Good morning everyone, I hope your weekend is going well. I recently had a change of heart and decided to redeem 1/3 of my Chase Ultimate Rewards Points with the Pay Yourself Back feature. Chase introduced the Pay Yourself Back feature on May 31 and I wrote How to Redeem Chase Ultimate Rewards Points via Pay Yourself Back (1.5 Cents Per Point for Restaurants, Grocery Stores & Home Improvement). Initially, I was not very excited about the new feature, since I convinced myself that I could use my Chase Ultimate Rewards Points in other ways and get more than 1.5 cents per point.

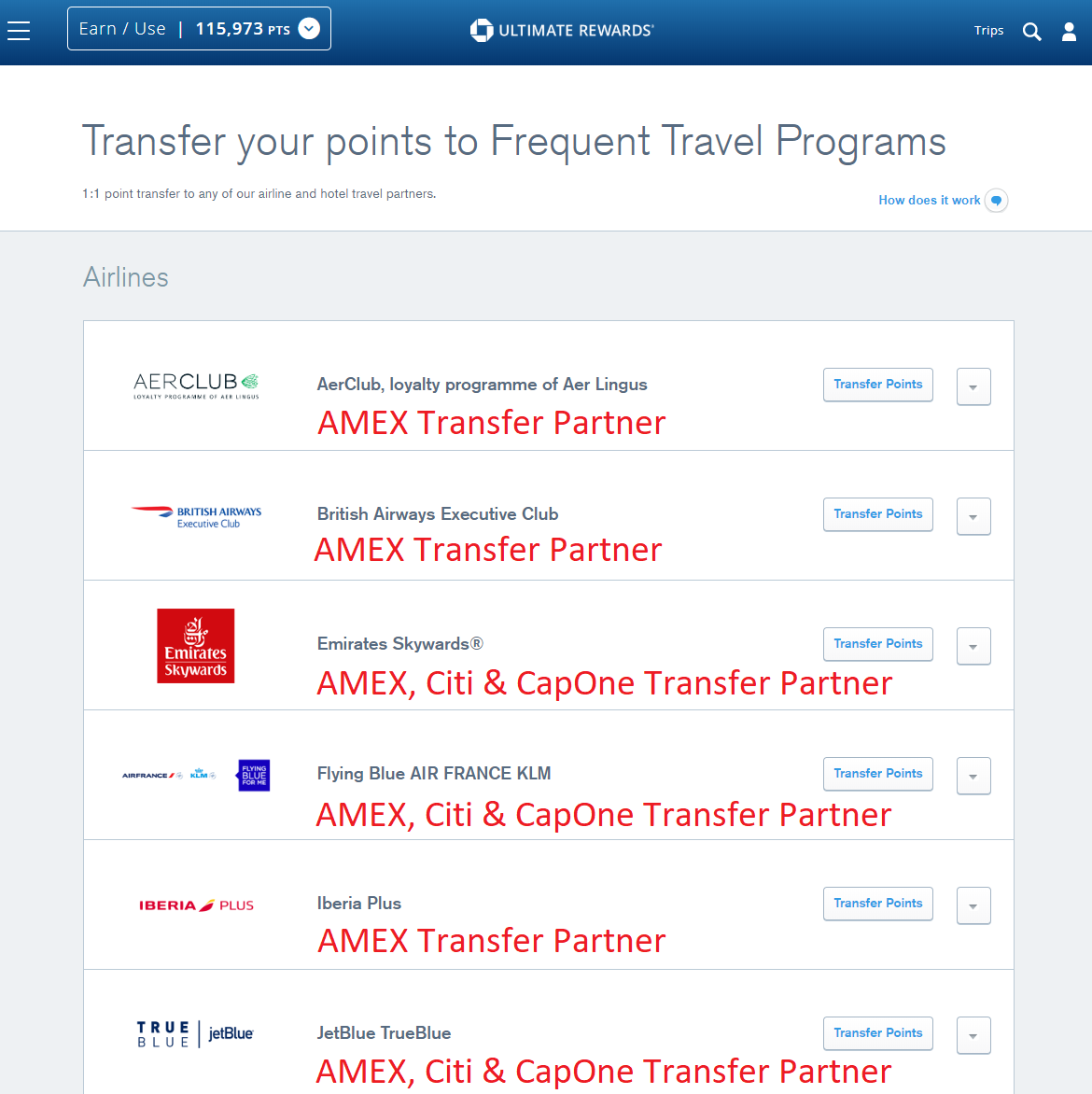

After realizing that I had no concrete travel plans remaining in 2020 (I recently cancelled trips to Boston & New York along with a big trip to Africa), I figured that my stash of Chase Ultimate Rewards Points would probably not be used much this year. Before redeeming 1/3 of my Chase Ultimate Rewards Points, I looked at Chase’s travel partners to see if there were any major reasons to keep my Chase Ultimate Rewards Points. Chase has 13 airline and hotel partners, but only has 4 exclusive partners (Southwest Airlines, United Airlines, IHG, and Hyatt), the remaining 9 travel partners are accessible with American Express Membership Rewards Points, Citi ThankYou Points, and Capital One Miles.

My wife and I have ~58,000 Southwest Airlines points and ~$150 in travel credit, so I would not need to transfer Chase Ultimate Rewards Points to Southwest Airlines. I am not a huge fan of United Airlines and can usually book Star Alliance flights with other travel programs, plus I have ~$178 travel credit from a cancelled United flight. IHG points are worth ~0.5 cents per point and I have ~222,000 IHG points in my account. Last but not least, Hyatt is the only travel partner that stands out from the list. I decided to save at least 60,000 Chase Ultimate Rewards Points just in case we stay at a Hyatt later this year).

I figured that normal spending on our Chase Ink Cash Credit Card, Chase Sapphire Reserve Credit Card, and Chase Freedom Credit Card this year would replenish our Chase Ultimate Rewards Points balance by the end of 2020.

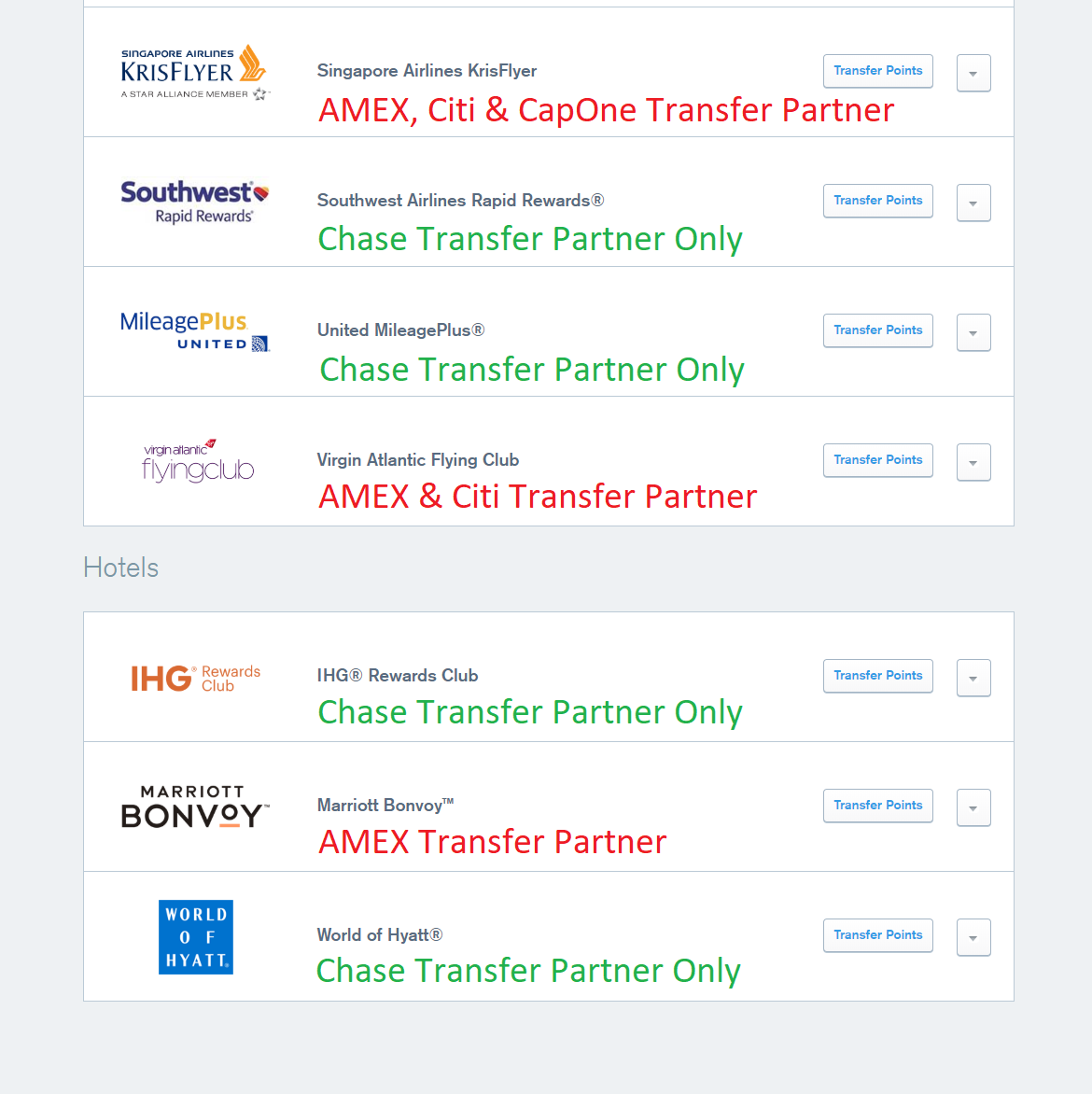

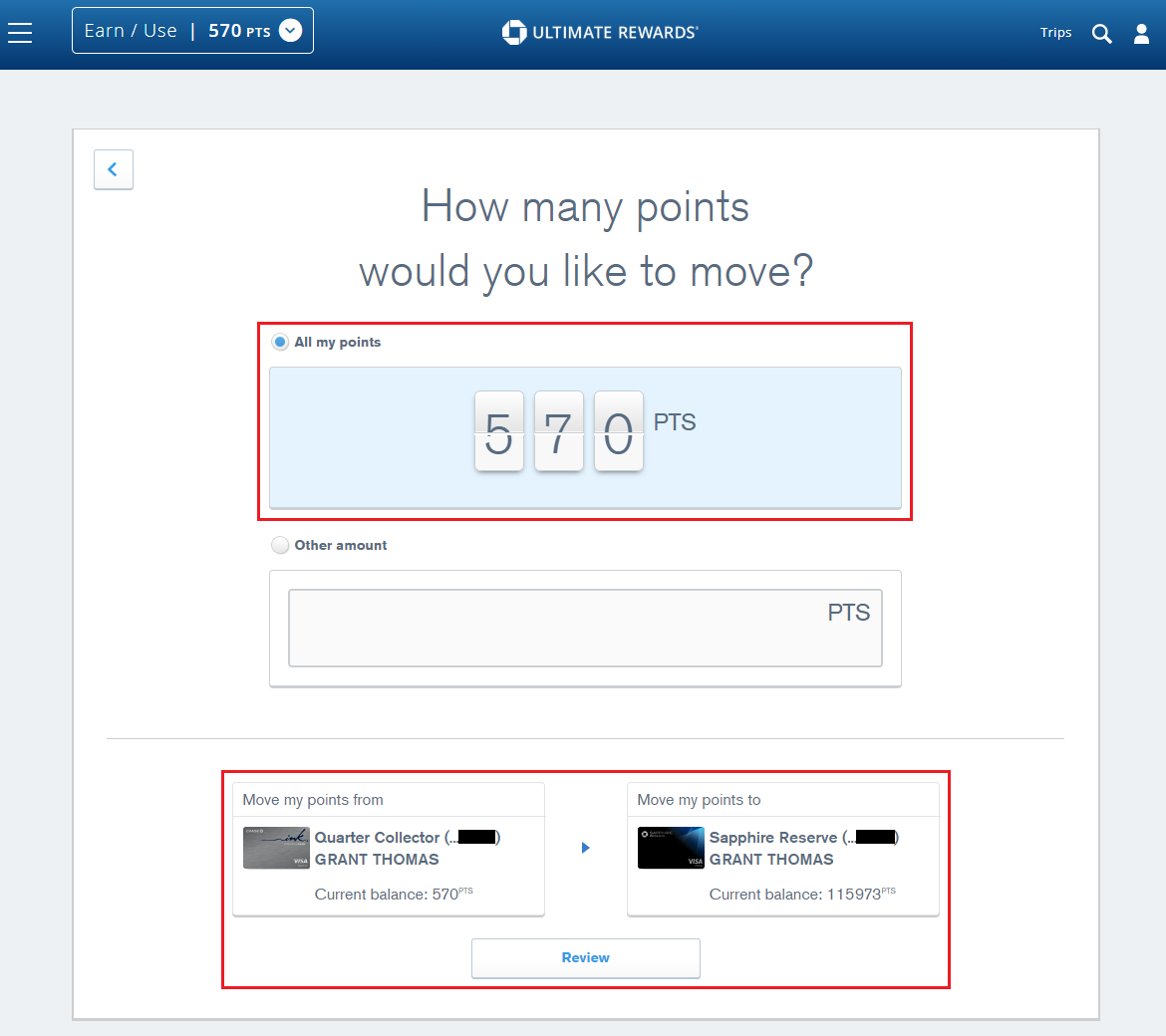

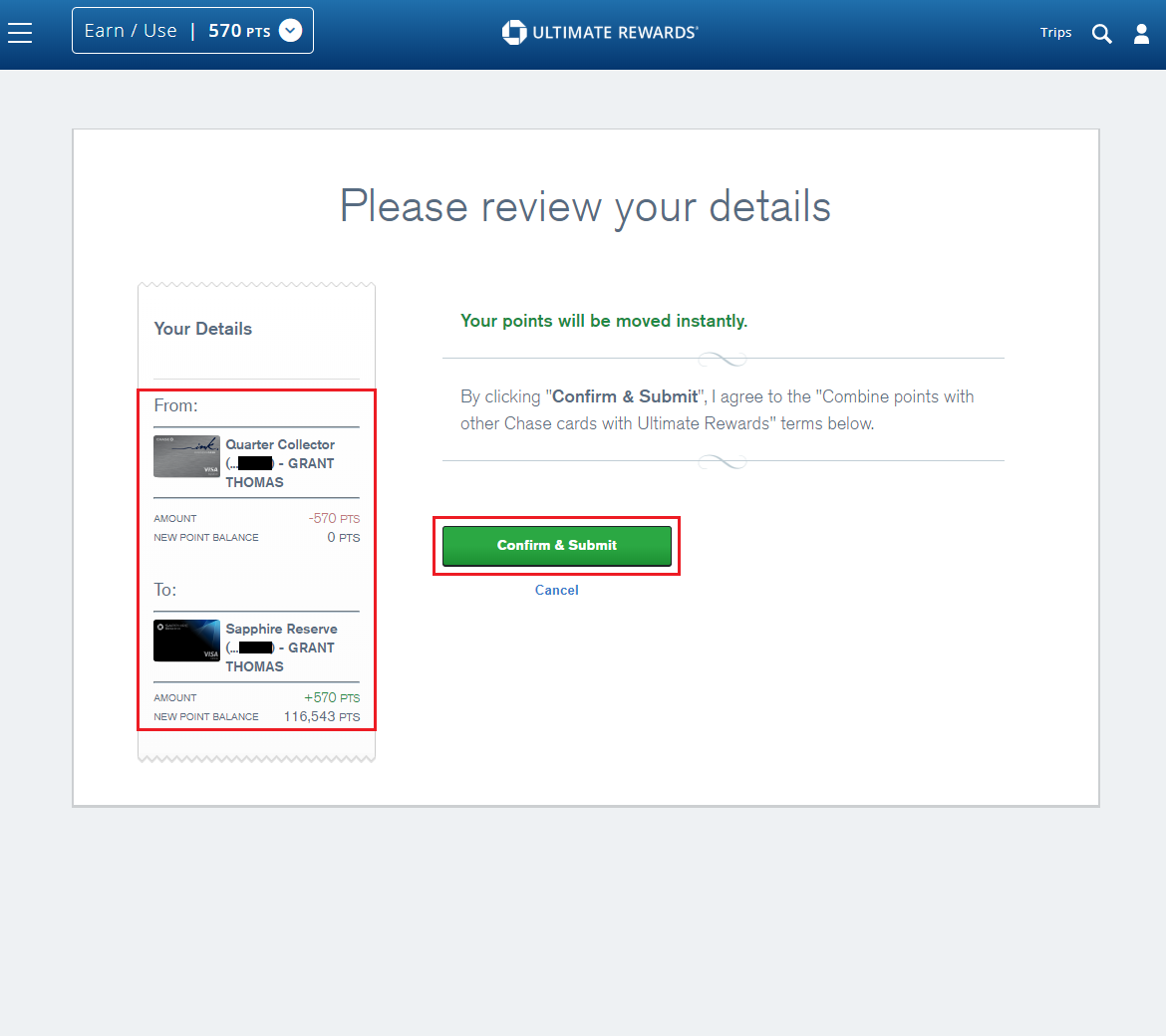

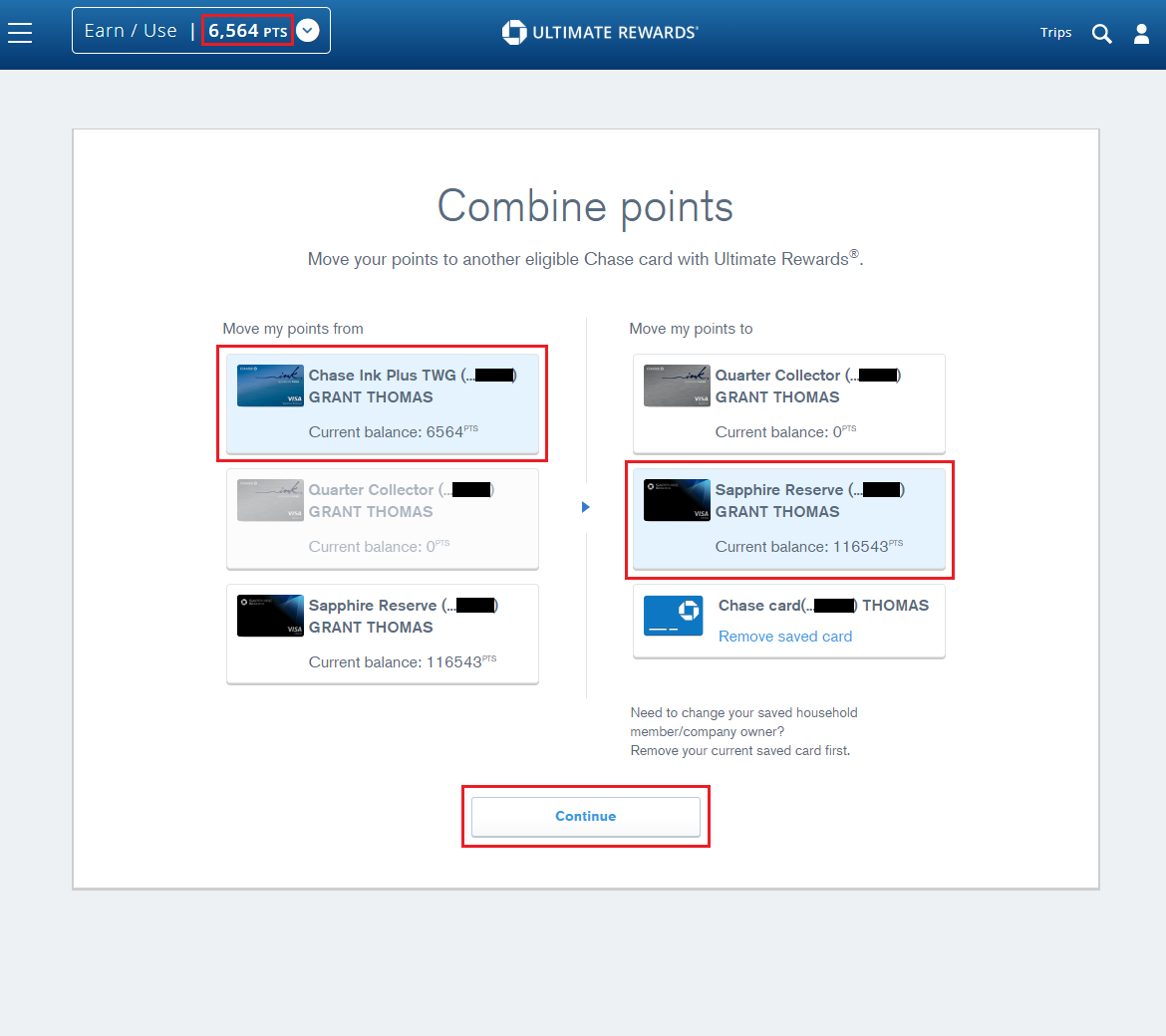

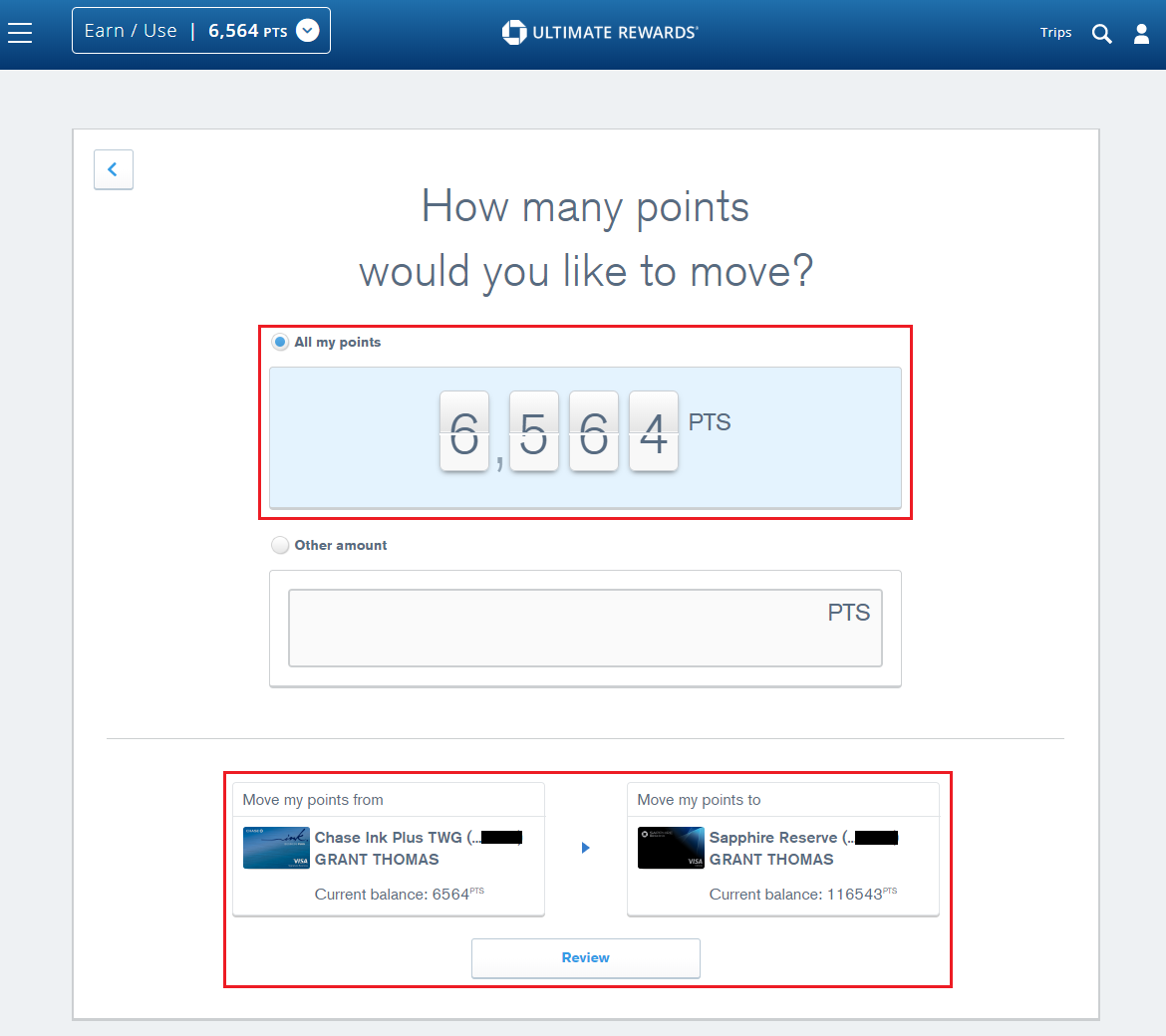

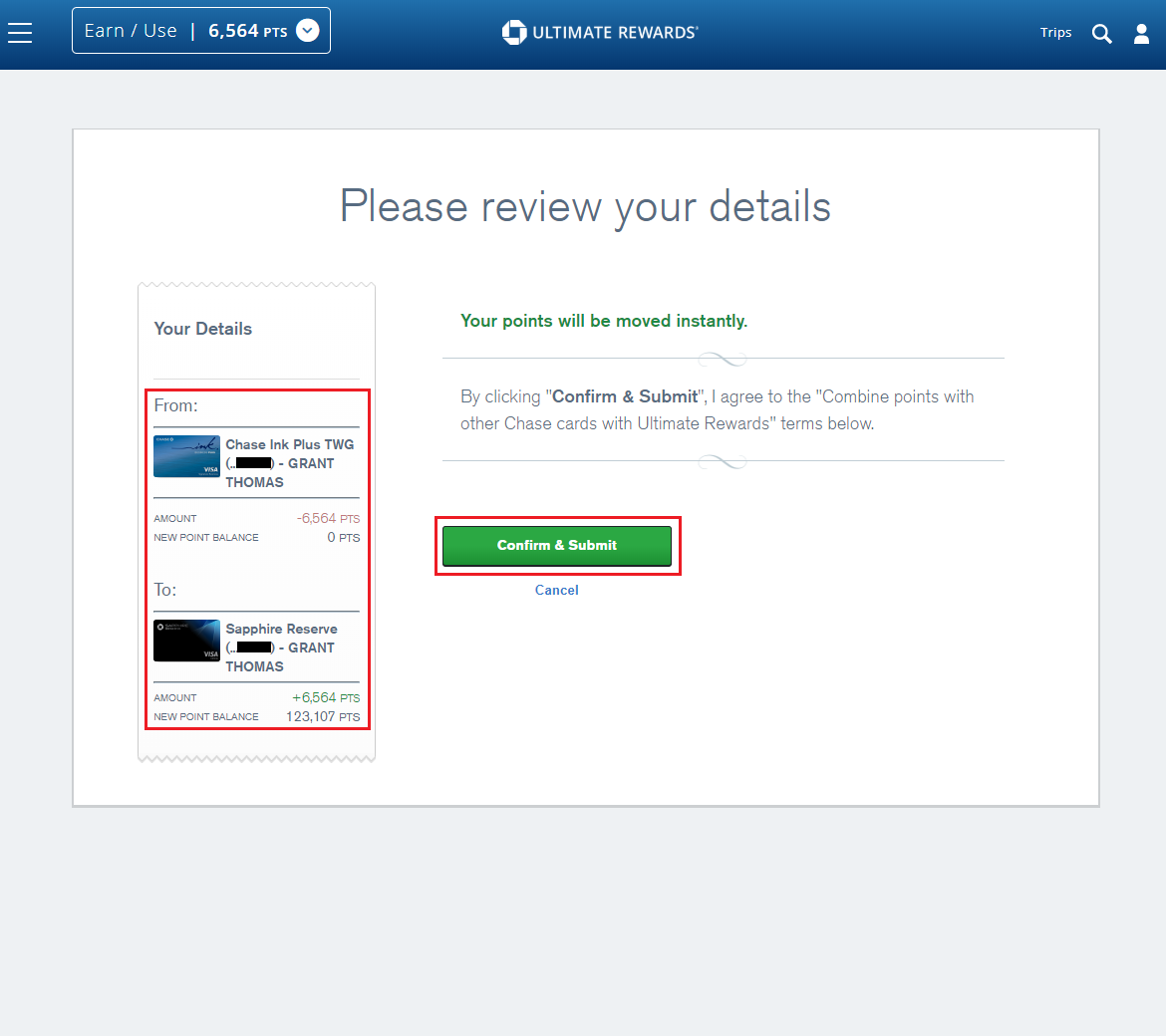

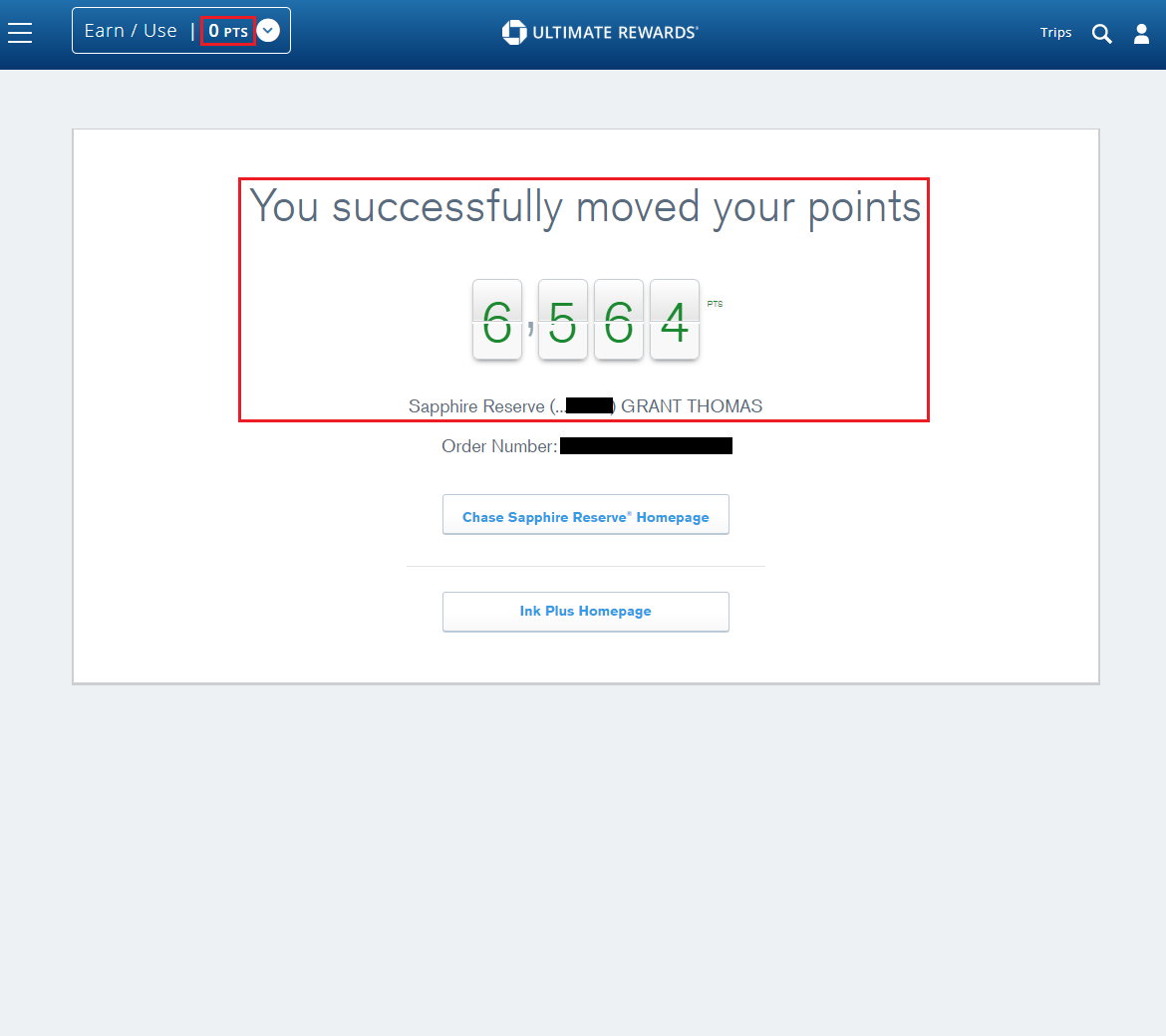

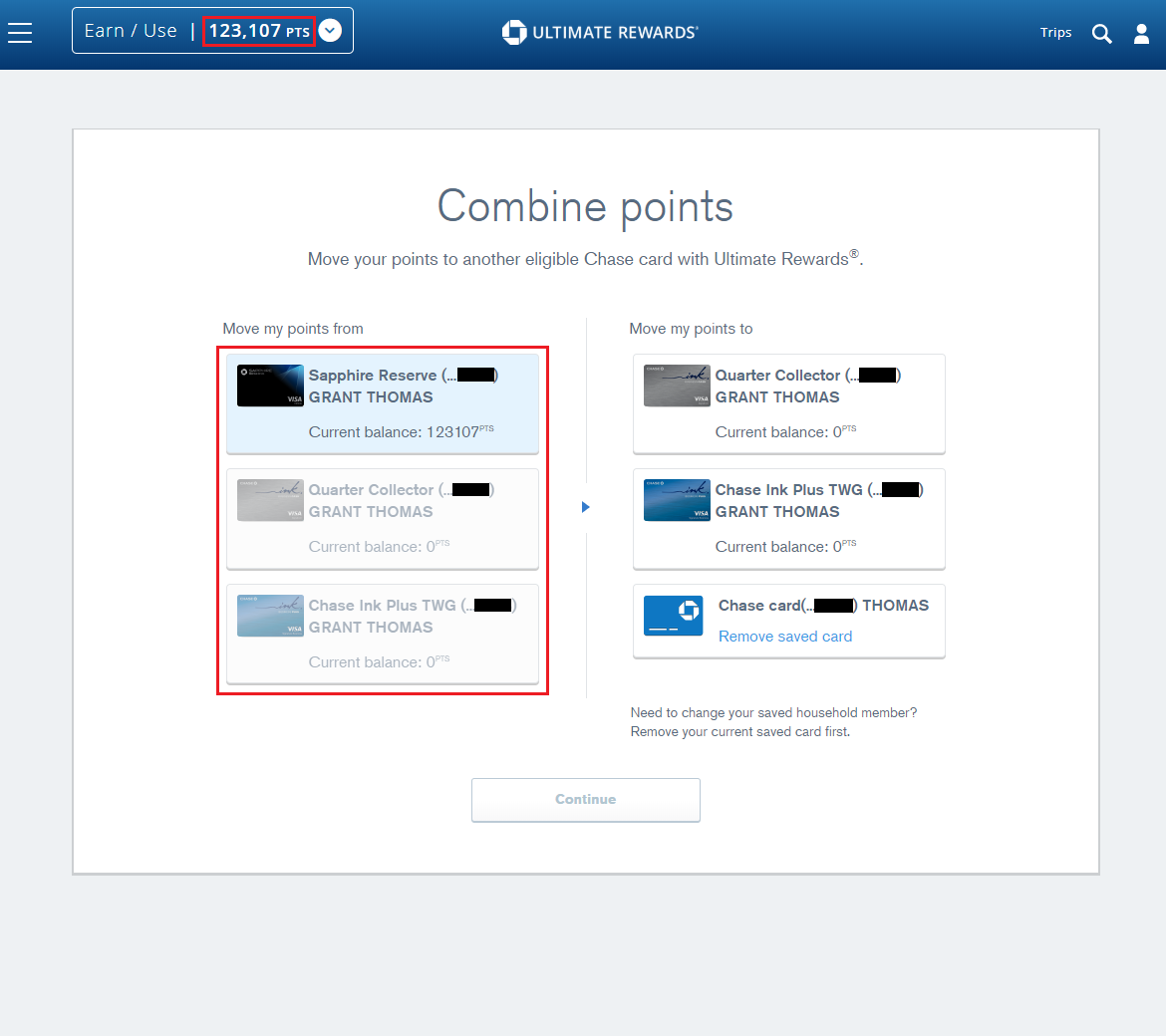

The first step of the process was to move all of the Chase Ultimate Rewards Points from my Chase Ink Cash and my Chase Ink Plus to my Chase Sapphire Reserve. This can be done very easily via the Chase Combine Points page. After the process was finished, my Chase Ink Cash had 0 points, my Chase Ink Plus had 0 points, and my Chase Sapphire Reserve had 123,107 points.

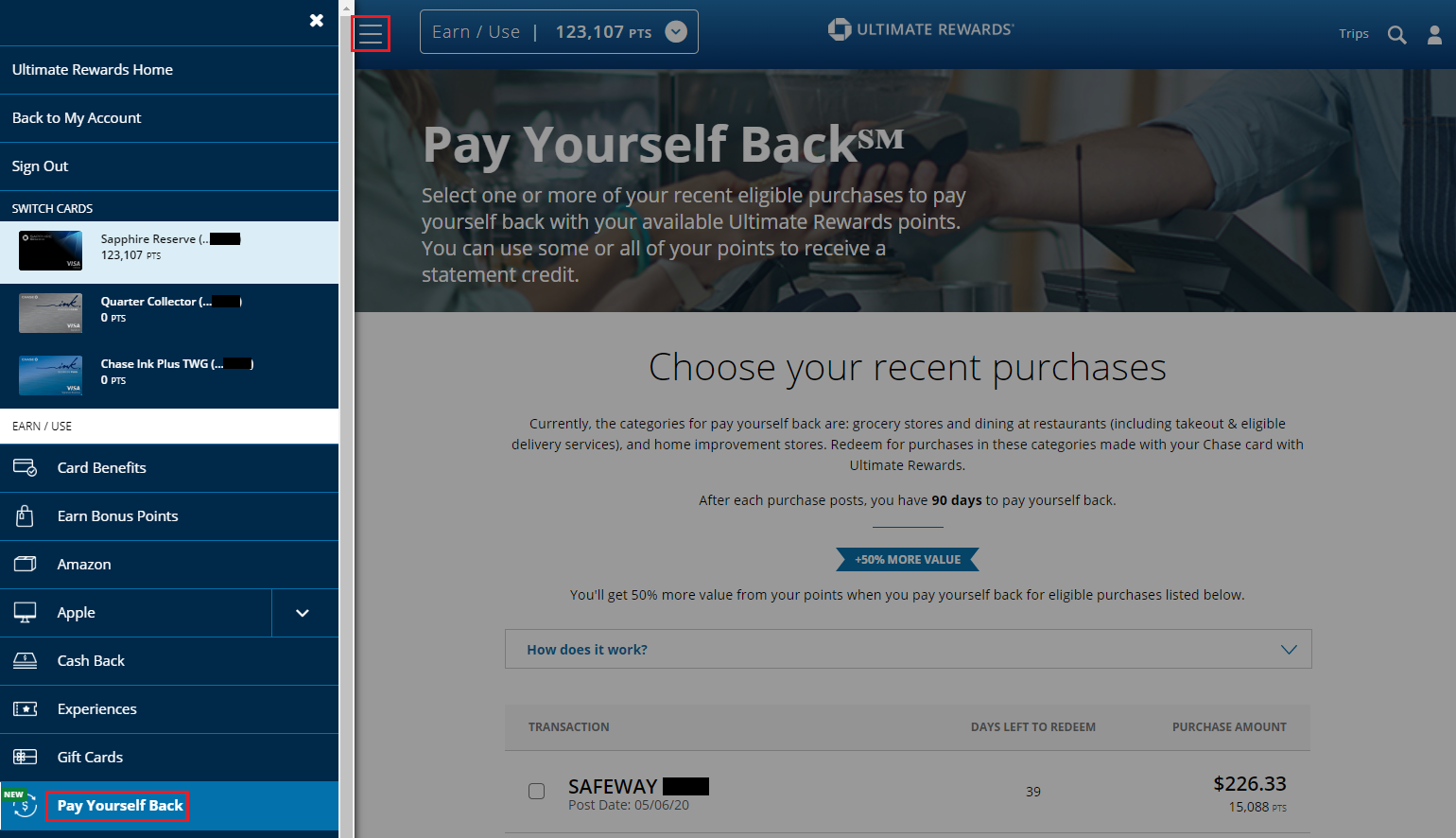

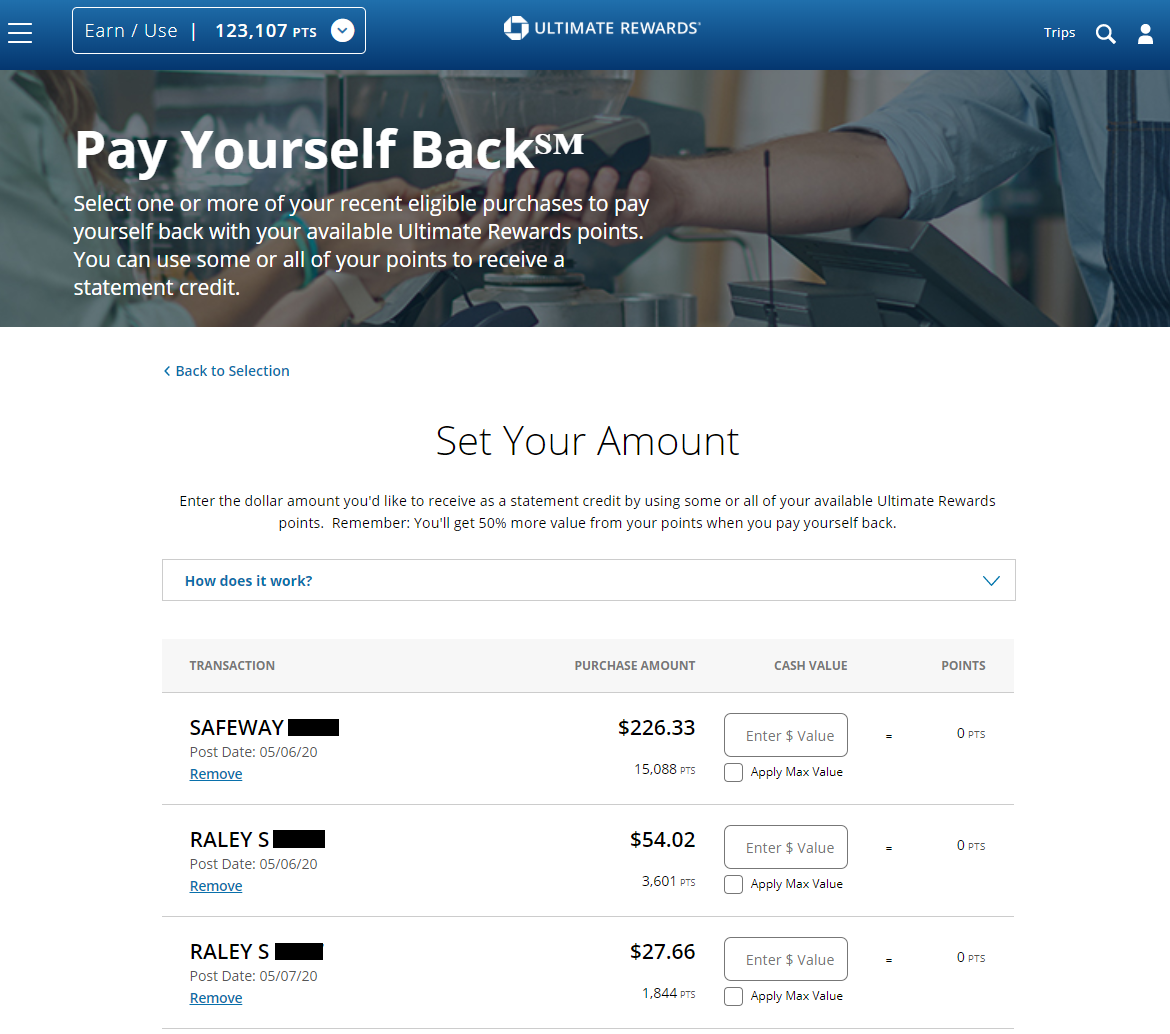

I then went to the Pay Yourself Back page.

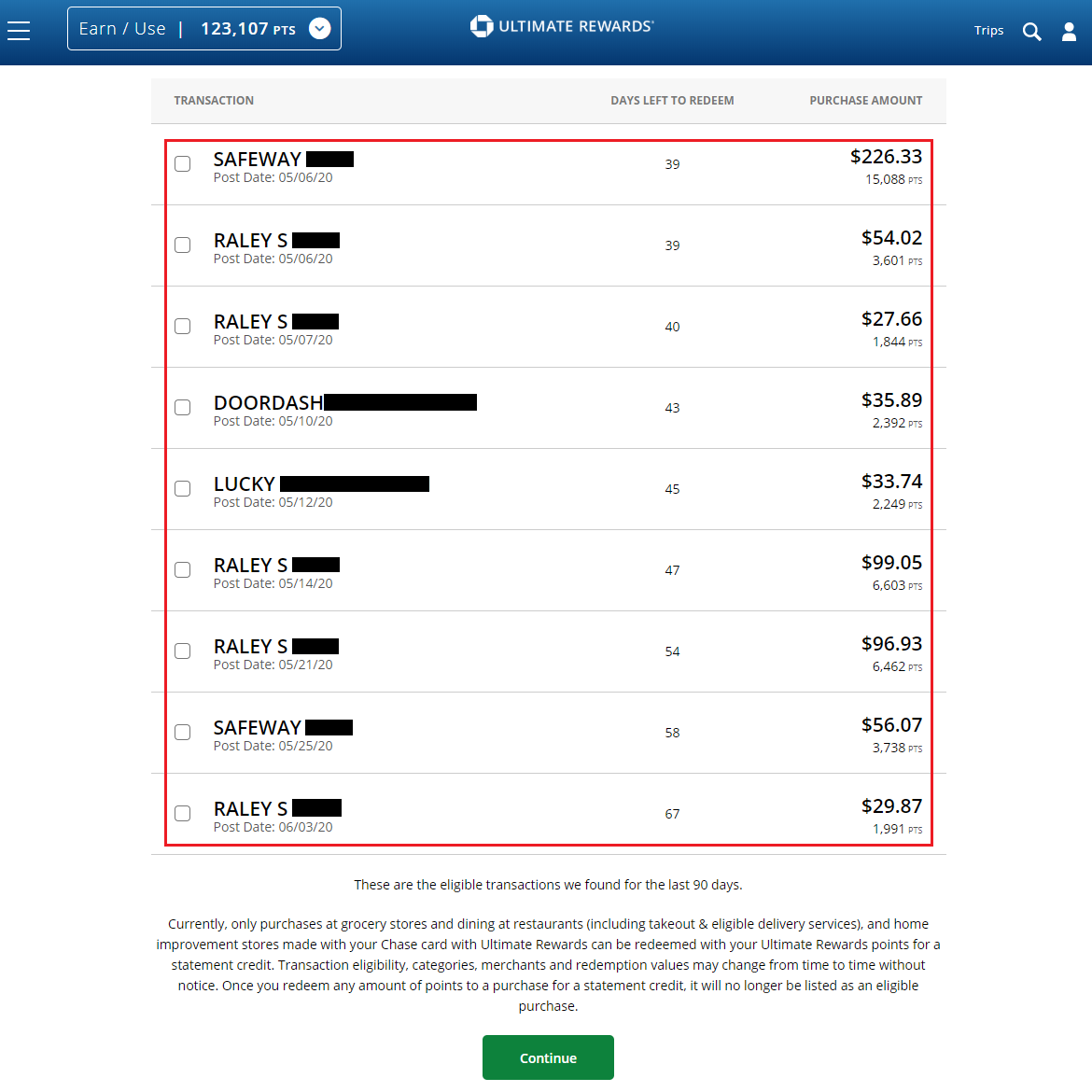

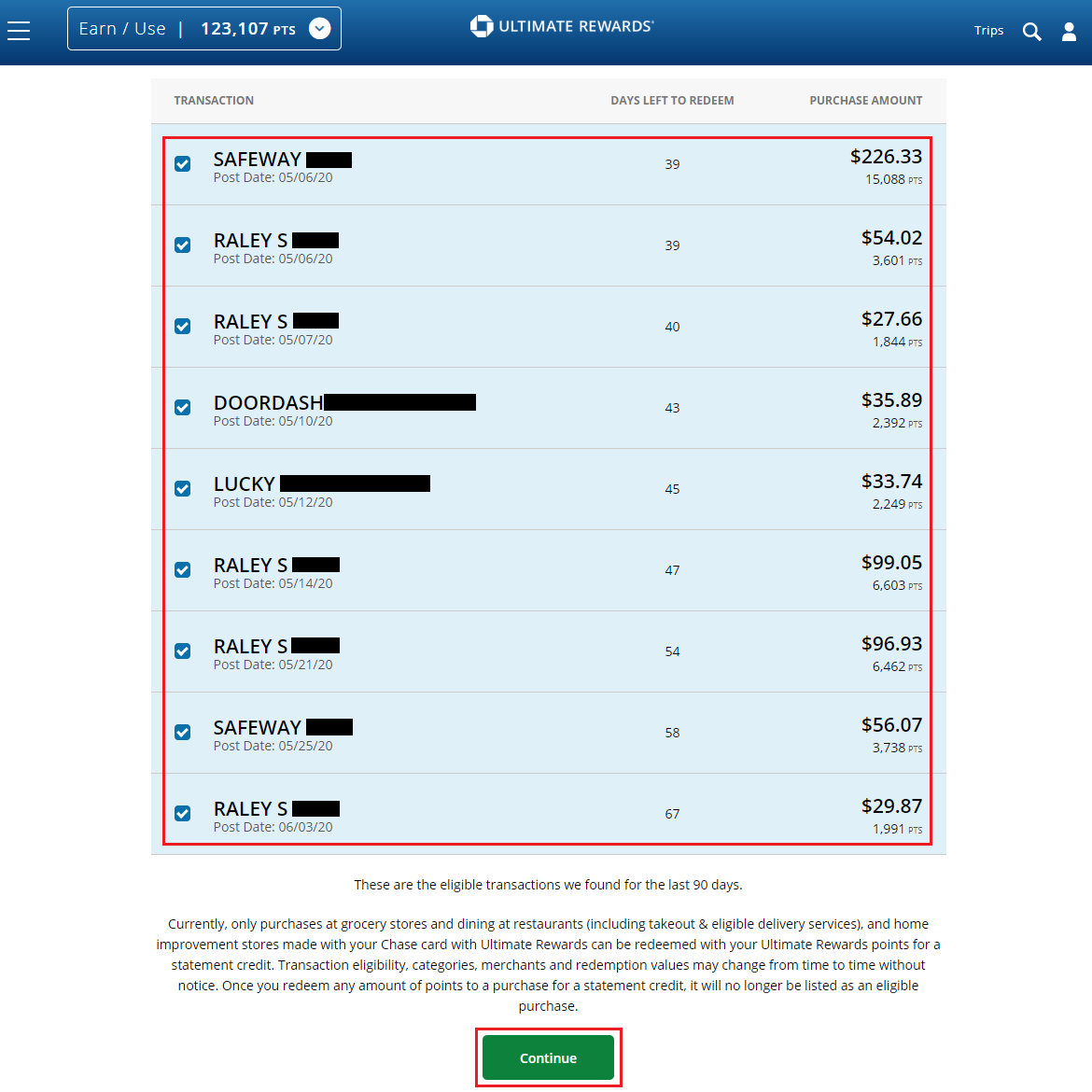

On this page, you can see all eligible Pay Yourself Back transactions, the number of days left to redeem points for that transaction, the dollar amount, and the maximum number of points possible to redeem for that transaction.

I decided to select all 9 of these transactions and then clicked the Continue button.

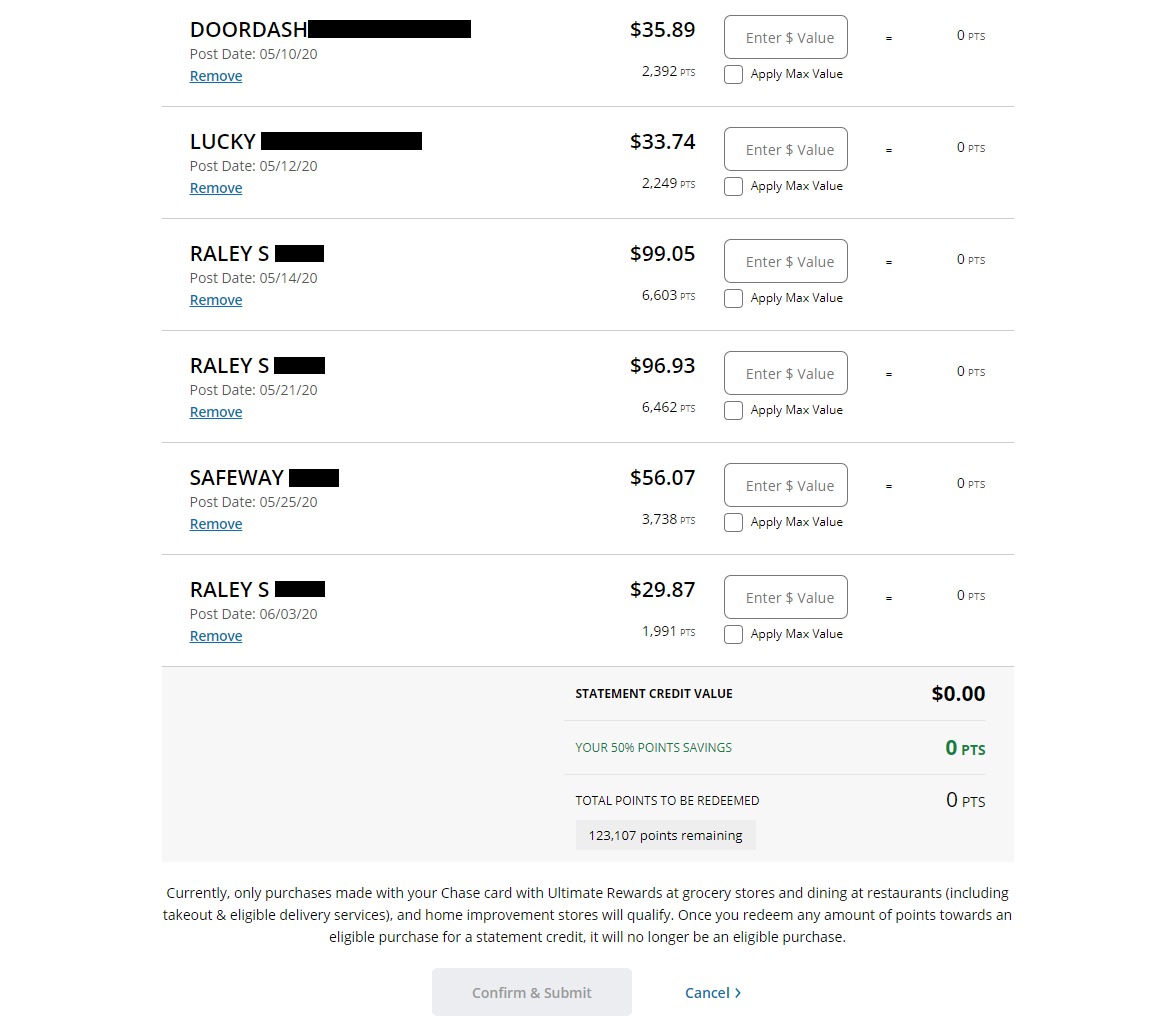

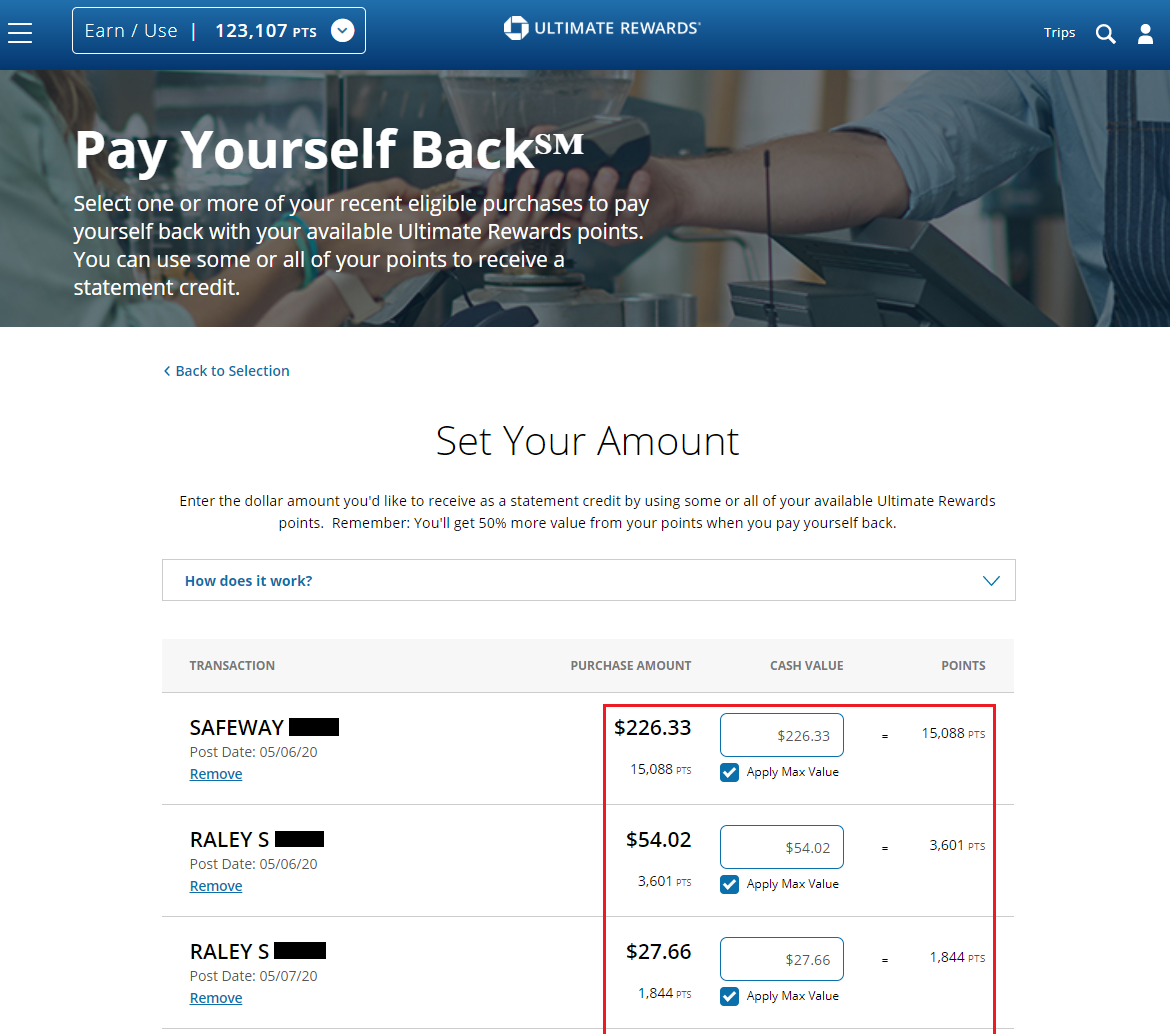

On this page, you can enter the dollar amount you want to receive as a statement credit for each transaction.

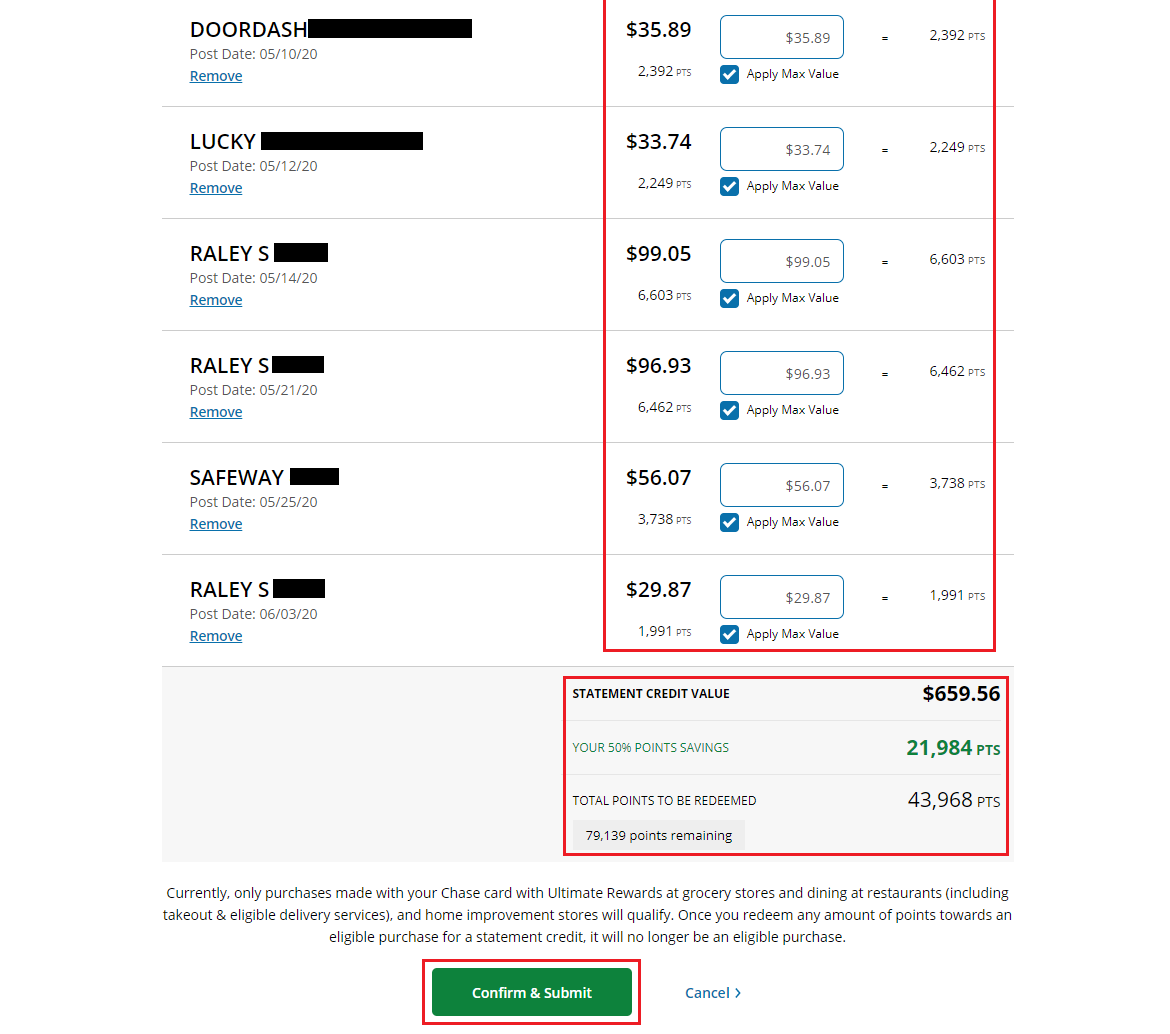

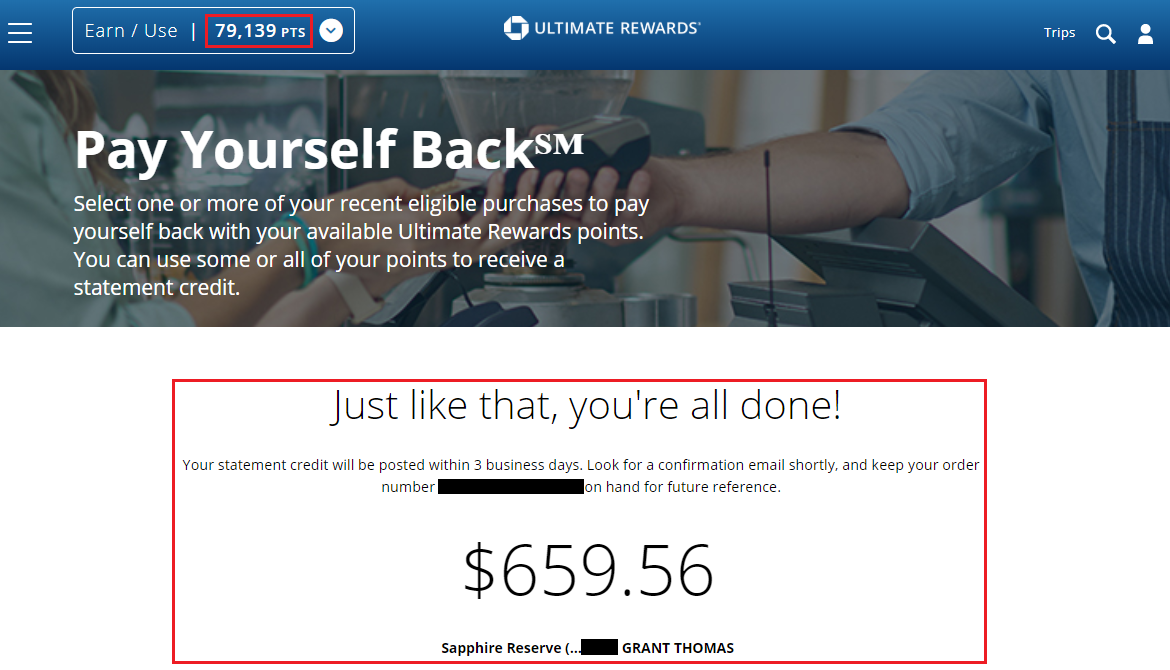

Since I wanted to use as many points as possible, I clicked the Apply Max Value checkbox for each transaction and the maximum dollar amount was automatically pre-filled. By choosing the Apply Max Value checkbox for all 9 transactions, I would receive a statement credit of $659.56 by using 43,968 points, leaving me with 79,139 points remaining. I then clicked the Confirm & Submit button.

The system processed my request in a few seconds.

Once the process was completed, my points balance went down to 79,139 points. The $659.56 statement credit should post to my Chase Sapphire Reserve account in the next 3 business days.

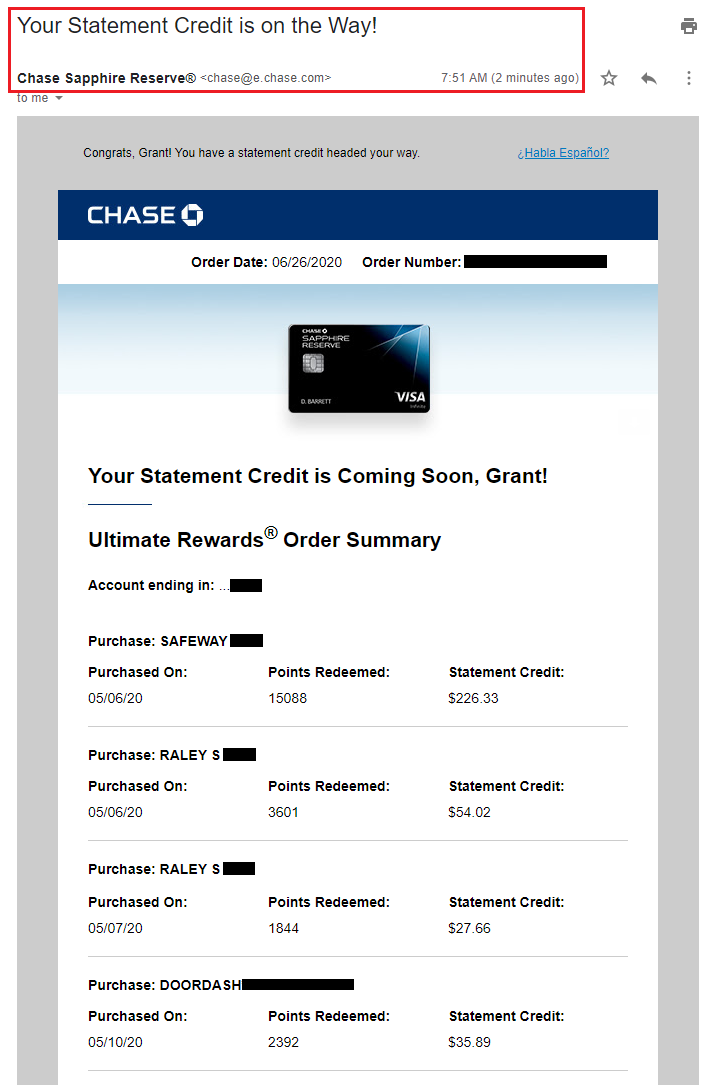

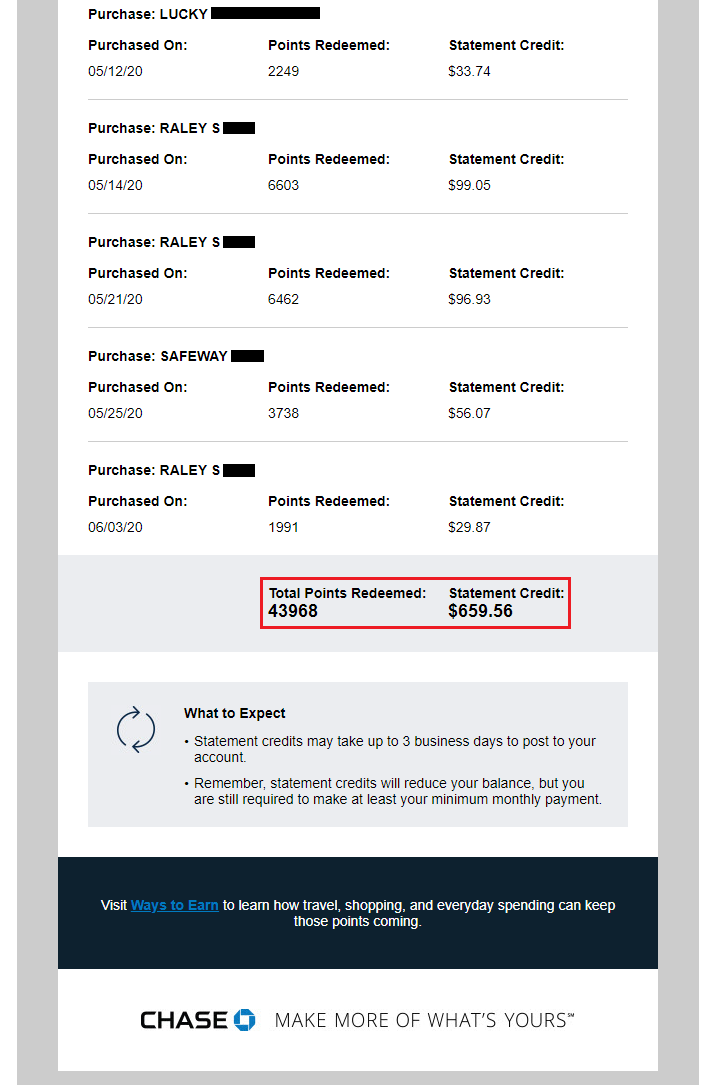

I received a confirmation email from Chase with the details of my Pay Yourself Back transaction.

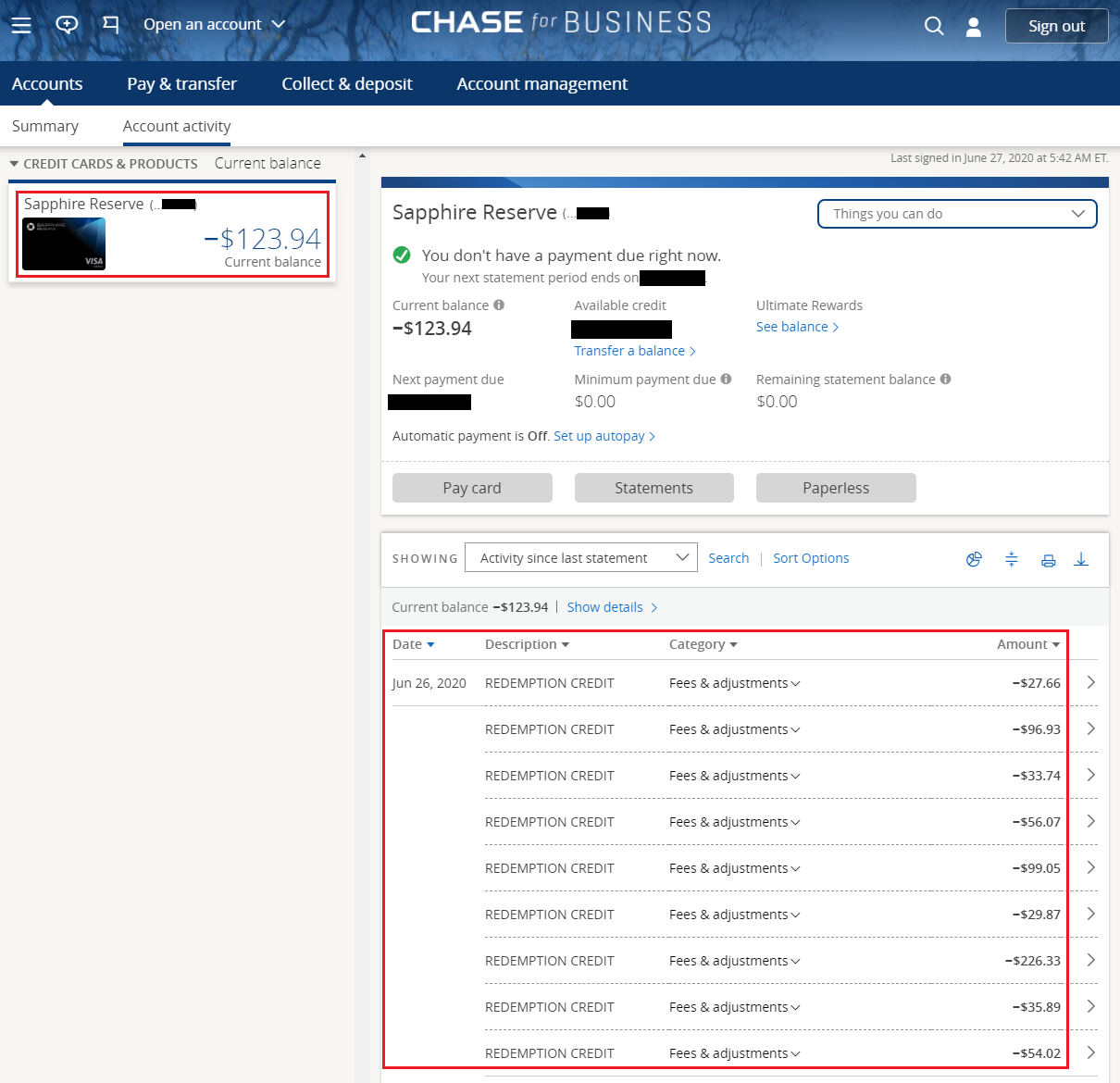

The following day, I logged into my Chase online account and saw that the 9 statement credits posted to my Chase Sapphire Reserve and my account now shows a $123.94 credit balance. If I end up with a credit balance at the end of the month, I can contact Chase to move the credit to a different Chase credit card to pay the bill.

As you can see, I redeemed 43,968 points out of my total 123,107 points (35.7%) to receive a $659.56 statement credit. I still have 79,139 points, which is 19,139 points above my 60,000 point threshold. 19,139 points x 1.5 cents = $287.09. From May 31 through September 30, the Pay Yourself Back feature will work on restaurants, grocery stores & home improvement stores, so I still have plenty of time to redeem points this year. If you have any questions about the Pay Yourself Back feature, please leave a comment below. Have a great weekend everyone!

I don’t think the feature “Pay Yourself Back” will be going away… But I do wonder what will the next categories be.. and if the 1.25(CSP)/1.5(CSR) cent bonus will stay.

I’m not a big fan on rotating award categories… which is why I’ve always stuck with the CSR & Freedom Unlimited, but hats off to Chase for stepping up and making the CSR, which is mainly a travel/dinning card, be very valuable to me during this pandemic.

I’ve used the feature a good bit.. and my only negative feedback is I wish it would be a one line transaction on your statement… When downloading into Quicken or other similar applications, it just looks nasty LOL

Yes, it is a big mystery what will happen after September 30, if it will stay or go, what categories will be participating, and what rates will be offered. Enjoy the feature while it lasts :)

I don’t use Quicken, but that sounds frustrating when downloading statements.

I’ve gone in pretty huge with the Pay Yourself Back, using the CSR 1.5c redemption, because as soon as the home improvement category was announced my mind lit up.

There were a number of home renovation/improvements I was biding my time about, in part due to cost… In particular, a garden/utility shed replacement. I discovered I could order a new custom shed through a Home Depot partner, and most importantly, pay for it AT Home Depot.

With the MS level and cpp I am able to sustain, my out of pocket cost was about $1200, to purchase a shed costing well over three times that… is 3x the size of my old one, and the price includes on-site build and installation!! Throw in all the other projects, landscaping, supplies, tools, etc and home improvement stuff… it looks and feels a lot different with price compression.

And, to put a cherry on top, since points are redeemed against the receipt cost, at HD I can still get my military 10% discount in there, too (though not for the shed).

Just for other lateral-thinking ideas… I bought a Target gift card for $300 at the grocery store. 20k redemption, with actual out of pocket MS cost of ~$100. Used that gift card to buy a $300 Nintendo Switch for my kids.

Same with summer clothes shopping. TJ Maxx and other retailers’ gift cards are sold at the grocery store…

In so many ways, it’s like the ultimate 60-75% off clearance sale *everywhere*!

All told, I’ve redeemed over 400k UR points (about 50% of my hoard), totaling about $6,200 in redeemed value…

I don’t know if PYB @1.5c will still be around after September 30th. I really, really hope so. But if not, I’m going for it while it is available.

Wow, you have done a great job using the new feature and getting great value out of your UR points. Only time will tell what will happen to the feature after September 30.

Without getting too personal — did the availability of income thru your work factor into your decision?

I totally can understand why, with the uncertainty of the world these days, cashing in some of your points for $700 would sound attractive, given you had no upcoming travel plans, and you’d be able to restore those points with normal spend. If you have extra-ordinary spend plans (like the reader who bot a Nintendo), perhaps that figures in as well.

Scott

Hi Scott, my income from my day job has stayed the same, I’m just working from home full time nowadays. The income from the blog is another story, similar to Frequent Miler’s story (https://frequentmiler.boardingarea.com/how-frequent-miler-the-business-is-surviving-covid-19/) but with much smaller numbers. Thankfully the blog is a labor of love and any money I make from it is just icing on the cake (or a nice dinner for my wife).

PS I see that only purchases made with the CSR are eligibile for the PYB at 1.5 ct. I’m not buying groceries with that card bc most of our spend is at Walmart, and CSR specifically excludes them from the 5X rewards.

That is a good point. I would normally use my AMEX Gold Card for grocery spend (4x at grocery stores), but since the CSR is offering 5x at grocery stores through June 30, I am using the card right now. It is a limited time spending opportunity and I only had to change my payment card, but I still go to my same grocery stores. I might be mistaken, but I thought some Walmart Grocery or Walmart stores that have groceries might code as a grocery store, but I could be wrong. What card do you normally use at Walmart?

I redeemed 1.2 million points. All visa gift cards purchased at grocery stores. No regrets.

Great deal Ron! Do you still have a large balance of UR points or did you cash most of them in with this feature?

How was it buying $18k worth of visa gift cards via a credit card? I’ve always struggled to buy even $500 at a time with most grocery stores getting concerned due too fraud in the past.

Just start small ($100 GC purchase) and work your way up. It also helps if you are buying other things other than just a VGC (like real groceries).

@RS_WI … I’m right there with you, my friend. I’m 3/4 of the way in burning down 1.2M in points and then I’m pretty much pumping and dumping Chase. I got screwed on a $2K travel claim on the Reserve card, and now I’m experiencing similar issues with a covid related chargeback on my Unlimited card. Chase will simply not honor the stated benefits of the card. SO, I’m taking my 90K combined checking and savings balance from Chase to Ally, dumping 3 of my 6 chase cards, and thinking about what my travel strategy will be a few years from now, when I might think about getting on an airplane. lol. Be careful out there.

Hi FF, I’m really sorry that Chase is not helping you out with those travel claims. I have had really good luck (knock on wood) with travel claims on my CSR, but I can totally understand your frustration. Will you use Citi or AMEX for travel purchases going forward?

@Grant – Right now, I’m 2 years out from any significant travel (my wife is immune compromised), so I’ll probably use a cashback card until then. Really disappointed with Chase not honoring the benefits of these cards.

@Mike – Completely on the same page with you.

A cash back card (or several cards) is a good idea for the next 1-2 years. The Citi Double Cash, Discover It, Citi Dividend, and US Bank Cash+ are all are pretty good cash back cards with no annual fees.

@Grant … Thanks, Grant. I appreciate the advice. Also, really good article and I appreciate everyone’s comments.

Thank you, I am currently working on another Pay Yourself Back post that will go live Tuesday morning.

Pingback: Coronavirus Surge, Chase Pay Yourself Points, PPP Fraud, Extinction for Restaurants - TravelBloggerBuzz

Good for you! I’d do it too except I don’t have a CSP or any organic grocery spend! Not worth the hassle of buying vgc imo.

No grocery spend? Where do you buy your groceries from?

I live with my Mommy! And she started shopping at BJ’s. So there goes our gas and grocery categories.

Haha, good deal then :)

Great post and hopefully they extend it to Ink natively. Or I get off my ass and call reconsideration on my rejected CSR application (I’m well under 5/24 but just have too much unsecured credit available from all credit companies).

I would wait for the denial letter and then call Chase reconsideration department and plead your case. Can you move some of your credit line over to be approved for the CSR?

Yes, it would be nice if the Chase Ink Plus / Cash / Preferred had this feature too (maybe even different categories).

I made a stupid mistake. I didn’t realize that the maximum redemption for an eligible charge (grocery) had to be made at one time. I redeemed $300 out of a $500 charge figuring I could redeem the remaining $200 at a later date. Well, I was wrong. But now I know for the rest of my eligible charges. I maxed out the grocery spend at 5x, so I won’t be doing any more grocery spend at 1x just to redeem points at 1.5x.

Hi Al, that is really good info to know. I just did a small partial redemption assuming that I could go back to max out the redemption for that charge. I guess that is not possible. I would contact Chase and see if they can help you with this issue. Maybe they can refund the partial redemption and then you can go back in and complete the full redemption?

The agent quoted me the language which I didn’t notice, but when I tried to make a new redemption and was looking for it, I saw it. I’m sure most people would miss it – there is nothing in the main part of the page alerting you to this rule, It is hidden towards the bottom. It says something about a redemption being final and once made, it is no longer an eligible purchase. I don’t think they can reverse a redemption. She sure made it sound like once you click it’s final.

Dang, that’s a bummer, sorry the agent wasn’t able to fix the redemption for you.

Hey Grant.

Great post. I’m with you. I normally wouldn’t even think of using UR points like this but I may as well. With cancelled trips to Taiwan, Bangkok, Bali (multiple Hyatt properties) I was going to use over 500,000 Hyatt points as well as several hundreds of thousands of points flying first class over/back. I also typically travel non-stop and burn a ton of Amex MR points.

But now in the age of COVID, I’m barely traveling and all my future trips are cancelled. I’m awash with tons of points and earning points organically with spend. All my elite statuses are extended until 2022 so there is no urgency to be forced into staying somewhere.

I DO hope I can travel soon but it’s not easy to plan to travel to Europe and Asia right now as an American. We don’t know if things will get worse. So this isn’t a bad use of points.

Stay safe.

Hey Mike, I’m right there with you. First time in my travel hacking career I don’t have several trips lined up over the next few months. If you consistently earn UR points and don’t have any good uses for them, cashing them in for 1.5 CPP is not a bad deal. Hopefully travel will be safe again soon and you can start redeeming your points for things that are more fun than groceries and home improvement projects :)

Pingback: Reminder: Chase's Pay Yourself Back Feature Does Not Allow Multiple Partial Redemptions

I think this is really a great redemption for Chase. The opportunity to buy groceries and essentially use the UR points and also earn them at the same time is a phenomenal deal.

I usually try to stockpile points, but I can’t pass this up. For Grocery Stores, you earn 5x on the purchase so you’re really redeeming 7.5% less points with this so that’s really a 1.6 cent redemption.

Given that, I’m always expecting companies to lower their redemption rates (similar to Citibank Thank You points years ago) any good redemption opportunity is (in my opinion) never to be missed. With all of the rumors of Chase moving to 1.25 c for CSR, I always am concerned about any types of devaluations. And with all of the airlines struggling, I really wouldnt be surprised if we see mileage devaluations at some point in the next 2 years.

I’ve always believed that 4.5c+ equivalent for restaurants is not a sustainable model for Chase, Citi or Amex. Granted most of those are travel costs which probably cost them less than the 4.5c but still it’s probably still more than the 3% they get.

Yes, I agree. Any good redemption opportunity should not be missed. Who knows when the next major devaluation (from airline, hotel, or credit card rewards program) will happen.

Pingback: Overpaid Chase Credit Card? Receive Credit Balance Refund via ACH Bank Transfer Instead of Check

Pingback: On My Mind: Using Chase Sapphire Reserve for Restaurants & Grocery Purchases Instead of AMEX Gold

Pingback: I Converted my Chase Sapphire Reserve to Freedom Flex – Here’s Why & What Happened Next