Good morning everyone. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit (and charge) cards to make sure they still deserve a spot in my wallet. Last week, I reviewed my American Express Business Platinum Charge Card and Chase Sapphire Reserve Credit Card. In today’s post, I will review my US Bank Altitude Reserve Credit Card, which could be my favorite credit card that I never carry (it is my default credit card in my ApplePay wallet though).

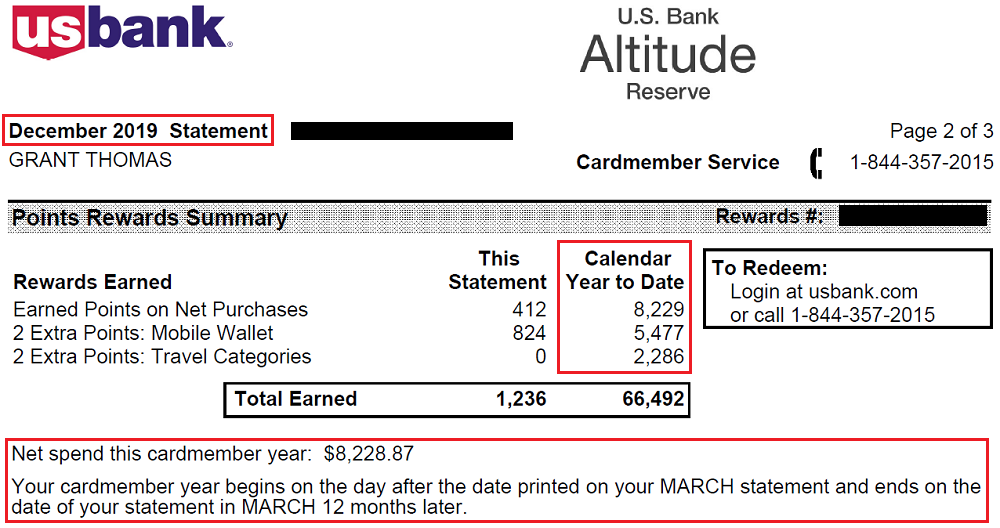

Even though the $400 annual fee for this credit card won’t post until March, I have been mentally thinking over my premium credit cards and seeing if there are ways to save some money on annual fees (read I Paid $4,588 in Credit Card Annual Fees in 2019 & Was it Worth it?). My December credit card statement closed a few weeks ago and I wondered if I get enough value out of this credit card to justify the annual fee. In 2019, I earned 66,492 FlexPoints (50,000 FlexPoints came from the sign up bonus) and I only spent $8,229 ($4,500 were required to complete the minimum spending requirement). I will review the credit card benefits and tell you why I think this credit card is a keeper.

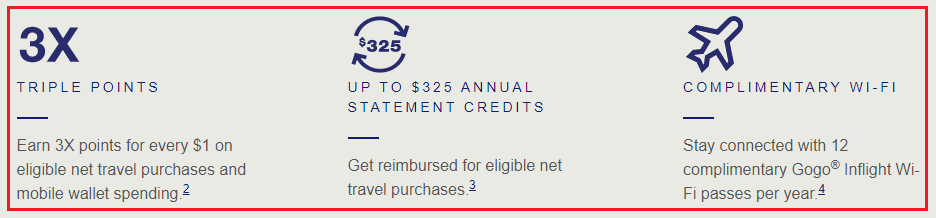

The most important benefit of this credit card is the $325 annual travel credit (I think US Bank went with $325 so that it was $25 higher than the Chase Sapphire Reserve’s $300 annual travel credit). This annual travel credit is based on cardmember year and is super easy to redeem, just pay for eligible travel purchases like flights, hotels, and rental cars. No games like the incidental credit on AMEX cards. I value this $325 annual travel credit as good as cash.

You also get 12 Gogo WiFi Passes every year. I tend to use 5-6 of these passes every year, just because I have them and know that they will expire at the end of the year. I don’t really value these passes since I usually bring entertainment on my iPhone or read a Kiplinger Personal Finance magazine to keep me entertained.

Lastly, this credit card earns 3x FlexPoints for travel and mobile wallet purchases. I use other credit cards for my travel purchases, but this is my go to credit card for mobile wallet purchases, assuming I’m not at a grocery store or restaurant (my American Express Gold Card earns 4x on those purchases). The amount you spend on mobile wallet purchases can be the deciding value in whether to keep or cancel this credit card.

Here are the 9 remaining benefits and I will highlight 3 of them. With this Priority Pass Select membership, you get 4 visits per year and can bring in 4 guests throughout the year (this should work at Priority Pass restaurants too). I have a much better Priority Pass membership with my JPMorgan Chase Ritz Carlton Visa Infinite Credit Card, so I don’t value this Priority Pass membership. You can get a $100 credit to cover your TSA PreCheck or Global Entry membership, but I have more of these credits than I can use, so I don’t value this benefit. Lastly, you have the ability to redeem your FlexPoints with Real-Time Rewards at 1.5 cents per FlexPoint. This is a really cool feature, but it’s hard to put a value on making it easier to redeem your own FlexPoints.

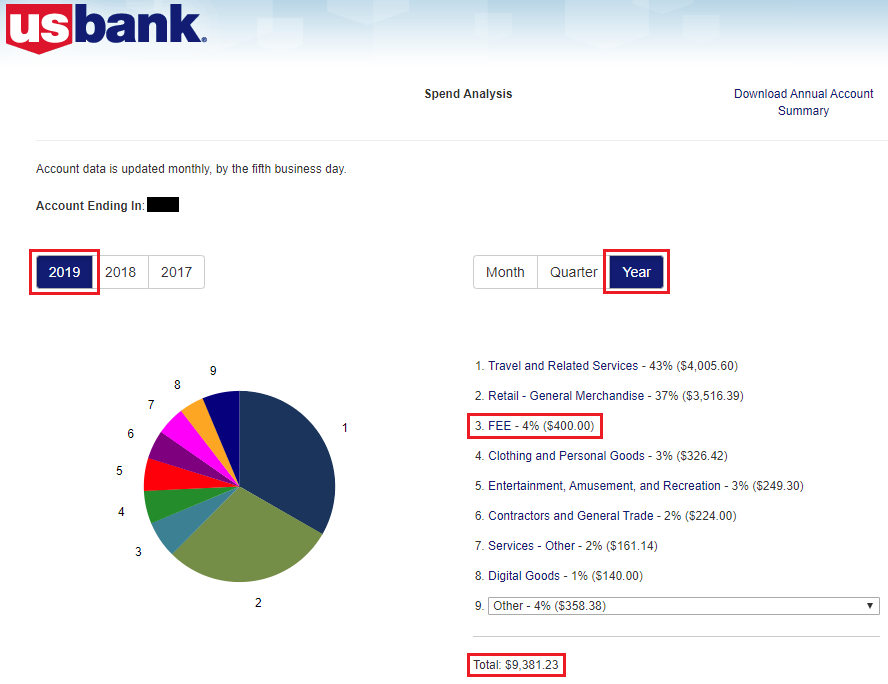

For me, the math is simple: $400 annual fee – $325 travel credit = $75 leftover annual fee. Since FlexPoints are worth 1.5 cents, I would need to earn 5,000 FlexPoints to offset the $75 leftover annual fee ($75 / 1.5 cents = 5,000 FlexPoints). Since I only use this credit for mobile wallet purchases that earn 3x, I would need to spend at least $1,667 on mobile wallet purchases (5,000 FlexPoints / 3x mobile wallet purchases = $1,667). If you divide $1,667 into 12 monthly pieces, you would have to spend more than $139 per month. To see how much I spent on mobile wallet purchases in 2019, I logged into my US Bank online account and clicked the View Spend Analysis link under my US Bank Altitude Reserve.

I then selected Year 2019 and selected the Year box. For 2019, I spent a total of $9,381 and $400 of that was the annual fee. That number doesn’t match up to what my December statement said, but that is not important right now.

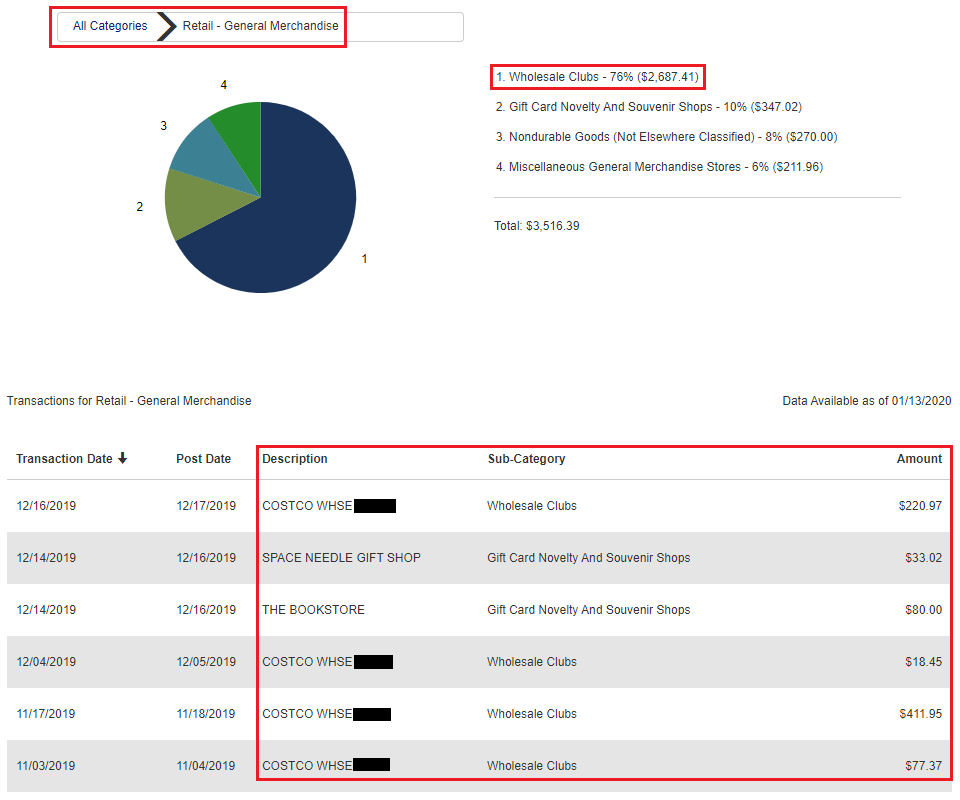

I decided to drill down and look at the “Retail – General Merchandise” category. Inside that category, the largest category was “Wholesale Clubs.” I use my US Bank Altitude Reserve through my ApplePay wallet to pay for our Costco purchases. By using this credit card, I earn 3x FlexPoints (worth 4.5 cents toward travel) vs. the Citi Costco Anywhere Visa Credit Card that only earns 2% cash back at Costco. In this category alone, I spent $2,687 which is higher than my $1,667 breakeven point that I calculated above.

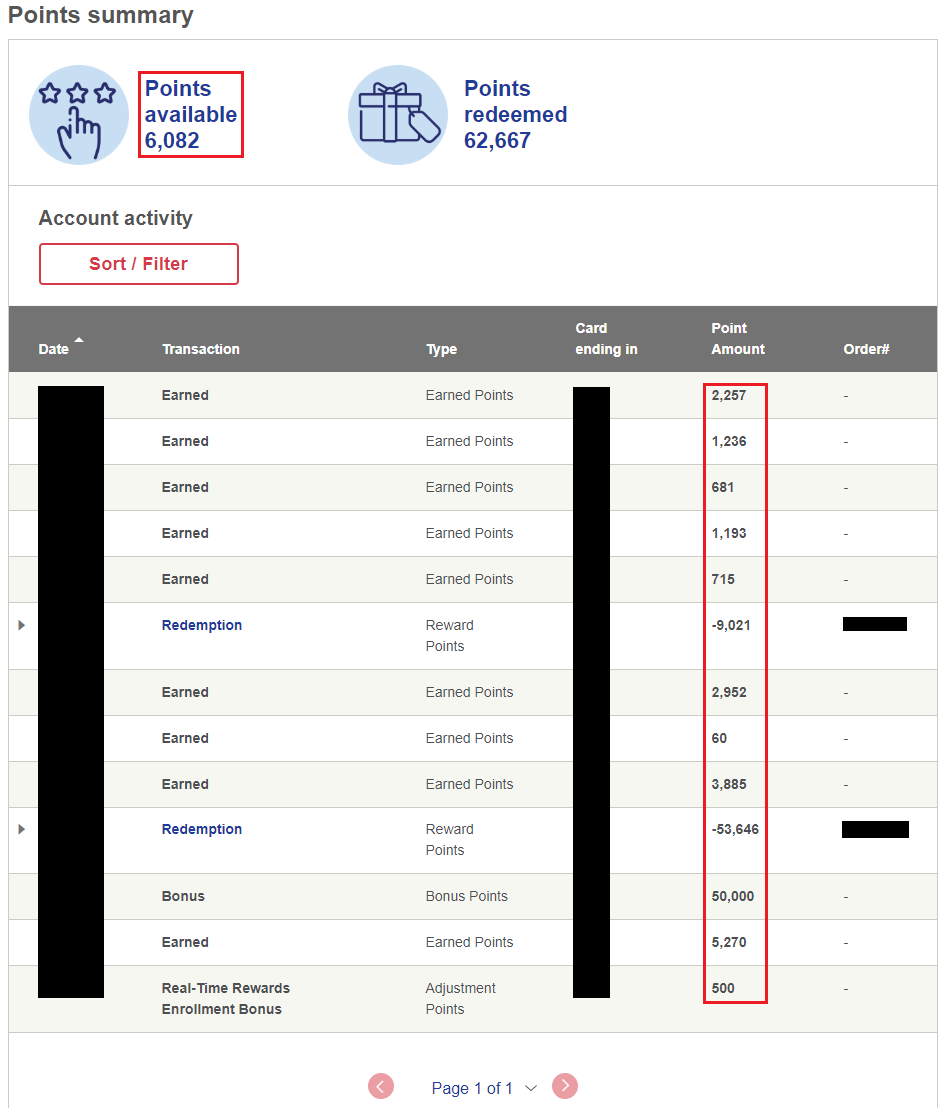

I also decided to take a look at my FlexPoints account summary. As of today, I have 6,082 FlexPoints which are worth $91.23 toward travel. Since I don’t have another FlexPoint earning credit card, if I closed this credit card, I would also lose all of my FlexPoints.

Do you agree with my logic that the US Bank Altitude Reserve is a keeper? If you have any questions about this credit card, please leave a comment below. Have a great day everyone.

You would only need to spend $1667 if your next best card, or the card you would otherwise use if you didn’t have the AR earned nothing. (75/0.045) If you had, let’s say, the 2% Costco card, you would need to earn $3000 (75/(0.045-0.02) to justify the Reserve.

Hi Steve, I guess the math checks out, but that’s not how I calculate the break even point. Either way, it looks like I spend more than enough to justify keeping this credit card.

After SUB, after AF, you basically earned less than [(66492-50000)*.015-75]/8229=2%. Its just the same as no AF citi double cash (which does even better if you can pair it up with premier and able to transfer the points for better values).

You can keep it, but it surely isn’t an undisputed decision, IMHO.

Hi Chris, thank you for the math equation. I try to use my Citi Double Cash and AMEX Blue Business Plus whenever I have an unbonused purchase.

I second Steve’s analysis. Have to compare to next best alternative. Only way your analysis is accurate is if your next best alternative is paying with cash.

I have had this card for 3 years and every year when I call for a retention offer I get one. (Usually 10,000 flex points). This more than justifies keeping and using the card (mainly apple pay but sometimes when I travel overseas as well).

Hi Laura, do you have an estimate on much you spend on this CC every year? I’m planning on doing a retention call when my annual fee posts and I’m hoping to get a generous offer like you.

I got 5k points after 8k spend, but that was the second renewal. I didn’t get anything my first renewal after 13k spend. Hope this helps.

Hi Steve, thanks for sharing your retention results. $8k spend is a bit high for me. I’m also surprised you didn’t get an offer after your first year.

in the $3-4K range. I still have my radisson card too (in case they factor those things in)

Thank you, that’s not too much spend, I think I’ve done at least that amount. I have a few other US Bank CCs, so hopefully that will help too.

Dude, you’ve got an expensive hobby that’s not giving you the value you’re paying for, given the amount of traveling you’re doing. If I were to give one piece of advice, switch to earning cash back and drop the fee cards regardless of how shiny they might seem. I found myself in a similar position years ago, and have never been happier with the hobby than after dropping the expensive cards. I don’t mean any of this offensively.

Hi Nate, I appreciate the feedback. Do you have any credit cards that carry an annual fee that you feel justify the cost of the annual fee?

What about the value of the emergency evacuation insurance if you are going to Bali, Vietnam, etc

I’m not sure how to value that benefit.

I love my Altutude and I have Citi prestige, double cashback, amex business plus, gold, green, platinum, CSR you name it, I have them all. I consistently get retention offer year after year, 10k points easy which more than covers the $75 annual fee difference. I use it everywhere apple pay is accepted and that I would just earn 1-2 point on next best card. 2x earning on business + is very close but with a retention offer that’s worth $150 and wifi passes it’s just a no brainier for me to keep this.

I would love to get a 10,000 FlexPoint retention offer. Do you have an estimate of how much you spent on your Altitude Reserve last year?

I just applied for the Altitude and plan to rely on it in addition to my primary card, Amex Platinum. The $325 travel credit,1.5-cent redeemable points, Priority Pass lounge passes good in restaurants and 3% Apple Pay redemption makes it a no-brainer. It kind of will fill in Amex’s weak spots at minimal to no cost.

That is a great plan James :)

For me, the card could be double the AF, still paying the AF

Hi Raymond, you mean if the annual fee was $800, it would still be a keeper to you? Why is this credit card so valuable to you?

Mobile wallet multiplier makes it a very useful card! If they took that benefit away, I’d probably cancel the card.

Yes, that is definitely the only real benefit I get from this CC too. If they get rude of that benefit, I’m not going to hold onto the CC anymore.

US Bank terms say “ ‘Mobile wallet’ is defined as the method of paying for a purchase by use of a mobile device (in-store, in-app or online) and using an eligible mobile wallet provider”. Anybody know if Samsung Pay is eligible?

Yes, it should be eligible. I haven’t heard anyone say that Samsung Pay wasn’t eligible.

I know I’m a year late on this but the most important aspect of this card that I see get overlooked is the versatility. $0.015/pt via RTR for travel is much more valuable than the $0.015 redemption CSR UR points provide you. Consider:

1) Redemption $0.015/pt against any travel charge – Uber, Lyft, taxicab, AirBnB, VRBO, etc. Can’t do that with UR points at $0.015. Because these are statement credits it’s advantageous to redeem as soon as available.

2) Shop via portals: you can book all of the above + hotels through a cashback or points portal and still redeem your points for $0.015 each.

3) Shop around for best deals: no need to worry if the Chase portal is giving you the best price available.

4) You earn points on your point redemption travel spend. If you book a $500 flight and redeem 33,333 points to cover the cost, you still earn 1500 points from the spend.

5) You can book direct with hotels and earn points and elite night credits. Can’t do that via a prepaid portal like AMEX or Chase. Of course, the caveat is you need to spend $500 to redeem your points in this case.

To give this an example:

Say you want to book 3 nights at a Marriott that costs $250/night or $750 total.

CSR: Book through portal, spend 50,000 points (assuming you get same rate as you would on Marriott’s website). Maybe get your elite benefits.

AR: Book through cashback portal presently earning you 3% back or $22.50, earn 2,250 AR points worth $33.75, earn 7500 – 13,125 Marriott points depending on your status worth around $50-$100, earn 3 EQN, redeem 50,000 points via RTR. Get your elite benefits.

Your 50,000 AR points got you anywhere from $100-$150 extra value than your CSR points did. This boosts the value of your AR points from $0.015 each to upwards of $0.018 each.

Hi Jags, you make a great point. US Bank Real Time Rewards are game changes when used with travel. I recently used RTR with another US Bank CC and the process worked flawlessly: https://travelwithgrant.boardingarea.com/2021/02/27/my-real-time-rewards-redemptions-on-us-bank-business-leverage-credit-card-observations-theories/