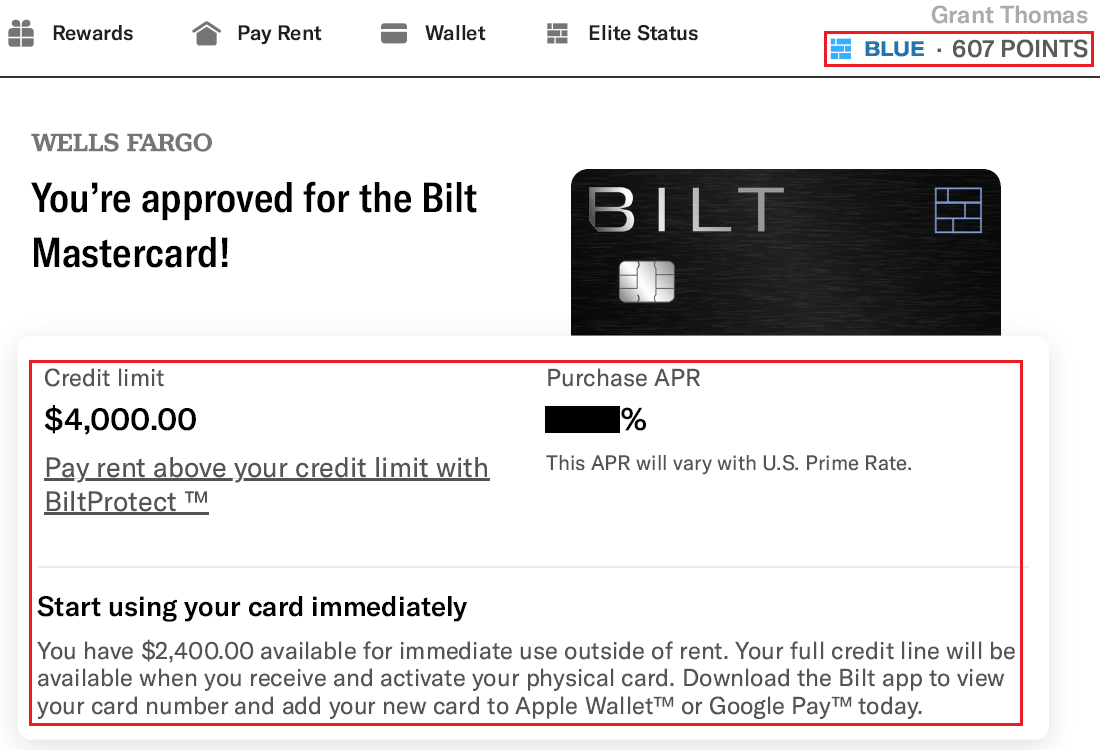

Good afternoon everyone. A few weeks ago, I wrote I Finally Got A Bilt Credit Card (Application Process, Earning & Redeeming Strategy, and Unboxing). In that post, I shared that I was excited that I was approved for the Bilt Credit Card (my referral link) but confused why I was only approved for a $4,000 credit limit since I applied for 2 other credit cards afterward and was approved for a $22,000 credit limit on a Bank of America Air France / KLM Credit Card and a $17,200 credit limit on a Barclays JetBlue Plus Credit Card. I knew with a $4,000 credit limit, it was going to be impossible challenging to spend $12,500 in the first 5 days in order to receive the maximum 50,000 bonus Bilt Points for new card members.

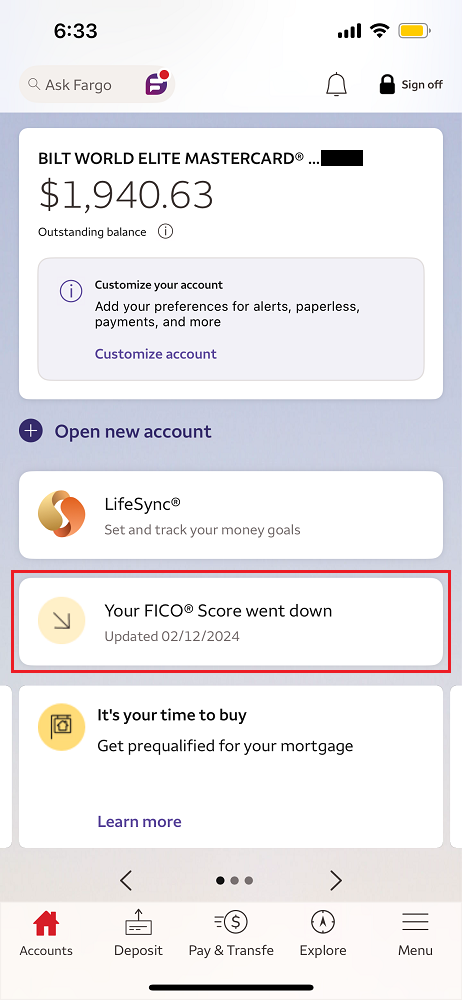

In the Wells Fargo app, I saw that my FICO credit score was 822 / 850, as of February 2024, so I decided to call Wells Fargo and see if they could increase my credit limit. The rep said he would send the request to the appropriate department, but said that they would need to do a credit check. I thought that was strange since Wells Fargo just did a credit check when I applied for the credit card a few days earlier. I don’t think there is anything in my credit report from the last few days that would convince a Wells Fargo credit analyst to increase my credit limit, so I gave up on that idea. I then told the rep that making payments to my Bilt Credit Card from the Bilt app took a few days to post and he suggested that I pay my Bilt Credit Card directly from the Wells Fargo app since the payment would post instantly and free up my available credit limit. Great idea, so I gave it a try…

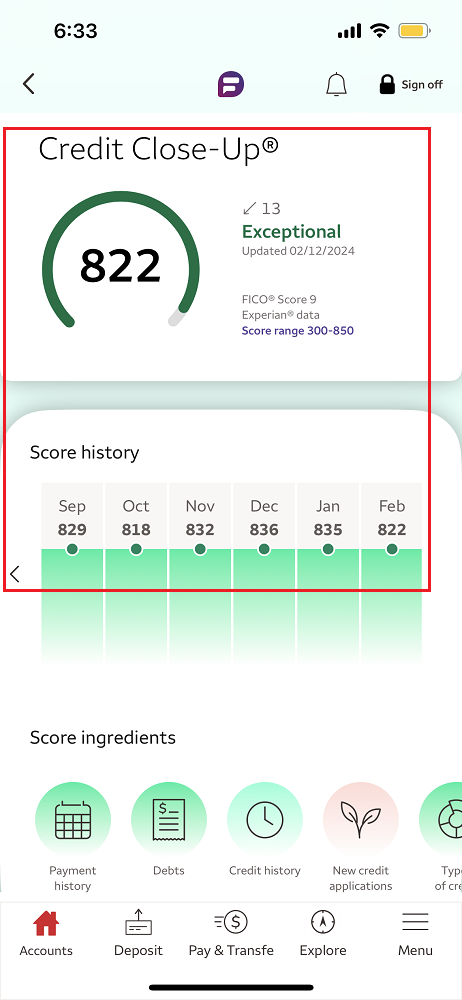

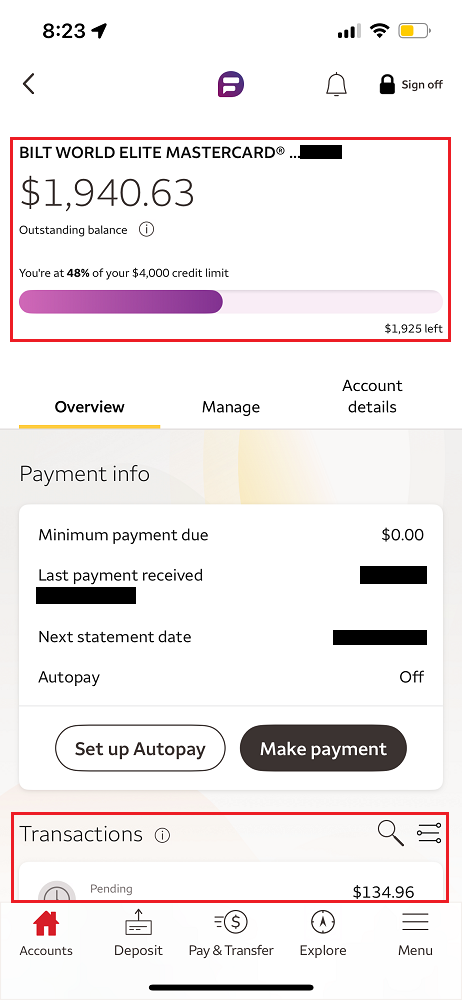

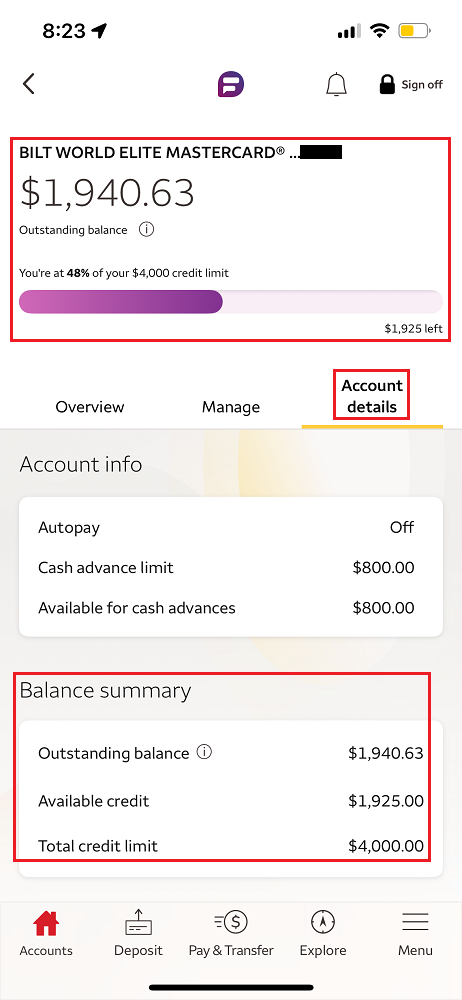

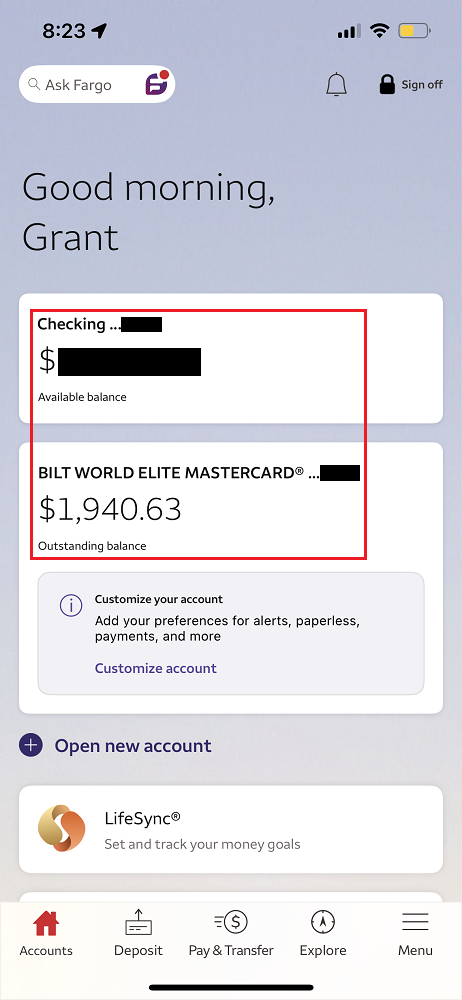

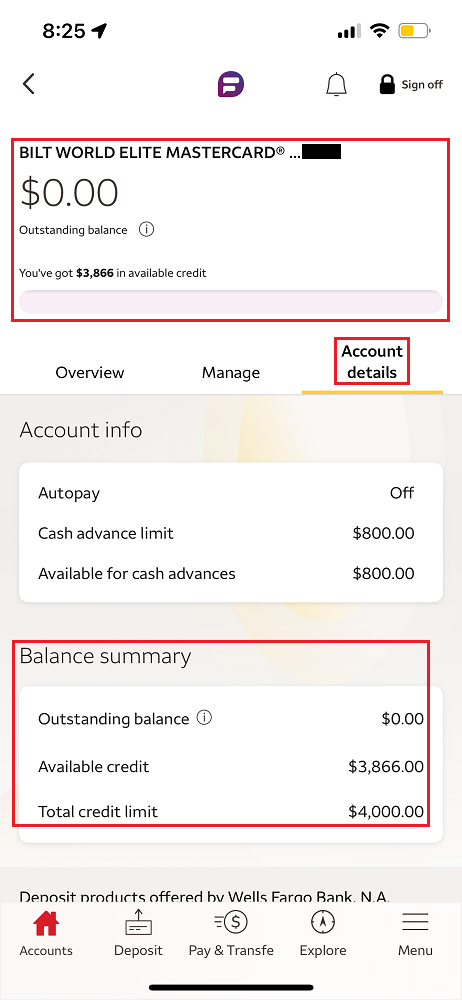

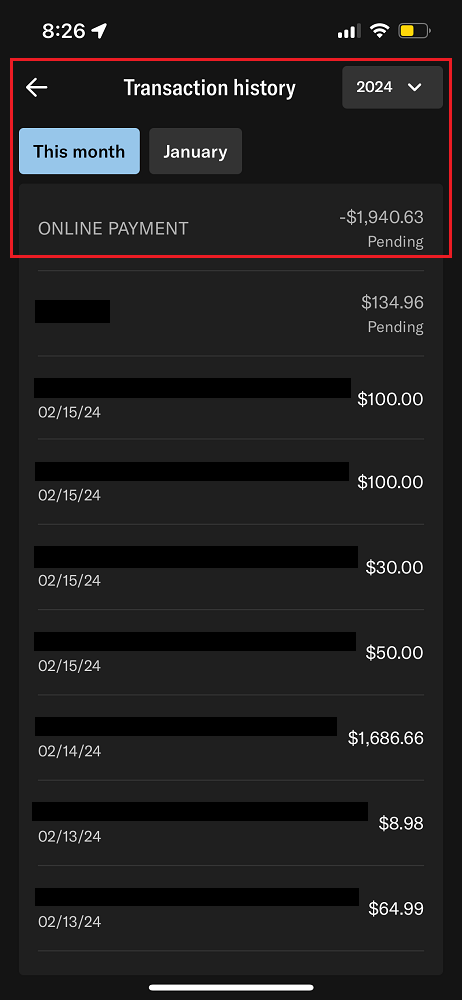

In the Wells Fargo app, I went to my Bilt Credit Card. I had $1,940.63 in posted transactions, $134.96 in pending transactions, and my remaining credit limit was $1,925.00. Those numbers also appeared when I clicked on the Account Details tab.

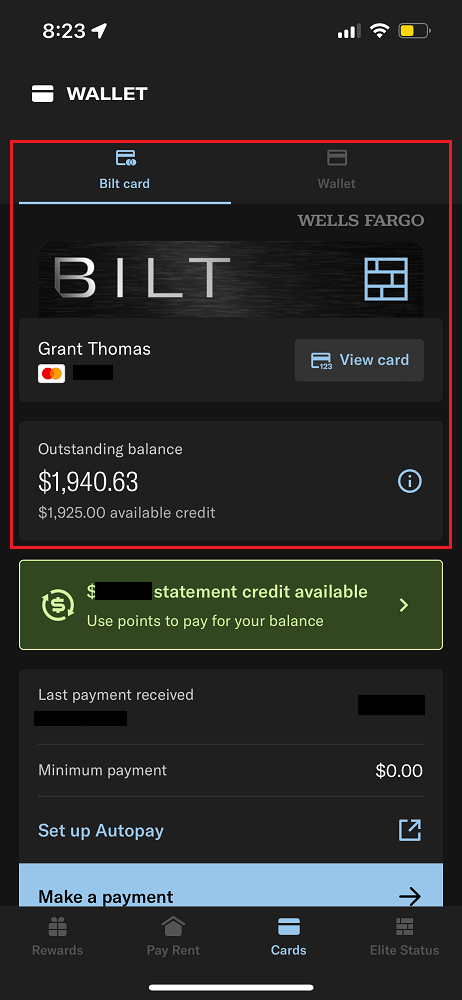

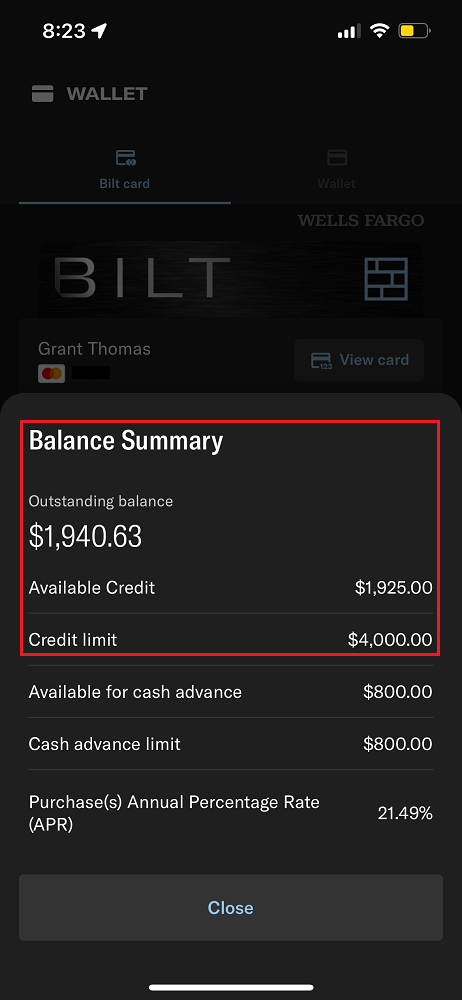

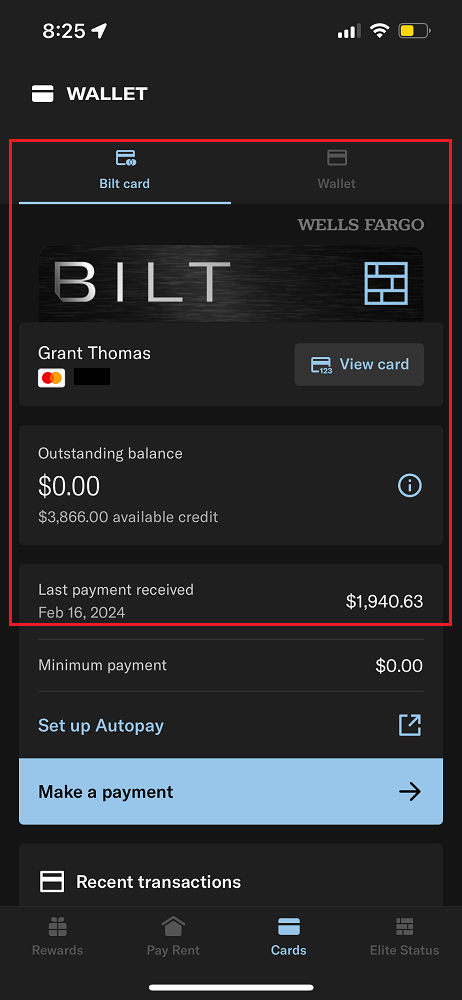

I then opened the Bilt app and went to the Cards / Wallet section. I had $1,940.63 in posted transactions, $134.96 in pending transactions, and my remaining credit limit was $1,925.00. All the numbers matched up between the Wells Fargo app and the Bilt app.

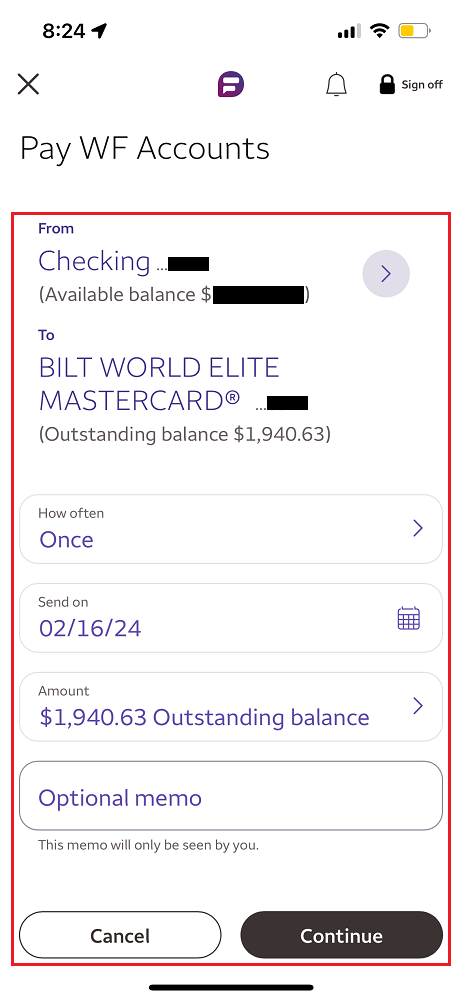

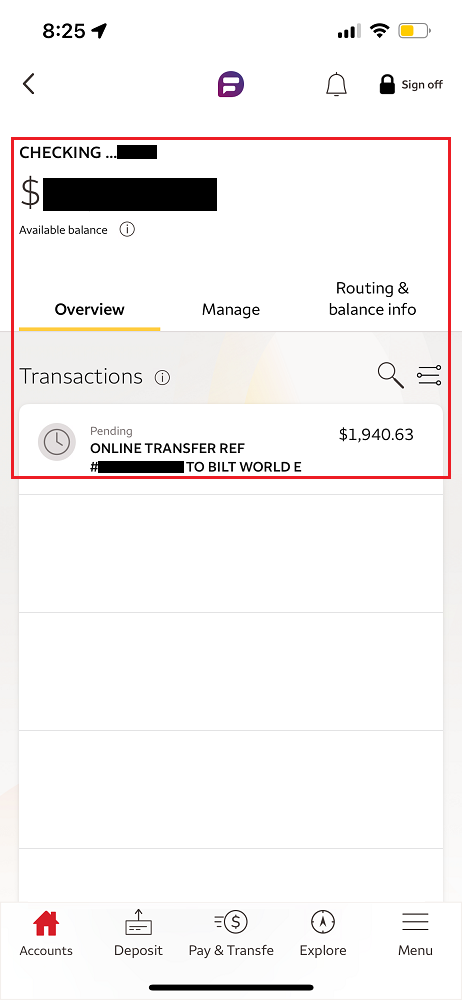

I then went back to the Wells Fargo app and went through the process to pay the current outstanding balance ($1,940.63) to the Bilt Credit Card.

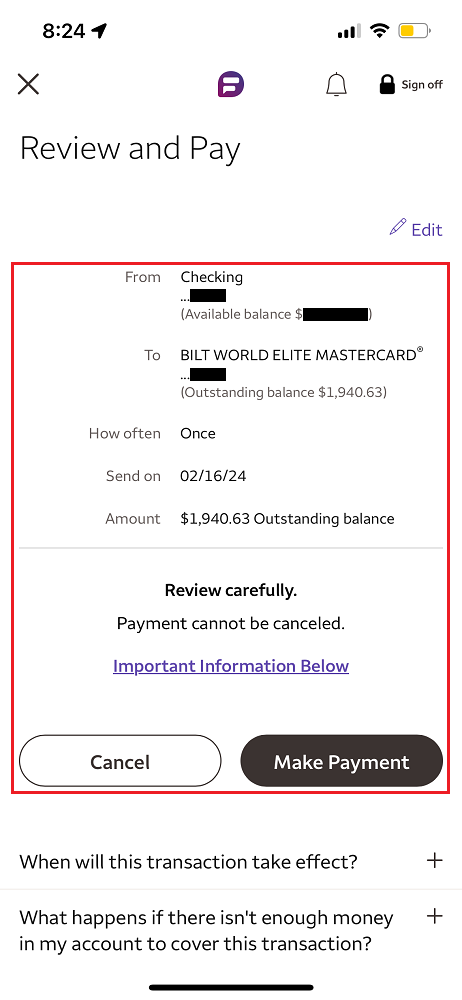

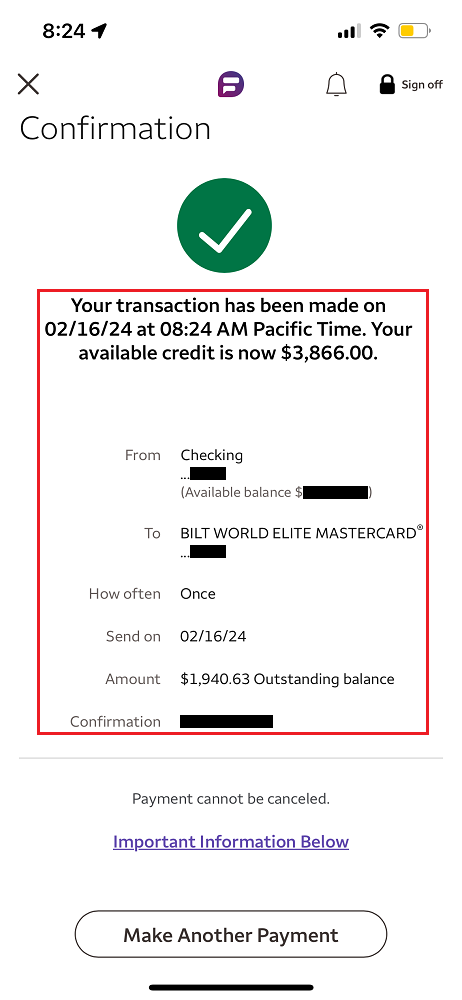

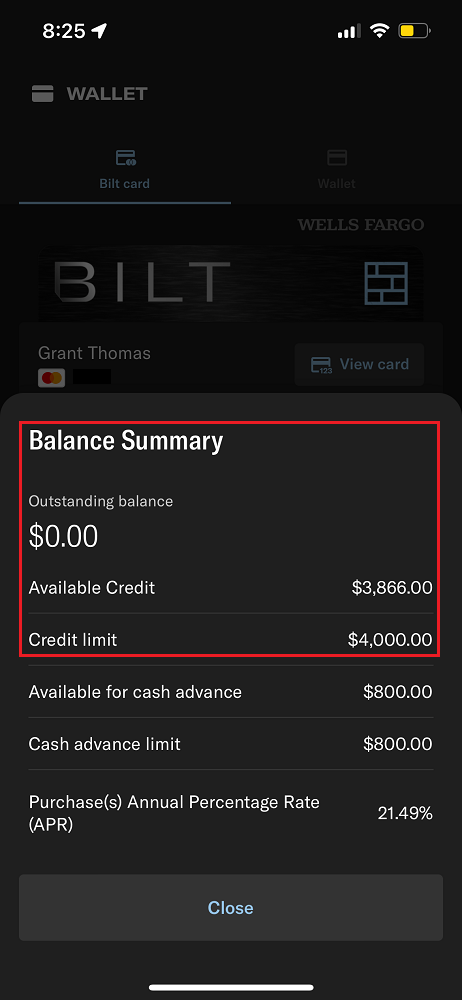

I reviewed the details and clicked the Make Payment button. The confirmation screen showed that my new available credit was now $3,866.00. The $134.96 pending transaction is why the available credit limit didn’t go back up to $4,000.00 after I made the payment.

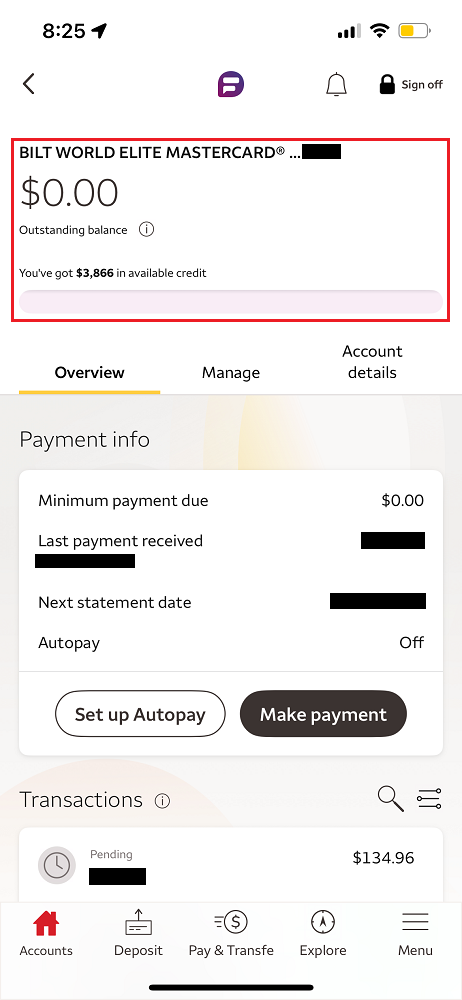

As you can see, my current account balance is $0.00 and I have $3,866.00 in available credit.

Back on the Bilt app, the outstanding balance also went down to $0.00 and my available credit also showed $3,866.00.

I can see the $1,940.63 pending payment in both the Wells Fargo app and Bilt app.

Long story short, some of the large transactions I was going to make toward the $12,500 spending goal didn’t line up with Bilt’s 5 day spending window, so I had to settle with a smaller bonus than the 50,000 Bilt Points I originally had in mind. Going forward, I am going to use my Bilt Credit Card for 6x on dining during Rent Day and 3x on dining for the other days of the month. I am hoping there are more great transfer bonuses coming up, so I can get a 100% transfer bonus with my Bilt Silver Status. After I meet the minimum spending requirement on my 2 other credit cards (I only need to spend $3,000 in the next 3 months), I plan on using my Bilt Credit Card as my everywhere else credit card for 2x on Rent Day and 1x for the other days of the month.

If you have any questions about the Bilt Credit Card (my referral link), please leave a comment below. Have a great day everyone!