4 Uber Rides in 24 Hours (FTU Seattle) and 3 Planned Retention Calls (Chase United, AMEX Delta, and Citi American Airlines)

Sign up for Uber and get a $10 Uber credit on your first ride (link)

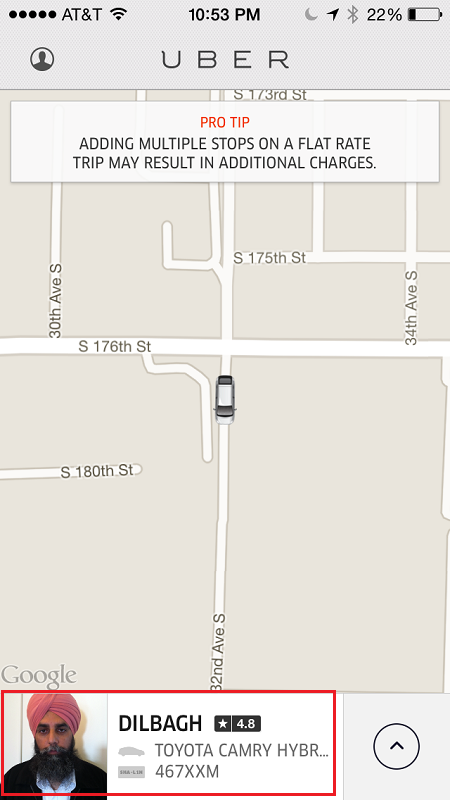

During my weekend in Seattle for FTU Seattle, I had the pleasure to try Uber 4 different times (within 24 hours). For those unfamiliar with Uber, it is an on-demand taxi service, meaning you can request a taxi ride whenever and wherever (Uber is supported). You need a smartphone and the Uber app needs to be installed. Once you load the Uber app, it finds your current location and shows you all drivers nearby. When you are ready to be picked up, just set your pick up location and the nearest available Uber driver will come pick you up. The Uber app shows you where the car is and who the driver is along with the make of the car and their license plate.

You can read the whole article about why Uber is awesome here. Continue reading