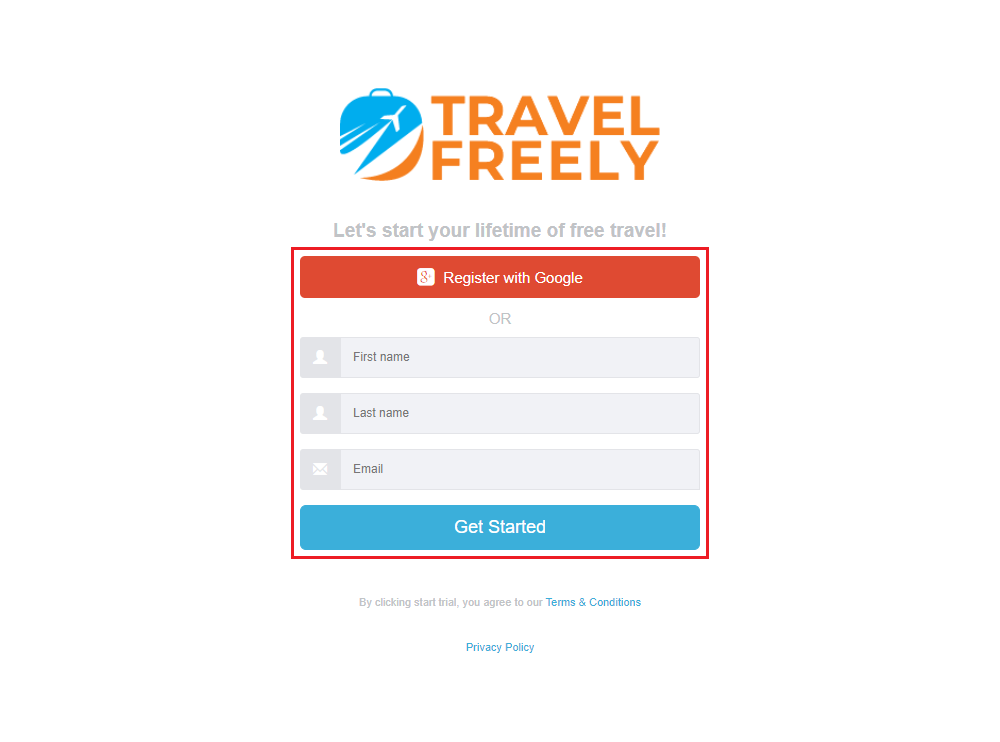

Good morning everyone, I hope you had a great weekend. A few weeks ago, I was in Denver and went to the Front Range Travel Hackers Meetup Group. At the meetup, I met Zac, the founder of TravelFreely, a website he created to track credit card sign up bonuses (deadlines to complete the minimum spending requirements), track credit card annual fees, calculate your 5/24 Score, and make it easy for you to track your credit cards along with your spouse / companion’s credit cards. And by the way, the service is completely free and you can set up your account in a few minutes (unless you have 30+ credit cards like me, in which case, it could take a little longer). Without further ado, here is how TravelFreely works. To get started, sign up for your free TravelFreely account here. Enter your name, email address, and click the Get Started button.