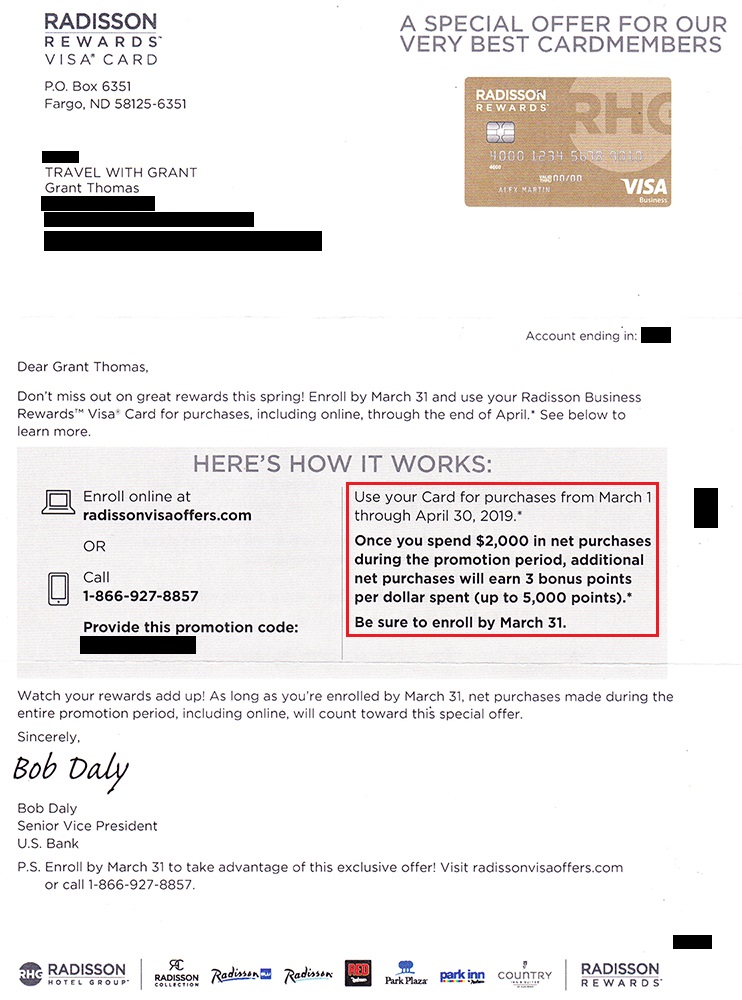

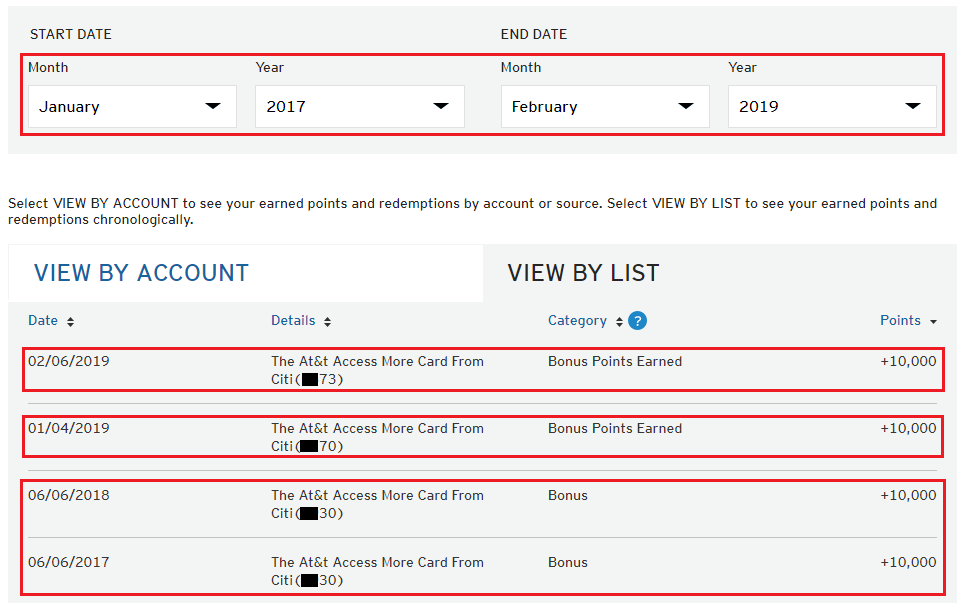

Good morning everyone, happy Friday! I’m heading to Las Vegas this weekend to do some hiking and watch the Golden Knights NHL game. I hope you have a fun filled weekend ahead too! Yesterday, I received 2 targeted spending offers from US Bank regarding my US Bank Radisson Rewards Business Credit Card and US Bank Radisson Rewards Visa Signature Credit Card. I will go through both offers and tell you what I think of each offer. If you received different targeted offers, please let me know in the comments. Without further ado, let’s go over the targeted spending offer on my US Bank Radisson Rewards Business Credit Card.

After spending $2,000 on the credit card, I will earn 3 bonus points per dollars, up to 5,000 bonus points. I would need to spend an extra $1,666.67 to max out the 5,000 bonus points. In total, I would need to spend $2,000 + $1,666.67 = $3,666.67 and earn 23,333 points ( [5 x 2,000 = 10,000] + [8 x 1,666.67 = 13,333], 10,000 + 13,333 = 23,333). If I spent $3,666.67 on my Citi Double Cash Credit Card, I would earn $73.33. So $73.33 cash back vs. 23,333 Radisson Rewards Points. According to Frequent Miler’s Reasonable Redemption Value table, Radisson Rewards Points are worth 0.38 cents per point, so 23,333 points is worth $88.67, or only $15.34 more than the cash back. I’m currently sitting on a stash of 146k Radisson Rewards Points, so I do not want/need any more points. If you value Radisson Rewards points at more than 0.38 cents per point, you might be interested in this offer.