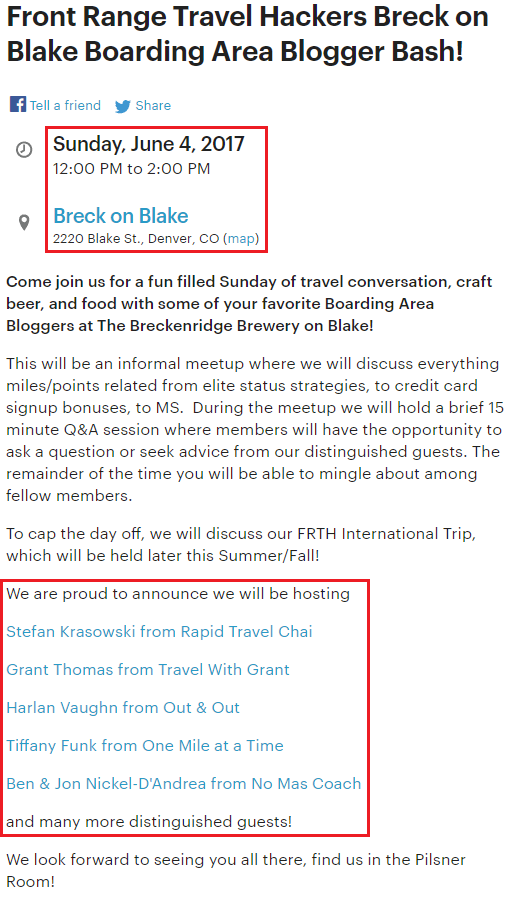

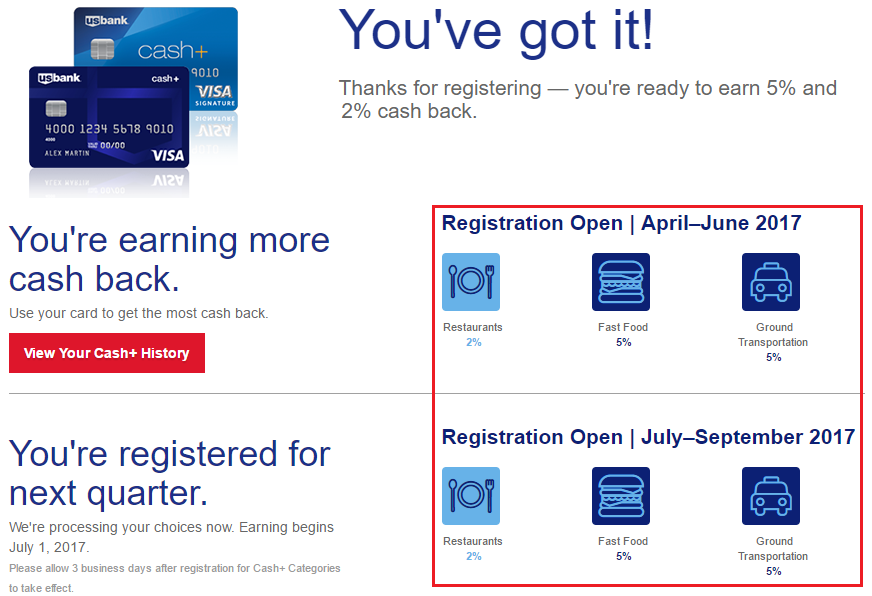

Good morning everyone, happy Friday! By the time you read this post, I will be on my way to Denver for a short weekend trip (with a Sunday travel meetup in Denver). My love affair with US Bank continues as they continue to shower me in gifts (in the form of targeted spending offers) on my US Bank Club Carlson Business Credit Card and US Bank Cash Plus Credit Card. Let’s go through the offers and see if there are any winners.

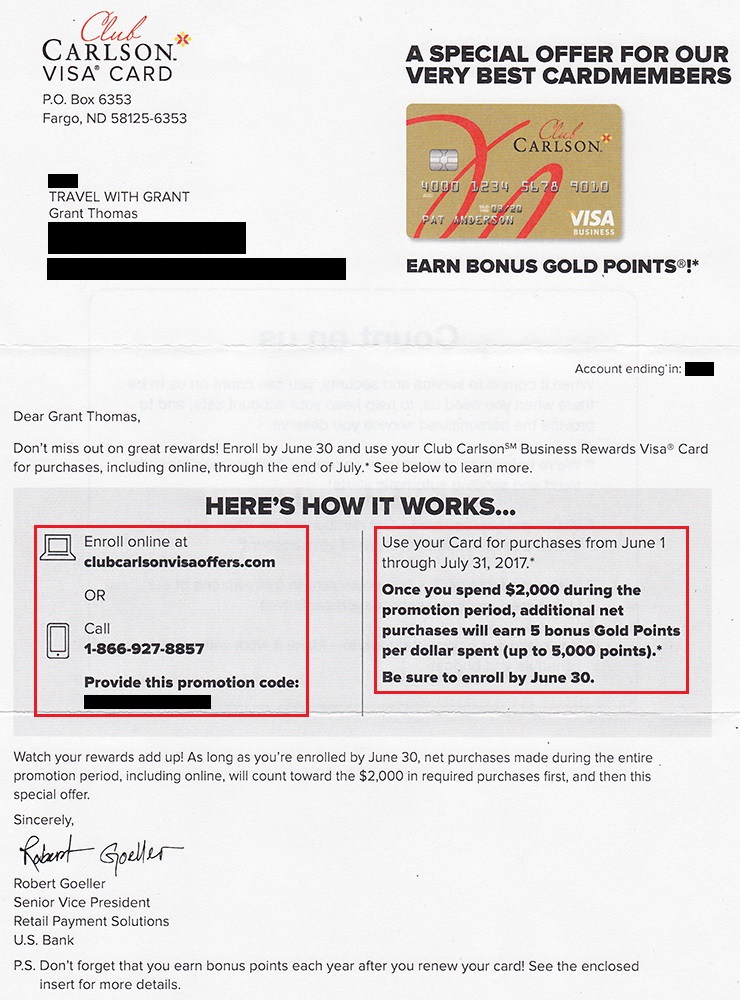

First up, I have a targeted spending offer on my US Bank Club Carlson Business Credit Card. After spending $2,000 on the credit card, I will earn an extra 5 Club Carlson Points per dollar, up to 5,000 bonus Club Carlson Points. To maximize the offer, I would need to spend exactly $3,000. I would receive $3,000 x 5 points per dollar = 15,000 Club Carlson Points + 5,000 bonus Club Carlson Points = 20,000 Club Carlson Points. 20,000 Club Carlson Points is worth ~$100 (each Club Carlson Point is worth 0.5 cents to me), so $100 / $3,000 = 3.33% return. Not bad, but I really don’t want any more Club Carlson Points, so I will pass on this offer.