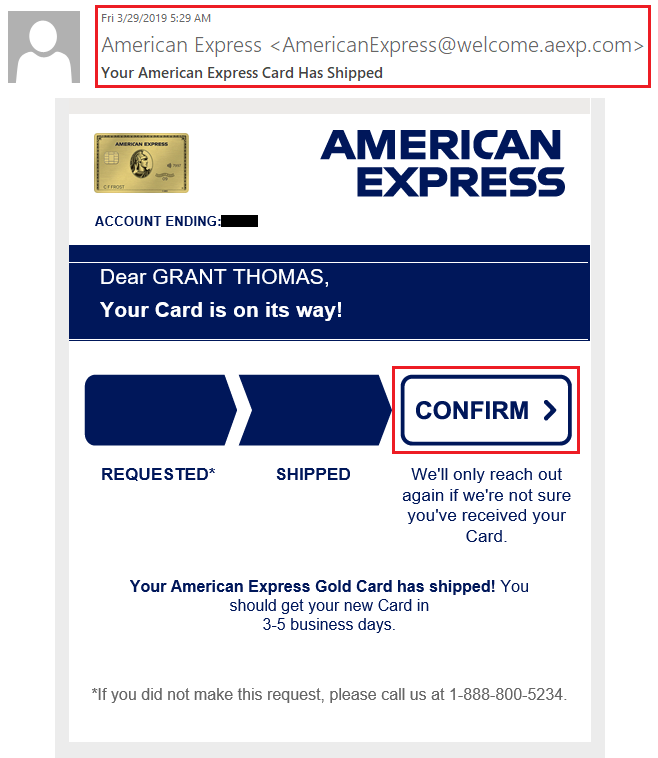

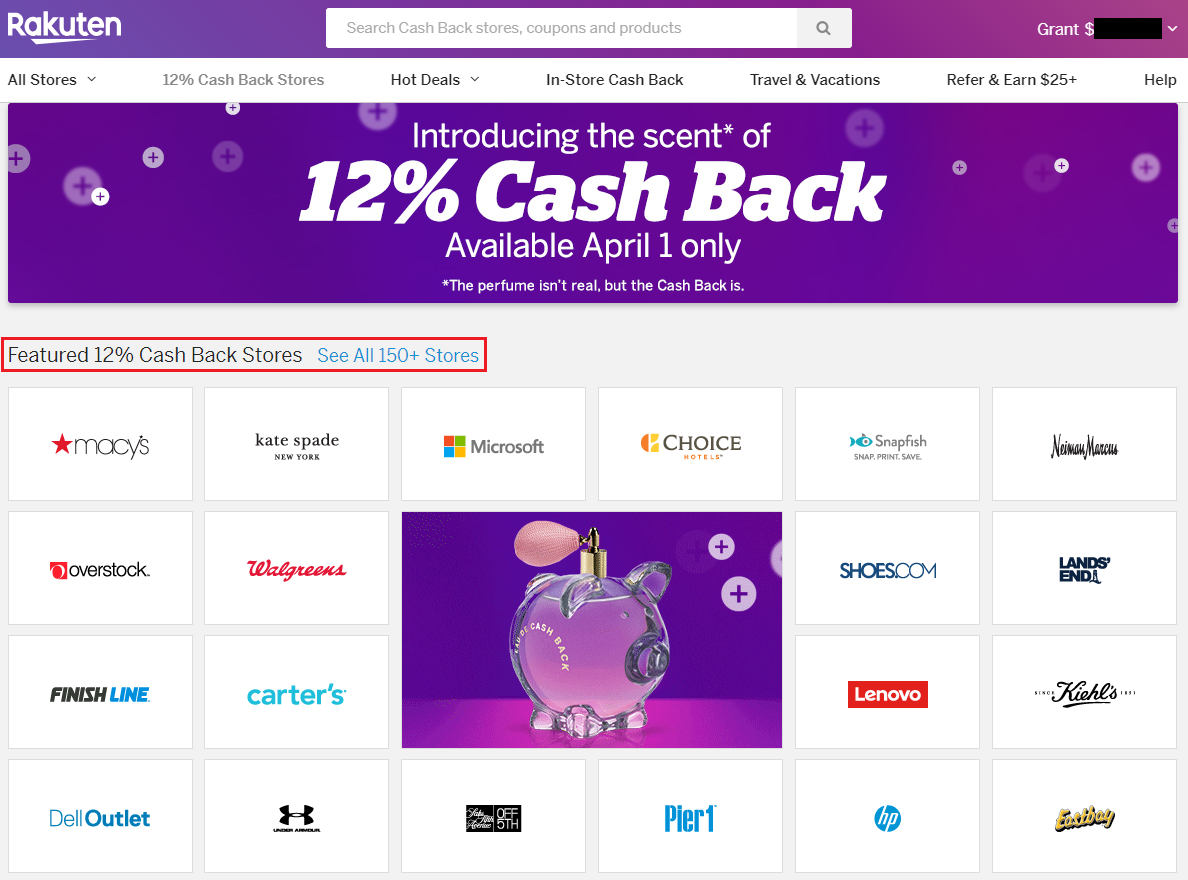

Good morning everyone. Yesterday, I wrote Unboxing my American Express Gold Card: Card Art & Welcome Documents and How to Activate & Set Up American Express Gold Card in AMEX Online Account. In this post, I will go through the benefits of the American Express Gold Card (my referral link) and show you how to enroll in 2 important benefits: $120 Dining Credit & $100 Airline Fee Credit. To get started, sign into your American Express online account, click on your Gold Card and then click the Benefits link to go to the Benefits page. As you can see, these 2 benefits require you to enroll in them before the benefits kick in, so make sure you do this right away.