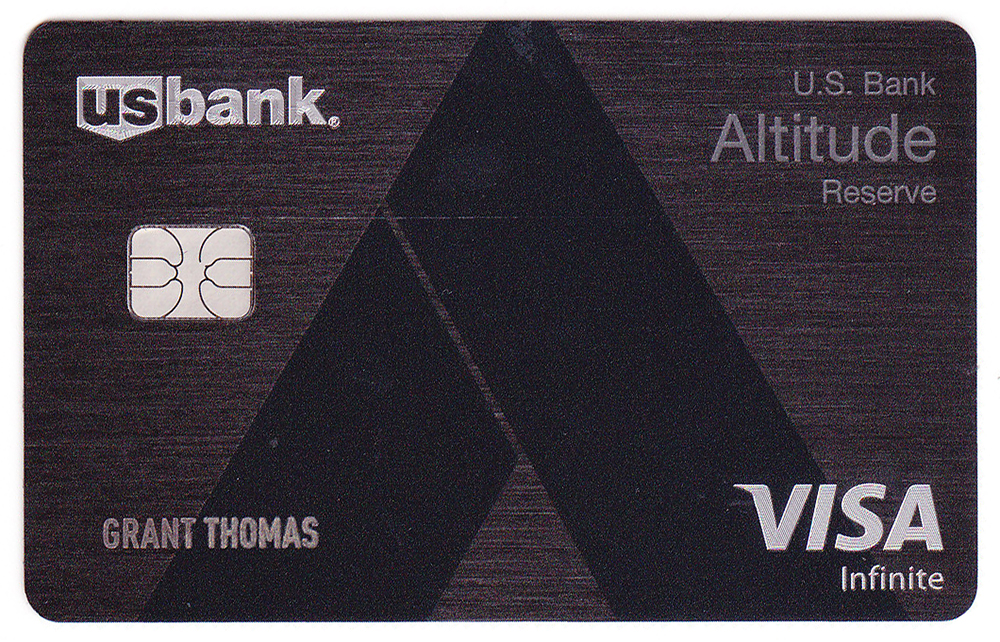

Good afternoon everyone. I hope you enjoyed reading my post from this morning: My March Madness App-O-Rama Results: 3 out of 4 Credit Cards Approved. In that post, I mentioned that I would be doing an unboxing of my new US Bank Altitude Reserve Visa Infinite Credit Card. This credit card has a sign up bonus of 50,000 FlexPoints (worth $750 in flights) after spending $4,500 in 3 months. This card has a $400 annual fee, but offers $325 in airline travel credits that mostly offset the annual fee. There are a few other credit card perks that I will go over in this post. But first, take a look at how beautiful this credit card is. The card is a thick metal, similar to the Chase Sapphire Reserve Credit Card. On the front of the credit card, it only shows your full name. On the back, it has your full name again along with all the other credit card information. Let me show you the rest of the items that came with this credit card.

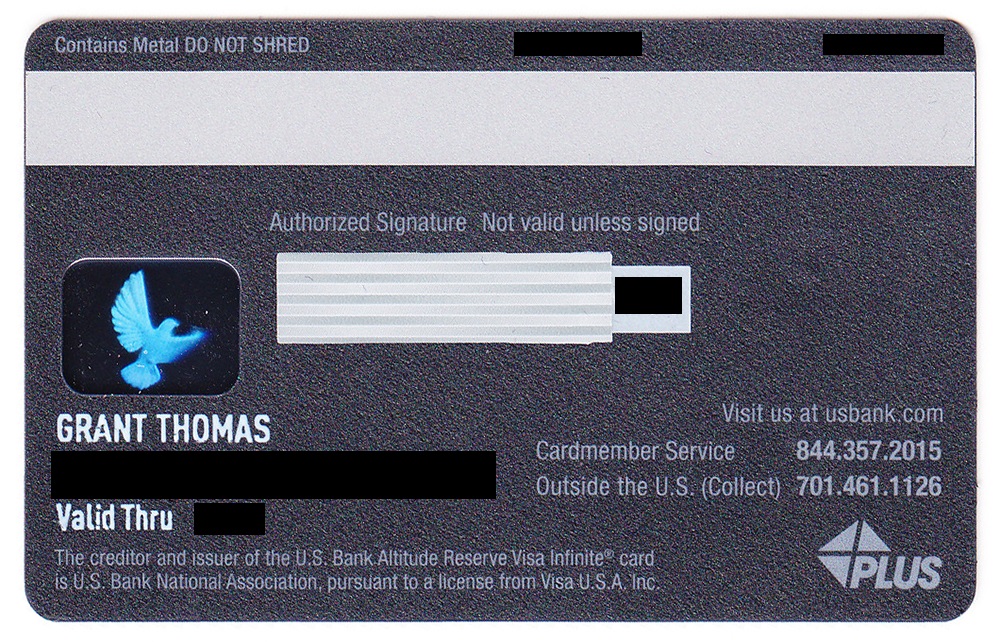

I applied for the US Bank Altitude Reserve Visa Infinite Credit Card on Monday evening, was approved sometime on Tuesday and the package arrived via UPS Next Day Air on Thursday afternoon. The credit card came in a white, nondescript box with an impressive folio on the inside.

Attached to the lid of the folio, the credit card was mounted and surrounded by soft black foam. In the bottom of the folio, there was an information booklet, credit card terms, and a welcome letter.

Here are all the items that came in the bottom of the folio.

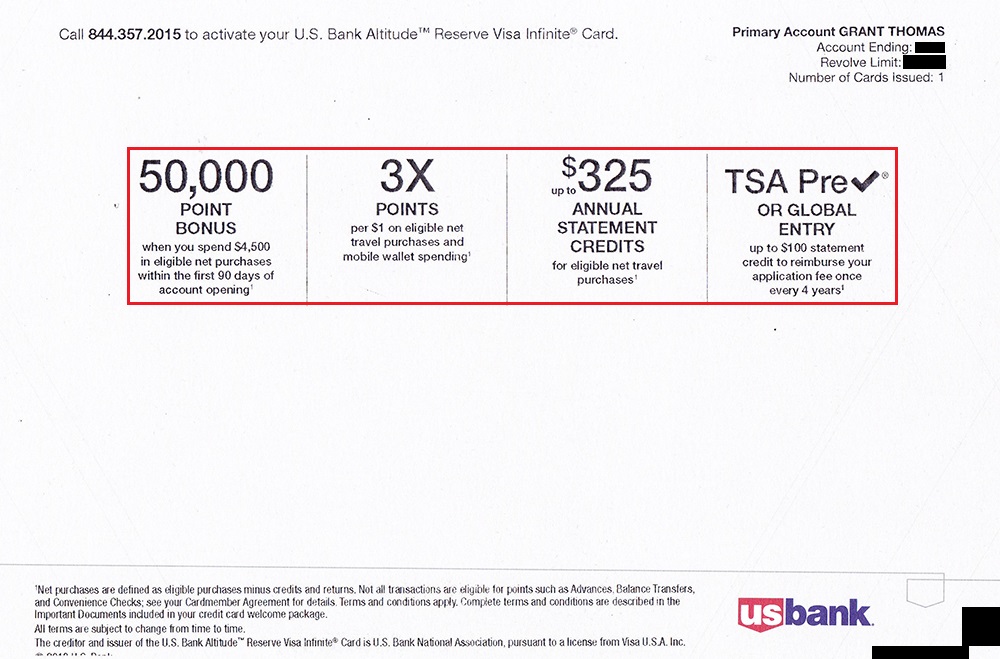

The large postcard has all the important features of the credit card, including the sign up bonus, the 3x earning on travel and mobile wallet (Apple Pay) purchases, the $325 airline travel credit, and $100 reimbursement for Global Entry / TSA PreCheck.

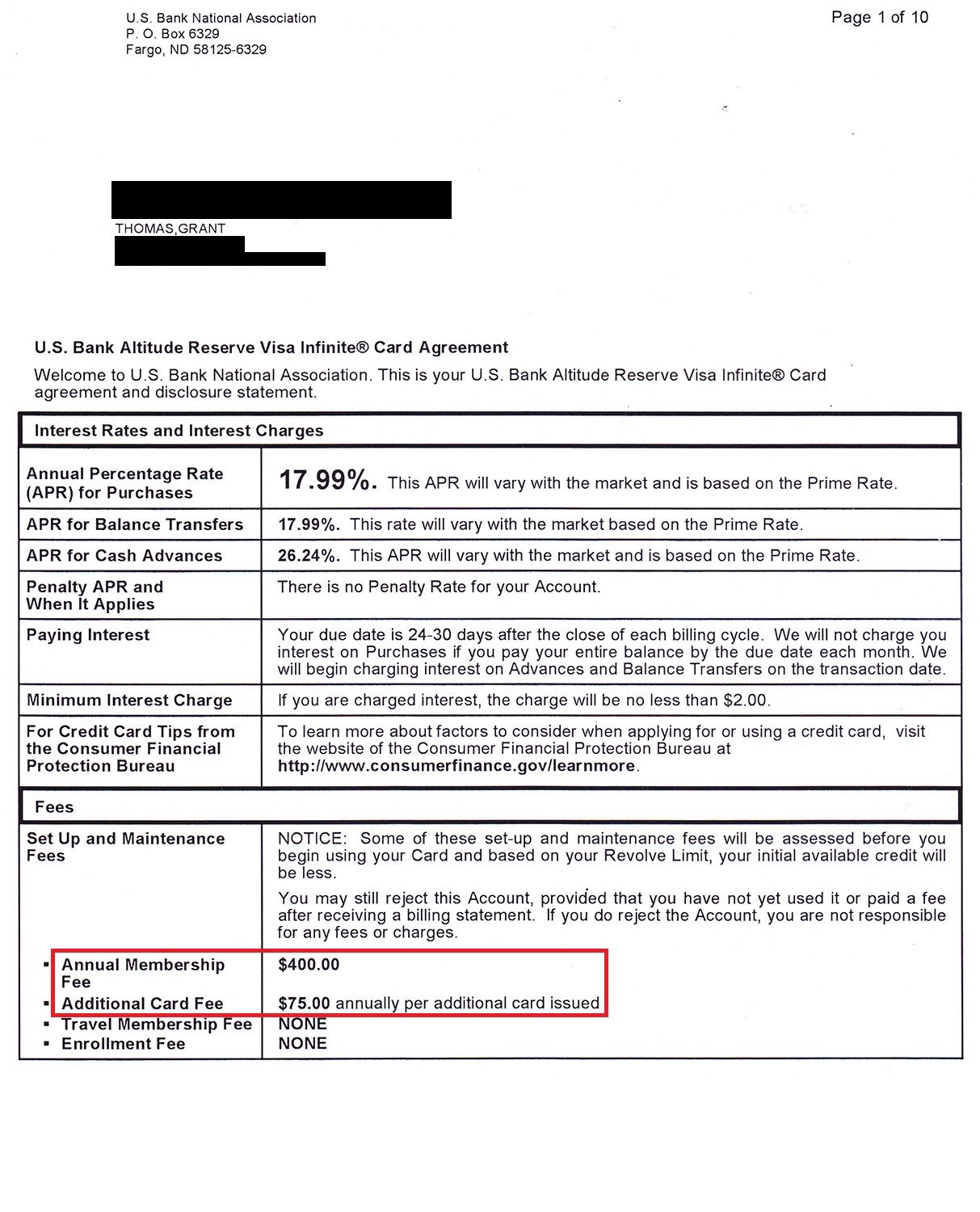

Here is the welcome letter that shows the credit card annual fee and extra charge for authorized users.

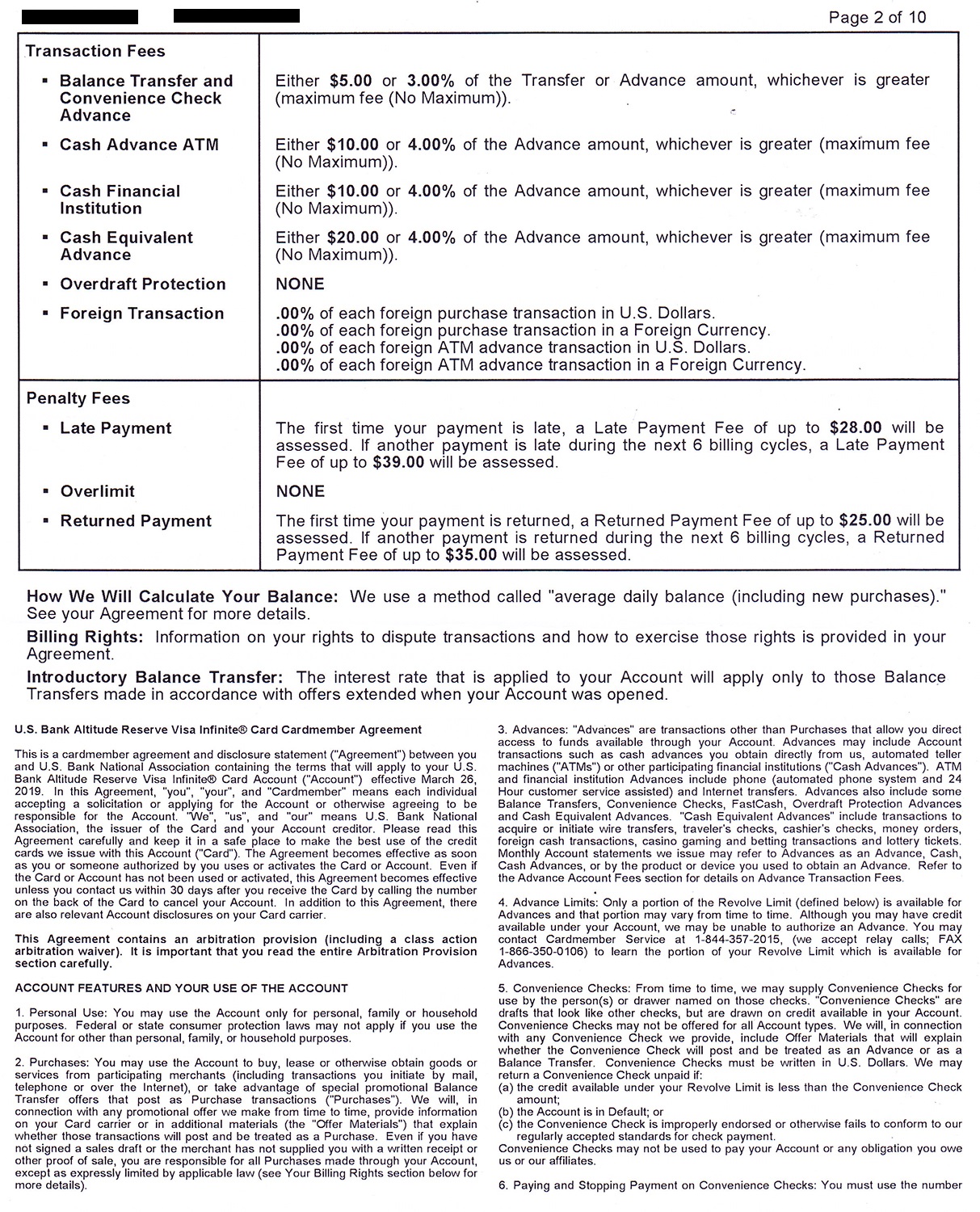

Here are the credit card terms (I didn’t look into these very closely).

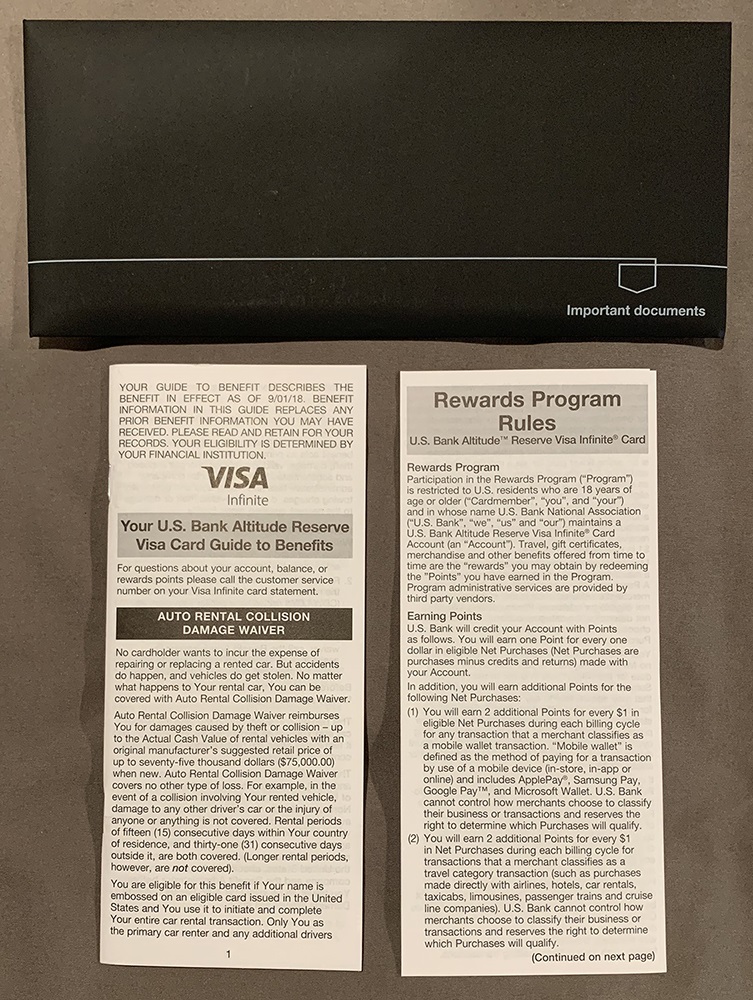

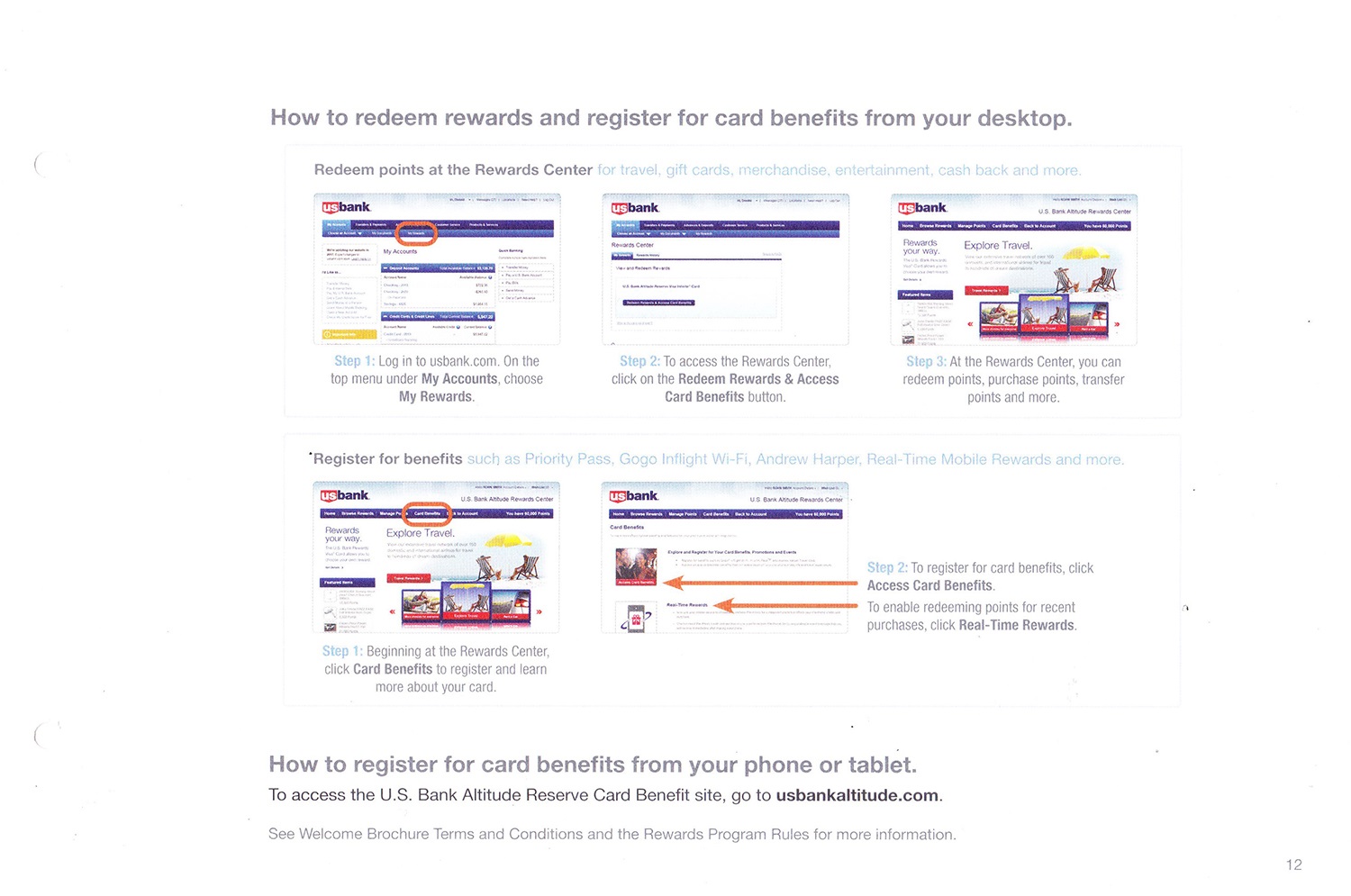

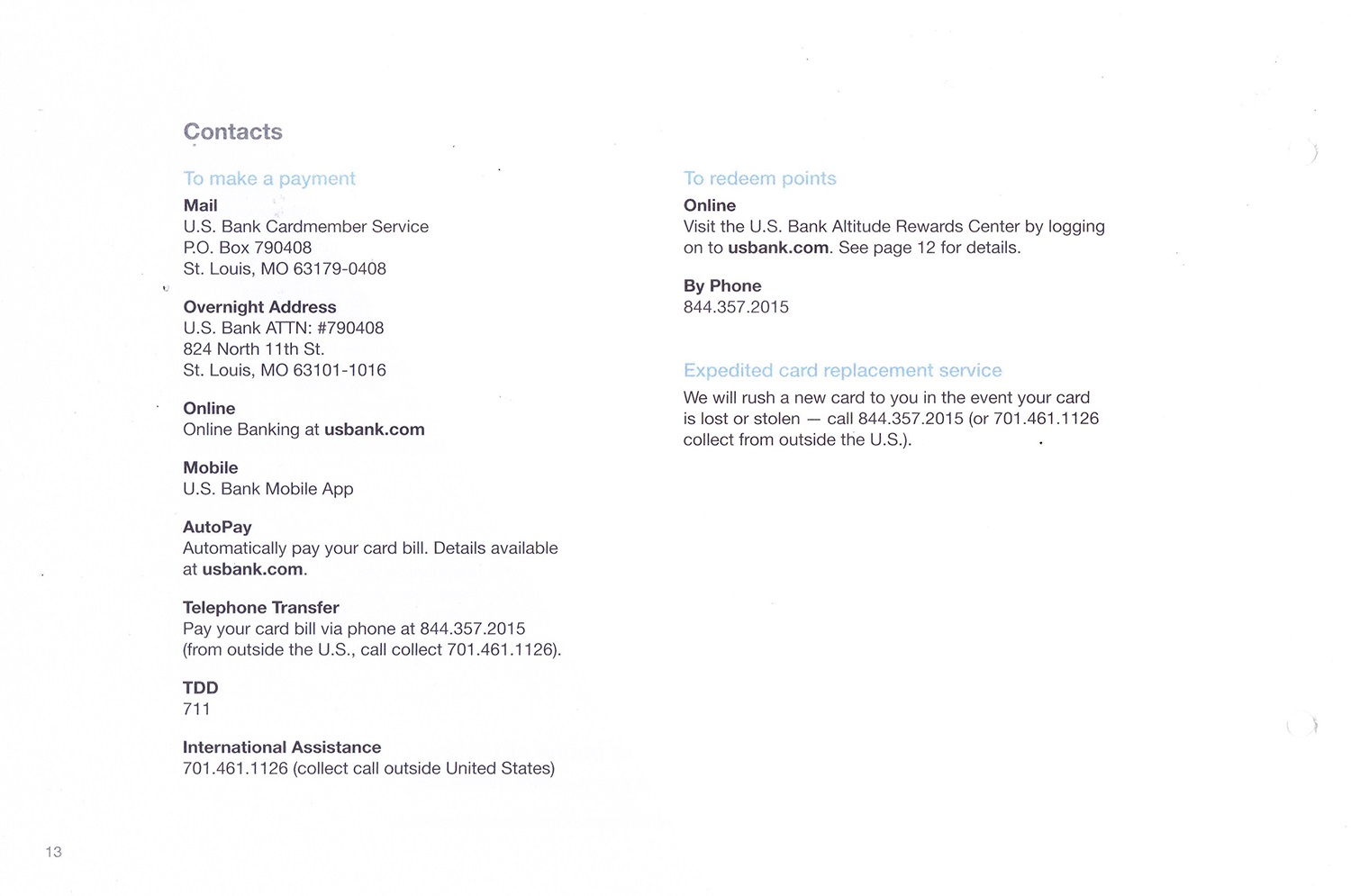

Lastly, here is the booklet that explains all the credit card benefits and the sleeve that holds the booklet closed.

I took the booklet apart so I could easily scan all the pages. You also get a Priority Pass membership and 12 Gogo Wifi passes each cardmember year.

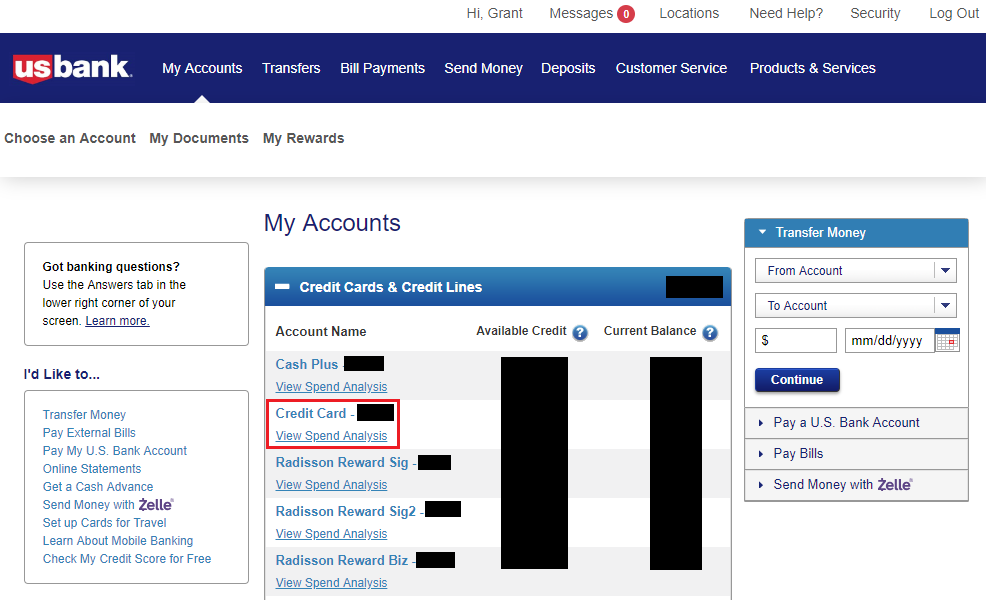

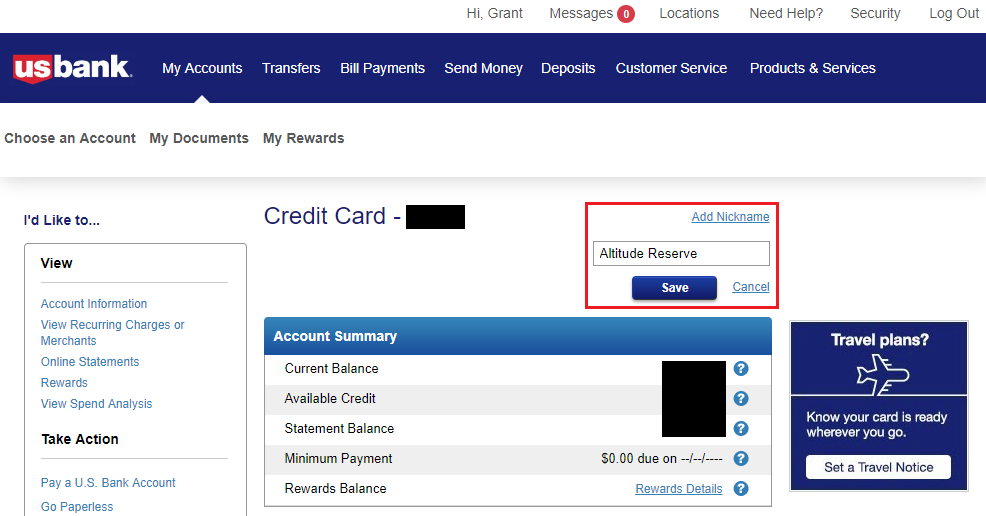

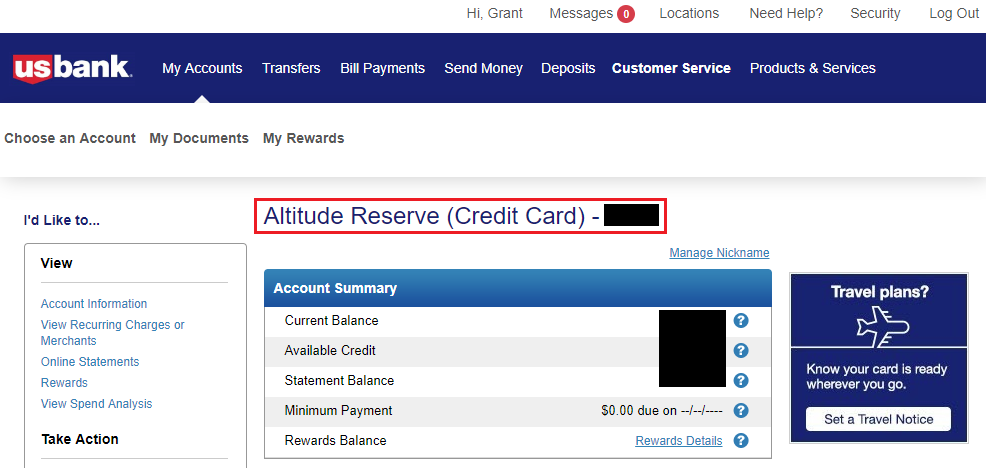

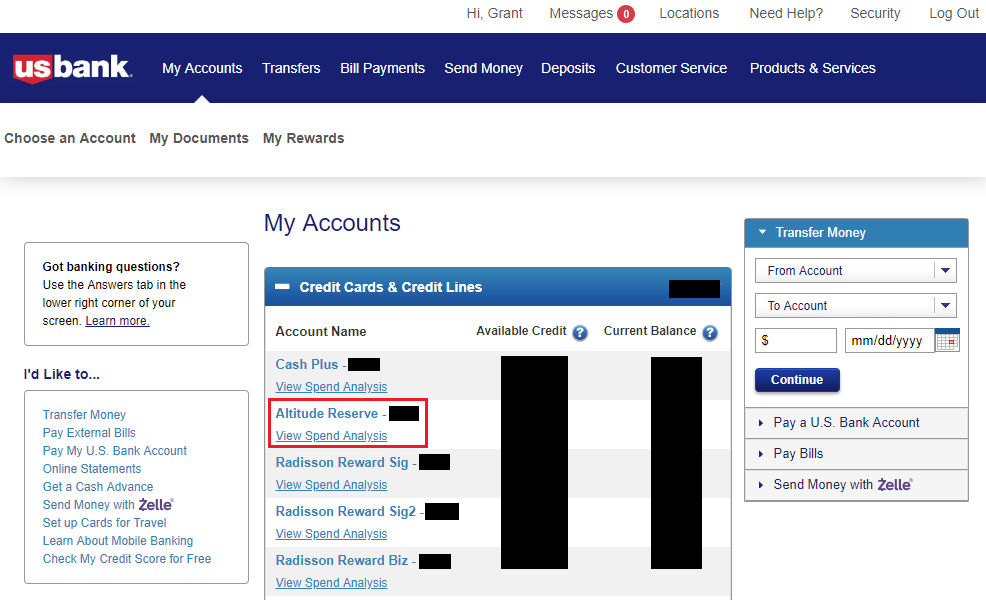

Last but not least, my new US Bank Altitude Reserve Visa Infinite Credit Card automatically showed up in my US Bank online account. I spotted it because it did not have a name I recognized. Not to worry, it is very each to add a nickname to your US Bank credit cards. Just click on the card, then click the Add Nickname link, enter a nickname, click the Save button, and you are done. You will see the new nickname at the top of that page and also back in your main account page.

If you have any questions about the US Bank Altitude Reserve Visa Infinite Credit Card, please leave a comment below. Have a great weekend everyone!

P.S. If you liked this post, I recommend reading my other credit card unboxing posts (sorted by date):

Congrats on getting the USB AR card, Grant! You will love having this card. The ongoing 3x earning opportunities on mobile wallet payments are great – especially as we continue to see more places accepting mobile wallet payments here in the US. It has definitely been our go-to card for Euro travel since we got it. The real-time mobile rewards program has worked well for us, too. Note that the 3x travel category isn’t as broad as we thought it would be – doesn’t cover OTAs & tour agencies. Enjoy all your new cards!

Thank you Craig, I added it to my Apple Wallet and made it my default card for Apple Pay. Have a great weekend!

You too Grant! Can’t believe you didn’t hold out for that sweet 2% coming soon on the Apple Card! ;)

Haha, I might add that card to the end of my next App-O-Rama :)

Mind if I ask what your pre-existing relationship was with the bank? I do not have one. Didn’t qualify based on location for checking and closed Radisson 2 years ago.

Before I was approved for the US Bank Altitude Reserve CC, I had 3 other US Bank CCs (see last group of screenshots).

How were they on approval of the Radisson biz? I’m 4/24 today, 2/24 in June. Thx.

I’ve had the US Bank Radisson Rewards Business CC for 3-4 years, before any of those rules were in place. I believe I was instantly approved, but I don’t remember exactly what happened.

If you haven’t already, be sure to setup your card for real time rewards. Redeeming for travel and earning another 4.5% on the purchase has been incredible.

That’s on my to do list, thank you for the reminder :)

Any tips on how to get around the residency “Catch 22” for this card that DON’T include opening a different card first? They will not let you apply for Altitude unless you have an existing relationship with US Bank, but if you live in state without any physical branches, you application for a bank account is summarily rejected. A few CSR say the only way around this is to “open a credit card” with them, since they have no residency restrictions. However, that gets me back to the requirement to open an Altitude… Not particularly interested in pulling my credit for a card I don’t want got pull it again for the card I do want.

Great question. Some US Bank checking account promotions are valid to all US residents, so maybe wait for one of those opportunities. You could also try to open a checking account when you travel to an area that US Bank has branches.

Alternatively, are there any other US Bank CCs that you are interested in? Cash Plus CC is convenient and Radisson Rewards CCs have big sign up bonuses.

Thanks for the tips…. I was actually able to open a Checking & Saving after opening a Self-directed investing account (which apparently has not residency restrictions). This allowed me to setup a US Bank online account and then open the other accounts over the phone. Just be sure to close the investment account BEFORE the $50 hits (rep tells me around Jan or Feb, if open after Aug 31, you get it punted another year).

However, here’s another question you might be able to answer. What if you were to apply for and get both the altitude GO & Reserve cards… Would it be like a Citi ThankYou situation where those points are combined into one account and the 1.5cpp for travel redemption would apply to the GO points in that combined rewards account?

I remember when my Citi Premier card has 1.25cpp on travel booked thought ThankYou and that same value was applied the the points I earned for relationship banking. AKA, the good olde days at Citi!

Anyhow, I thought you might have both cards, and/or be able to provides some educated insight.

Thanks!

Good workaround idea! According to Doctor of Credit (https://www.doctorofcredit.com/us-bank-soon-to-launch-two-new-altitude-cards-full-details/), “Points on (US Bank Altitude) Go and Connect cards can not be combined with Reserve to increase their value to 1.5 cents.” I would therefore just go for the US Bank Altitude Reserve CC.

FYI… Card has been redesigned:

https://cimg3.ibsrv.net/gimg/www.flyertalk.com-vbulletin/2000×1504/img_8544_ea4a0b9a03547999894f8c352a183dfb419f4c21.jpeg

Looks like they want it to match the vertical style of the newer GO card.

Hi Giuseppe, I’m not surprised that the card is getting redesigned to match all the other Altitude CCs. I kinda like the previous card design better.

Yeah, me too… But I got it mostly for the 3x mobile wallet earnings. So with any luck, I’ll never have to take it out of my wallet again! More acceptance of contactless payments seems to one of the only good things to come out of the pandemic!

I’m in the same boat. I don’t think I’ve used that card in person for the last several months (since I maxed out the $325 travel credit at restaurants). This CC works great in my ApplePay wallet and that’s where it will stay until my $325 travel credits reset.