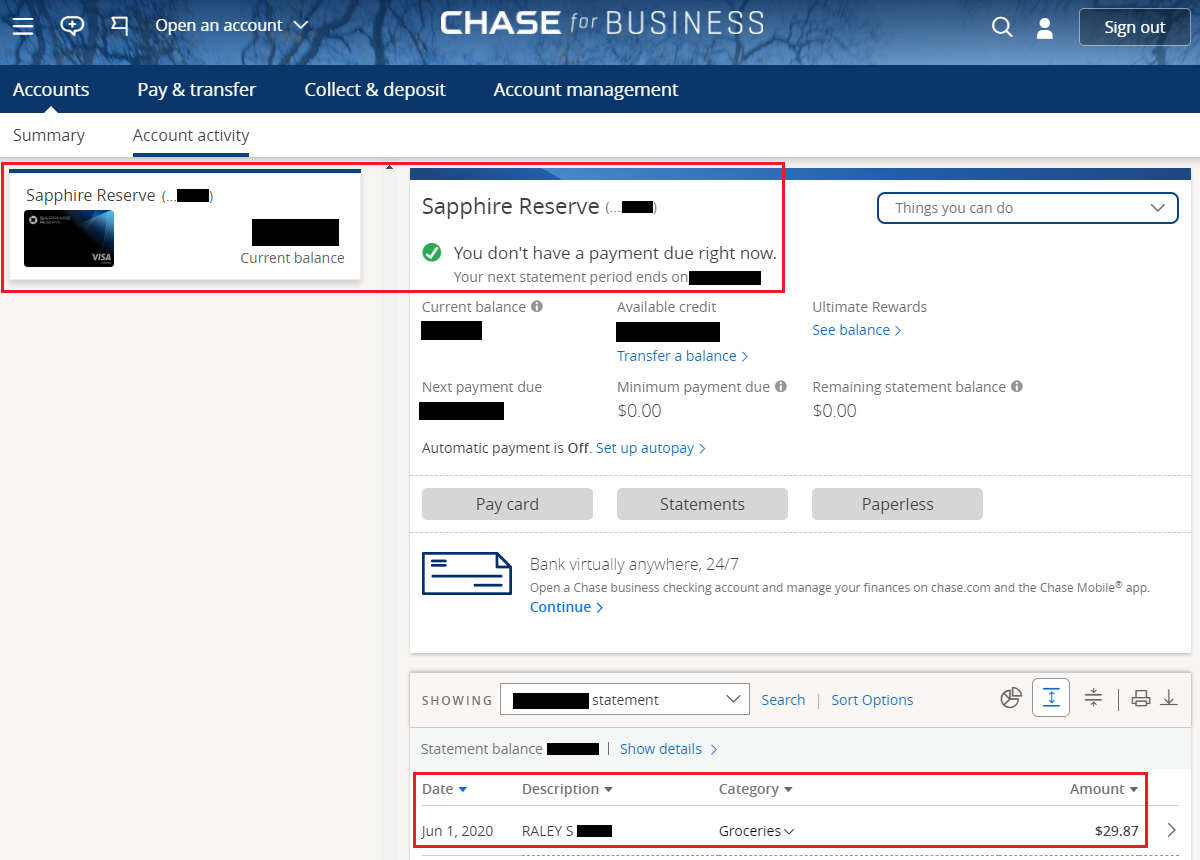

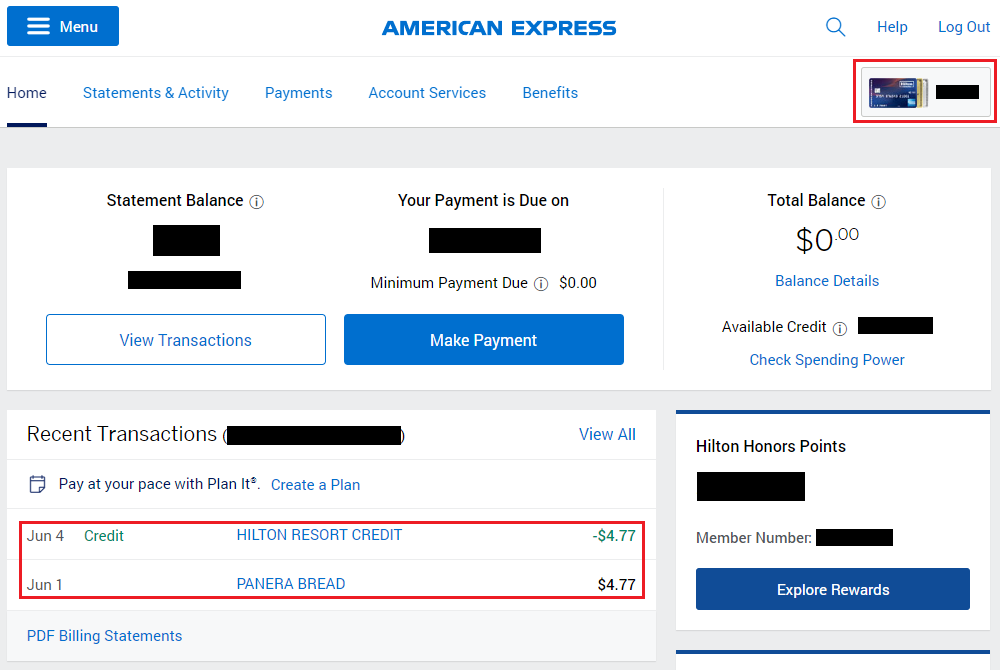

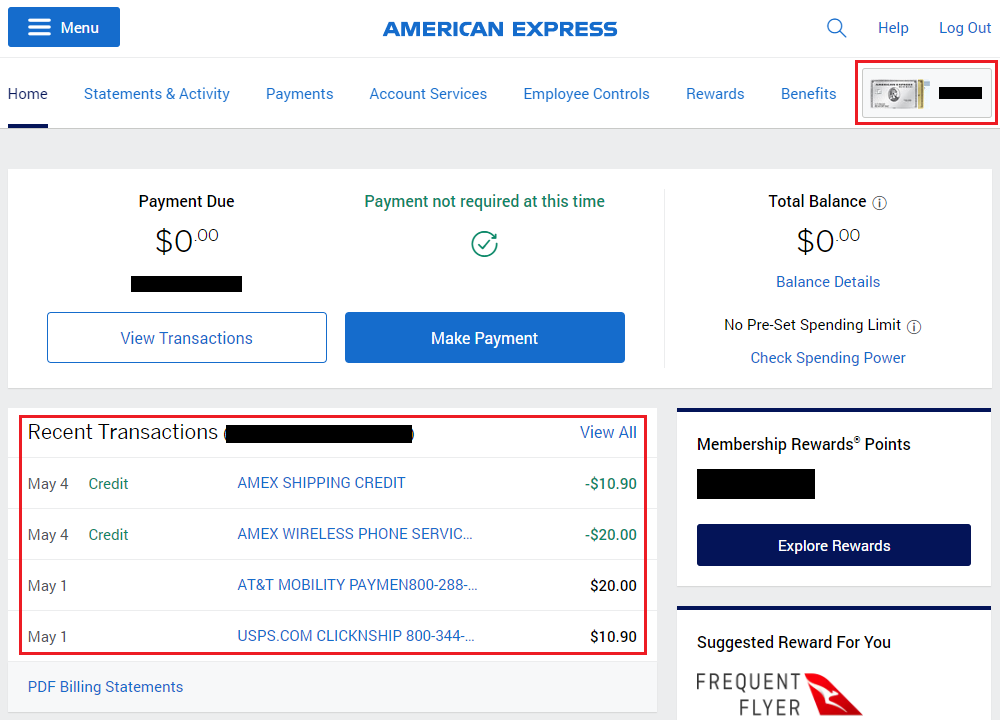

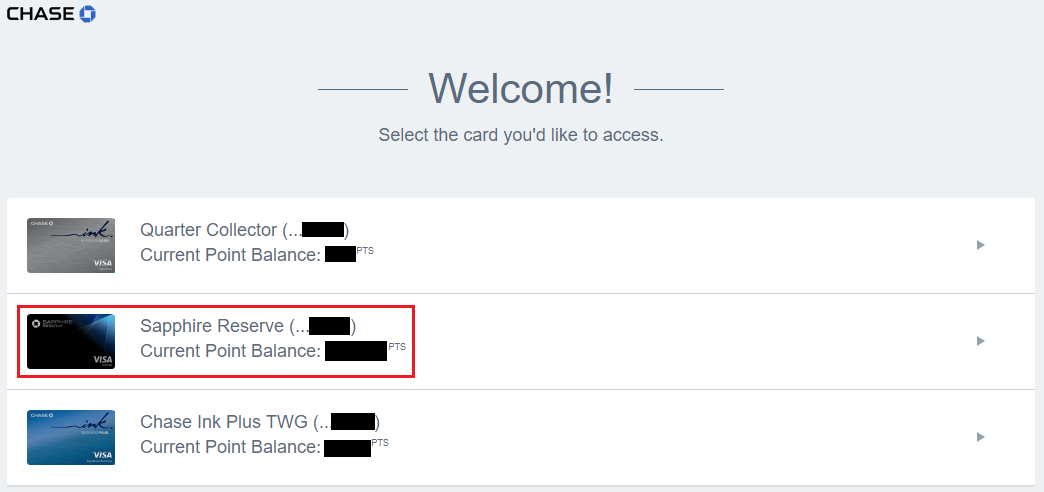

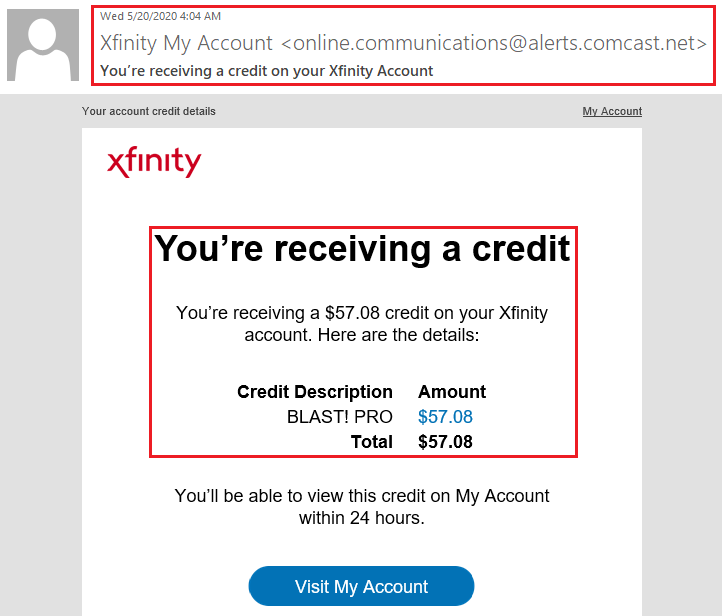

Good afternoon everyone, I hope your weekend is going well. A few weeks ago, Chase announced a few changes regarding the Chase Sapphire Reserve Credit Card. Among the changes were the ability to redeem Chase Ultimate Rewards Points for 1.5 cents per point toward restaurant, grocery store, and home improvement purchases from May 31 through September 30 and the ability to redeem the $300 travel credit toward grocery and gas station purchases from June 1 through December 31. Since my annual fee posted in April, I was excited to take advantage of the $300 travel credit toward those new categories. I used my Chase Sapphire Reserve at Raley’s (my local grocery store) and patiently waited for the travel credit to apply. Unfortunately, after waiting a few days, the statement credit did not post. I did some digging and found out that I had already used my $300 travel credit in October 2019. Let me explain what happened.