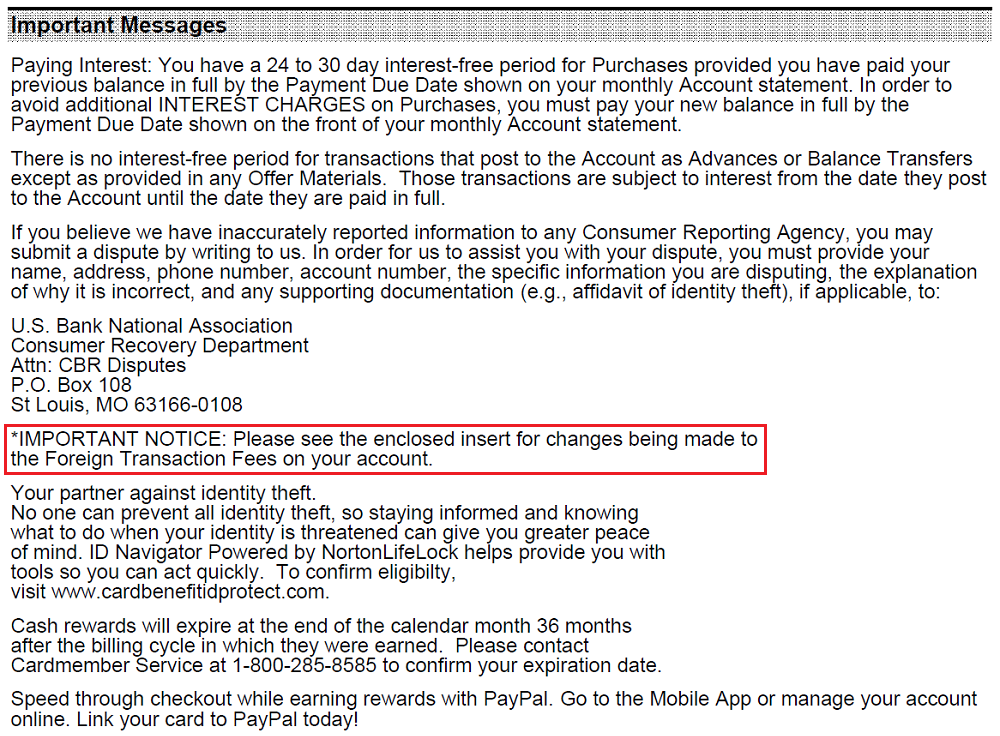

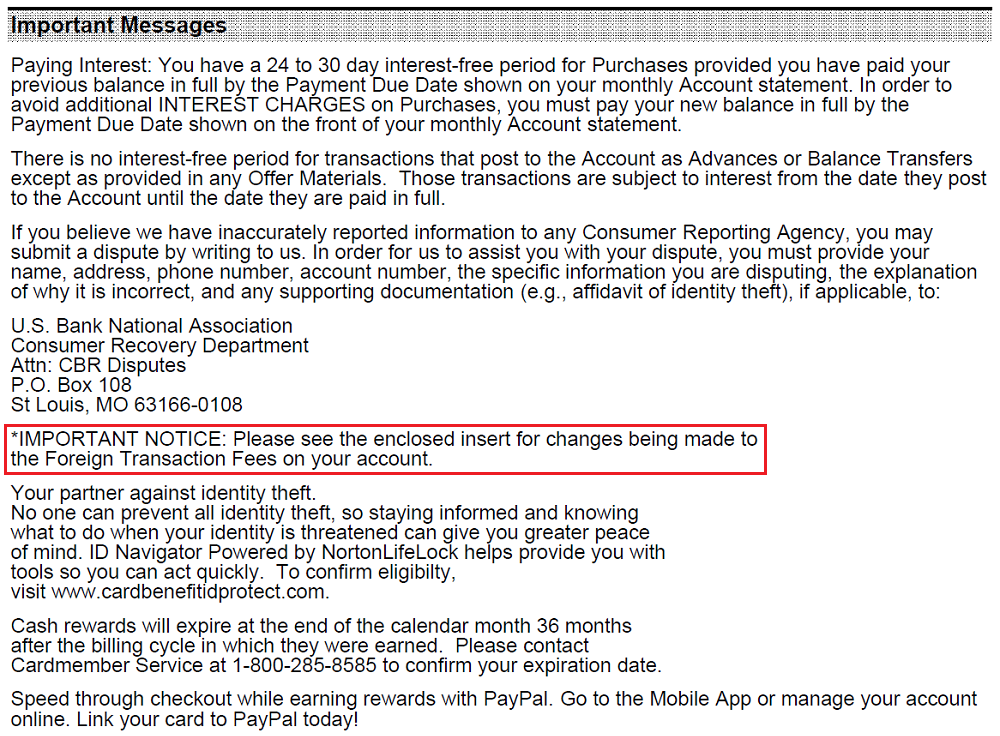

Good afternoon everyone, I hope your Fourth of July Weekend is going well. I was reviewing my recent statement from my US Bank Cash Plus Credit Card when I spotted this “IMPORTANT ANNOUNCEMENT” about foreign transaction fees. The statement doesn’t tell you anything about the change, so you need to look at the insert that comes with your paper statement or download the digital insert online to find out what is changing.

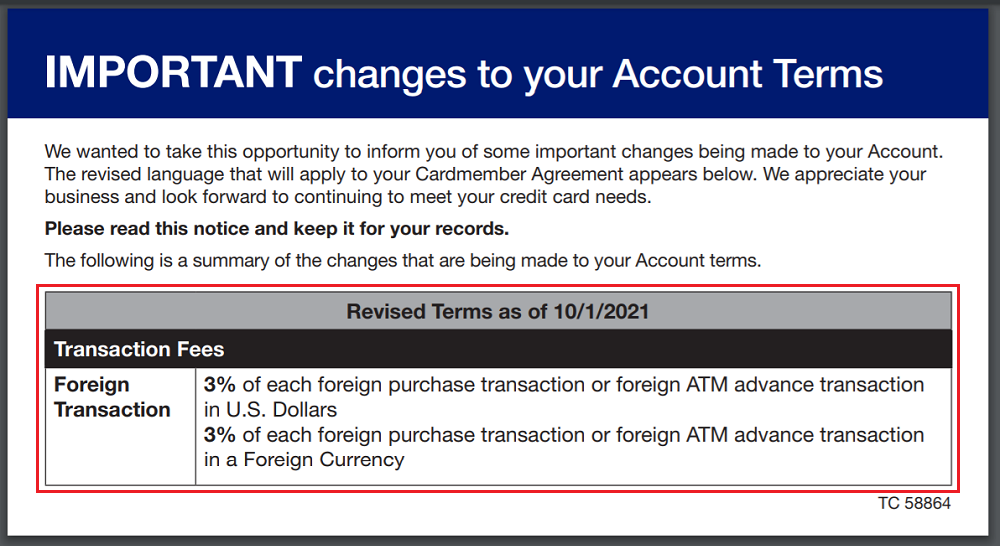

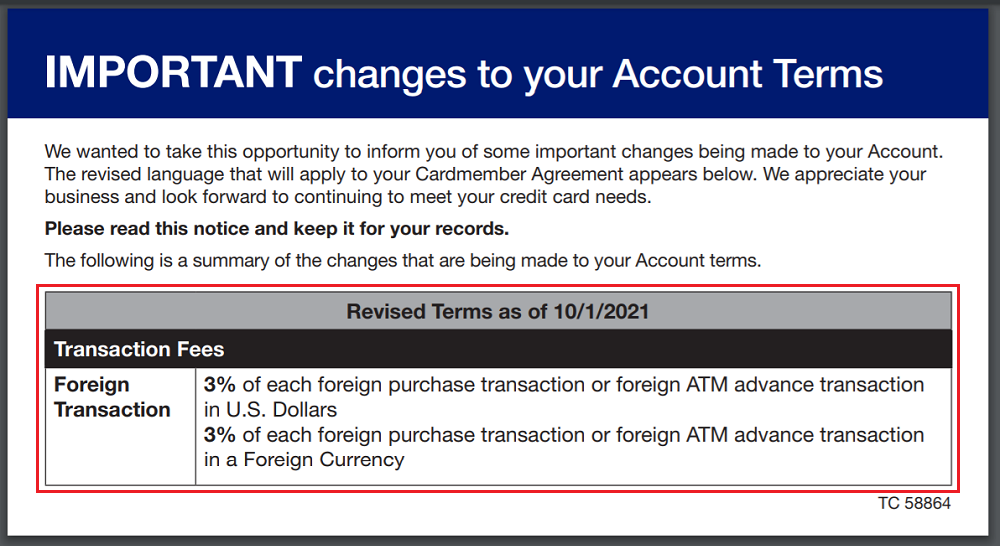

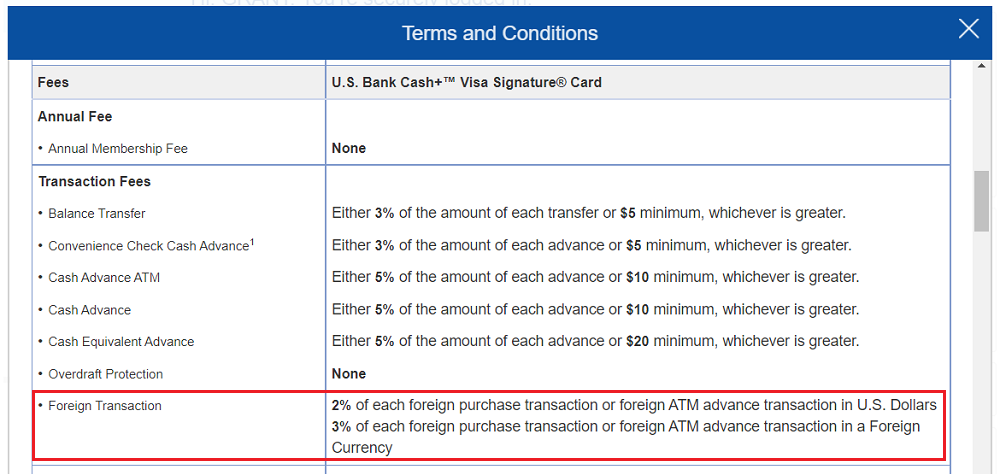

The digital insert says that effective October 1, 2021, the foreign transaction fee will be:

- 3% of each foreign purchase transaction or foreign ATM advance transaction in U.S. Dollars

- 3% of each foreign purchase transaction or foreign ATM advance transaction in Foreign Currency

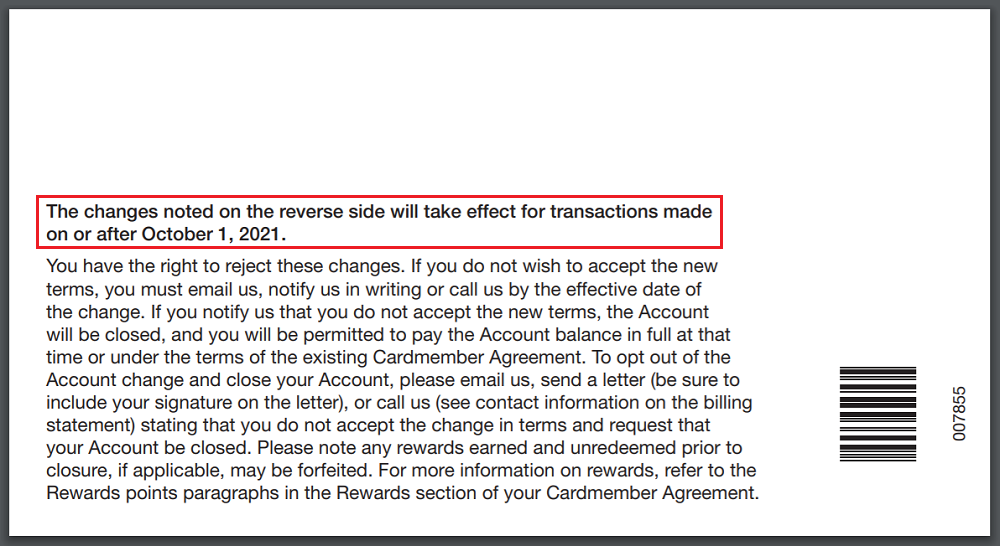

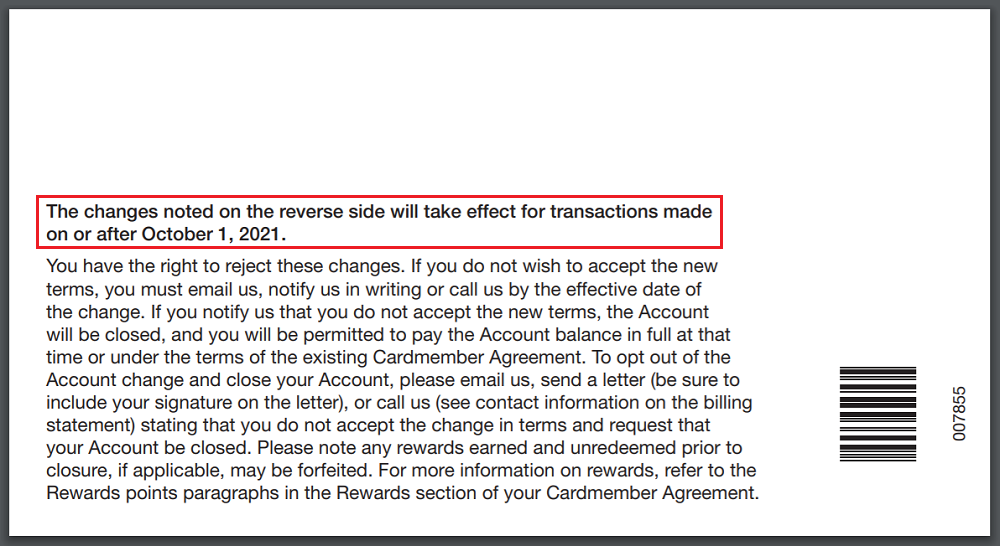

Here is the backside of the digital insert that says you can reject the change by contacting US Bank, but that will result in US Bank closing your Cash Plus Credit Card.

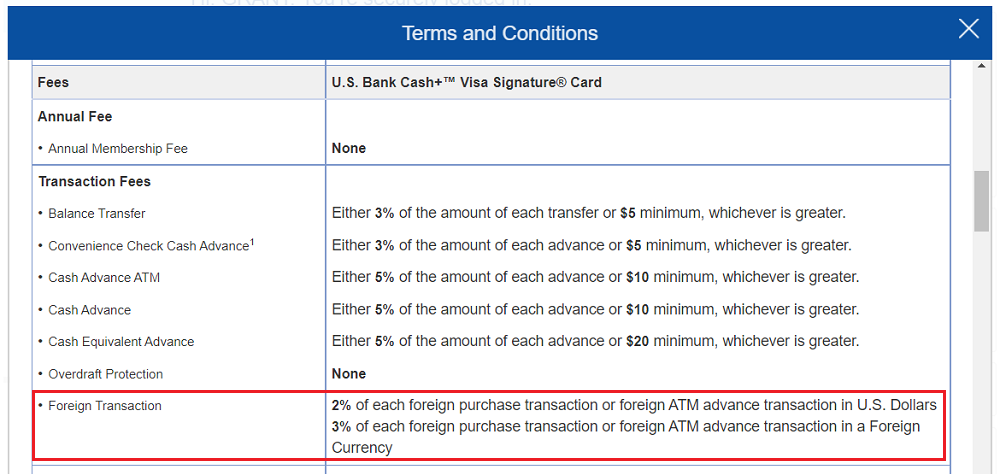

I found the current terms for the Cash Plus Credit Card and it currently says “2% of each foreign purchase transaction or foreign ATM advance transaction in U.S. Dollars.” It looks like effective October 1, 2021, that will increase from 2% to 3%.

The Cash Plus Credit Card is not a good card to use internationally or to make purchases at international websites. If you plan to make international purchases, use a credit card that has no foreign transaction fees, like the US Bank Altitude Reserve Credit Card. If you have any questions about this change, please leave a comment below. Have a great Fourth of July everyone!