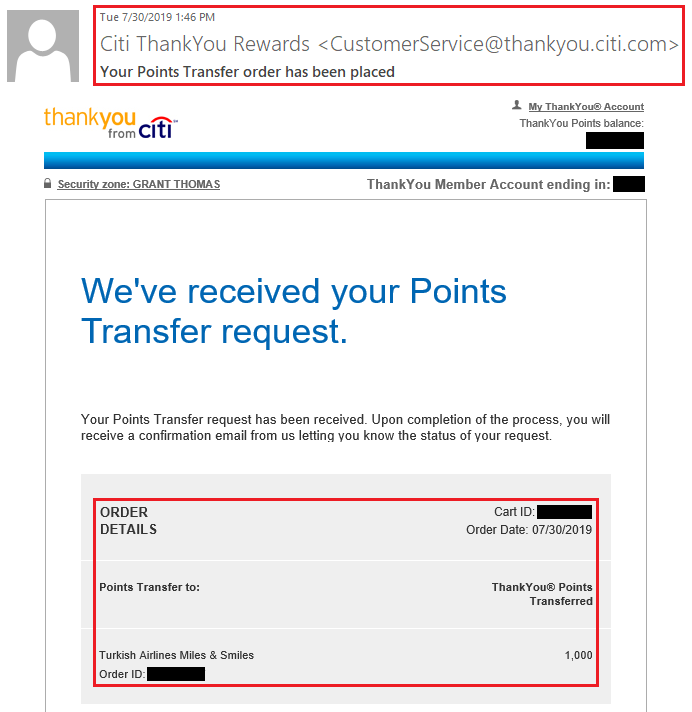

Good morning everyone, I hope you had a great weekend. In mid July, I applied for 5 credit cards and was ultimately approved for 4 credit card in my July App-O-Rama. Here are the credit cards and their sign up bonus details (listed in the order the sign up bonus posted):

- American Express Platinum Delta SkyMiles Credit Card – spend $3,000 in 3 months and get 70,000 Delta SkyMiles

- Wells Fargo Propel World Credit Card – spend $3,000 in 3 months and get 40,000 Wells Fargo GoFar Rewards Points

- Banco Popular Avianca Vuela Credit Card – spend $1,000 in 3 months and get 60,000 Avianca LifeMiles

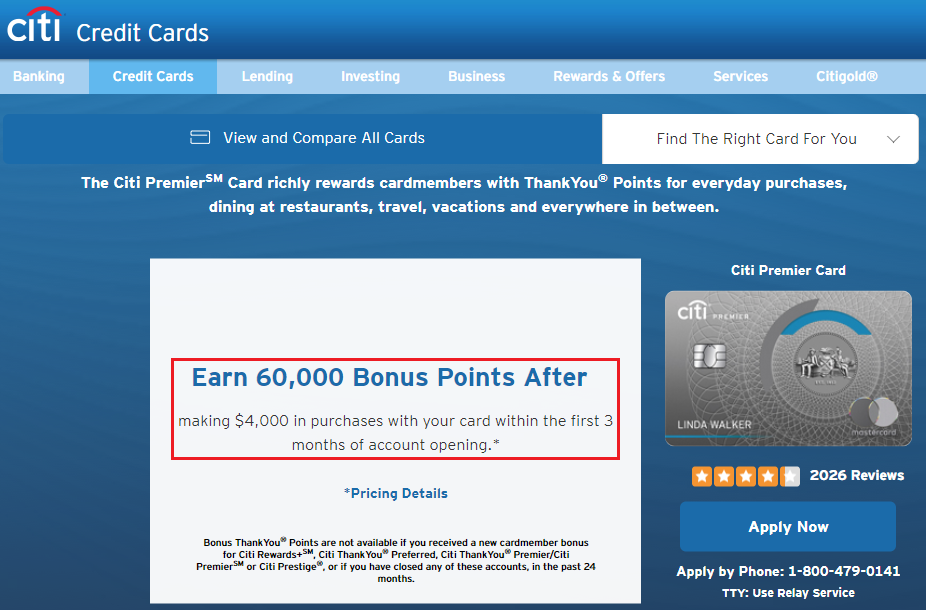

- Citi Premier Credit Card – spend $4,000 in 3 months and get 60,000 Citi Thank You Points

I have had all of these credit cards before (with the exception of the American Express Platinum Delta SkyMiles Credit Card), so I will share my dates and churning details in this post. I have also written about some of these sign up bonuses already, so I will link to those posts too. Without further ado, let’s start with my American Express Platinum Delta SkyMiles Credit Card.

American Express Platinum Delta SkyMiles Credit Card

This was the quickest sign up bonus to post (with the miles posting 9 days after applying for this credit card). I wrote more details of the quick sign up bonus here. As of today, I haven’t used the Delta SkyMiles yet and do not have any immediate plans to use them.