Updated 10/7/2020 at 12pm PT: El Al Israel Airlines just sent out this email to their members letting them know that their American Express Membership Rewards partnership is ending on December 31, 2020. A screenshot of the email is included below.

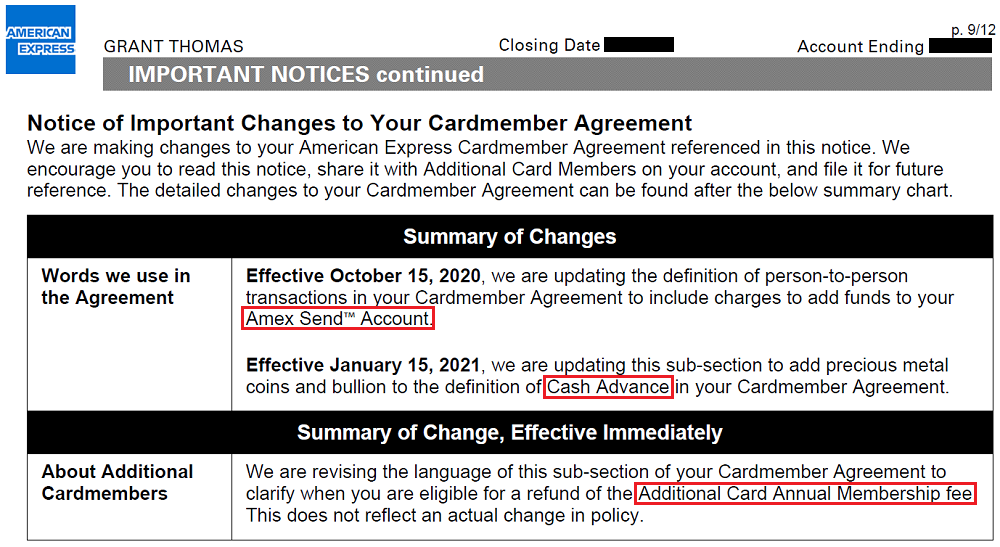

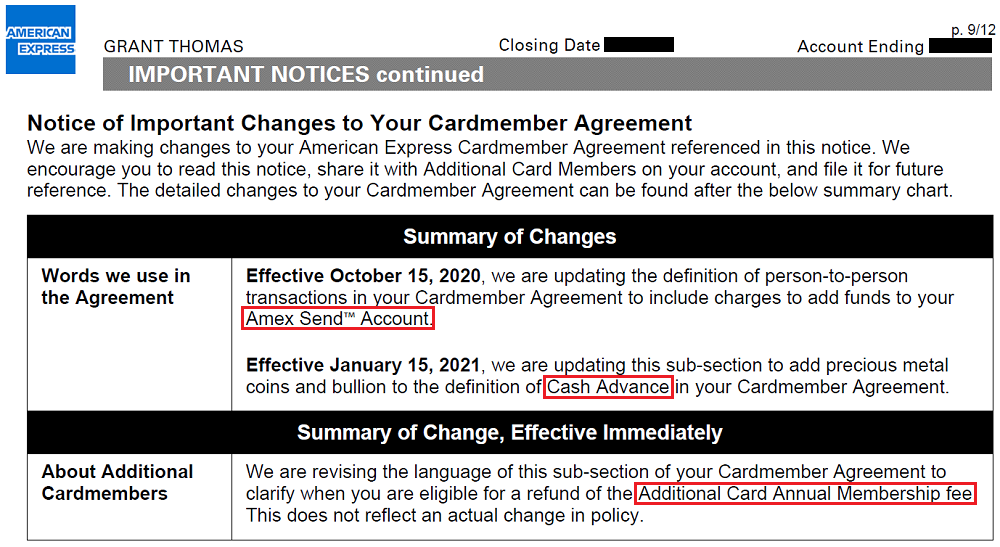

Good morning everyone, I hope your weekend is going well. 2 months ago, I wrote Changes to American Express Credit Card Terms (Bye Ameriprise, Third Party Purchases, Foreign Currency & Cash Advances). Like clockwork, American Express likes to make regular monthly updates to their credit card terms. I was reviewing my recent American Express credit card statements this morning and spotted a few changes that I thought you might like to know about. Some of these changes raise some questions or do not provide exact answers, but I will do my best to decipher and interpret the changes. If you have differing thoughts / opinions about how to interpret these changes, please let me know in the comments section.

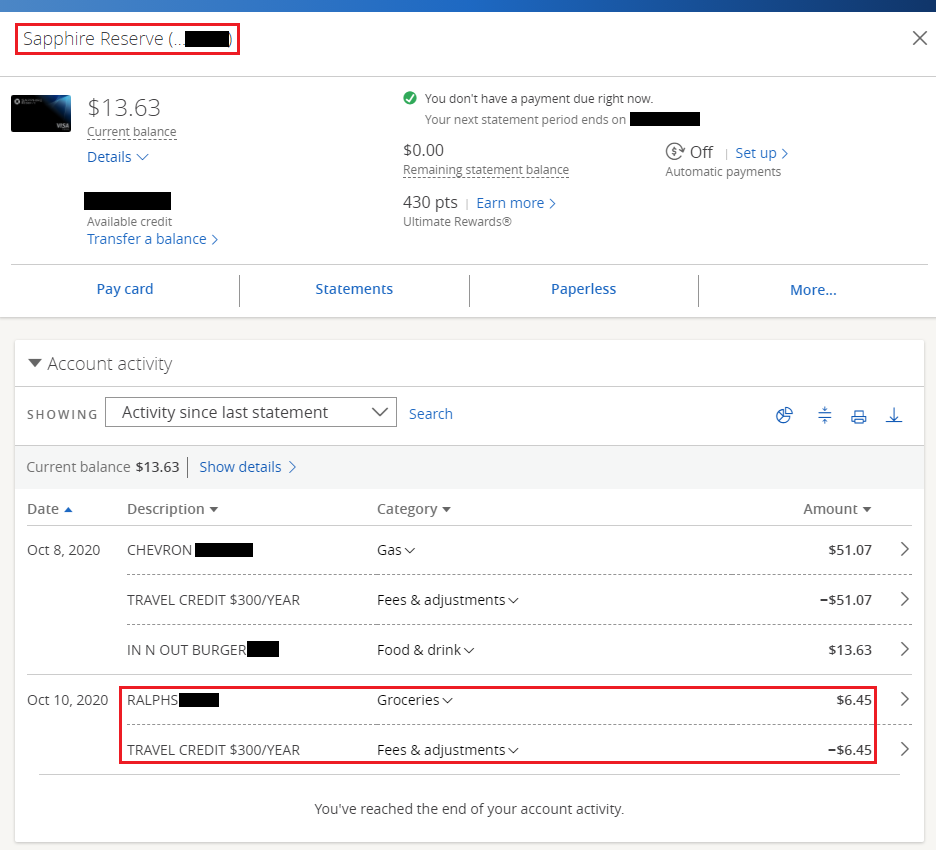

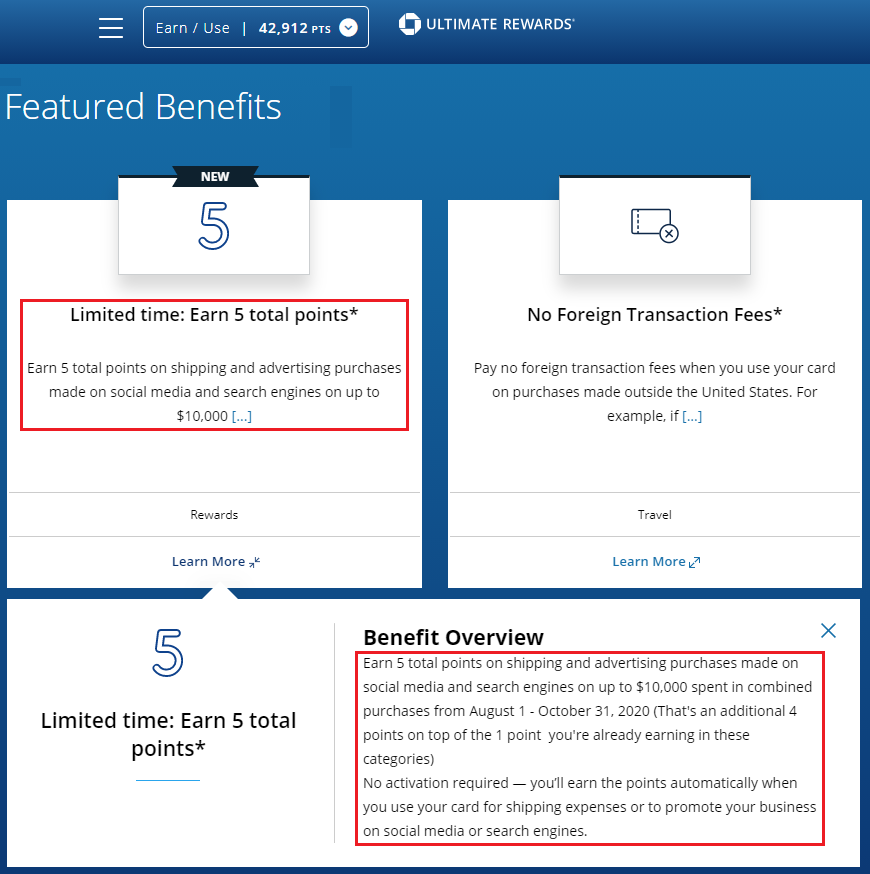

To get started, I reviewed all the recent credit card statements on all my AMEX cards and decided to use screenshots from my American Express Gold Card since it covered all the changes. Most of these changes affect several other AMEX cards. Here is a brief overview of the upcoming changes (AMEX Send Account, cash advances & additional card annual membership fees), but I will go into more detail on subsequent screenshots.

Continue reading →