Good morning everyone, I hope you had a great weekend. In mid July, I applied for 5 credit cards and was ultimately approved for 4 credit card in my July App-O-Rama. Here are the credit cards and their sign up bonus details (listed in the order the sign up bonus posted):

- American Express Platinum Delta SkyMiles Credit Card – spend $3,000 in 3 months and get 70,000 Delta SkyMiles

- Wells Fargo Propel World Credit Card – spend $3,000 in 3 months and get 40,000 Wells Fargo GoFar Rewards Points

- Banco Popular Avianca Vuela Credit Card – spend $1,000 in 3 months and get 60,000 Avianca LifeMiles

- Citi Premier Credit Card – spend $4,000 in 3 months and get 60,000 Citi Thank You Points

I have had all of these credit cards before (with the exception of the American Express Platinum Delta SkyMiles Credit Card), so I will share my dates and churning details in this post. I have also written about some of these sign up bonuses already, so I will link to those posts too. Without further ado, let’s start with my American Express Platinum Delta SkyMiles Credit Card.

American Express Platinum Delta SkyMiles Credit Card

This was the quickest sign up bonus to post (with the miles posting 9 days after applying for this credit card). I wrote more details of the quick sign up bonus here. As of today, I haven’t used the Delta SkyMiles yet and do not have any immediate plans to use them.

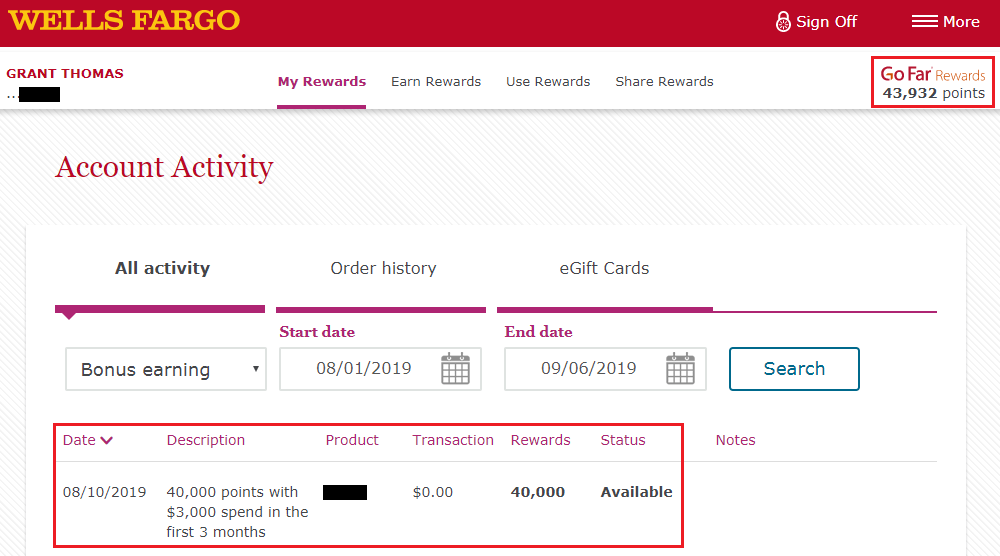

Wells Fargo Propel World Credit Card

I originally had the Wells Fargo Propel World Credit Card from March 2017 through April 2018. I then reapplied for this credit card in July 2019 and got the sign up bonus in August 2019. Before I closed this credit card in April 2018, I made sure to take advantage of the $100 airline reimbursement credit. Wells Fargo GoFar Rewards Points are only worth 1 cent each toward cash and travel. As of today, I haven’t used any Wells Fargo GoFar Rewards Points yet, but I am leaning toward redeeming them for cash in my Wells Fargo checking account (2,500 Wells Fargo GoFar Rewards Points = $25 cash). If you are interested in this credit card, read this Doctor of Credit post.

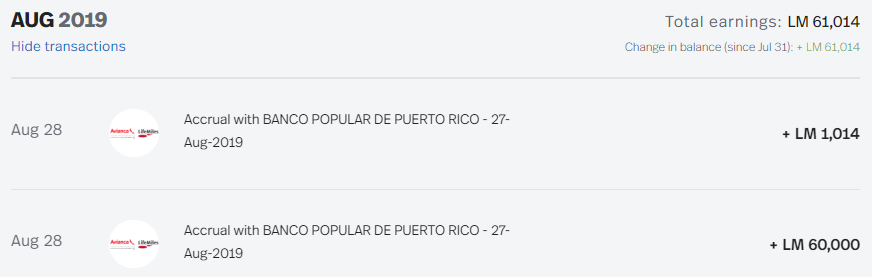

Banco Popular Avianca Vuela Credit Card

I originally had the Banco Popular Avianca Vuela Credit Card from December 2016 through June 2017, when the 60,000 Avianca LifeMiles posted after your first purchase. I then reapplied for this credit card in July 2019 and got the sign up bonus in August 2019. This credit card was a pain to deal with since my credit card was frozen and I needed to provide identification verification documents to Banco Popular. I don’t have any immediate uses for these LifeMiles, but I have been able to get some very good uses out of these miles in the past (like business class from SFO-SAL-LPB on Avianca and SFO-PEK on Air China).

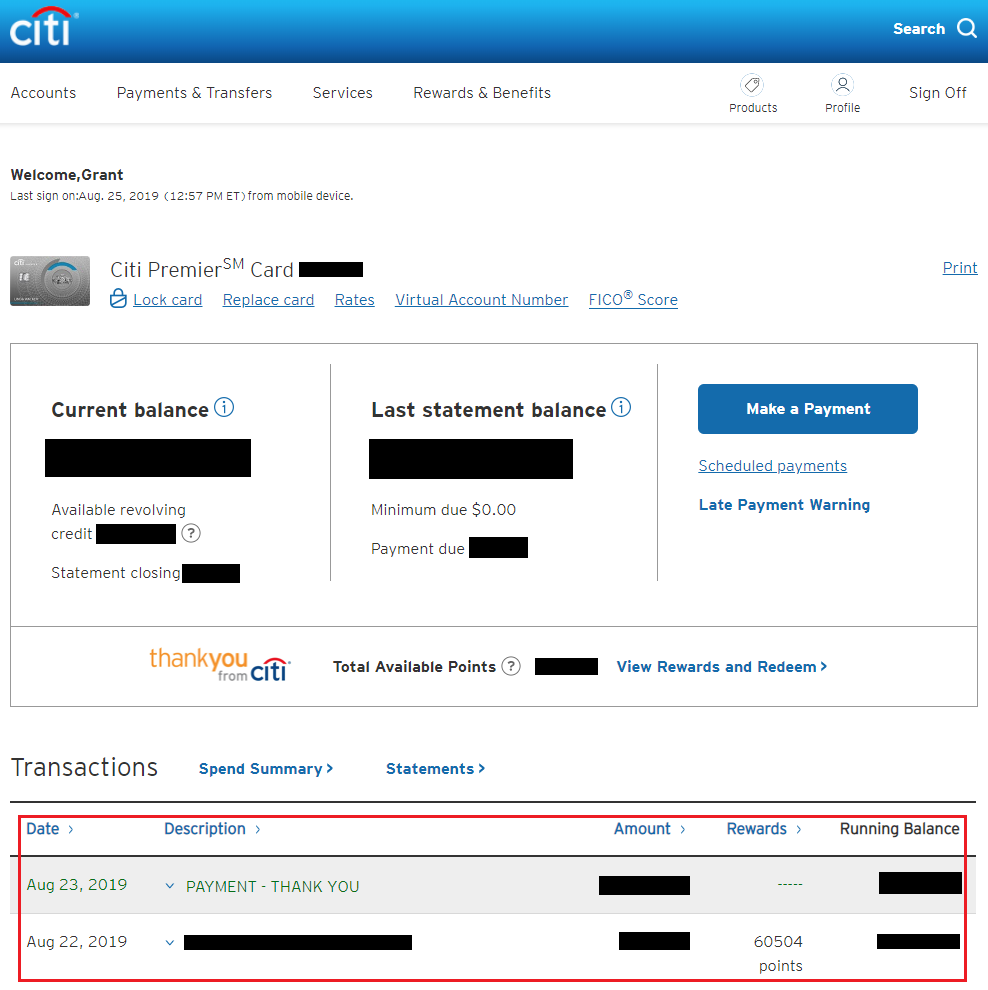

Citi Premier Credit Card

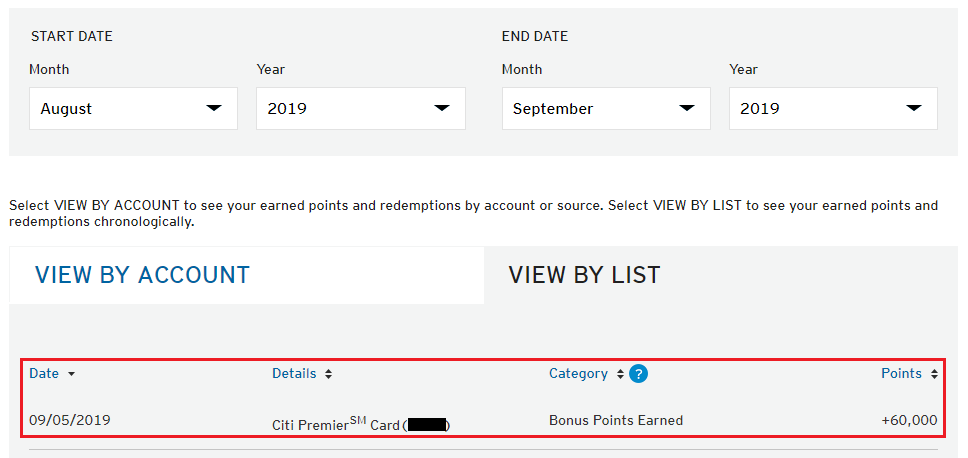

I still have my original Citi Premier Credit Card that I opened in April 2015. Since it has been more than 2 years since opening or closing this credit card and more than 2 years since closing/converting a Citi Thank You Point earning credit card, I was able to apply for my second Citi Premier Credit Card in July 2019 and got the sign up bonus in September 2019. The Citi website showed that I earned the bonus on August 22 with my purchase, but the 60,000 Citi Thank You Points posted after my statement closed.

I had to wait until September 5 for the sign up bonus points to post. I don’t have any immediate plans for the Citi Thank You Points (but Turkish Airlines awards to Hawaii sure are tempting). But first, my plan now is to convert my original Citi Premier Credit Card into a Citi Rewards+ Credit Card so I can get 10% of my Citi Thank You Points back as a rebate (up to 10,000 Citi Thank You Points per year).

I am pretty happy with my App-O-Rama results and I look forward to my next App-O-Rama after October 15. If you have any questions about the sign up bonuses for any of these credit cards or how to get the sign up bonus more than once, please leave a comment below. Have a great day everyone!

Grant, in that last sentence you mentioned getting the bonus more than once. How do you go about doing that?

You have to get the credit card more than once. I shared my data points regarding how I spaced out the credit card applications over a few years.

Will you retain the conversion options with Citi Rewards+ card just like with Premier? I don’t see the “transfer to partners” option under Rewards+ card, and any language if that will count as a qualifying 10% rebate activity. Can you have data points on that?

Instead of having 2 Citi Premier CCs, I will have 1 Citi Premier CC and 1 Citi Rewards+ CC – I will still have access to the travel partners and the 10% TYP rebate.

Ok, that make sense, but still the TYP 10% rebate is in question. Would a point transfer qualify for it?

Yes, I did a 1,000 TYP transfer to LifeMiles and got the email that the 10% rebate would post on my next statement. I will have another blog post about that transfer.

Thanks – that is a good data point as there is no description in T&C of that card.

I never understand how you and others meet the minimum spends on four cards in one time period. Can you give some tips?

I was planning a wedding, so meeting the minimum spending requirements was pretty easy.

Pingback: Easy Conversion / Product Change from Citi Premier to Citi Rewards+ Credit Card

I have no idea what your credit rating is, but doesn’t canceling cards mess with it?

Hi Dan, at a certain point, if you have many credit cards and a high total credit limit, cancelling a single card has a minor influence on your credit score. It’s more important that you pay your credit card bills on time.