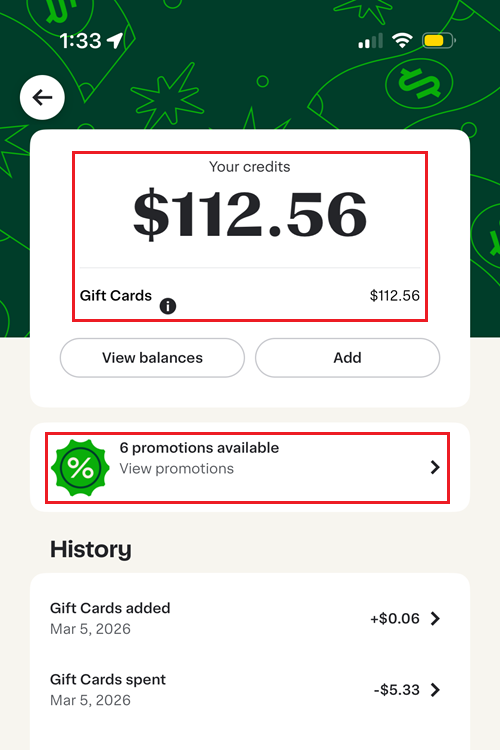

Good afternoon everyone, I hope your weekend is going well. I’ve been a big fan of Instacart ever since Chase added $10 and $20 Instacart credits to many of their cobranded credit cards in May 2025. Before then, I had never used Instacart because I assumed the grocery prices were significantly higher than shopping in-store and I actually enjoyed going to my local grocery stores. Between my wife and I, we currently have 8 qualifying Chase cobranded credit cards, which provide $80 – $100 in Instacart credits each month. When you combine those credits with discounted Instacart gift cards, it becomes possible to have groceries delivered to your front door for a fraction of the normal cost.