mercedes and regular Platinum cards before so don’t qualify. Approved instantly.

Citi AA Platinum 50K. Just time for the next one, e.g. 24 months since the close of the last one. Approved instantly.

Amex SimplyCash Plus targeted offer (I have the SimplyCash, don’t really use it for much other than Amex Sync offers). $300 for $3K spend, $500 for $5K spend. Will be going for the latter. Approved instantly.

BofA Alaska 30K + $100. Have had 5 of these before, but its been > 3 mos since the last one. Approved instantly.

I’d go for the Biz one too but with the upcoming wife’s AOR the spend would get to be a bit much. Only vehicle I’ve got these days is the NationWide, which is really only going to be convenient for spend on the Citi AA card. Not sure how you’d use it otherwise if you don’t want to pay the ATM fees. I don’t have any Citi cards I put a lot of spend on typically.

I’d also go for another Arrival+ card but sounds like I have to close the current one first, so not in the cards at the moment.

Thanks for the datapoints, Glenn. Sounds like your recent App-O-Rama went well. I too also have a few Nationwide Buxx cards but I do a fair amount of spending on Citi cards so it works out well. Keep on churning!

My 2 cents is that if you have nearly every other card, then focus on the cards that offer a special increased bonus, are about to go away or be changed, or start a new relationship with a bank you’re not currently dealing with. It looks like the US Bank card’s sign-up bonus is significant, and if the miles are useful to you, that card makes perfect sense. The AT&T card is not advertised widely, so getting it now before it disappears completely could be advantageous, and since the AT&T offer allows you to wait to get your phone, the 90 day period aligns nicely with the launch of the new iPhone or Note phones. Cards that are changing can be hit or miss – If you got in with the Priceline Visa when it was 2%, that’s great because so far Barclay is allowing existing cardholders to keep their 2% rewards, but on the Arrival, both new and existing cardholders will only earn the 5% bonus going forward.

If you receive some prescreened invitations or preapprovals from Chase, it can circumvent the 5/24 rule. That might bring the Southwest, Marriott, or United cards back into play, for example.

Very good advice Bill. Hay helps to clarify my strategy going forward. Thank you!

Pingback: My June 2016 App-O-Rama Results: 155,000 Miles/Points and $650 AT&T Phone Credit | Travel with Grant