Good afternoon everyone, I hope you had a great weekend. I just read Frequent Miler’s article Alaska tanks utility of its “Famous Companion Fare” and learned that you can no longer use Alaska Airlines wallet funds to pay for Companion Fare tickets. That’s a major disappointment, since wallet funds and discounted Alaska Airlines gift cards from Costco used to pair beautifully with the Companion Fare.

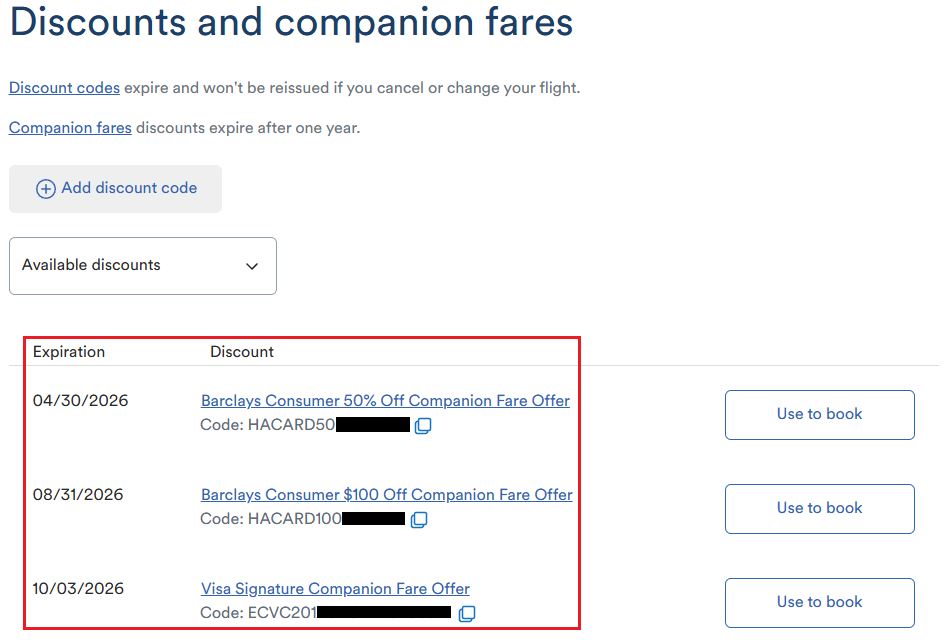

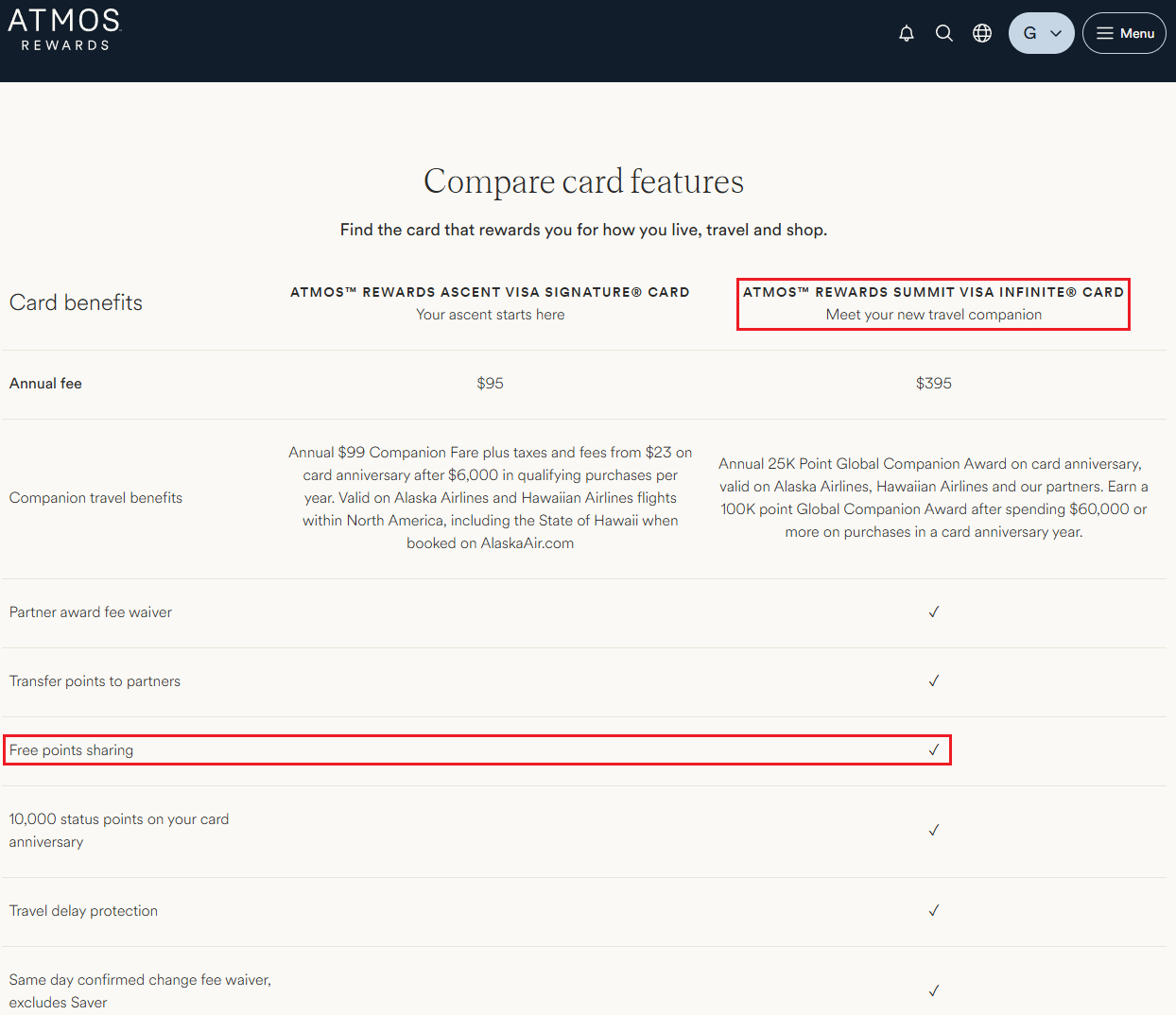

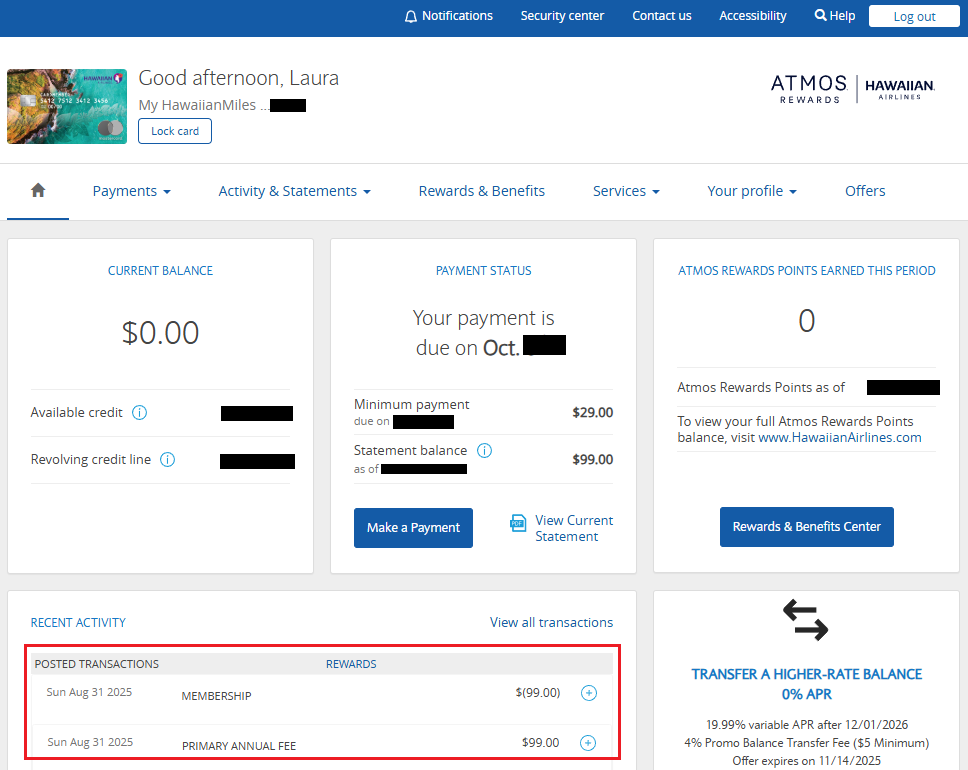

Naturally, that got me wondering: Does Atmos Rewards also block wallet funds when using Barclays discount codes? (Short answer: yes.) What started as a quick check turned into a full comparison of Barclays vs. Bank of America and how their Discount Codes and Companion Fares stack up. You can find your discount codes and companion fares in your Atmos Rewards account under the Discounts and Companion Fares section.

Background

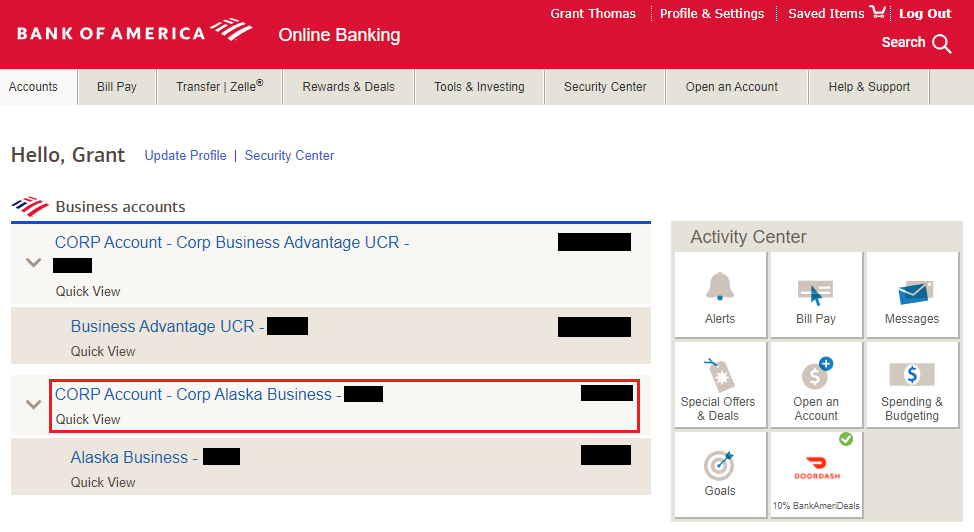

A couple of weeks ago, I wrote Maybe the Barclays Hawaiian Airlines Credit Card is a Keeper – Here’s Why and wanted to take a closer look at how the Barclays 50% Off Companion Fare and the Barclays $100 Off Companion Fare compare to the Alaska Airlines Companion Fare from the Bank of America Credit Card. Here’s what I found.