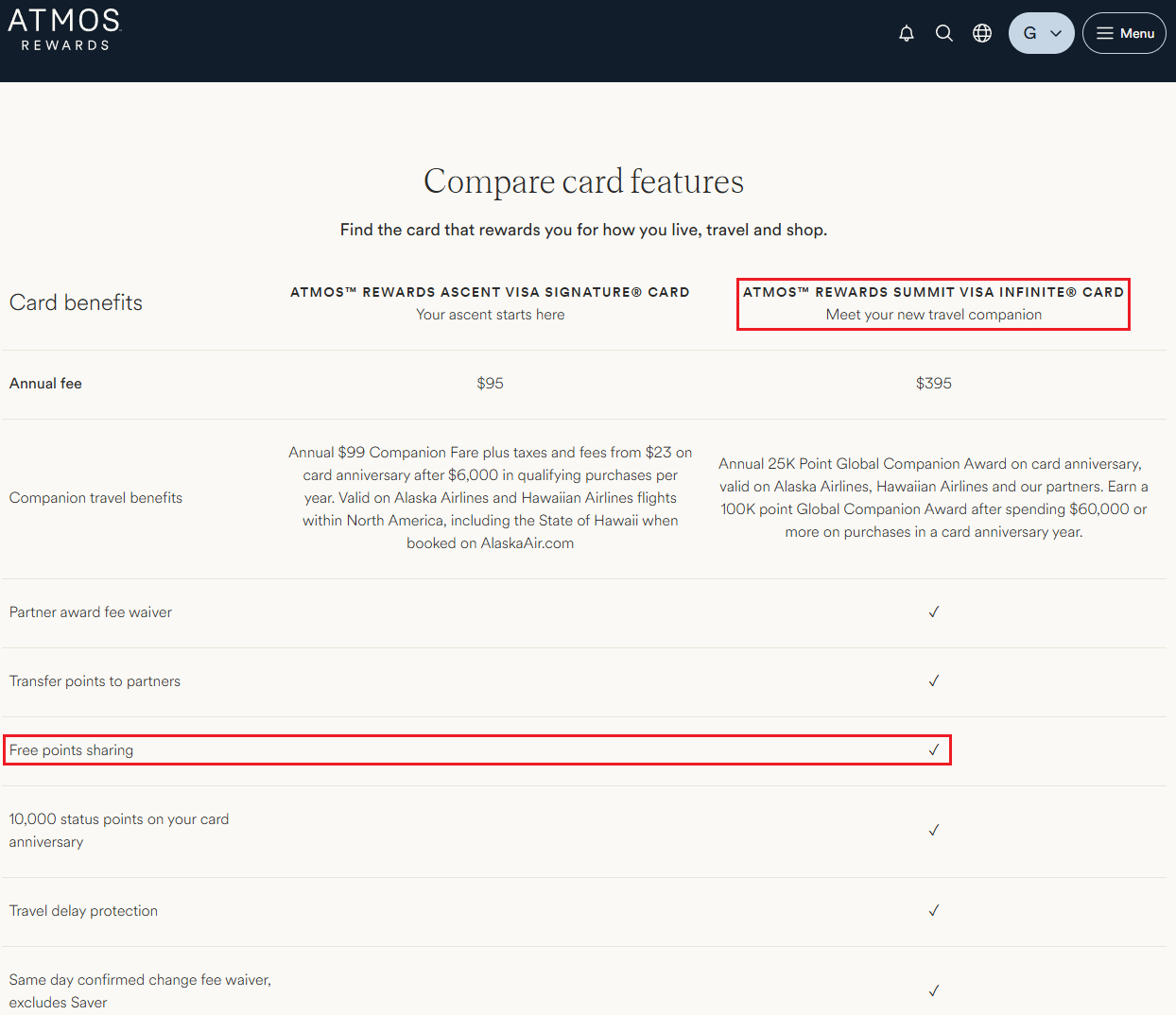

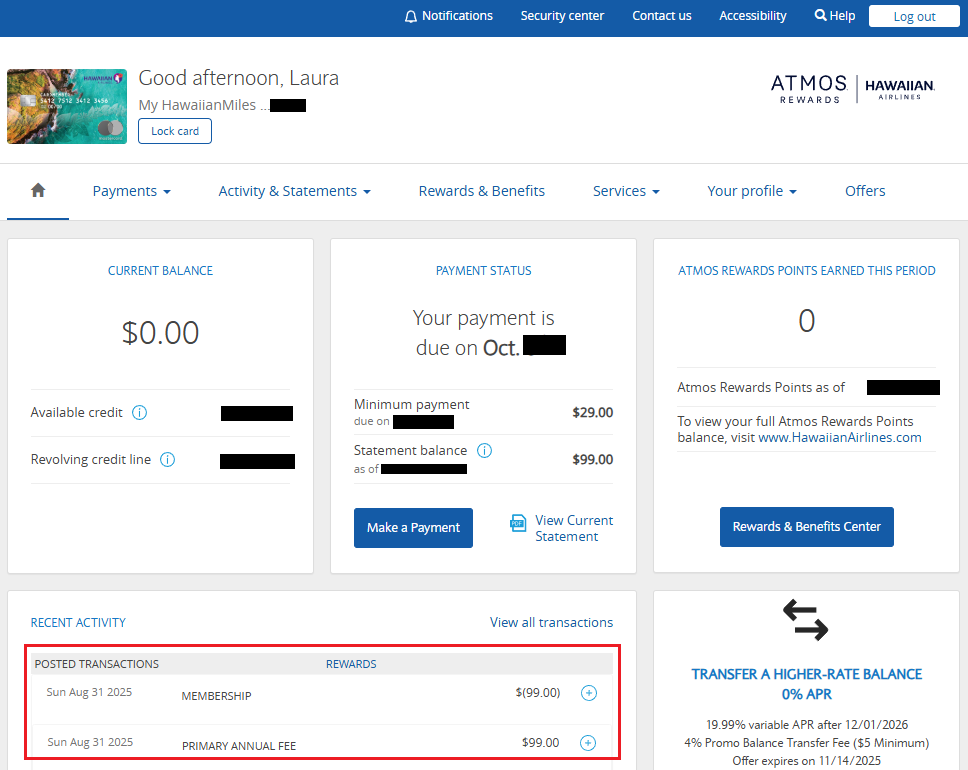

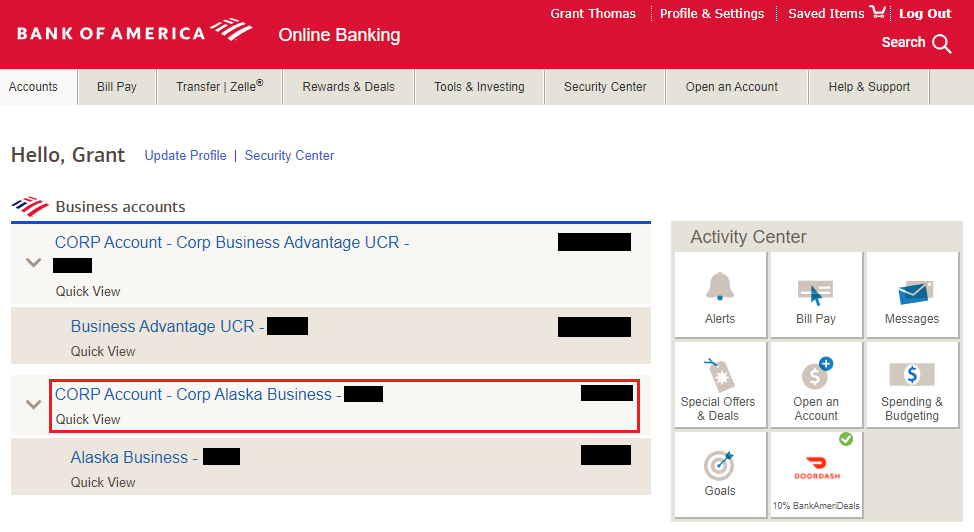

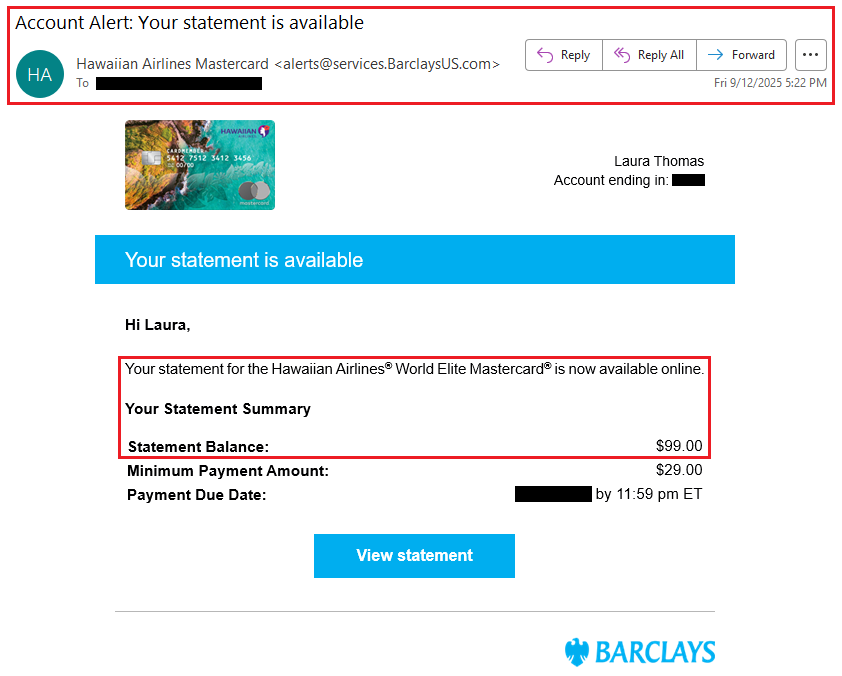

Good afternoon everyone! I hope you had an enjoyable Indigenous Peoples’ Day or a festive Canadian Thanksgiving (both celebrated on October 13 this year). Speaking of giving thanks, I want to thank the Atmos Rewards team for adding one of my favorite perks (free point sharing) to the Bank of America Atmos Rewards Summit Credit Card. This was one of the best features on the Barclays Hawaiian Airlines Credit Card, and I’m thrilled to see it available on the new Summit credit card.

Laura generously offered to share her Atmos Rewards points with me, so I’ll walk you through the step-by-step process of sharing points with another account.