Over the last week, Chase increased the sign up bonus for the Chase Ink Bold and Plus Business Credit Cards from 50,000 Chase Ultimate Reward Points to 60,000 Chase Ultimate Reward Points after spending $5,000 in 3 months. They also increased the sign up bonus on the Chase Ink Cash Business Credit Card from $200 to $300 after spending $3,000 in 3 months. See proof below…

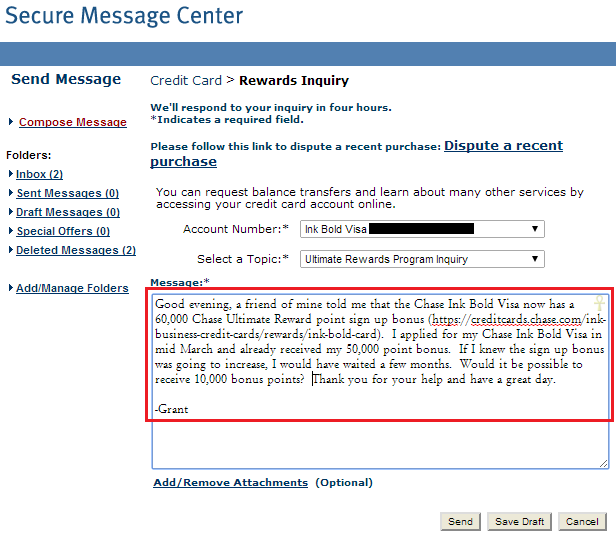

This is all well and good, but what if you just got one of the 3 credit cards recently, like in mid March like I did? Not to worry, just send Chase a secure message asking for the difference in sign up bonuses.

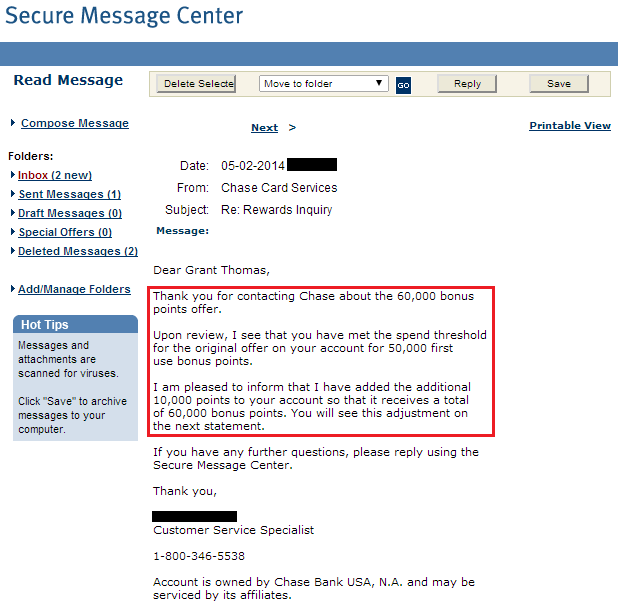

Within a few hours (while I was sleeping), Chase replied to me and offered me 10,000 Chase Ultimate Reward Points. I looked at my Chase Ultimate Rewards balance and I can already see it is 10,000 points higher. It really is that simple. It never hurts to ask.

If you have any questions, please leave a comment below.

P.S. I don’t have any affiliate links for any of the credit cards in this post. Have a great weekend everyone!

I totally forgot chase would match this easily. I definitely owe you one, thanks!

You’re welcome! Enjoy the free points.

Also got the 10k adjustment within an hour or so seeing your post above and immediately sending a Secure Message. Thanks!

Congrats RJP! Saved you a few trips to Staples :)

Thanks a lot for the info Grant I don’t think I would’ve gotten around to this. I submitted a message for the extra $100 in cash back today for my recently approved Ink Cash and it was approved. 100 more monies! Much appreciated.

Feel free to send me some $$$ if you want. I accept tips :)

Tip: never stand up in a canoe

:-)

I tried for the 10k and failed but here’s why. I opened my account last August. I wasn’t going to even write and ask but thought what the heck, wouldn’t hurt. So I phrased it nicely like above, admitted that my account had been opened awhile but graciously requested their consideration for the additional 10,000 points. Here was their response:

“Thank you for contacting Chase regarding the 60,000 points

enrollment bonus offer.

With the continual changes and promotional offers for many

credit card products we at Chase will always consider

allowing the newest promotion to be applied to any

qualified accounts that were opened within the previous 90

days of the offer.

In reviewing the open date on the account, I regret to

advise that the account is not qualified to participate in

the new enrollment promotion and therefore we are unable

to honor your request.

Although we appreciate your loyalty, we ask that you trust

that this decision is the same for all members whose

accounts do not fall within this designated time frame. We

feel that adhering to the same policy for all members

outside of this designated time frame is the best way to

remain fair and consistent.”

So for those getting close to that 90 day deadline, better move fast. I was all pumped up to give Grant a generous tip but alas it won’t happen. Please feel sorry for both of us :)

Kent

Thanks for the data point Kent, I am not surprised that they cannot offer points to everyone with a Chase Ink card. However, are you in the market for another Chase Ink card? Could be a good time to apply.

Yes, I have no complaints. I was successful in getting the 60k Bold card a few days ago (have the Plus). It took a reconsideration call that was like an interrogation from hell. I do have a legitimate business, retail sales, but she just beat me over and over with questions and opinions like, “why do you need another card, you should have more spend on the plus card” I explained to separate product purchases from packaging materials, etc. She wanted last 3 years of revenue, expenses, net income, where I sold, the name of my business on the internet. Even though I hadn’t applied for a card for 6 months now and my credit score is 810, she was very upset that I had, as she put it, “so many inquiries”. I said well maybe over 6 months ago. She said they go back 18 months every time. Had to explain using the various cards for different benefits, etc. I had essentially given up after about 25 minutes on the phone when she sternly said she would open up the Bold card but only on the condition that my Southwest business card be cancelled. Since I met the SW promotion, I said ok. Before we got off the phone, she warned me once more about my many inquiries like a mother to a child and then let me go on my way.

I’ve probably done about 7 reconsideration calls total, and this was the most epic. At least I got approved after all that. It always pays to try, especially for 60,000 points.

Wow, reconsideration call from Hell. Glad you survived the journey. Practically every other credit card I apply for has to be approved thru a recon call, they are like second nature now. It seems that business card recon calls are more strict and ask many more questions than personal cards. How many total chase credit cards do you have? I have 5 personal and 2 biz. I think I would be hard pressed to get approved for any more cards from Chase.

I have 4 personal right now but just applied for the Sapphire card and of course it’s under review. I’ll probably call on that next week unless I get a miracle approval via e-mail…..and 2 business cards, the two Inks.

I’ve had more cards with Chase that I’ve closed over the last few years. Those were, Fairmont, British Airways, Sapphire, Southwest, prior Ink M/C versions. Yes, this is a reapply of the Sapphire. Closed it in Nov 2011. Wife was successful getting approved a 2nd time so I thought I would try. It took a recon call for her but surprisingly they didn’t bring up the prior Sapphire, just agreed to move credit around for her. She did get the bonus again.

Interesting, let me know if you get the CSP bonus again. I closed mine a few months ago.

Will do.

Thanks for the tip! I just contacted Chase regarding my month old Plus card. Within 2hrs I had an additional 10,000 pts. Gotta love this stuff!

Congrats Bill! Happy travels!

Grant,

I got one of the Chase Business cards back in December and received my bonus 50K bonus in February. I already plan on applying for the other Chase Business card for 60K in minimum spend (since it’s one of the few good offers left that I haven’t gotten yet.) Maybe I’m overly paranoid but would it be better to apply for the bonus before or after I apply for my 2nd Chase Business card? Or just forego it altogether in this situation? I just feel if they do me a favor of extending the 10K and then I apply for another card, it would seem I’ve asked too much from them too quickly. Thanks.

From what I’ve seen on all the various blogs, people who have received an Ink card w/in 90 days of new offer have gotten the courtesy of the extra 10k points. People who received their Ink card >90 days ago have not. Chase does reference this cut off in their email response.

If it’s been more than 90 since you received the sign up bonus, I think you missed your window. I think you will be fine applying for a new Ink card now. Which card did you get in December?

I got the Ink Bold back in December and received the bonus some time around mid to late February. I hope the 90 day window hasn’t passed.. gonna try contacting Chase like you did and will keep you posted!

December (31 days), January (31 days), February (28 days), March (31 days), April (30 days), and today is May 7th. Hmm… I’m not a math wiz, but I’m gonna take a guess that you may be slightly outside the 90-day window.

Ya, I don’t have a good feeling about that. Keep me posted on what Chase decides.

Quick Update:

I applied for the Chase Ink Plus yesterday evening and got the “pending application” notice. This morning I called the Chase business card reconsideration line and asked if they could give me some more insight/info on the status of the application and the woman told me that my application was declined due to too many requests in a 30 day period.

The only other application that I submitted this month was for the Sapphire Preferred which I was approved for a couple weeks back so I assume that’s what they’re referencing.

I have two personal cards with Chase (Sapphire Preferred and the United Mileage Plus Explorer) so I told the woman I would be willing to give up my Explorer card if it meant that I would be approved for the Ink Plus.

She asked me a few questions about my business, what my projected income was going to be for 2014, and a few other things and before I knew it, she told me I was approved BUT she would need to close out the Mileage Plus Explorer Card before we could move forward with the approval.

So the Mileage Plus Explorer Card has officially been canceled and I’m a proud new holder of the Chase Ink Plus! Woop!

Congrats, you will love your Chase Ink Plus credit card soooo much better than your Chase United MileagePlus credit card.

Nope, negative. Said I’m not eligible due to the dates.. thought you only needed to have received the bonus within 90 days ago, not opened the account within 90 days.

The link to the landing page/application is not working!!! Is the 60k bonus promotion over now???

Link is still working: https://creditcards.chase.com/ink-business-credit-cards/rewards/ink-plus-card/?CELL=64QS&jp_aid_a=59047099&jp_aid_p=col_biz_home/trip1

Thanks a lot! gotta hurry to apply, do you have a guide how to apply biz card? my first time…and I don’t have own business…can I still get this card?

I don’t have a step by step guide. There are a few good ones online. Search frequent miler business card and see if anything shows up. Good luck!

Thanks a lot Grant! do you know good reconsideration number to call for Chase Ink application? I think since I will apply as start up venture I will have to call.

These numbers should work:

Chase Credit Card Reconsideration

888-245-0625 (personal credit analyst, 7am-10pm EST M-F; 8am-10pm EST Sat. and 9am-9pm Sun.)

800-453-9719 (business credit analyst, 8am-10pm EST M-F)

You can find other recon numbers here:

http://travelsort.com/blog/credit-card-denied-call-these-reconsideration-phone-numbers

Thanks a lot, Grant and RJP! I will try it!

You might be surprised. I applied as the sole-proprietor of my Scuba Instructor “business” and reported less than one year in business and $0 of annual revenue. Had the card in 7 days.

Thanks for sharing, did you have to call? or instantly approved?

Wasn’t instant, but no call needed. Right after I submitted I got a message that my application was received and being reviewed. Within a day or two I got an email that I was approved and card was on the way.

Shoot, I called and got denied. They told me that they cannot verify the nature of my business. I filled my business as sole proprietorship and ecommerce business with 1 year long and $100 revenue as it being start up. They also told me that they see I bought a lot of vanilla reload cards at CVS over several months with my Southwest Rapid Reward card (I did to meet minimum spending and to get Companion Pass) and this is not a good role model for business start up.

I am so sad now, maybe if I didn’t call it would turn out differently. Grant and RJP, do you have any suggestion of what should I do now or advice in the future to get approved for Ink card? thanks a lot in advance.

And how long should I wait until I could apply for new business card? (until my previous record of biz app cleared from Chase database). When I got denied the first call then I quickly called the second time with different rep but the 2nd rep could know everything by the note that the 1st rep left…so I want the record to be cleared first just to be safe before I re-apply again.

I think you just have to use your Chase personal credit cards often and make normal purchases, not all manufactured spend purchases. That’s my only recommendation.

Also, when the recon rep asked me have you start your business yet? I answered I planned to start a business since last year and about to start. And he said when do you start? I answered: as soon as I got the card. Then he said “so you need the card to start the business” I said “yes” (I thought, it’s a business card, so it would serve the purpose, right?). then the rep put me on hold and came back with denial, saying “I am sorry but this card’s purpose is not to fund the start up business, it’s for business that already established”….I was in shock…..do you know about this?

Makes perfect sense, when you think about it. This is why folks shouldn’t just bound blindly into applying for cards. Your efforts to get one fast has resulted in a denial, and notes in the system. Now if you apply again later they may well check the notes… and deny you again… since you’ll still have no income, so that will be proof that either a.) You still haven’t started the business, or b.) the business isn’t making money.

but how come a lot of people got approved even they haven’t start the business yet and they put 0 in the annual revenue? I am really confused

It’s one thing to have a startup with no revenue yet. It’s another to plan to start a business with money that you’re going borrow on a credit card. Not that you were going to do that… but that’s pretty much what you told the Chase representative.

Ok thanks…..So how long do you think I should wait until the notes cleared up from the system and reapply?

I think you start the business with your money then you get a business card (Ink bold or plus) to expand the business and keep personal/business finances separate. You might want to think about getting a EIN/TIN, but I don’t know why you got such a tough time. Is your credit history relative new? They take a look at your personal finances and use that to approve or deny your business credit card.

So how long do you think I should wait until the notes cleared up from the system and reapply?

Thanks Grant. My credit history is around 4 years and has a perfect excellent credit score of 770. How long do you think it’s safe to reapply and the note that the rep wrote in the system go away?

Hmm, your credit history is about as long as mine. For my Chase Ink Bold cards, I have my ebay business which I have been doing for 9+ years (yes, I am only 24). Chase likes to see businesses that have been around for a while, not start ups funded by their card. I don’t know how long you should wait, maybe 3 months, maybe 6 months. The worse they can say is no.

Thanks. What did you tell them when they asked you why you apply for business card?

I have had a Chase Ink Bold MasterCard since April 2012 (just the $95 annual fee for year #2). I applied online and used the same dollar amounts for revenue and got a pending decision. Upon calling the recon line, I explained that the only reason I wanted to the Chase Ink Bold Visa was because “some of my vendors accept Visa and not MasterCard”. That was a good enough answer for him, so he approved my Ink Bold Visa over the phone. It was that simple.

Awesome~ I am happy it worked for you. I might have to stay low for a while and try this again within few months. thanks! Will keep you updated.

Good luck Alex!

Pingback: Boingo Preferred Plan for AMEX Platinum, Chase Freedom Refer-a-Friend 20k, and SPG Refer-a-Friend 30k | Travel with Grant