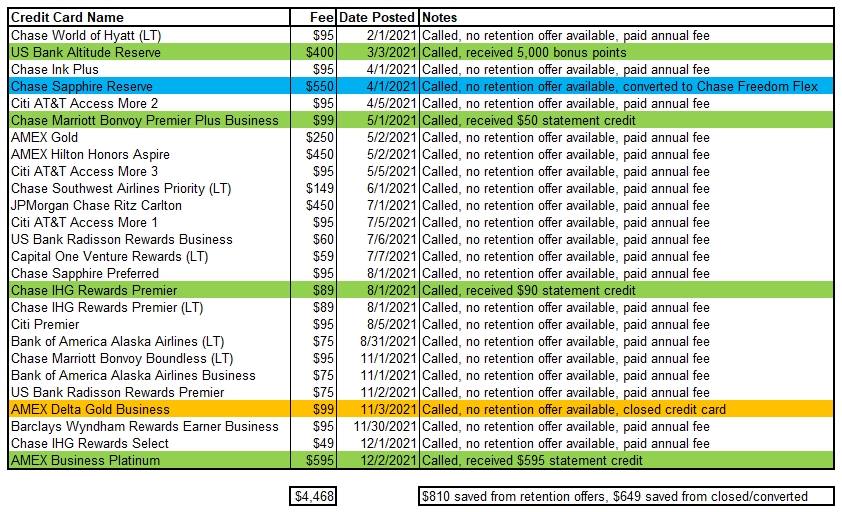

Good morning everyone, I hope your week is going well. Last year, I wrote How Much Did I Pay in Credit Card Annual Fees in 2020? I wanted to create a similar post for 2021, so I listed all of our credit cards that have annual fees and sorted them by when the annual fee posted. Whenever I see an annual fee post, I always call the credit card company to see if there are any retention offers available. At the bottom of this post, I will also share what retention offers I received this year, which credit cards I closed, and which credit cards I converted. As a starting point, if I kept every single credit card with an annual fee this year, I would have 26 credit cards and paid a total of $4,468 in annual fees. Here are our credit cards and annual fees (LT = Laura’s cards):

Credit Card Retention Offers

Of the 26 credit cards above, I only received 4 credit card retention offers. For my US Bank Altitude Reserve Credit Card, I received 5,000 points (worth $75 toward real-time reward travel purchases) that closed the gap between the $400 annual fee and the $325 travel credit. For my old Chase Marriott Bonvoy Premier Plus Business Credit Card (no longer available), I received a $50 statement credit, which covered half of the $99 annual fee (this credit card also comes with a Marriott 35K Free Night Certificate and 15 elite night credits every year). For my Chase IHG Rewards Premier Credit Card, I received a $90 statement credit that completely covered the $89 annual fee (this credit card also comes with an IHG 40K Free Night Certificate). Last but not least, for my American Express Business Platinum Card, I received a $595 statement credit that completely covered the $595 annual fee. All total, these 4 retention offers saved me $810. Not a bad return for making 26 retention calls in 2021.

Credit Cards that were Closed or Converted

At the end of 2020, I redeemed ~150K Chase Ultimate Rewards Points via the Pay Yourself Bank feature on my Chase Sapphire Reserve Credit Card. A few months later, I Converted my Chase Sapphire Reserve to Freedom Flex to avoid paying the $550 annual fee. That move also allowed me to sign up for the Chase Sapphire Preferred Credit Card that came with a 100,000 point sign up bonus. I also closed my American Express Gold Delta SkyMiles Business Credit Card since the credit card was not worth the $99 annual fee or AMEX credit card slot. These 2 actions saved me an additional $649 in annual fees.

Grand Total

To calculate the total amount of credit card annual fees I paid in 2021, let’s start with $4,468 – $810 in retention offers – $649 in closed/converted cards = $3,009 total. $3,009 in annual fees seems like a lot of annual fees for the average person, but I did get a lot of value out of these credit cards, sign up bonuses, free night certificates, etc. I will work on another post to calculate how much value I received from these $3,009 in annual fees. Stay tuned…

If you have any questions about the credit card annual fees or my retention offers, please leave a comment below. Have a great day everyone!

Why do you have 3 Citi At&T Access More cards? Whats so special about them?

Hi Anthony, each Citi AT&T Access More Credit Card offers 10,000 Citi ThankYou Points every year when you spend $10,000+ on the card.

Pingback: I Paid $3,009 in Credit Card Annual Fees in 2021 – Was it Worth it?