Good afternoon everyone, I hope your week is going well. A few weeks ago, I traded in my old iPhone XS from 2018 for $700 toward a new iPhone 13 Pro. My old iPhone was in pretty good shape but the battery wasn’t holding a great charge. I heard about these trade-in deals with AT&T and Verizon so I did some research and found out how they worked. Now that I understand how these trade-in deals work, I thought I would write this post to explain the process. If you have an old iPhone or other smartphone, check with your current wireless carrier to see if they have any similar upgrade offers. Also, these deals change on a monthly basis, so check back often to see if new deals are live.

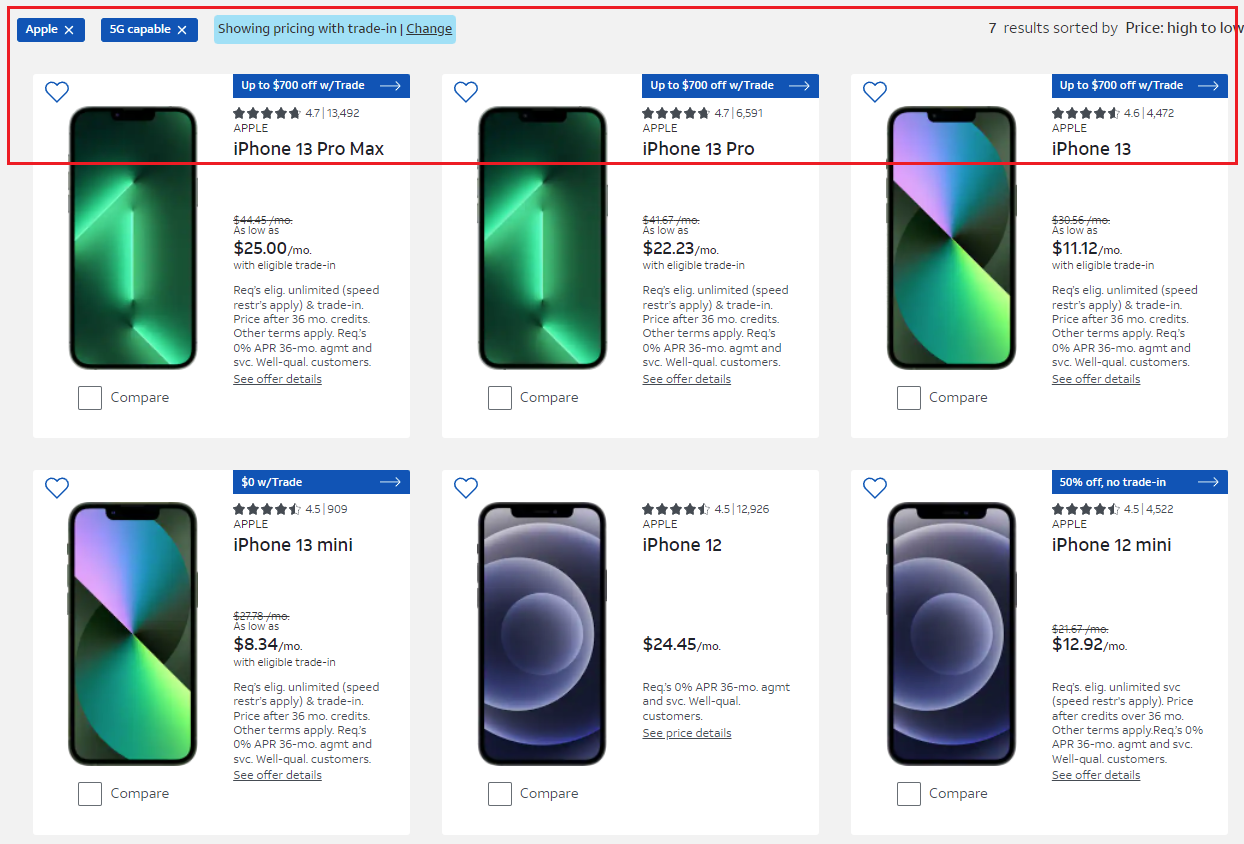

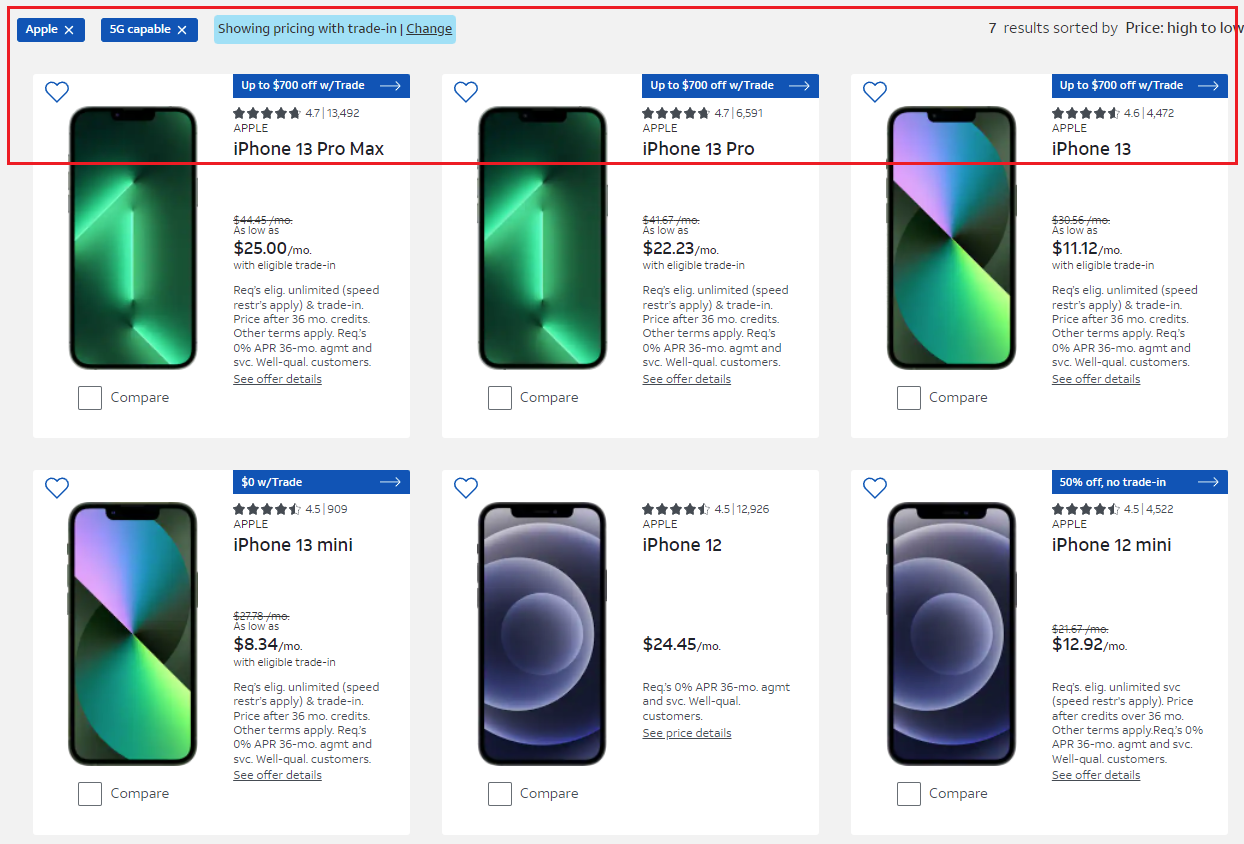

First things first, I have AT&T, so the majority of this post talks about AT&T’s trade-in program. Laura has Verizon, so I can confirm that the Verizon upgrade and trade-in process is very similar, which I will cover at the end of this post. Here are the newest iPhones available on the AT&T website and you will see the banner that says “Up to $700 w/ Trade”. The iPhone 13 and iPhone 13 Pro are almost the same size as my old iPhone XS, so I wanted my new iPhone to be the same size. The iPhone 13 Pro has 3 cameras, a larger battery, and faster processor vs the iPhone 13 so I decided to purchase the iPhone 13 Pro.

Continue reading →