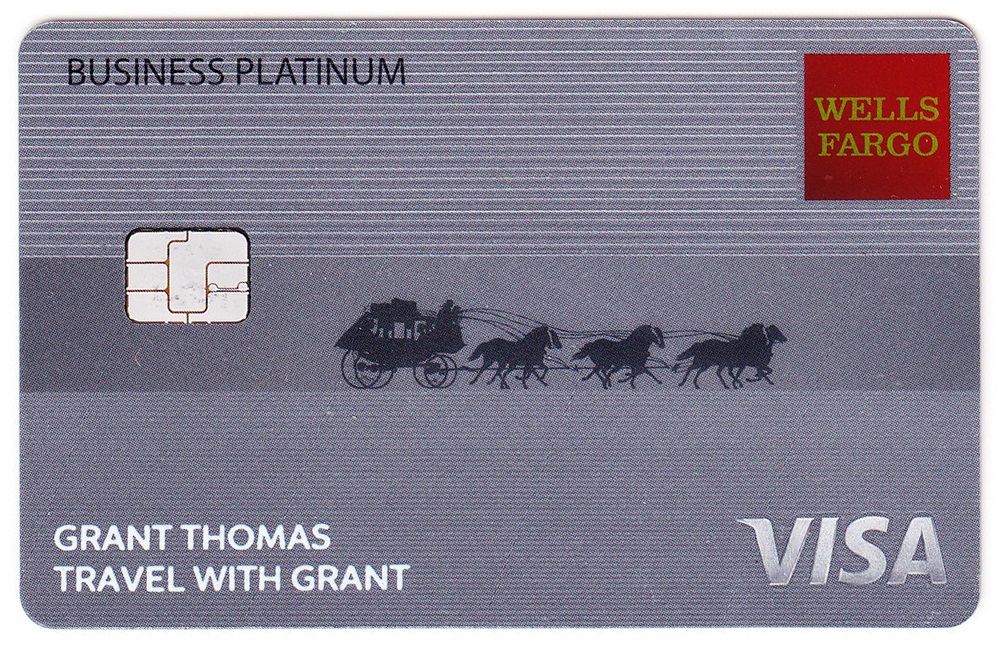

Good afternoon everyone, I hope your week is going well. Back on January 14, 2022, I applied for the Wells Fargo Business Platinum Credit Card. This credit card is currently offering a $300 cash back bonus after spending $3,000 in 3 months. Fast forward 2 months, I finally received the credit card. In this post, I will cover the approval process, show how to add the card to ApplePay before the card arrives in the mail, and show you the welcome letter, brochure, and inserts. But first, here is the card art for the front and back of the credit card:

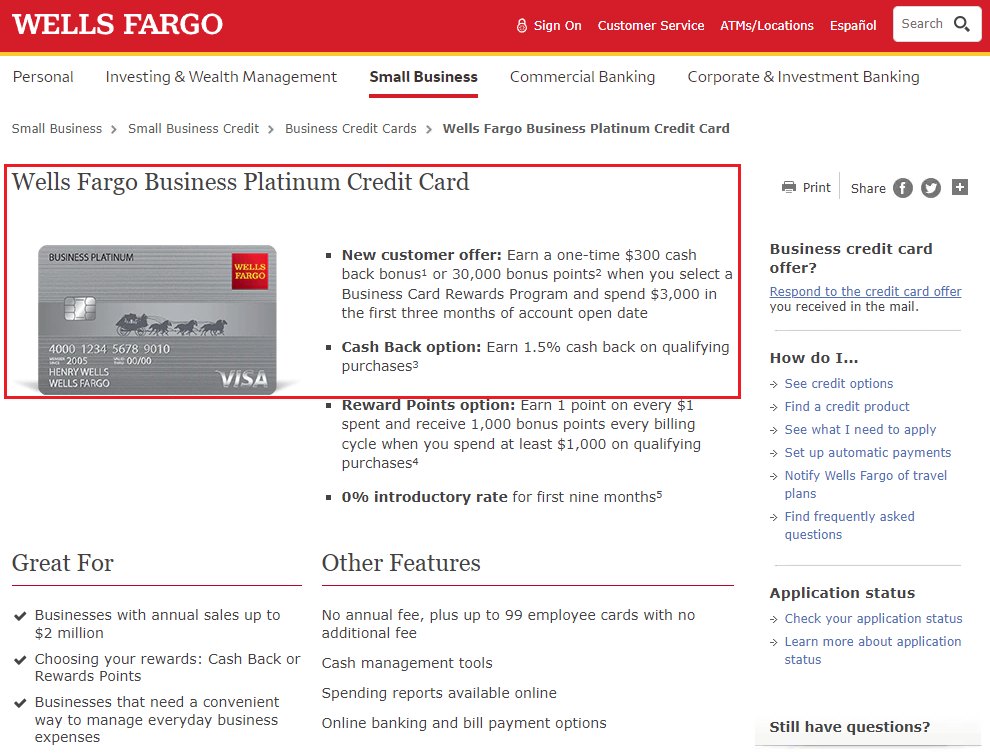

Here is the current sign up bonus. There is a cash back option and a points option. The cash back option comes with 1.5% cash back on all purchases while the points option only offers 1 point per dollar on all purchases. I picked the cash back option. This card has no annual fee and not many other perks. The sign up bonus is decent, but that’s about it.

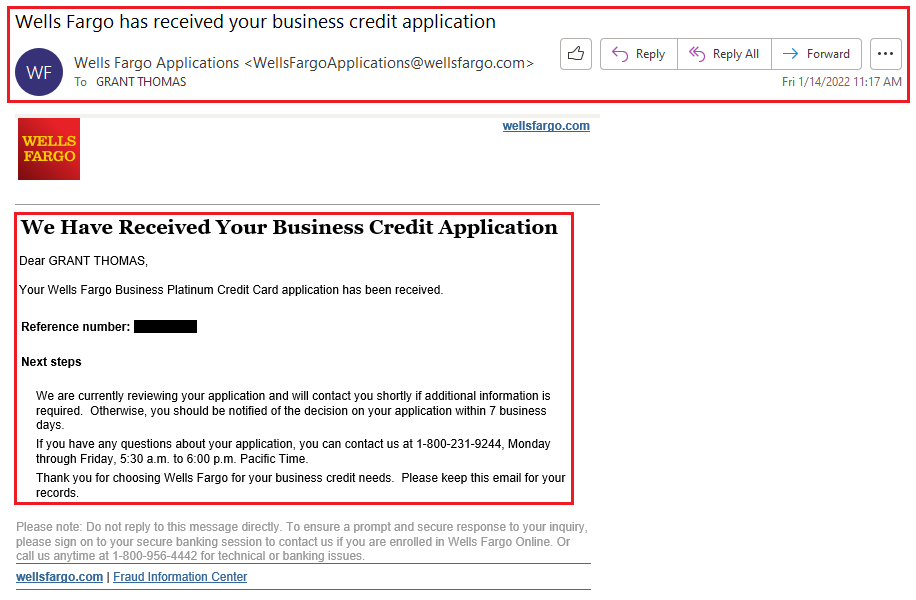

I applied for the credit card on January 14, 2022, and my application went pending. I followed up with Wells Fargo every week by calling the application status phone number (1-800-231-9244) and telling the rep my reference number. After a few weeks, the rep told me my application was conditionally approved and moved to a different department that would process the rest of the application. Several weeks passed and still no update from Wells Fargo.

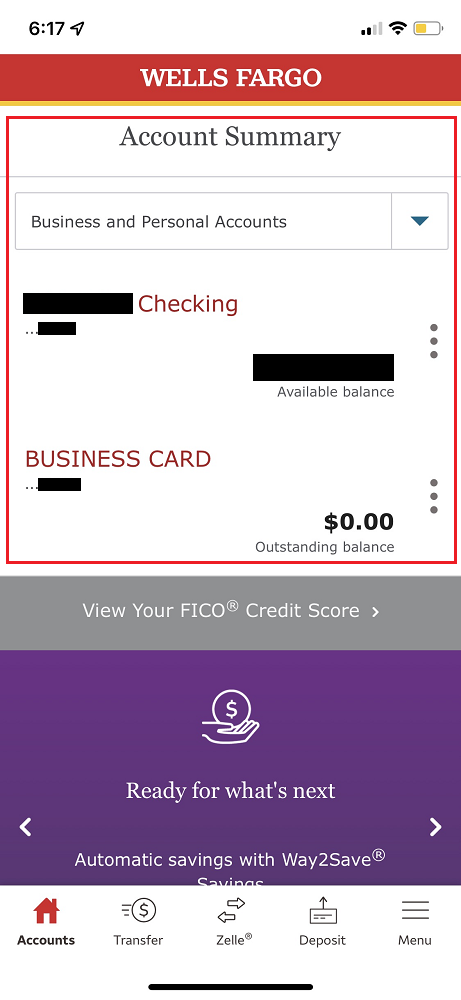

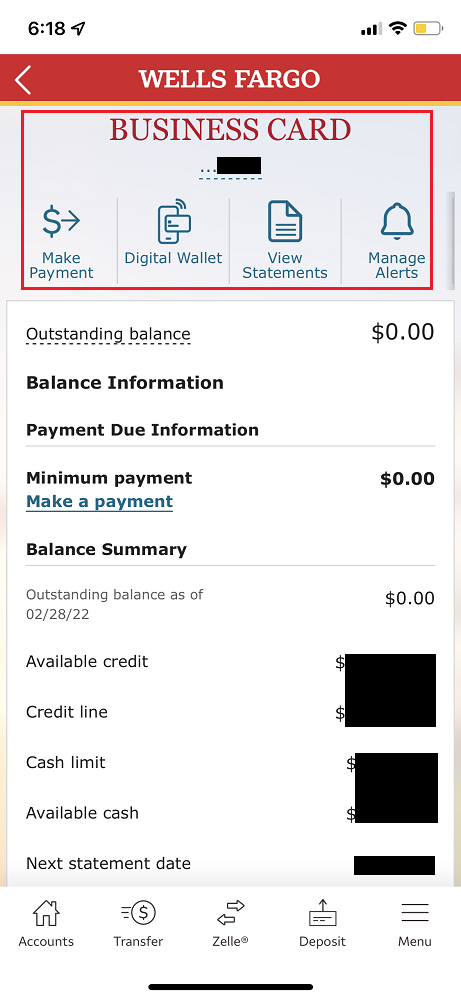

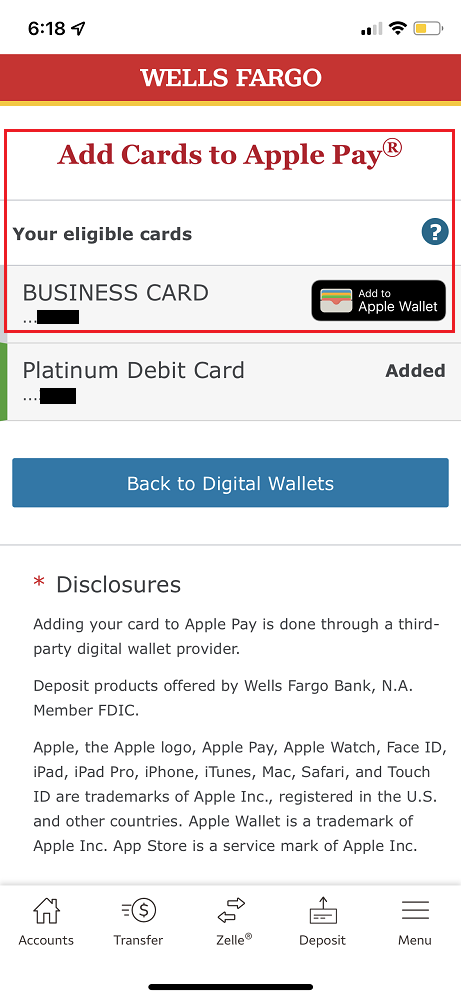

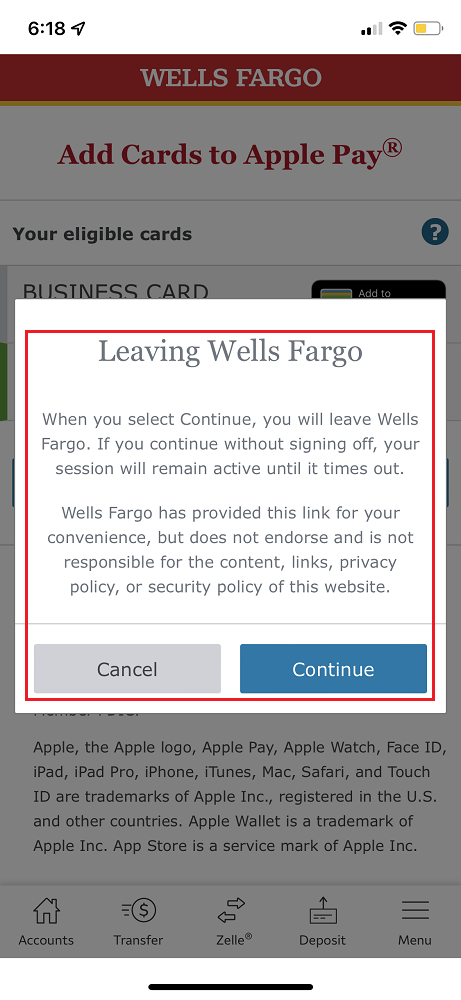

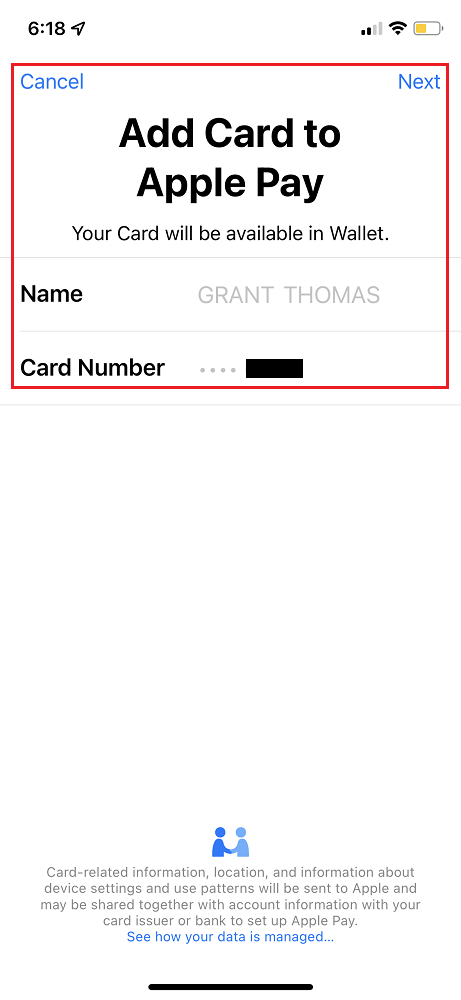

Roughly 1.5 months later, on March 1, I signed into my Wells Fargo app and saw a new business credit card added to my account. I went through the steps of adding the new credit card to my ApplePay Wallet without having received or activated the credit card yet. Now that the new credit card was added to my ApplePay Wallet, I was able to make charges to the card via ApplePay.

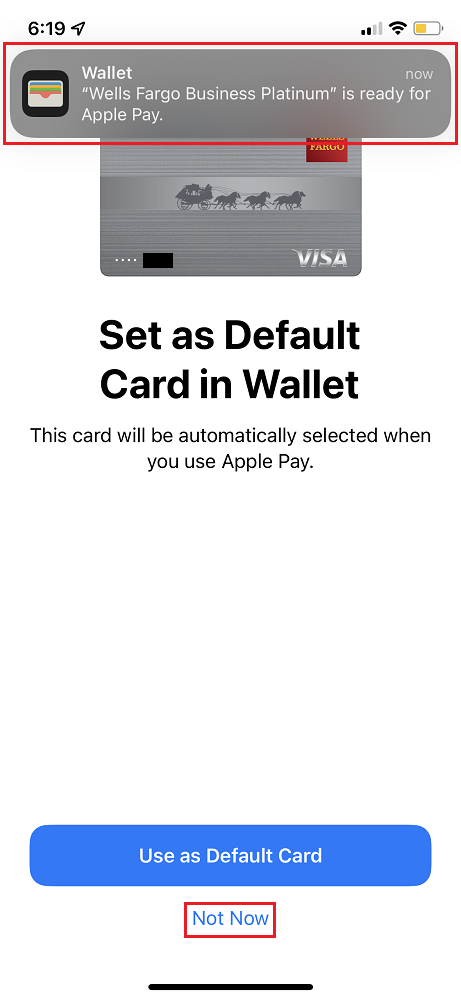

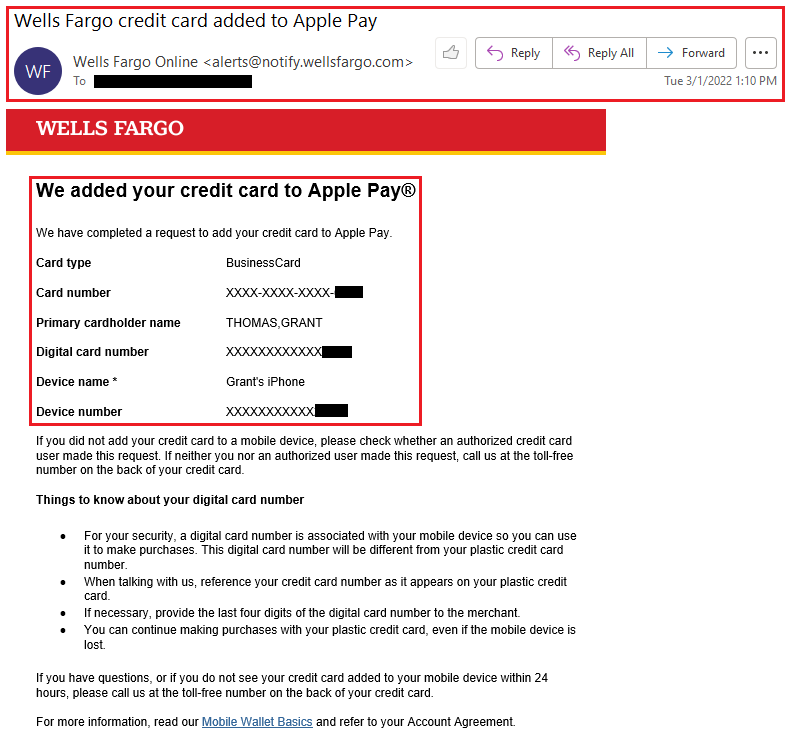

After adding the credit card to my ApplePay Wallet, I received this confirmation email from Wells Fargo.

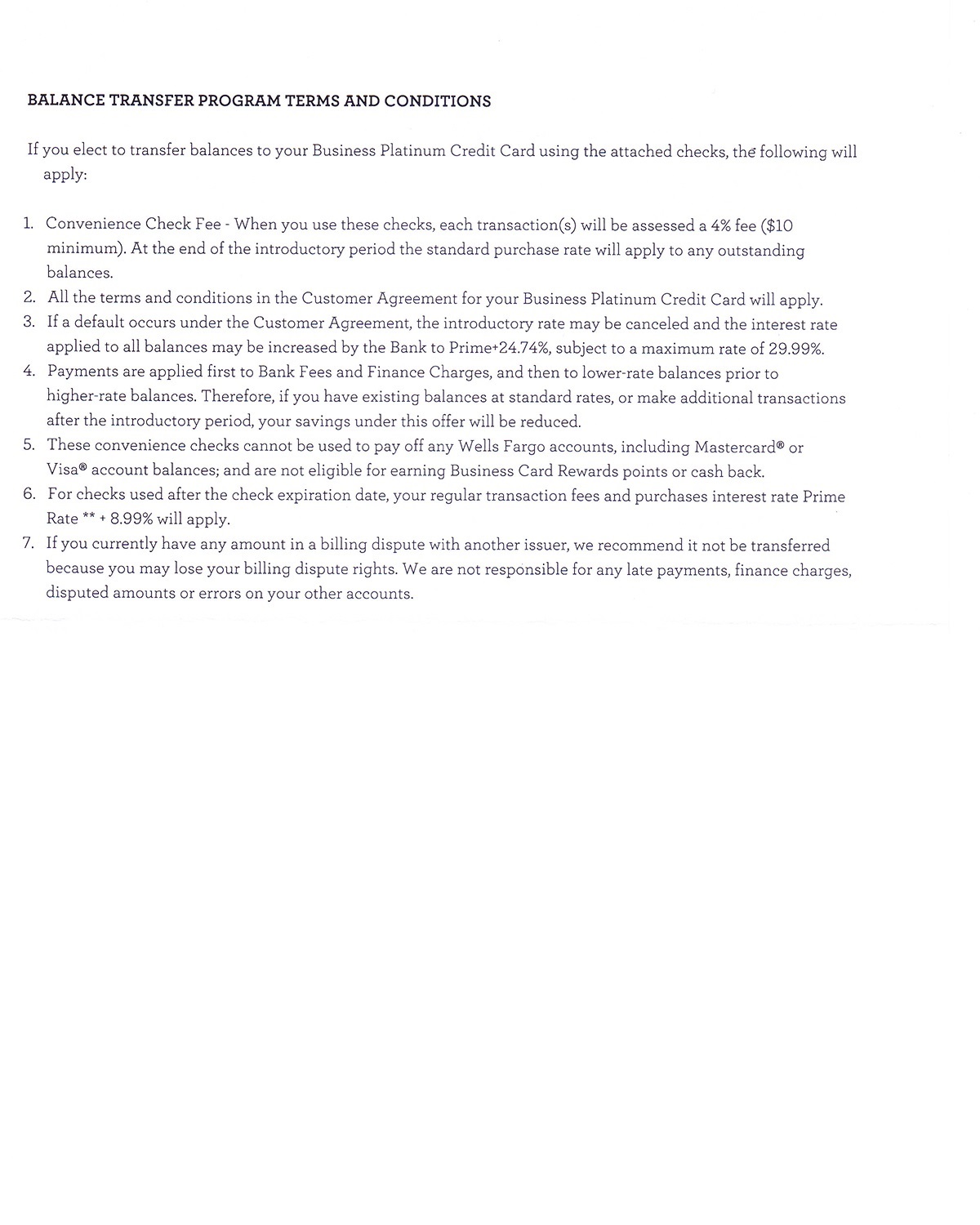

About a week later, on March 7, I received the approval letter, dated March 1. The approval letter stated the sign up bonus details and came with some balance transfer checks (which I immediately shredded).

The following day, on March 8, I received a letter informing me that my new credit card was added to ApplePay, dated March 1.

That same day, I also received the PIN for my new credit card. If you want to change the PIN to a different number, you can call the business banking center (1-800-225-5935).

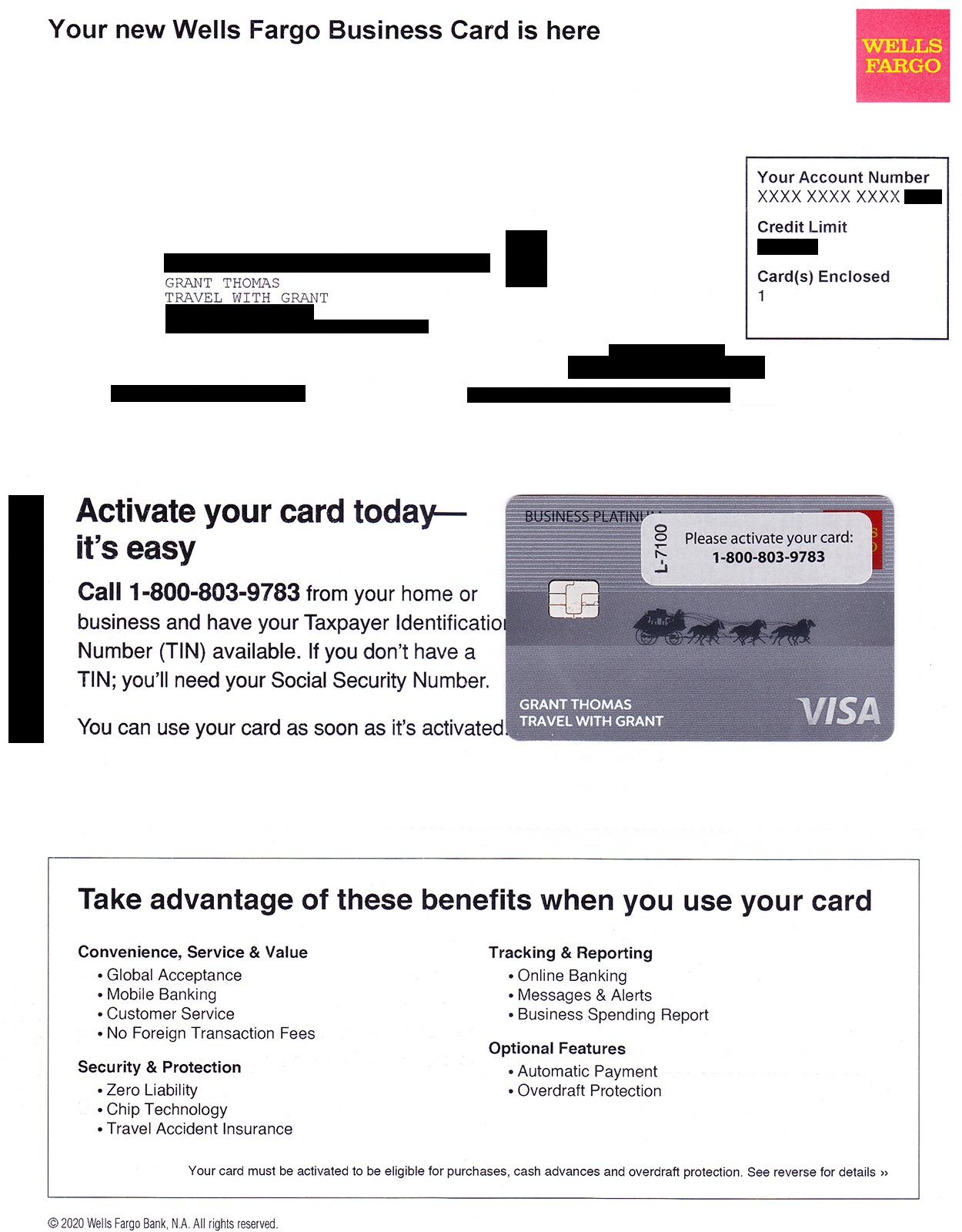

2 days later, on March 10, my new credit card finally arrived in the mail. This was almost 2 months from the date I applied for the credit card. I called the number on the sticker and activated my card. I’m not sure if this was necessary since I already used the credit card with ApplePay, but I went through the process anyway.

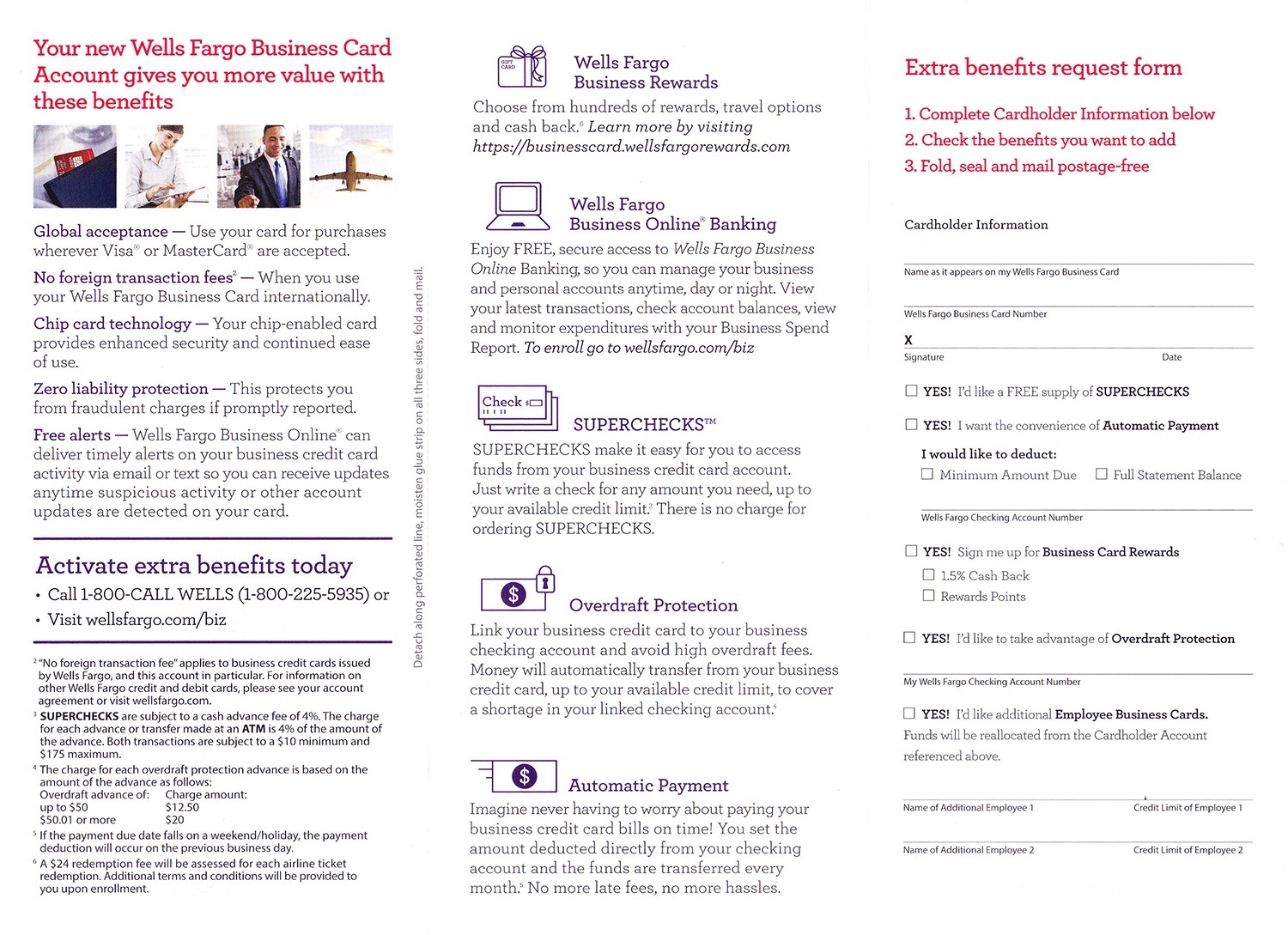

Here is the brochure that came with the welcome letter. If you want a custom design on your credit card, you can use Wells Fargo’s Card Design Studio.

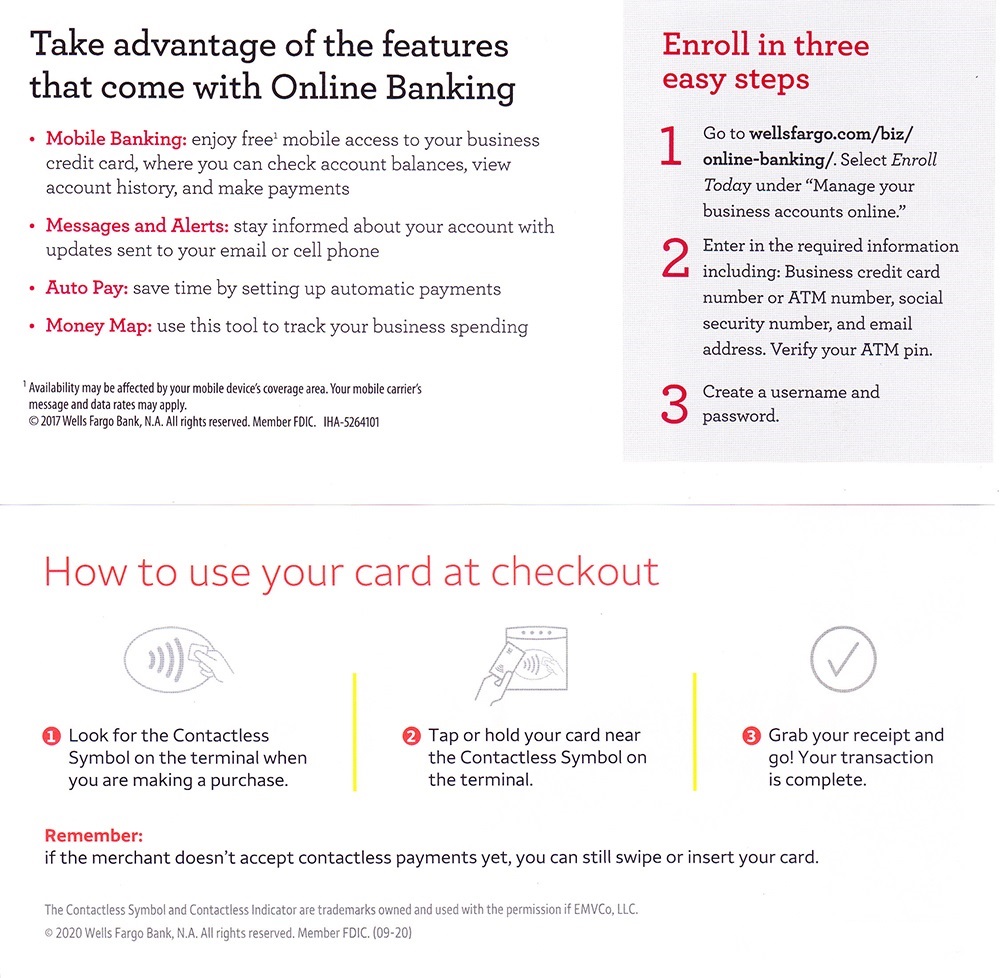

Last but not least, here are the 2 inserts that came with the welcome letter that explained online banking and mobile payments.

Long story short, I am not very impressed by the speed of Wells Fargo in approving my application. If you are considering applying for this credit card, keep in mind that the approval process could take up to 2 months. If you have applied for this credit card recently, please let me know how long the approval process took. If you have any questions about the Wells Fargo Business Platinum Credit Card, please leave a comment below. Have a great day everyone!

P.S. If you liked this post, I recommend reading my other credit card unboxing posts (sorted by date):

Are we really writing articles on UNBOXING A CREDIT CARD?!?

what’s next – unboxing videos for junk mail?

Thank you for the feedback. I did share some useful info about the approval process, which I hope will help some people. Thanks for reading and have a great day.

Thank you very much for the information. The details about the application process and the idiosyncrasies of each bank are very helpful. Grateful that sometimes you “take one for the team.” ;)

I’m glad you appreciate the information. I didn’t think I was taking one for the team, I had hoped Wells Fargo would act like Chase, Citi, AMEX, etc. and make the approval process quick and easy, but I was way off.