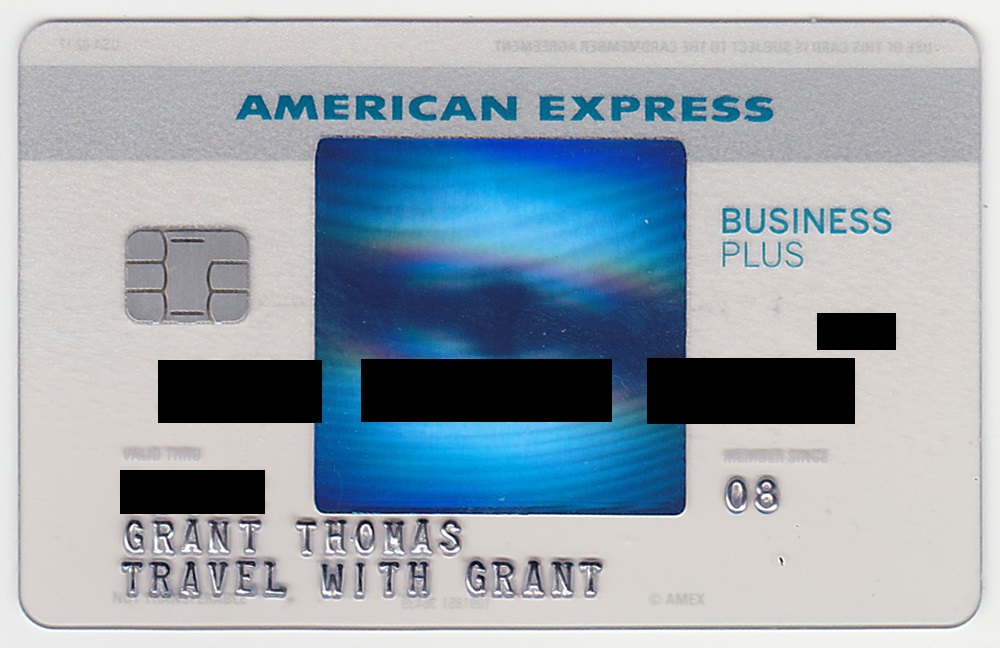

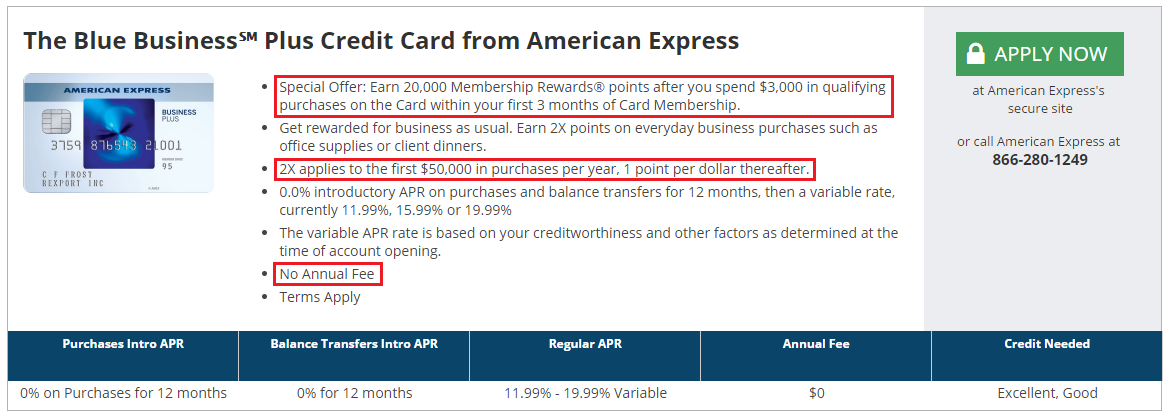

Good morning everyone, happy Thursday! Last week, I applied for the much talked about new American Express Blue Business Plus Credit Card (my referral link). The sign up bonus was decent (20,000 Membership Reward Points after spending $3,000 in 3 months), the 2x on all spend for the first $50,000 in purchases every year is great, and having no annual fee is the perfect reason to hold on to this credit card for years to come. In this post, I will walk you through the approval process and “unbox” the new credit card and show you what the new credit card looks like. (Disclaimer: there is no box, just a UPS Second Day Air flat envelope.) Here is the front and back of the American Express Blue Business Plus Credit Card. I am kind of disappointed that this credit card looks just like my American Express Old Blue Cash Credit Card (OBC) and my American Express Blue Cash Everyday Credit Card (BCE). I wish the card was more distinctive looking. Oh well.

Here are the card details:

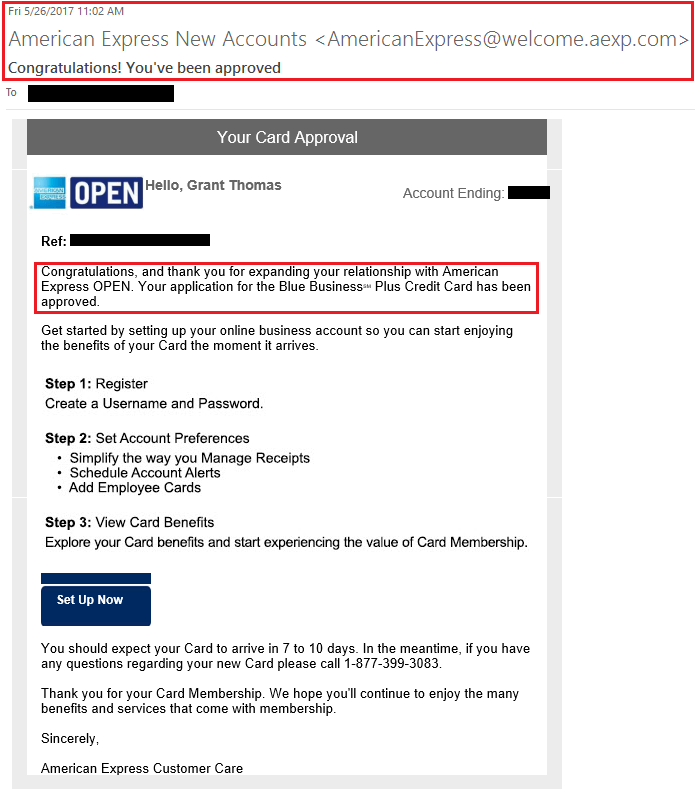

I applied for the American Express Blue Business Plus Credit Card on Friday morning and was instantly approved. Woo hoo!

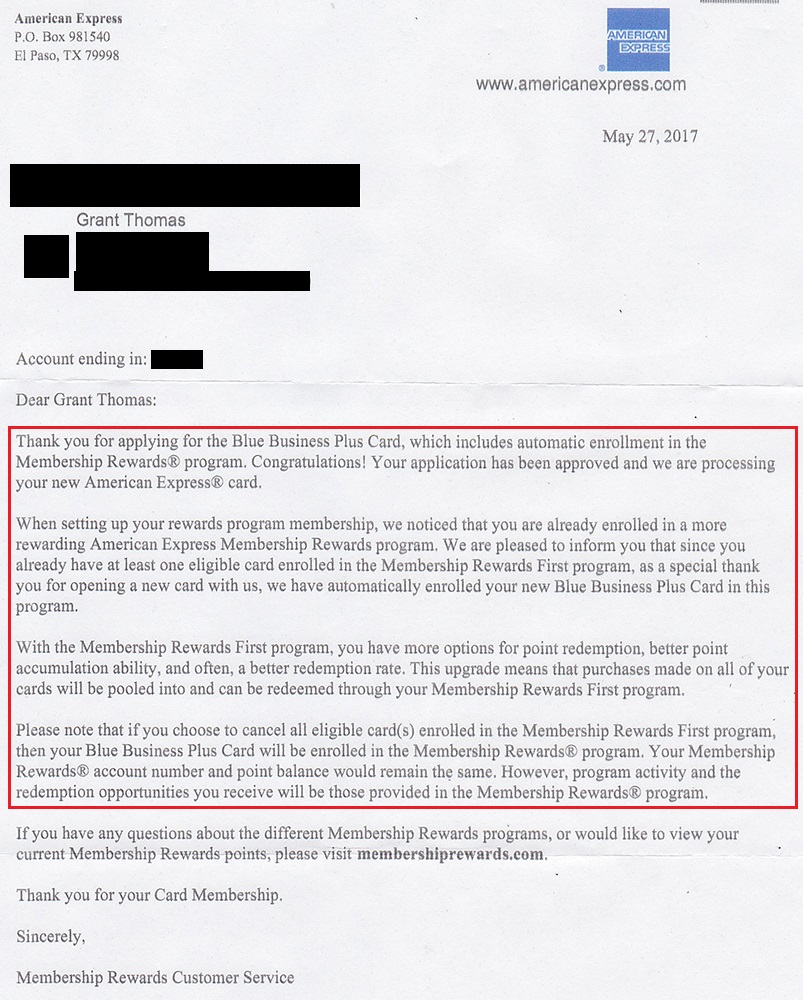

I didn’t get home until Wednesday night, but this approval letter was waiting for me in my mailbox. The letter mentions the “Membership Rewards First program” which is new to me. I believe the American Express Business Platinum Charge Card is part of the Membership Reward First program, making my Membership Reward Points more valuable. I really don’t know much more than that.

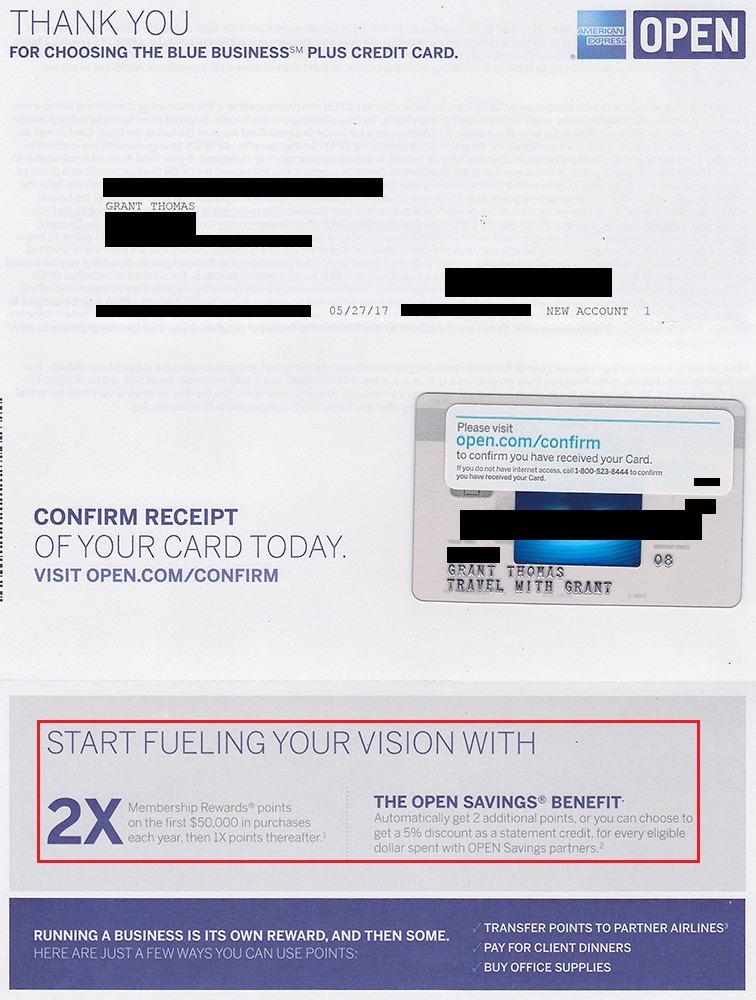

Waiting on my doorstep was a UPS Second Day Air flat envelope from American Express (envelope was shipped from FDR – RAPID DEPT. (P4R), 10910 MILL VALLEY RD, OMAHA NE 68154). I opened the UPS envelope and pulled out the envelope from American Express. Here is the welcome letter with my new American Express Blue Business Plus Credit Card.

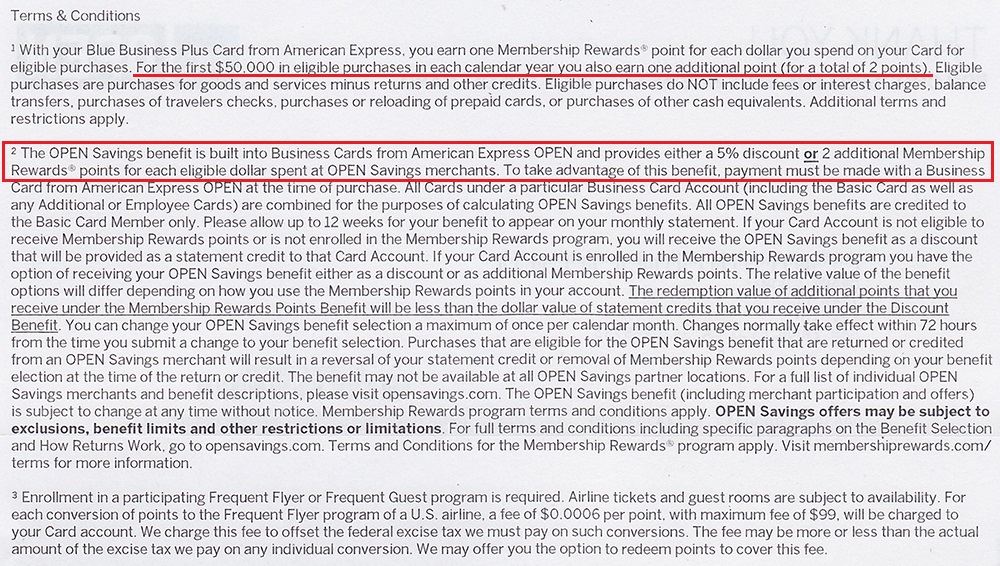

Here is the back of the welcome letter.

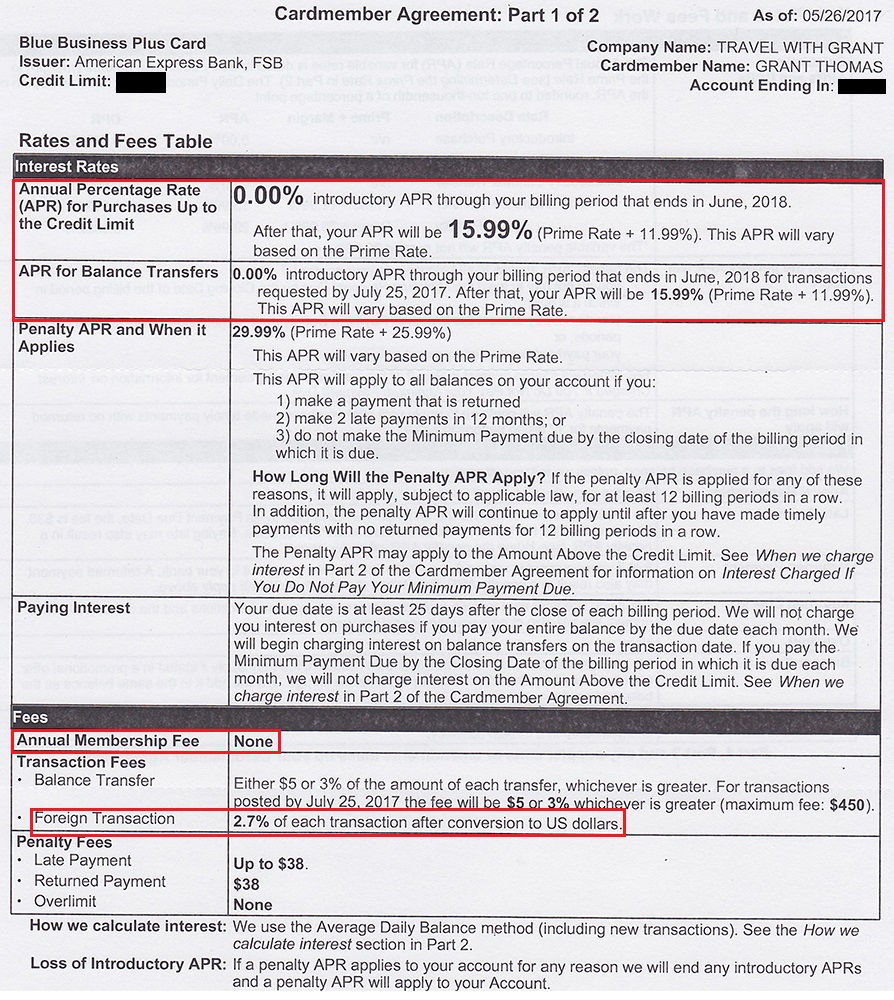

Here are the complete credit card cardmember terms. I didn’t realize this credit card offered 0% APR and 0% balance transfers for 12 months. Balance transfers do have a 3% transfer fee, but after the transfer is complete, you will not pay interest for 12 months. That could be good for some business owners.

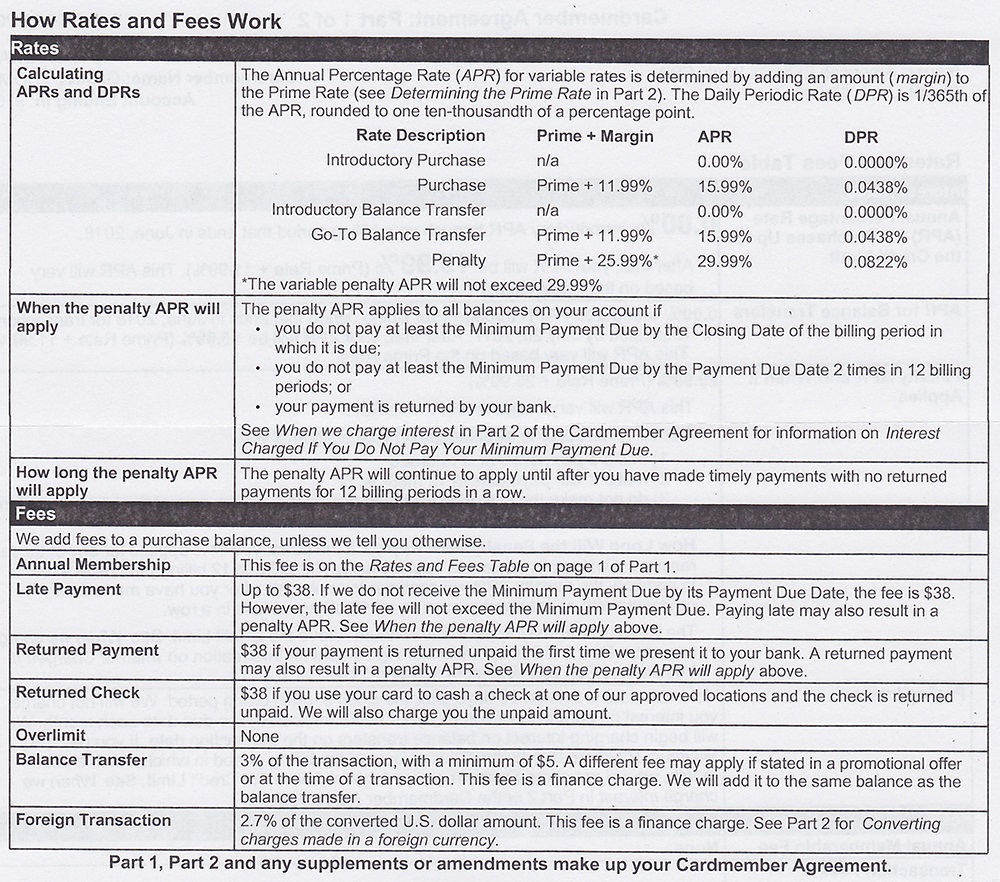

Here is the back of the cardmember terms.

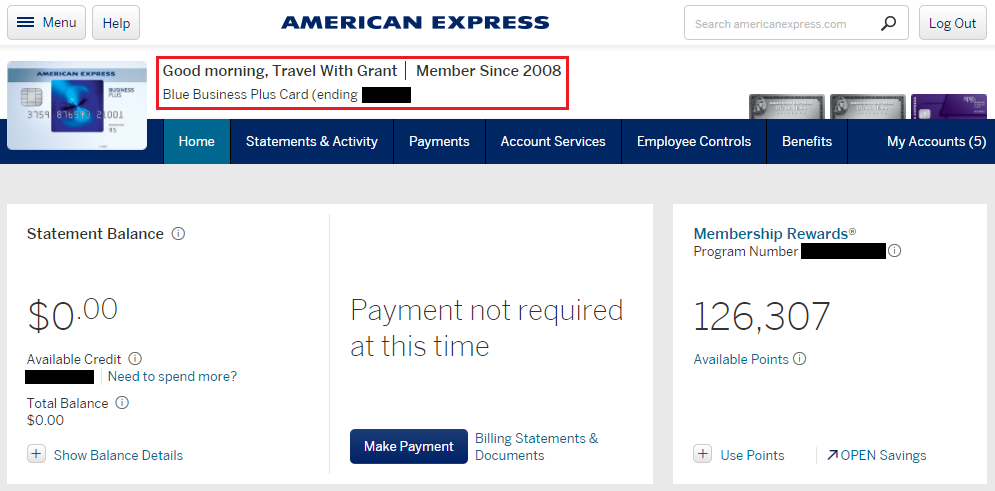

I activated the American Express Blue Business Plus Credit Card and added it to my new American Express business online account. I only have 6 AMEX Offers showing, but I will check back in a few days to see if any new ones are added.

If you have any questions about the American Express Blue Business Plus Credit Card (my referral link), please leave a comment below. Have a great day everyone!

P.S. If you liked this post, I recommend reading my other credit card unboxing posts (sorted by date):

will Chase count this card under their 5/24 rule?

Since it is a business credit card, it should not show up on your personal credit report, therefore, it should not count under Chase 5/24.

I applied yesterday and was immediately approved.

Congrats! The word on the street is that American Express isn’t doing hard pulls for this credit card for some customers.

They actually call you Travel with Grant on the Amex website?

Yes, that’s my business name :)

Oh yea, ic. Btw, is this the same blue card that was offered earlier in the year with 10X at restaurant?

I don’t think so. This is a the new American Express Blue Business Plus Credit Card that came out last week. That might be the old American Express Blue Business Credit Card you are thinking of.

I am curious if one could balance transfer from their personal Amex platinum to this card (charge card to credit card)?

I don’t think you can do balance transfers from charge cards, but I might be wrong.

Cost of adding authorized users?

Since the credit card has no annual fee, I believe authorized users are free as well.