Good morning everyone, I hope you had a great New Year’s Day! A few weeks ago, I wrote My Best Practices for New Credit Cards and Sign Up Bonuses. In that post, I shared a variety of tips and tricks to stay organized and squeeze out the most value from your new credit cards. In today’s post, I will talk about the other side of the coin – best practices for closing credit cards. There are many things you need to do before you call to close your credit card. Here are some tips and tricks to follow:

Is the Credit Card Worth the Annual Fee?

Whenever a credit card has an annual fee, you need to ask yourself, “Does the value you receive from the credit card benefits meet or exceed the cost of the annual fee?” Most credit card benefits are intangible (you cannot touch them), but you must assign a value to them. For example, if your credit card offers these benefits, how much are the benefits worth to you?

- Airline Elite Status – you must fly in order to use your status.

- Free Checked Bags – you must check bags on flights.

- More Award Seats / Better Award Availability / Lower Pricing – you must search and book award tickets using miles and points.

- Hotel Elite Status – you must stay at the hotel chain (or match to another hotel elite status).

- Free Night Certificate – you must find participating hotels and award availability to use your free night certificates.

- Rebated Points – you must have enough points to redeem for an award in order to get rebated points.

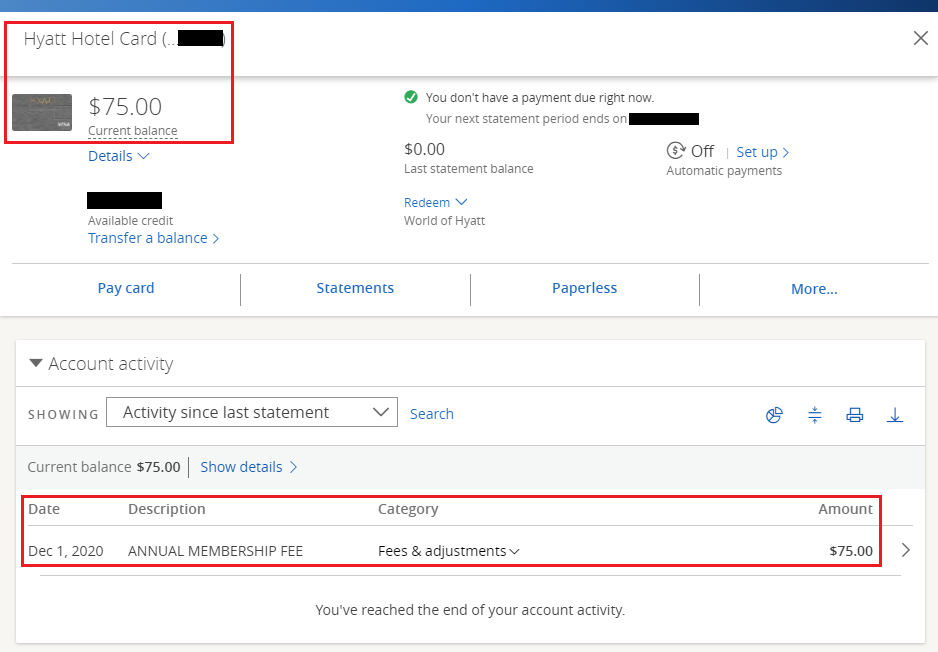

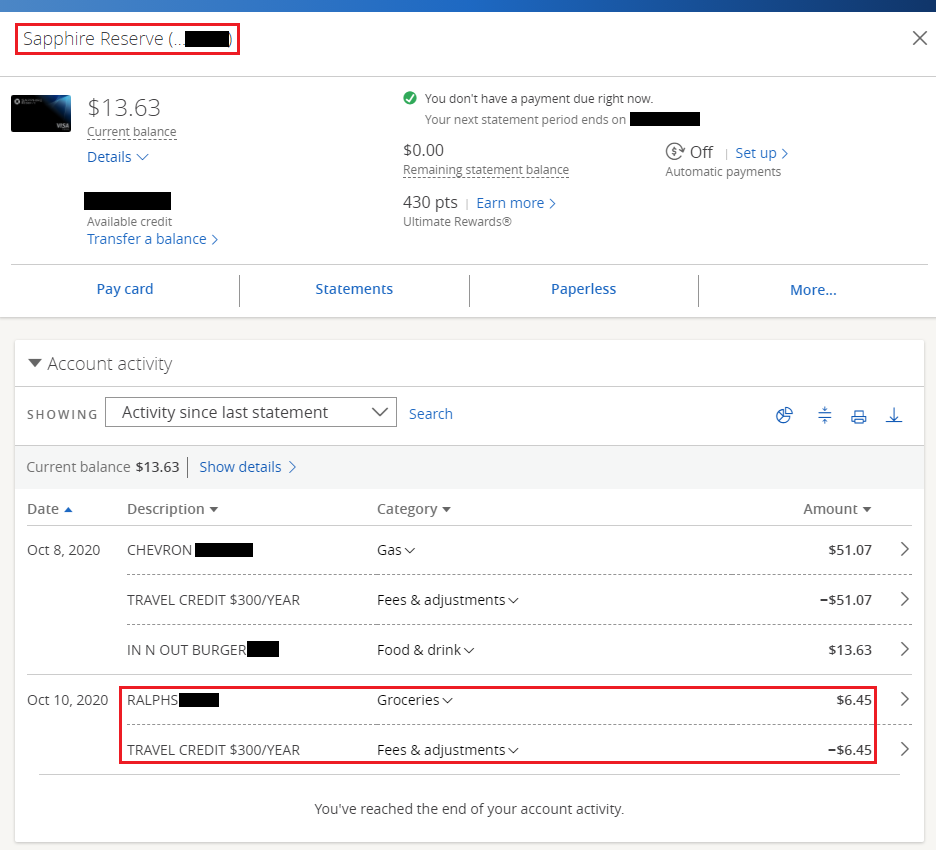

- Statement Credits – you must spend money (hopefully on something you want / need) in order to get the statement credits.

- Airline Travel / Incidental Reimbursement Credits – you must find qualifying charges to make in order to trigger the credits.

- Refer a Friend Bonuses – you must have friends, family, or blog readers who will apply for new credit cards with your referral links.

If you are interested, check out my Keep, Cancel, or Convert? Series to see how I decide which credit cards are worth keeping and paying the annual fees.