Good morning everyone, I hope you all had a great weekend. Over the weekend, I reviewed my recent American Express credit card statements and spotted some major and minor changes to the terms. A few months ago, I wrote about other changes: AMEX Membership Rewards Changes: No Points for Cash Equivalents (Gift Cards) & Person-to-Person Payments (Venmo). Usually, whenever American Express makes a change to their program, it usually benefits American Express more than their cardholders.

In this month’s updates, there are some major and minor changes. I reviewed the changes to my American Express Blue Cash Everyday Credit Card and there are some changes that affect cash back credit cards. I also reviewed the changes to my American Express EveryDay Credit Card that earns Membership Rewards Points, and there are some changes there too. Lastly, some changes affect all types of credit cards. There is a lot to cover, so I will try to bold the most important stuff.

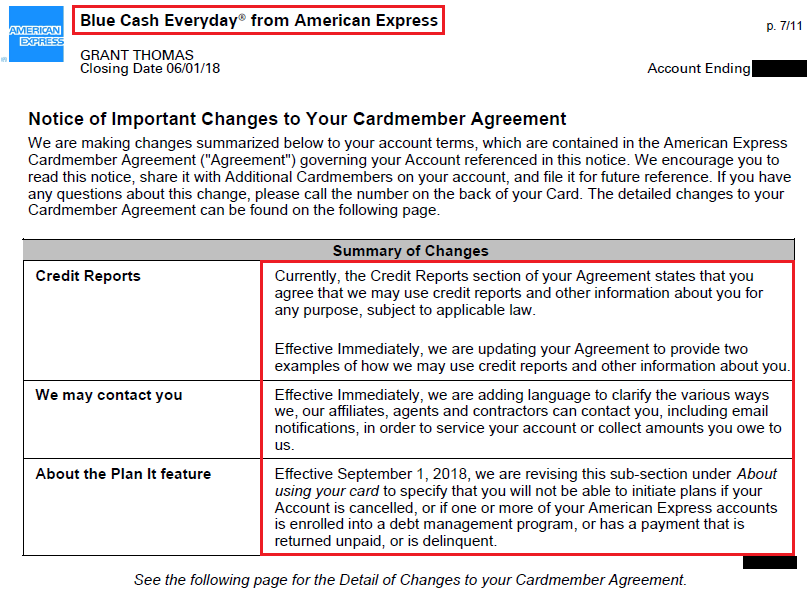

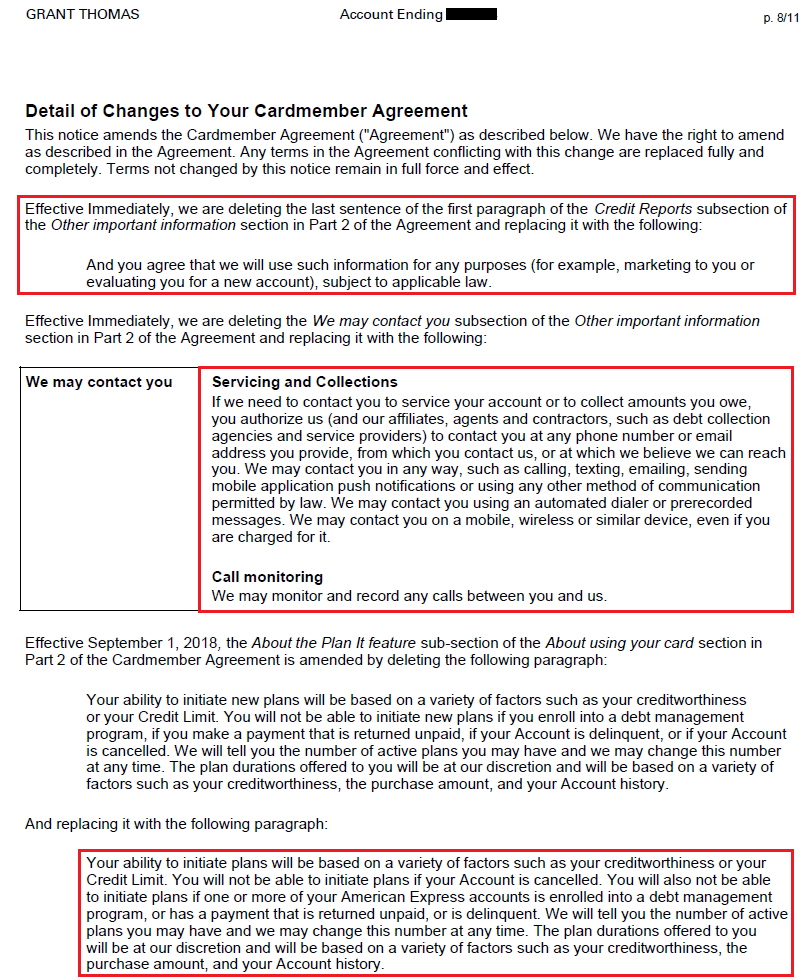

- American Express will look at your credit report and may use the info for marketing purposes, to evaluate your account, and more.

- American Express (and their affiliates and partners) may contact you at any phone number or email address to service your account or collect past due amounts.

- American Express will specify when and how frequent you can use the Plan It feature.

The part that I find interesting / disturbing is that American Express, or their affiliates, agents, contractors, debt collection agencies, and service provides may contact you via calls, texts, emails, mobile push alerts, and “any other method of communication permitted by law”. Uh oh, that sounds scary.

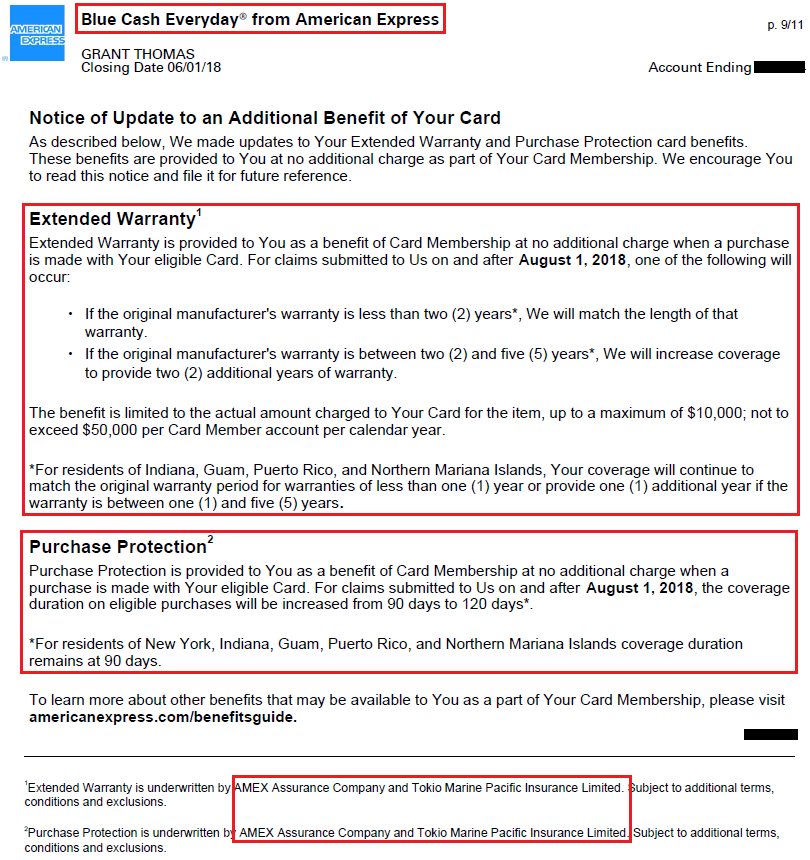

2 good changes come in the form of improved Extended Warranty and Purchase Protection. For Extended Warranty, if you purchase an item that has less than a 2 year manufacturer’s warranty, American Express will double the length of the warranty. For example, if the manufacturer provides a 1 year warranty, you are covered for 2 years. However, if the manufacturer warranty is between 2-5 years, American Express will give you 2 more years of warranty protection. You are covered up to $10,000 per item and up to $50,000 per calendar year per card.

For Purchase Protection, you will have 120 days to file a claim, instead of the current 90 days. 30 more days may not seem like much, but it’s better than nothing.

If you live in New York, Indiana, Guam, Puerto Rico, and Northern Mariana Islands, you will have less coverage. #sorrynotsorry from American Express

Lastly, does anyone know anything about Tokio Marine Pacific Insurance Limited? They are underwriting both Extended Warranty and Purchase Protection.

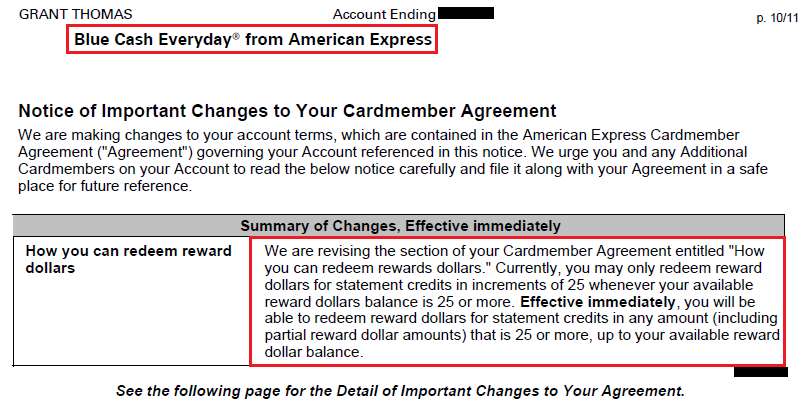

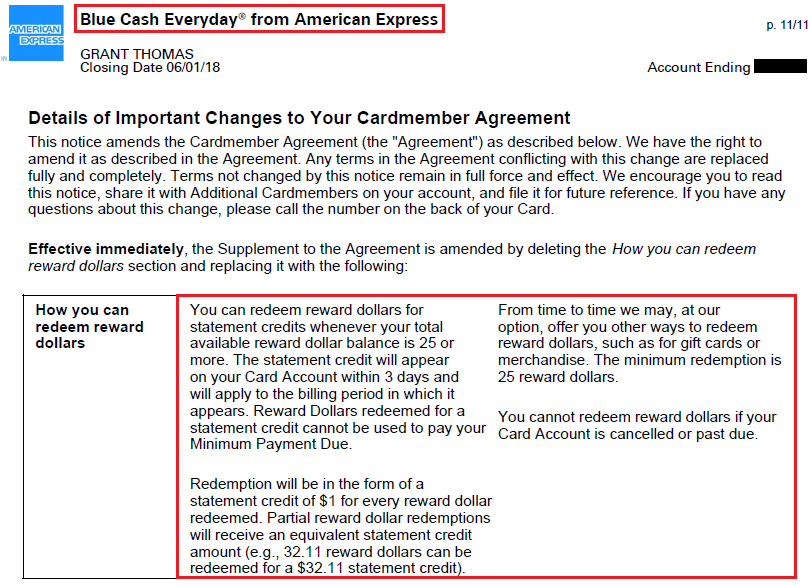

In another positive change, you can now redeem cash back in any amount as long as you have a minimum $25 amount. This change replaces the old policy where you had to redeem in $25 increments. I’m not sure why the $25 minimum amount is necessary, if I am just going to redeem my cash back for a statement credit.

Cash back redeemed as statement credits will post to your account within 3 days. I think that is the current processing time, so I don’t think anything has changed. Perhaps American Express will offer gift cards at a discount, similar to Discover.

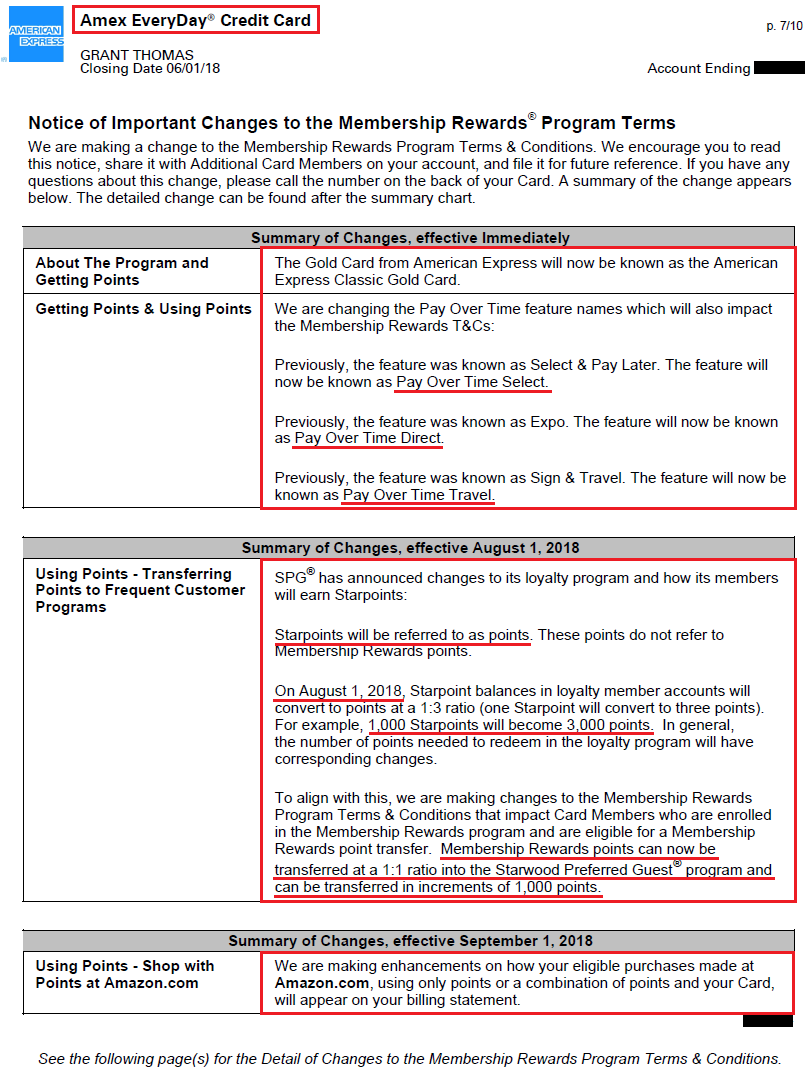

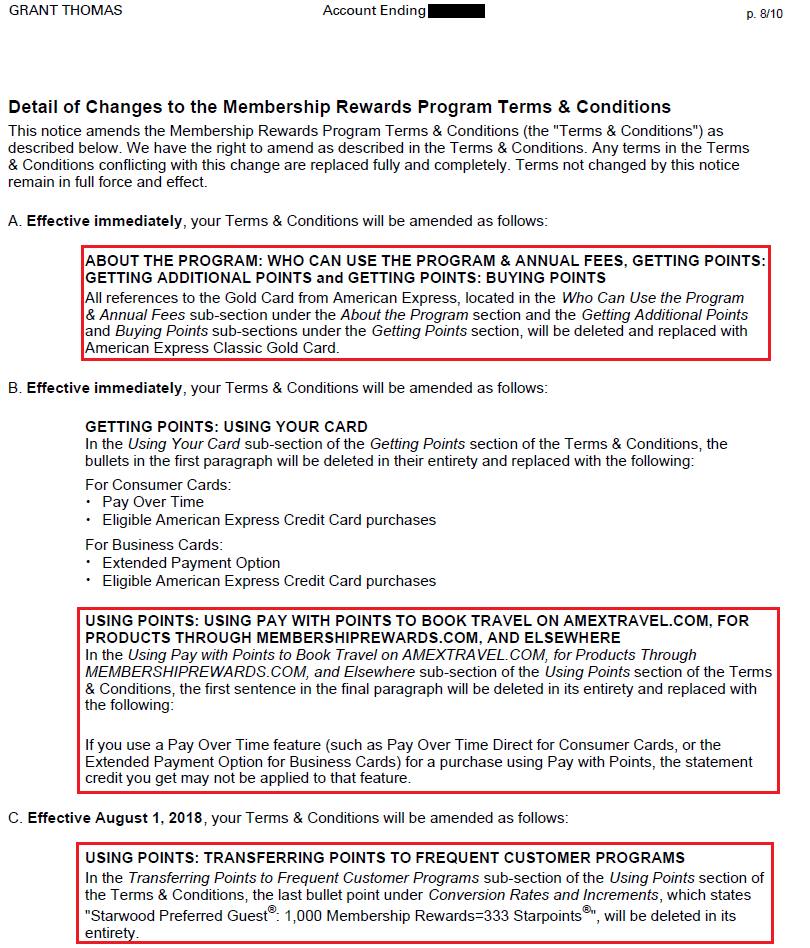

If anyone has an old American Express Gold Card, that card is being renamed the American Express Classic Gold Card (not to be confused with the American Express Premier Rewards Gold Charge Card) *yawn*. Some pay over time features are also being renamed *double yawn*

In SPG news, SPG Starpoints will be called points and 1,000 SPG Starpoints will be worth 3,000 points. You will then be able to redeem 1,000 Membership Rewards Points into 1,000 (SPG / Marriott) points.

There is also a minor change regarding redeeming Membership Rewards Points on Amazon.

Nothing exciting on this page, move along…

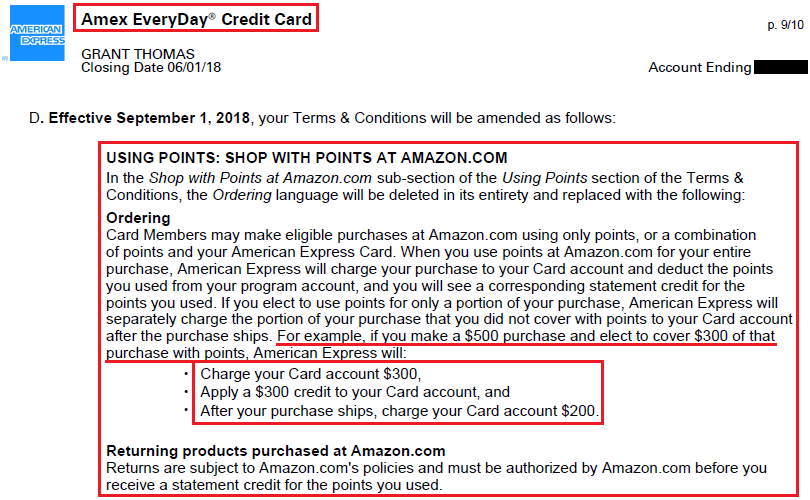

This part is kind of confusing. Let’s follow the example about redeeming Membership Rewards Points on Amazon. If you buy a $500 item on Amazon and pay with $300 in Membership Rewards Points, your American Express credit card will be changed $300, then a $300 credit will be applied to your account (presumably you redeemed $300 in Membership Rewards Points), at which point, your American Express credit card will be changed an additional $200 to cover the remainder of the purchase. I guess that makes sense, but I still think redeeming Membership Rewards Points on Amazon is a bad deal.

None of these changes is make or break for me, unless I start getting calls, texts, emails, etc. from American Express and all of their partners. Then I will be upset. Do any of these changes make a difference to you? Let me know. If you have any questions, please leave a comment below. Have a great day everyone!

Is there a list of AMEX credit cards that do NOT earn points when purchasing cash equivalents?

Technically, I believe every AMEX CC has that “cash equivalent” restriction, but AMEX does not always enforce that rule.

Pingback: American Express Lengthens the Extended Warranty Benefit to 2 Years in August (up from 1 year) - Doctor Of Credit

Pingback: American Express Ehances the Purchase Protection Benefit to 120 Days (up from 90) - Doctor Of Credit

Pingback: Amex Improving Extended Warranty, Purchase Protection Benefits

Pingback: American Express Enhances Benefits Including Purchase Protection

Pingback: Several Positive Changes Coming to AMEX Cards! Better Warranty & Purchase Protection, and More Cash Back Flexibility | Million Mile Secrets

At present, in Canada 1000 Membership Rewards points equates to 500 Starpoints, which at the 3:1 ratio would be 1500 Marriott points. So they are devaluing the MR points in relation to Marriott points after August 1. No surprise, since the earning ratio is presumably also dropping to 2/3 of the pre-August ratio. I’m assuming the Canadian changes will mirror the US ones, but I can’t get a straight answer from Amex about this, a mere two months before it all happens.

The Canadian American Express Membership Rewards program runs slightly differently than the US version, so I have no idea what they are going to do. Hopefully on your next AMEX CC statement there will be more info.

Pingback: Amex Enhances Purchase Protection and Extended Warranty - Danny the Deal Guru

What exclusions are there on the American Express warranty enhancement? I just purchased a new car totally on Amex. Are cars generally included in the warranty?

I would call Amex and see what is covered. I don’t know if cars are covered.

Pingback: Redemption Options & Process for American Express Old Blue Cash