Good morning everyone, happy Friday! I am flying to Phoenix this weekend to watch some Spring Training baseball games, go to a Phoenix Suns basketball game, and maybe catch a Phoenix Coyotes hockey game – lots of sports in my future!

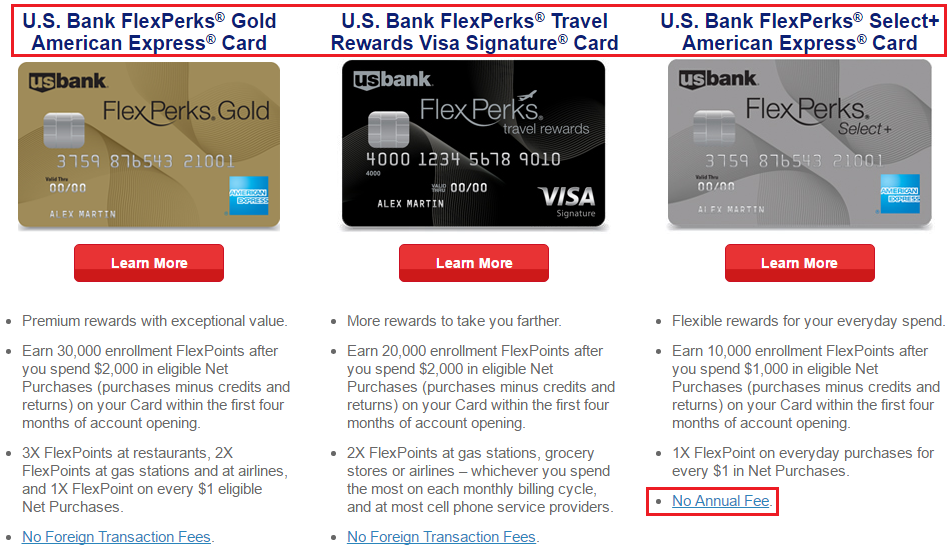

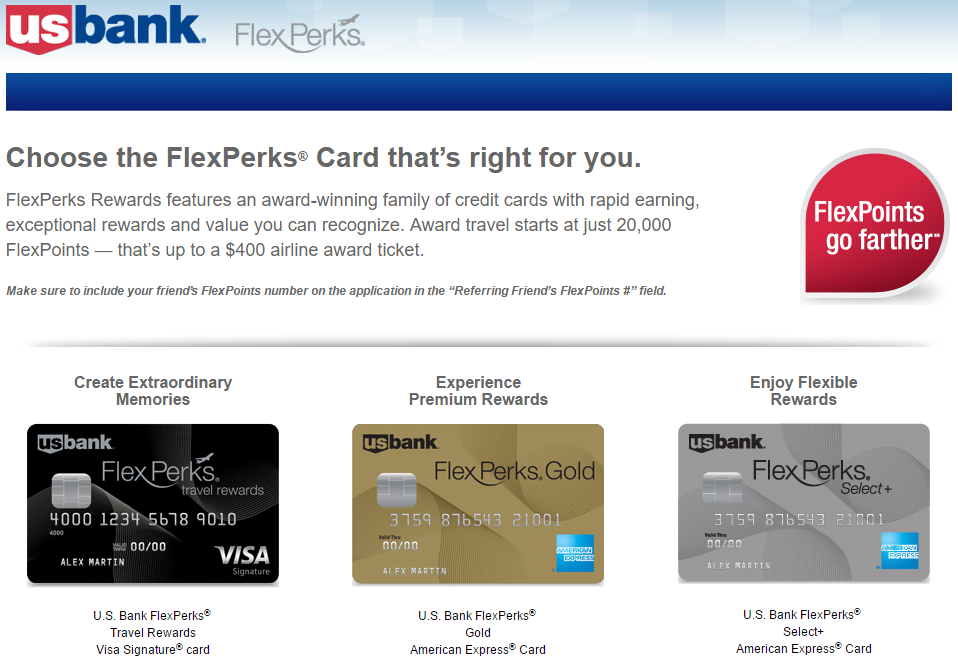

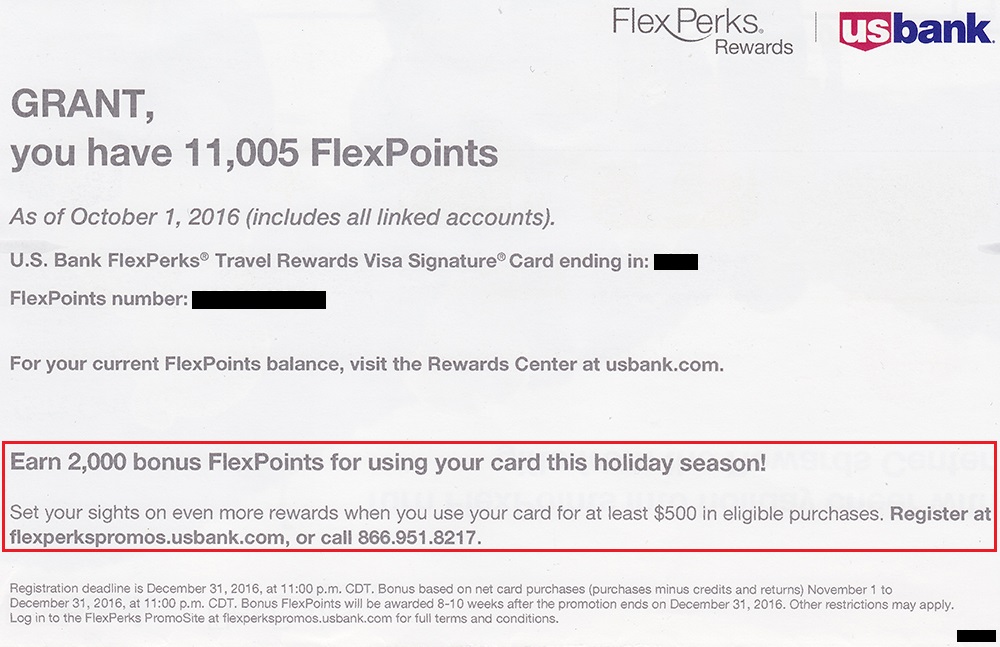

In credit card related news, both my US Bank FlexPerks Travel Rewards Visa Signature Credit Card and US Bank FlexPerks Travel Rewards American Express Credit Card had $49 annual fees that just posted. I got both credit cards during various Summer / Winter Olympic promos and have since spent down the majority of my FlexPoints. The only reason to keep the FlexPerks Visa Signature card is for 3x at charity (making Kiva loans) or 2x at gas stations and grocery stores. You do get 10 Gogo Wifi Passes every cardmember year, but I seem to earn them faster than I can redeem them (plus the American Express Business Platinum Charge Card gave me 10 free Gogo Wifi Passes that I have yet to use either). As for the FlexPerks American Express card (no longer offered – it has since been replaced by the US Bank FlexPerks Gold American Express Credit Card), I really never use that card either.

Long story short, both credit cards had annual fees that posted and I wanted to downgrade / convert to credit cards with no annual fees. Here is my journey calling US Bank and figuring out which credit cards you can downgrade / convert to. The obvious choice is the US Bank FlexPerks Select Plus American Express Credit Card that earns FlexPoints and has no annual fee.