Good morning everyone, I hope you are all having a great week. By the time you read this post, I will be ATVing around the island of St. Kitts (I know, tough life). Anyway, I wanted to talk about one of my favorite topics – credit card sign up bonuses. In March, I discussed Which 10 Credit Cards am I Considering for my March App-O-Rama and then in early April, I wrote about my March App-O-Rama Results. In this post, I will share with you my plans (if any) for redeeming my miles and points. If you have any better suggestions than the ones I share in this post, please let me know in the comments. Thank you!

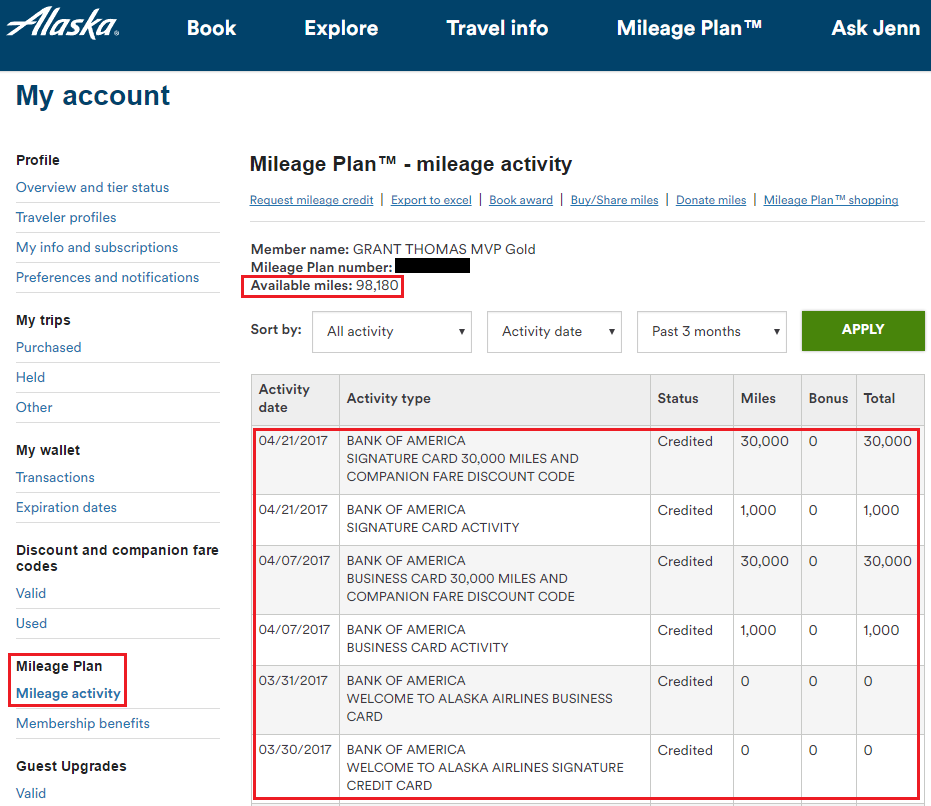

To get started, I was approved for the Bank of America Alaska Airlines Visa Signature Credit Card and the Bank of America Alaska Airlines Business Credit Card. Both credit cards offered 30,000 Alaska Airlines miles after spending $1,000 in 3 months along with an Alaska Airlines Companion Ticket (which can now be used on Virgin America). I have a few other Alaska Airlines Companion Tickets in my Alaska Airlines account, so I will probably not use them all. 60,000 Alaska Airlines miles is worth ~$900 to me (valuing Alaska Airlines miles at 1.5 CPP). I don’t have an exact use in mind, but I like flying on Virgin America first class when I fly from SFO to JFK.

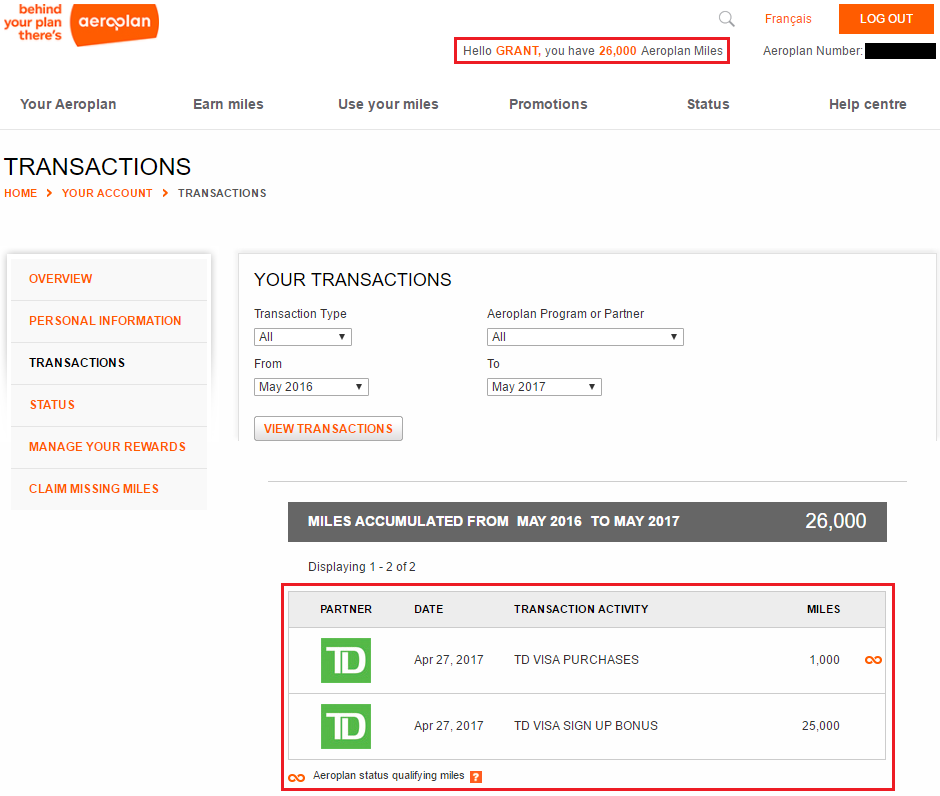

Up next, I was approved for the TD Bank Aeroplan Credit Card that offered 25,000 Aeroplan (Air Canada miles) after spending $1,000 in 3 months. I have the TD Connect Prepaid Reloadable Debit Card that I can load for free with my TD Bank credit card, so I can generate free Aeroplan miles. Unfortunately, I have never used Aeroplan before, so I need to figure out the best redemption values. Does anyone have any redemption recommendations for what I can do with 25,000 to 30,000 Aeroplan miles, departing from SFO? I know they are in the Star Alliance and partner with United, but I was hoping for a better use than that. 25,000 Aeroplan miles is worth ~$400 in flights (I value Aeroplan miles at around 1.5 CPP).

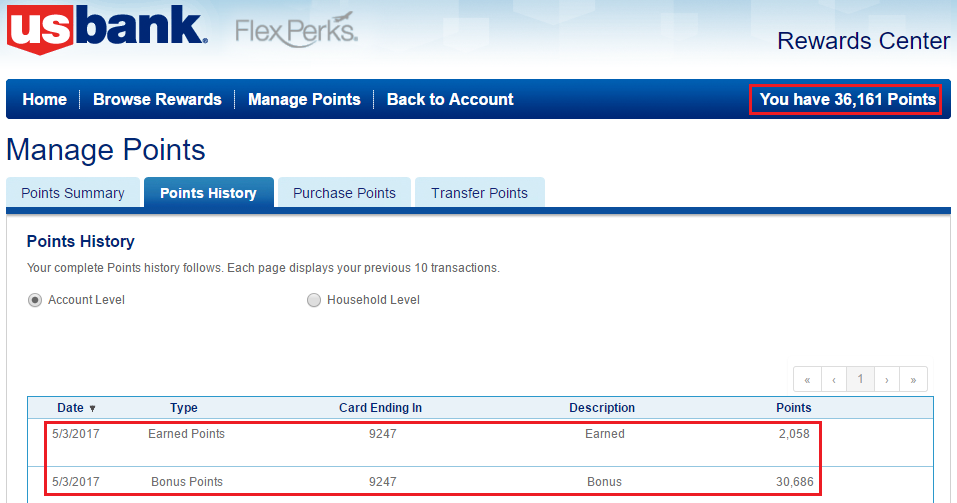

Up next, I was approved for the US Bank FlexPerks Travel Rewards Gold American Express Credit Card that offered 30,000 FlexPoints after spending $2,000 in 4 months. I am the master of FlexPoints and have routinely booked flights that cost $399.96 for only 20,000 FlexPoints. 30,000 FlexPoints is worth ~$600 in travel credit. When I see an airfare that fits into the $380 to $400 price range, I will use my FlexPoints to book that flight.

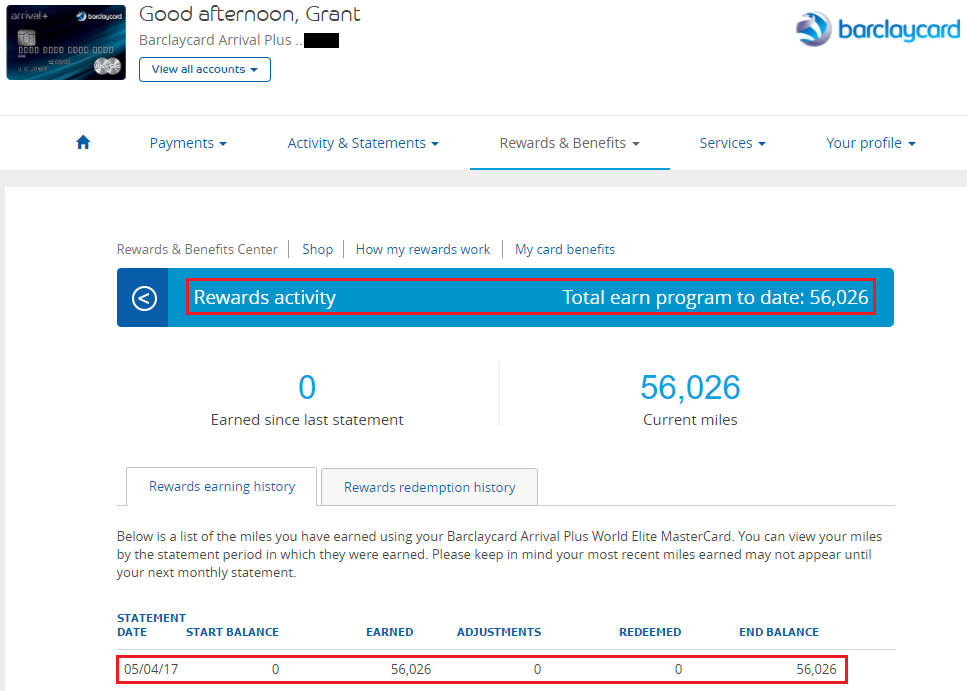

Up next, I was approved for the Barclays Arrival Plus Credit Card that offered 50,000 Arrival Points after spending $3,000 in 3 months. I am on a roll with Barclays lately. I had been 0 for 6 earlier in my travel hacking career, constantly being declined for US Airways credit cards back in the day. Luckily, the tides have changed and I now have Barclays Lufthansa, JetBlue, and Arrival credit cards. 50,000 Arrival Points is worth ~$500 in travel credit. What is the best use of Arrival Points? Paying for 1 large travel purchase over $500 or redeeming for smaller charges that are over $100? Any help and guidance would be greatly appreciated.

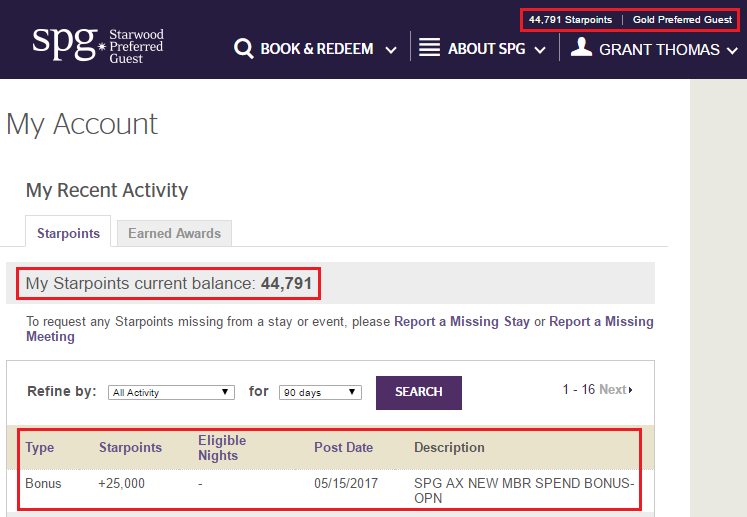

Up next, I was approved for the American Express SPG Business Credit Card that offered 25,000 SPG Points after spending $5,000 in 3 months, along with an additional 10,000 SPG Points after spending an extra $3,000 in 4 months (I think that is correct, but correct me if I am wrong). I just completed the first $5,000 spending requirement and the bonus points posted to my account. I have been with SPG for a long time, so I no how to get good value out of SPG Points. I prefer to use them to pay for category 1 and 2 hotels or transfer a few thousand SPG Points to airline partners to top up for award flights. After completing the full spending requirements, I will have 35,000 bonus SPG Points in my account, which I value at ~$700 (2 CPP).

Last, but not least, I was approved for the Wells Fargo Propel World American Express Credit Card that offered 40,000 Reward Points after spending $3,000 in 3 months. I completed the spending requirement and my statement closed, but the 40,000 Reward Points haven’t posted yet. I don’t have any idea what I am going to do with the Reward Points, but I know I can redeem them for travel. I’m not sure of the value I can get, so I will be conservative and assume ~$400 in travel.

Here is a quick summary of my March credit card sign up bonuses:

- $450 – Bank of America Alaska Airlines Visa Signature Credit Card

- $450 – Bank of America Alaska Airlines Business Credit Card

- $400 – TD Bank Aeroplan Credit Card

- $600 – US Bank FlexPerks Travel Rewards Gold American Express Credit Card

- $500 – Barclays Arrival Plus Credit Card

- $700 – American Express SPG Business Credit Card

- $400 – Wells Fargo Propel World American Express Credit Card

- Total value is $3,500

If you have any questions about any of these credit card or sign up bonuses, please leave a comment below. Have a great day everyone!

What pushback did you get from B of A for applying for 2 Alaska cards? I was rejected in January for a 2nd Alaska card as they claimed a policy of limiting cards to 1 per person.

No push back, both of those cards were instantly approved. I even got a BofA Better Balance Rewards Credit Card instantly approved after getting these 2 credit cards. I applied for all 3 on the same day within minutes of each other.

Tell us about “TD Connect Prepaid Reloadable Debit Card”! Sounds interesting. From what I read, $5.99 monthly fees without their checking account and 10k free miles per months?

You have to get the card in a TD Bank branch and you can only load with a TD Bank credit card. I’ve only put a few thousand dollars on the card over the last few months. Slow and steady I go.

Was it ok that your address was in CA?

I used my friend’s address in NY when I picked up the TD Bank Connect Prepaid Reloable Debit Card.

Great churn report.

With the SPG biz you are 1/2 correct (with the 25K starpoints). Then the additional 10K starpoints – you just need to spend an additional 2K within the first 6-months.

Gotcha, even easier than I thought. I should hit that mark in a week or two.

Nice haul.

My experience with Barclays is that they won’t approve me for a second card or won’t extend me any more credit beyond what’s available for the card I already have. I had the Hawaiian Airlines card and applied for the Aviator card and got rejected but then canceled the Hawaiian and re-applied for it a month later and instant approval.

I wanted to apply again for another Alaska card, but they had to reallocate credit from my first card to get approve for the second in February so I’m pretty sure I’ll get rejected for a third without canceling one or both cards first.

Similarly, Amex had to reallocate some credit when they approved me for Everyday Preferred earlier last week. I think I’ve maxed out the credit they’ll extend to me.

So, I’m going to look at other banks like the one you mentioned, TD. Maybe I’ll try a US Bank card too.

Instead of closing a card, you can try lowering your credit limit before applying for your next Barclays credit card. I think they are more concerned with total outstanding credit than the number of credit cards you have open with them.

Grant what method are you using to generate churn. Prepaid gift cards or? If so, which and how?

Great question, I do a little bit of everything. I don’t want to go into too much detail, but here is what I use to met minimum spend and for MS these days:

* Gift of College gift cards

* Reloading TD Bank Connect prepaid reloadbale debit card

* Buying and selling gift cards and egift card to The Plastic Merchant

Is there a reason you prefer TD Bank Connect prepaid reloadable debit card over Blue Bird?

My Bluebird and Serve cards were shutdown by Walmart / American Express and I don’t have any Walmart stores near me in San Francisco.

Pingback: Best Credit Card for Restaurants: US Bank Cash Plus or FlexPerks Gold AMEX?