Good morning everyone, I hope you had a great Super Bowl weekend. I was down in Orange County enjoying the warm weather, but now I am back up in the chilly Bay Area. I’ve been wanting to write about this topic for a while, but my final motivation was reading 2 Frequent Miler articles: What’s in Nick’s wallet? and What’s in Greg’s wallet? The first thing you should know about me (if you already didn’t know) is that I am a millennial and I live in the Bay Area, so I can go weeks without using cash. For that reason, my wallet is built into my iPhone XS case. I use the Urban Armor Gear (UAG) iPhone Case ($30 on Amazon) that has room for 4 cards: my drivers license and 3 credit cards. Which 3 credit cards do I carry with me on a daily basis and which credit cards do I have in my ApplePay Wallet?

As I mentioned earlier, the back of my iPhone case has room for 4 cards. Those 4 cards are my drivers license, my American Express Gold Card, my Chase Sapphire Reserve Credit Card, and my Citi Double Cash Credit Card. With these 3 credit cards, I have an American Express, Visa, and MasterCard, so one of these 3 credit cards will work anywhere. I use the AMEX Gold for 4x at restaurants and grocery stores. If the restaurant doesn’t take AMEX, I will use my Chase Sapphire Reserve to earn 3x on restaurants. This card is my go to card for paid flights and all international purchases. Lastly, the Citi Double Cash earns 2% cash back everywhere.

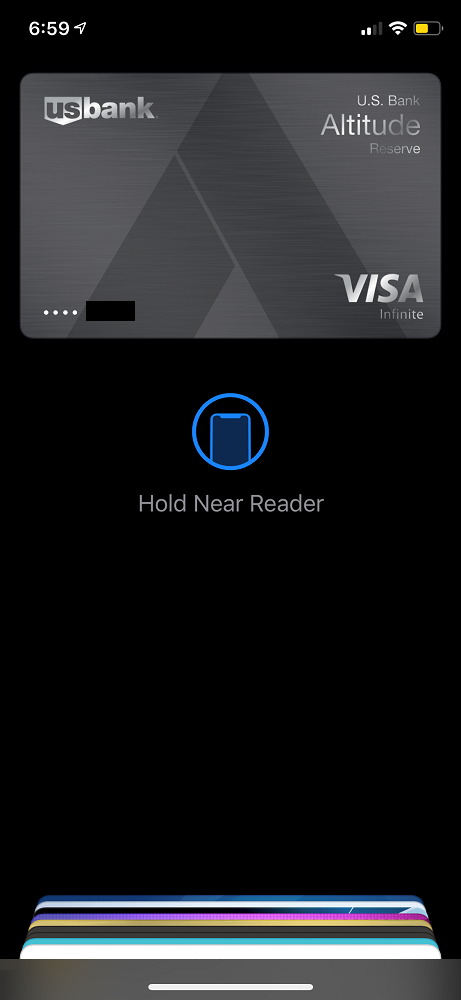

In addition to those 3 physical credit cards, I also have several credit and debit cards loaded to my ApplePay Wallet. My default card is the US Bank Altitude Reserve Credit Card because it earns 3x on all ApplePay purchases. Here are the 10 cards in my ApplePay Wallet:

- Wells Fargo debit card – joint checking account with my wife (useful for accessing Wells Fargo ATMs that accept ApplePay cards)

- Bank of America debit card – backup checking account (I only have this checking account so that I get bonus cash back with my 2 Bank of America Better Balance Rewards Credit Cards)

- Chase Freedom Credit Card – earns 5x at rotating cash back categories (Q1 categories include Gas Stations; Internet, Cable & Phone Services; and Streaming Services)

- Citi Rewards+ Credit Card – roundup small purchases to 10 Citi Thank You Points (doesn’t get much use)

- Citi Double Cash – earns 2% cash back everywhere (doesn’t get much use)

- American Express Blue Business Plus Credit Card – earns 2x everywhere (primary everywhere else credit card)

- Chase Sapphire Reserve – earns 3x at restaurants and travel

- Rakuten Cash Back – earns 3% cash back for Rakuten purchases

- American Express Gold – earns 4x at restaurants and grocery stores

- US Bank Altitude Reserve – earns 3x on all ApplePay purchases (primary ApplePay card)

I have several other credit cards that I use on a weekly basis that I do not carry with me. For example, we use Laura’s Citi Costco Anywhere Visa Credit Card to earn 4% cash back at Costco gas stations. I use my Chase Ink Plus for 5x at cable / phone / internet purchases. And I carry my American Express Business Platinum Card with me when I travel for lounge access. If you want to see all the credit cards that I have, check out this post: If I Could Only Keep 5 Credit Cards with Annual Fees… Let me know if you have any questions about which credit cards I carry or use on a daily basis. Thanks for reading and have a great day everyone!

Other What’s In My Wallet posts:

- Middle Age Miles just posted What’s In Our Wallet 2020? Part 1: Our Cards and Breakdowns by Annual Fee and Date Acquired

Many thanks for the link, Grant! Hopefully our What’s In Our Wallet 2020? series will be interesting to TWG and MAM readers. Nice choices for your own cards in your physical and mobile wallets for everyday use. ~Craig

Thank you Craig, your post is very detailed and I enjoyed reading about the cards that you have,

Pingback: Ep. 130 – Ireland, Mawwiage, and What’s in Travel with Grant’s Wallet? – Saverocity Observation Deck