Good afternoon everyone, I hope your weekend is going well. A few weeks ago, I wrote these 2 posts:

- I Paid $4,588 in Credit Card Annual Fees in 2019 & Was it Worth it?

- Why Do We Keep 16 No Annual Fee Credit Cards?

In those posts, I listed all the credit cards that Laura and I have. I also justified why I paid $4,588 in credit card annual fees in 2019. Since that post, there have been a few credit card changes (JPMorgan Chase Ritz Carlton Credit Card lost the Visa Infinite Discount Air Benefit and the Chase Sapphire Reserve Credit Card added Lyft and DoorDash benefits). A few readers commented and other bloggers linked to the top post and shared which credit cards they keep every year. As part of my 2020 travel resolutions, I said I wanted to reduce the amount I paid in credit card annual fees. In this theoretical post, here are the 5 credit cards with annual fees that I would keep…

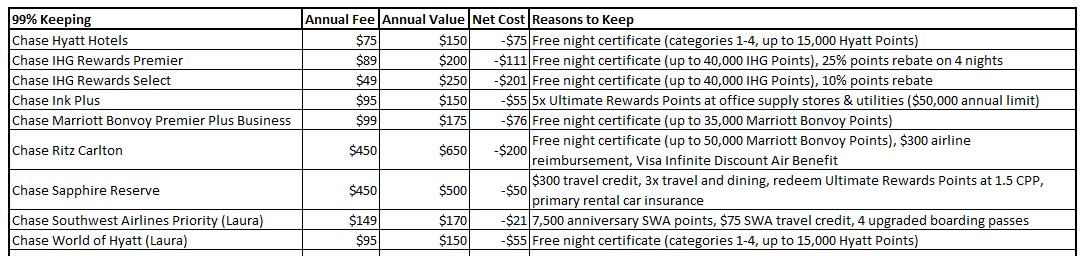

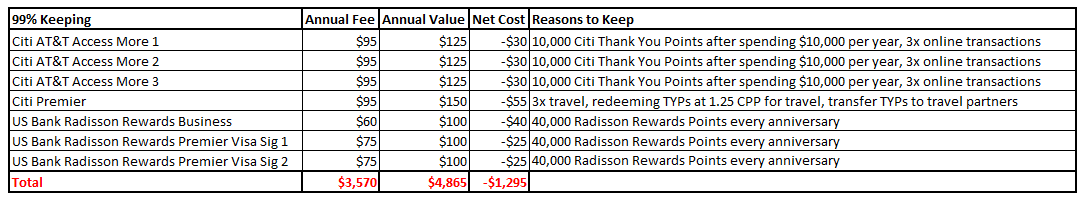

As a refresher, here are the credit cards that I was 99% sure that I would keep and the reasons I would keep the credit card (some annual fees and benefits have changed since this chart was created).

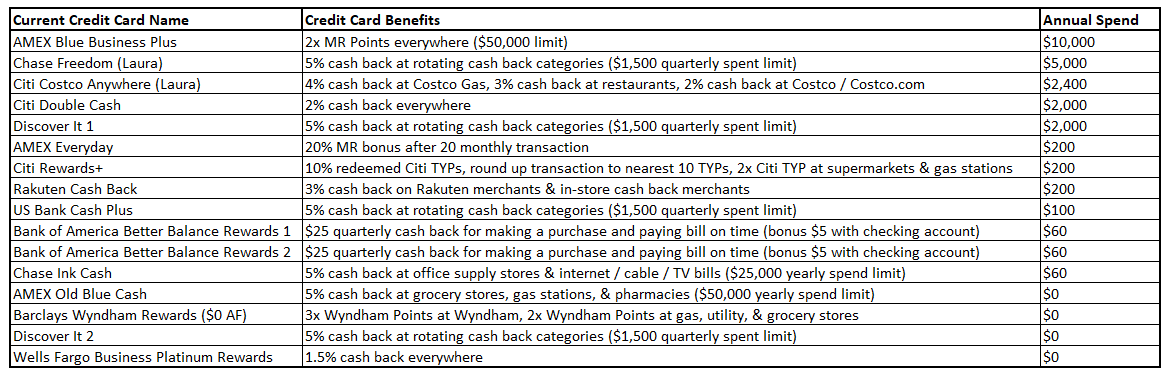

I also plan to keep all 16 of our no annual fee cards. It doesn’t matter if you have 1 or 100 no annual fee credit cards, the total amount you pay in annual fees is still $0. I plan to pair the 5 annual fee credit cards with my 16 no annual fee credit cards to increase the overall value I get from the 5 annual fee credit cards.

Super Combo 1: Citi Premier ($95 annual fee) + Citi AT&T Access More ($95 annual fee) + Citi Double Cash (no annual fee) + Citi Rewards+ (no annual fee)

The Citi AT&T Access More allows me to earn 3x Citi Thank You Points for online purchases, the Citi Double Cash allows me to earn 2% cash back everywhere (now cash back can be converted to Citi Thank You Points), the Citi Premier allows me to transfer Citi Thank You Points to various airline partners or redeem for travel at 1.25 cents per point, and the Citi Rewards+ allows me to get 10% of my redeemed Citi Thank You Points back every year (up to 10,000 rebated Thank You Points per calendar year).

Without the Citi Premier, I would not be able to transfer Citi Thank You Points to airline partners and I would only be able to get 1 cent per point value from my Citi Thank You Points. Last year, I redeemed more than 100,000 Citi Thank You Points and received 10,000 Citi Thank You Points back because I had the Citi Rewards+. Without that credit card, I would be out 10,000 free Citi Thank You Points. The Citi AT&T Access More and Citi Double Cash allow me to earn between 2x – 3x Citi Thank You Points on all purchases and I receive an annual bonus of 10,000 Citi Thank You Points when I spend at least $10,000 on my Citi AT&T Access More per cardmember year. These 4 credit cards make up a super combo.

Super Combo 2: Chase Sapphire Reserve ($450 annual fee until April 2020) + Chase Ink Business Cash (no annual fee) + Chase Freedom (no annual fee)

The Chase Sapphire Reserve allows me to earn 3x Chase Ultimate Rewards Points for all travel and restaurant purchases, allows me to transfer Chase Ultimate Rewards Points to airline and hotel partners, allows me to get 1.5 cents per point for travel, and provides excellent travel protections and primary car rental insurance. I also get Lyft Pink Membership and DoorDash DashPass membership with $60 DoorDash credit. The Chase Ink Business Cash earns 5x Chase Ultimate Rewards Points on phone/internet/cable bills and on office supply purchases, up to $25,000 per cardmember year. The Chase Freedom allows me to earn 5x Chase Ultimate Rewards Points on select rotating quarterly categories, up to $1,500 in quarterly spend. With these 3 credit cards, I can earn between 3x – 5x on select purchases.

Without the Chase Sapphire Reserve, my Chase Ultimate Rewards Points would only be worth 1 cent per point and could not be transferred to airline or hotel partners.

Super Combo 3: American Express Gold ($250 annual fee) + American Express Blue Business Plus (no annual fee)

The American Express Gold allows me to earn 4x American Express Membership Rewards Points on grocery purchases (up to $25,000 per cardmember year) and restaurant purchases, $120 dining credit ($10 per month), and $100 airline fee credit. The American Express Blue Business Plus allows me to earn 2x American Express Membership Rewards Points everywhere. With these 2 credit cards, I would earn between 2x – 4x on all purchases (where American Express is accepted).

Solo Card: US Bank Altitude Reserve ($400 annual fee)

The US Bank Altitude Reserve comes with a $325 airline credit and earns 3x US Bank FlexPoints on travel and mobile wallet purchases (ApplePay, Google Pay, etc.). When you redeem US Bank FlexPoints for travel, you get 1.5 cents per point. Combining that with the 3x mobile wallet purchases means you earn 4.5% cash back on all purchases that accept mobile wallet payments.

Goodbye Airline and Hotel Credit Cards

As you can tell, I heavily favor transferable points with Citi, Chase and American Express. I would have to say goodbye to several airline and hotel credit cards (even though I feel like I get more value out of their perks than the annual fees cost). I would also say goodbye to my American Express Business Platinum and the Centurion Lounge access I have grown to love. By not paying the $595 annual fee every year, I could “rough it” with the Priority Pass membership that comes with my Chase Sapphire Reserve (access to thousands of lounges and restaurants) or just pay for food at the airport when I wanted to eat.

If I cut back to just 5 credit cards with annual fees, I would still pay $1,290 in annual fees. That is a 72% drop from my current $4,588 in credit card annual fees. This is definitely food for thought. What do you think of my chosen 5 credit cards? Do you agree or disagree with my picks? If you have any questions, please leave a comment below. Have a great weekend everyone.

Waffling on the Altitude — on paper, good value if all you did was spend enough on travel to get the credit, and use the Gogo passes. However you (and me in similar situation) already have other great options for category and everyday spend…I am always wondering when I would actually use this card? The only leftover category for this card is Mobile wallet purchases (that aren’t already in a good category bonus otherwise). Trying to wrap my head around how much per year that actually is at the end of the day. What do you think?

I agree with your thought process. I use this CC for unbonused spend where ApplePay works (mainly at Costco or random merchants when I travel). I’m hoping my level of annual spend gets me some type of decent retention offer.

I think you should keep the cards that have no annual fee, or are truly cash-flow-positive for your situation. I have canceled cards in the past that I thought were borderline to keep or not, thinking I could get it again later if I wanted – only to have the card benefits change. (I still miss you, old Starwood and Hyatt and IHG cards!)

I agree. I used to open and close Chase CCs all the time before 5/24 was enforced, so there are a few CCs that I thought I could cancel and get the bonus again. Unfortunately that plan was interrupted by 5/24.

For me I like combo #2. I like to put my spending in one system to max the points out and spending among several point systems dilutes point earning power. I will be dropping the Reserve card when AF comes due next January and picking up the Preferred card for the 60k offer. The travel benefits are somewhat similar but can’t make a case for keeping the Reserve with this price hike.

My advice is to have transferable points with Citi, Chase and AMEX, so you have the most options of transfer partners. Citi has some decent airline partners and I love earning and spending Citi Thank You Points.

Citi is the cheapest at just $95 annual fee.

Yes, but I really don’t put any spend on my Citi Premier CC because there are no travel protections :(

Pingback: Where is the No Annual Fee Hyatt Credit Card?

Pingback: What's in Grant's (iPhone) Wallet?