Updated 10:20am PT on 5/15: I received letters from Barclays with the complete terms for all 3 targeted spending offers.

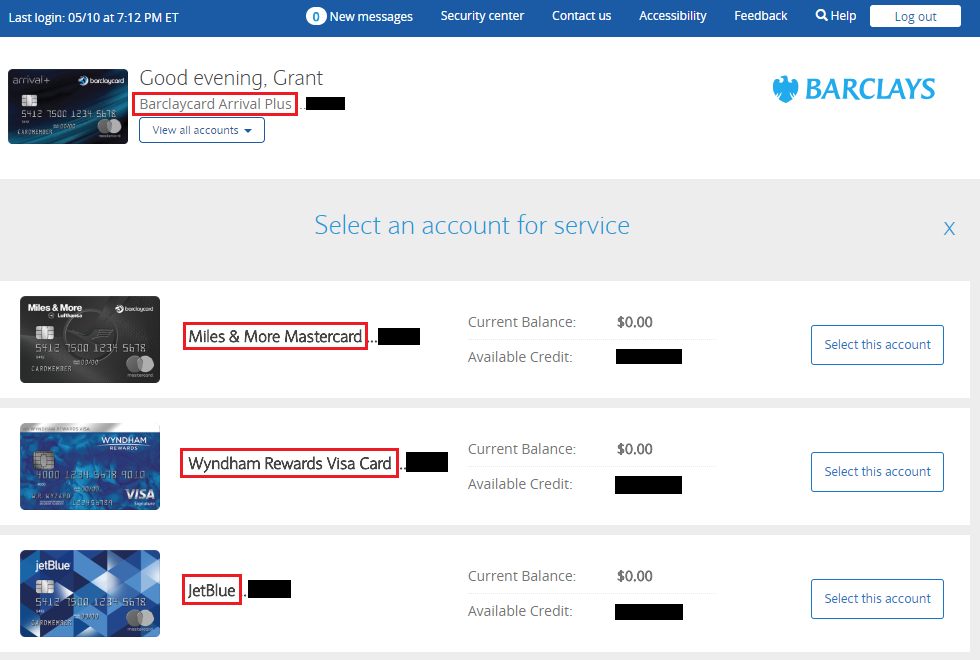

Good morning everyone, happy Friday. A few days ago, I called Barclays to request a downgrade from my Barclays Arrival Plus Credit Card to the no annual fee Barclays Arrival Credit Card. After the downgrade was completed, I asked the rep (I believe he was a customer relationship manager, or some similar title) if there were any targeted / spending offers available. To my surprise, there was an offer. To say I don’t put much spend on my Barclays credit cards would be an understatement – all 4 of my credit cards have $0 balances and haven’t had charges on them for a few months.

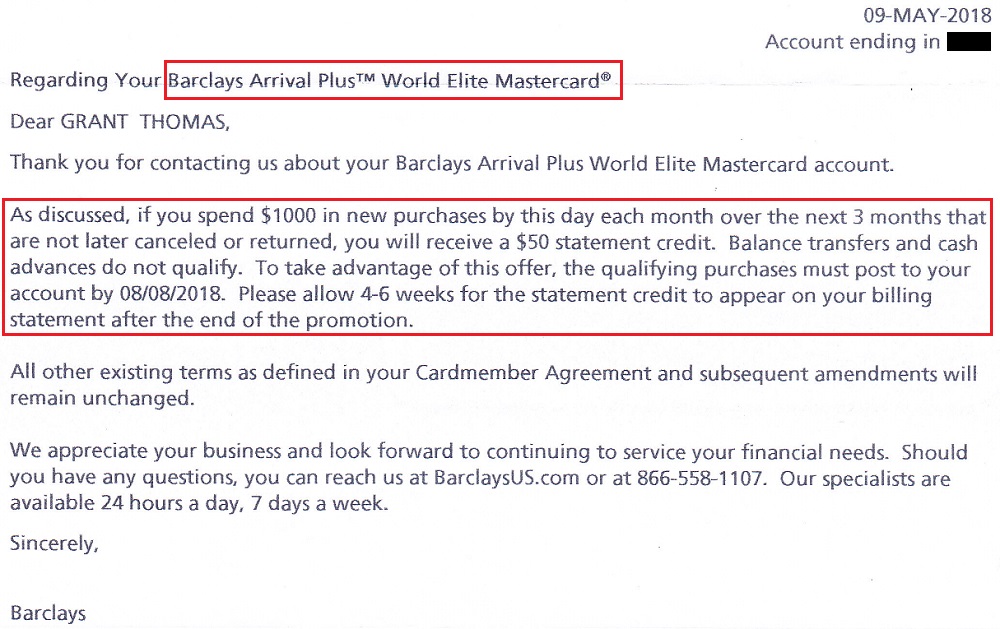

The rep said that my new Barclays Arrival Credit Card had the following offer: earn a $50 statement credit after spending $1,000 each month for the next 3 months. Since that was the only offer available, I accepted the offer, even though I have no intention on spending $3,000+ over 3 months to get a $50 statement credit ($50 / $3,000 = 1.67% bonus). I then asked if he could check my 3 other Barclays credit cards and see if there were any offers available. Who knows, if you don’t ask, they will never proactively tell you about your offers.

Here is the targeted spending offer letter that arrived on May 14:

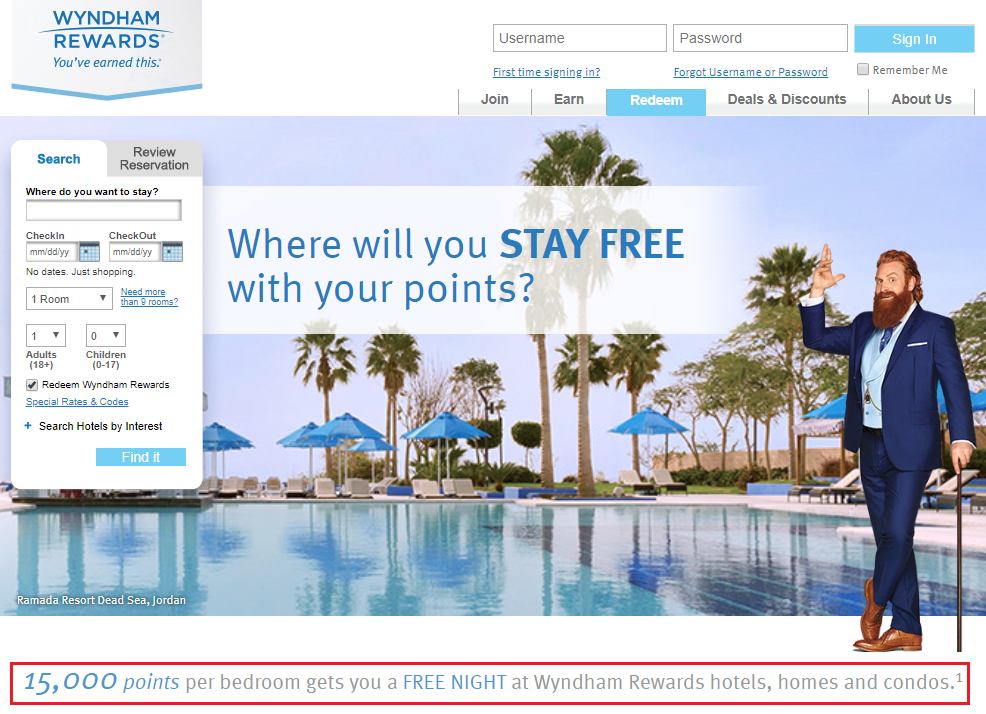

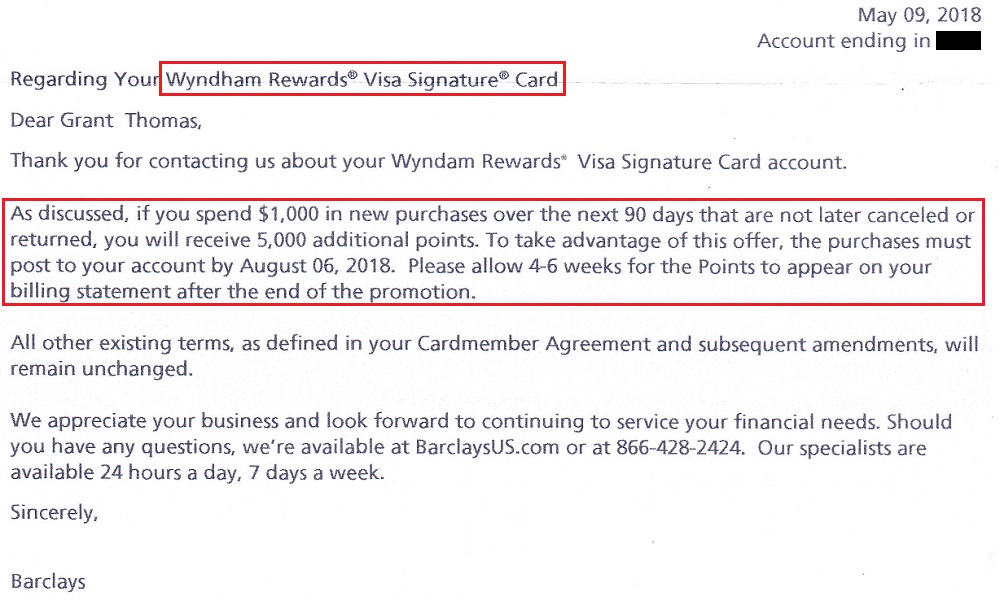

The rep then checked my Barclays Wyndham Rewards Credit Card and had this offer: earn 5,000 bonus Wyndham Rewards points after spending $1,000 in 90 days. Since 15,000 Wyndham points is enough for a free night at any Wyndham hotel, this offer is basically 1/3 of a free night. Let’s value a free night at $150, so this offer would be worth ~$50. That equates to a 5% bonus ($50 / $1,000 = 5%). That return is pretty good, but I would still need to earn an extra 10,000 Wyndham points to get a free night. I decided to accept this offers, but I will not complete the spending (I am still working on meeting my minimum spending requirement from my March App-O-Rama).

Here is the targeted spending offer letter that arrived on May 14:

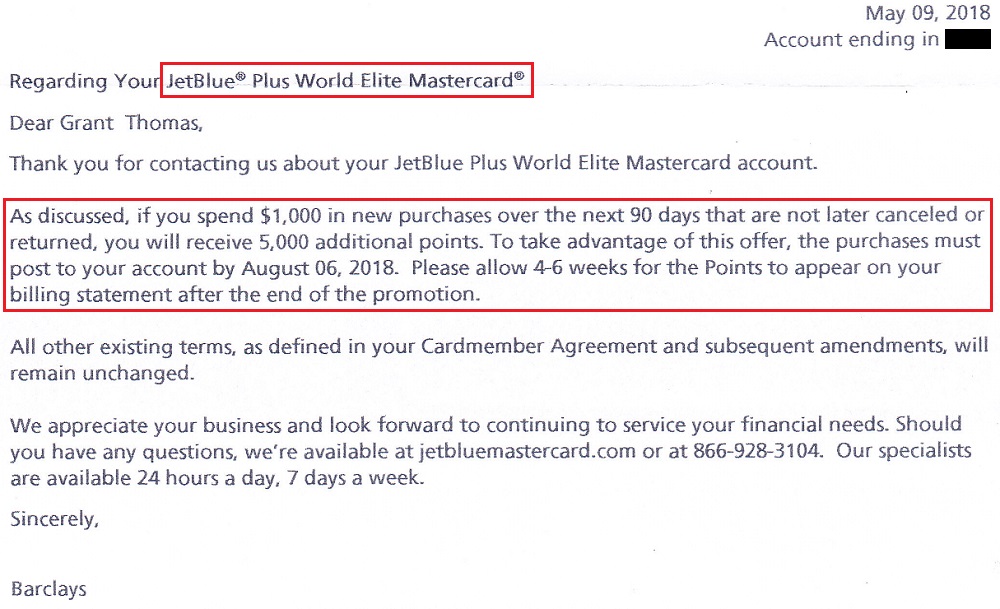

Up next was my Barclays JetBlue Plus Credit Card and this offer: earn 5,000 bonus JetBlue points after spending $1,000 in 90 days. JetBlue points don’t have a fixed value, but if you value them at 1.5 cents per point (CPP), you get a value of $75 or 7.5% bonus ($75 / $1,000 = 7.5%). This is the best offer of the 3 so far, but I have way more JetBlue points than I can spend (thanks to earning 3x at Amazon for such a long time). Like the 2 previous offers, I decided to accept this offer, but I will not complete the spending requirement. Here is the targeted spending offer letter that arrived on May 14:

Lastly, the rep checked my no annual fee Barclays Miles & More MasterCard but he said no offers were available. No big deal, I cashed in all my Lufthansa miles a few months ago for 2 business class tickets on Turkish Airlines to Athens, Greece.

I’m not sure if not using these Barclays credit cards over the last few months made it more likely that I would get decent targeted / spending offers, but that is my hunch. If you call Barclays anytime soon, ask them if they have any targeted / spending offers available. Like I always say, if you do not ask, you will not receive. If you have any questions, please leave a comment below. Have a great Mother’s Day Weekend everyone!

I hadn’t heard of calling about targeted / spending offers. Why would the company offer them but not make a point of telling people about it? I don’t understand. Thanks for the info!

They probably hope customers just use their cards for everyday spending, without offering them an incentive.

I called in for retention offer on one card, and asked about spending offer on all my accounts, got $1000 spending for 5k bonus in 3 months on our 3 Barclay Aviator AA cards. AF was credited too. I may call again after bonus posted.

That’s awesome, glad you got good spending offers and your annual fees waived.