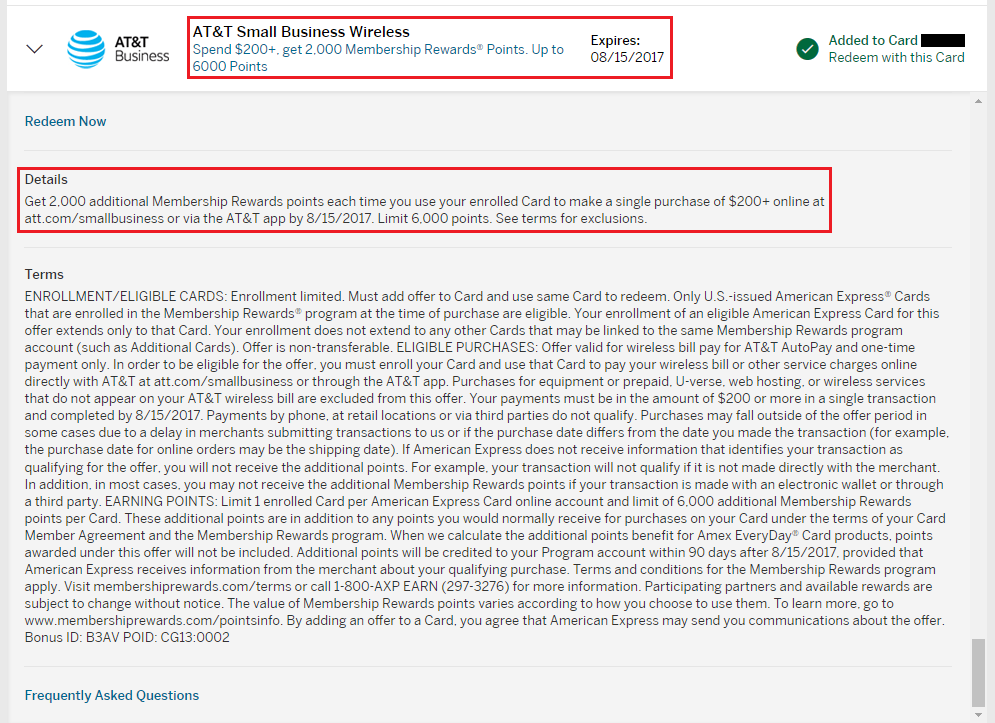

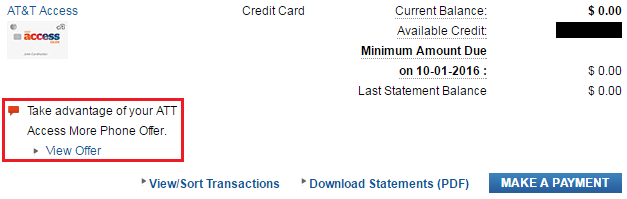

Good morning everyone, happy Friday! A few days ago, there was a great AMEX Offer that came out from AT&T Small Business Wireless where you could earn 2,000 Membership Reward Points for making a qualifying purchase of $200 or more. To make the AMEX Offer even better, you could use that AMEX Offer up to 3 times per enrolled card and get up to 6,000 Membership Reward Points. Frequent Miler and Doctor of Credit were the first I saw to cover the AMEX Offer. Even though the AMEX Offer was only targeted to American Express business cards and supposed to be for business wireless purchases, I decided to see what would happen when I made a $200 payment to my AT&T Wireless account (I do use AT&T service for my blog). If you are interested, here are the full AMEX Offer terms: