All award space and screenshots were taken on September 10. Award space has likely changed (for better or worse) since this post was originally published.

How to Book US Airways Off-Peak Award Flights to Europe for 30,000/35,000 Miles Round Trip

US Airways off-peak flights to Europe are amazing. I went to Europe in January 2013 and visited Amsterdam, Paris, Cologne, Munich, and Brussels. In January 2014, I went back to Europe and visited Amsterdam, Berlin, Vienna, and Rome. Of course it is cold in January, but if this SoCal boy can handle a bit of snow, I’m sure you can too. The weather in southern Europe, specifically Spain and Italy, is usually pretty good year round. Rome in January was about 50-60 degree each day. Amsterdam and Vienna were about 30-40 degrees each day. Berlin was freezing, probably 10-20 degrees each day.

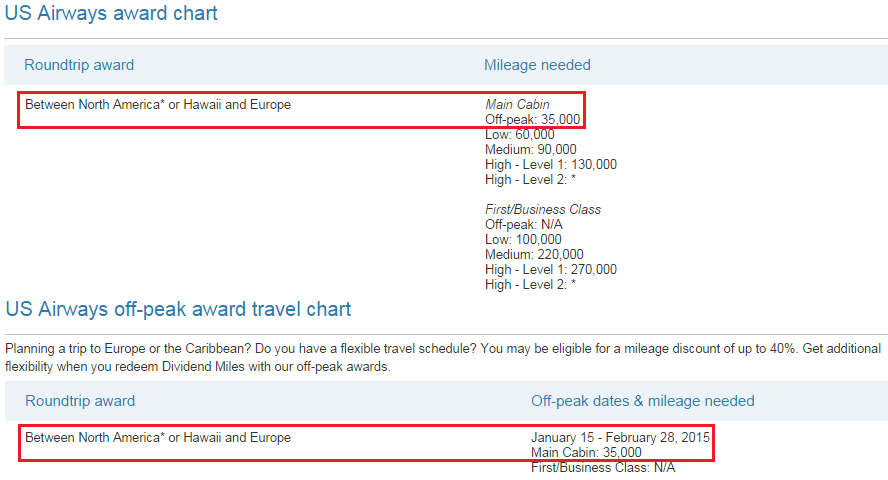

With that said, a winter getaway could be just what you need. Thanks to US Airways and their off-peak awards to Europe, you only need 35,000 US Airways miles to fly from the US to many cities in Europe. The rules are:

- You must travel only on US Airways operated flights (no American Airlines or One World Alliance partners)

- You must travel in economy class (no business or first class allowed)

- You must complete your travel between January 15 and February 28

If you want to see the full US Airways award chart and other off-peak dates, please click here.

To read the entire post, please click here.