Updated at 6pm PT on 1/2/21: Thanks to everyone who answered the poll question at the bottom of this post. Even though “Do Nothing Until 2021” was the second most popular answer, that is what I decided to do. Hopefully I will be able to make some Citi TYP redemptions in 2021.

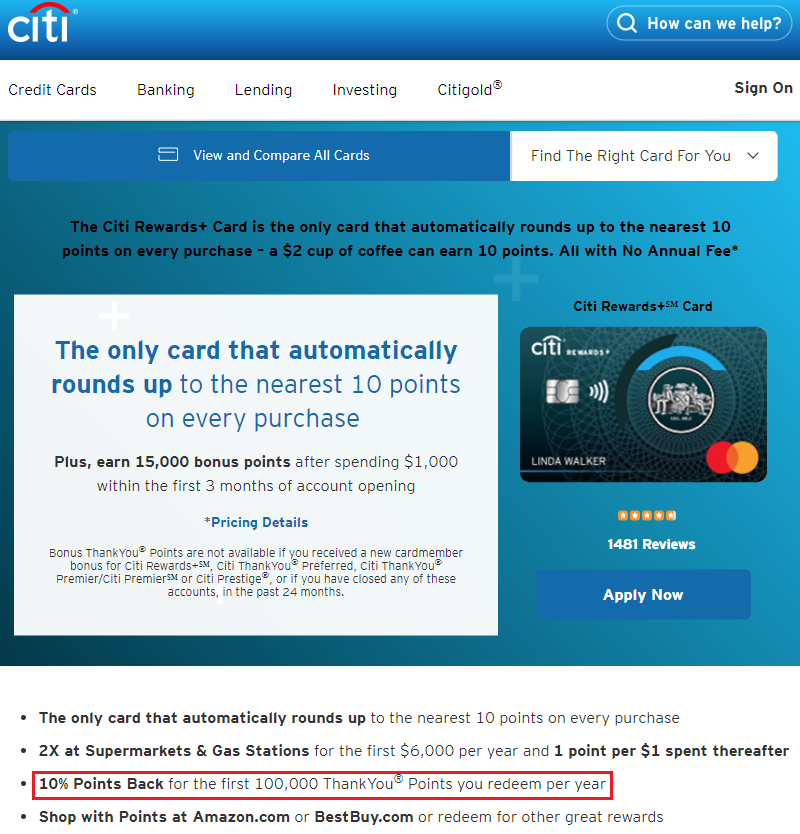

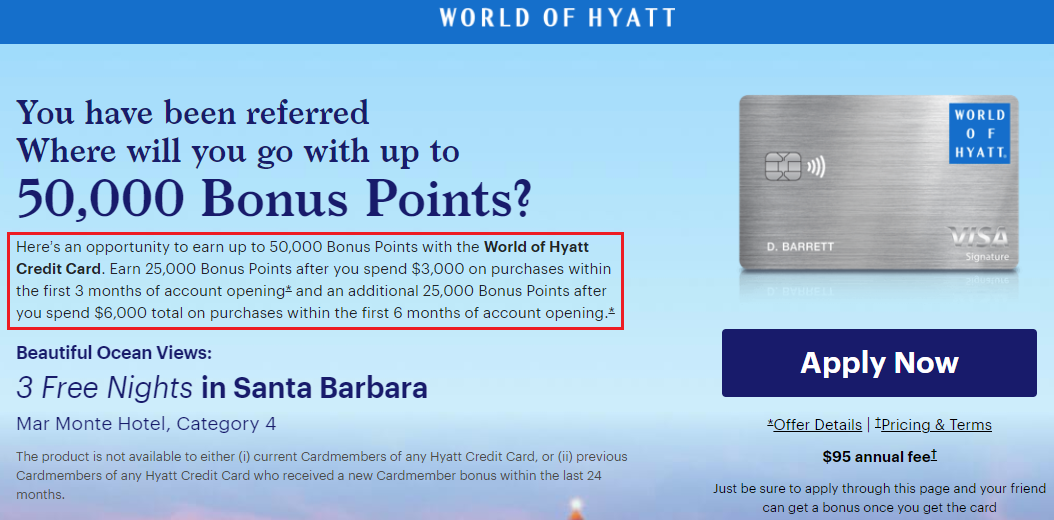

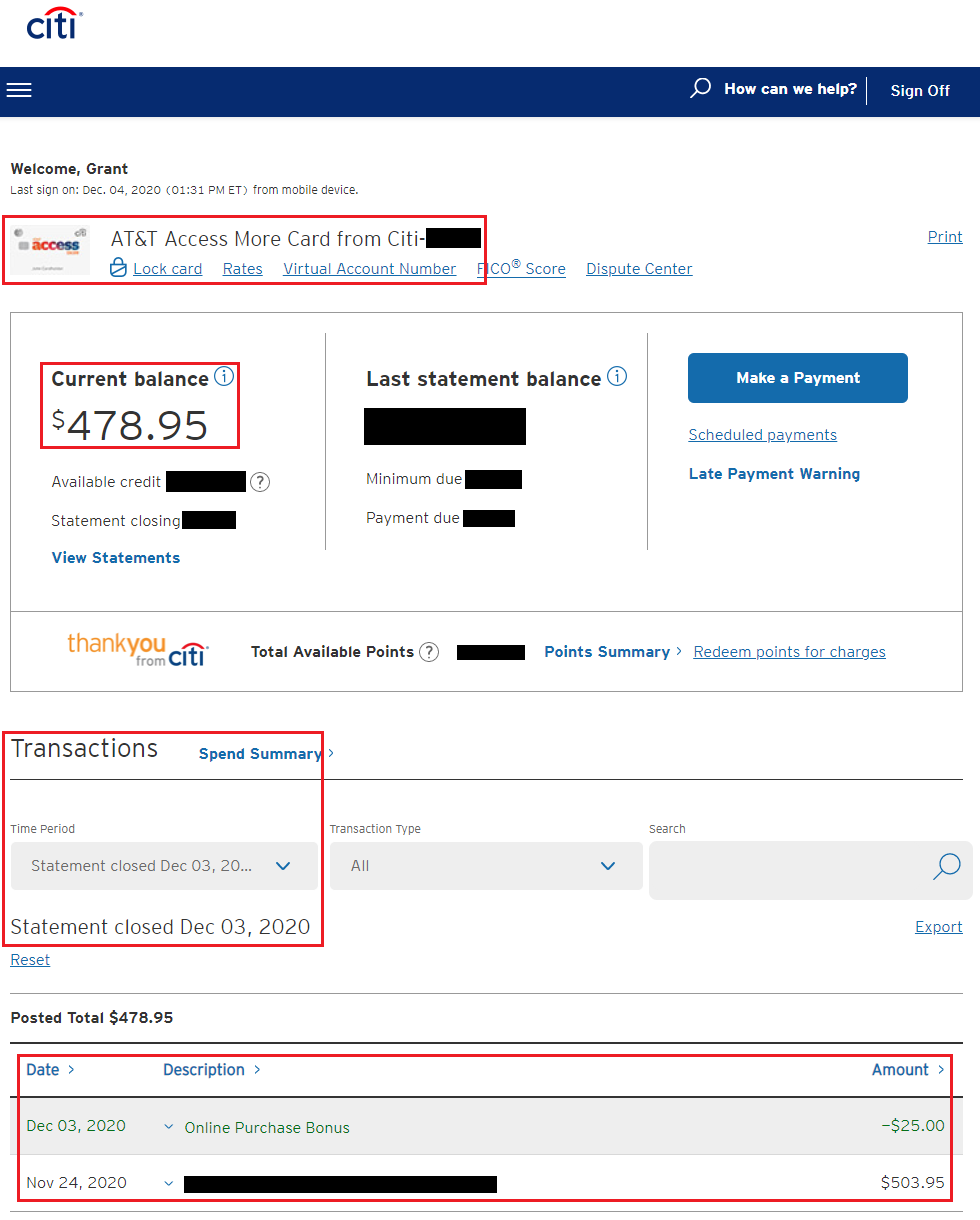

Good evening everyone, I need some help. First of all, this post could be classified as a “First World Problem” or a “Good Problem to Have”, but I would still like to get some help on making my decision. Long story short, I have a Citi Rewards+ Credit Card and one of the benefits of the credit card is the ability to get 10% of your redeemed Citi ThankYou Points (TYPs) back, on the first 100,000 TYPs redeemed per calendar year (10K TYPs rebate max). Since there are only a few weeks left in the year and I have only redeemed a few thousand TYPs this year, I need to spend 84K TYPs by December 31 in order to max out the 10K TYP rebate. In this post, I will discuss how I calculated how many TYPs I need to spend and go through all the various redemption options and my thoughts on each option.