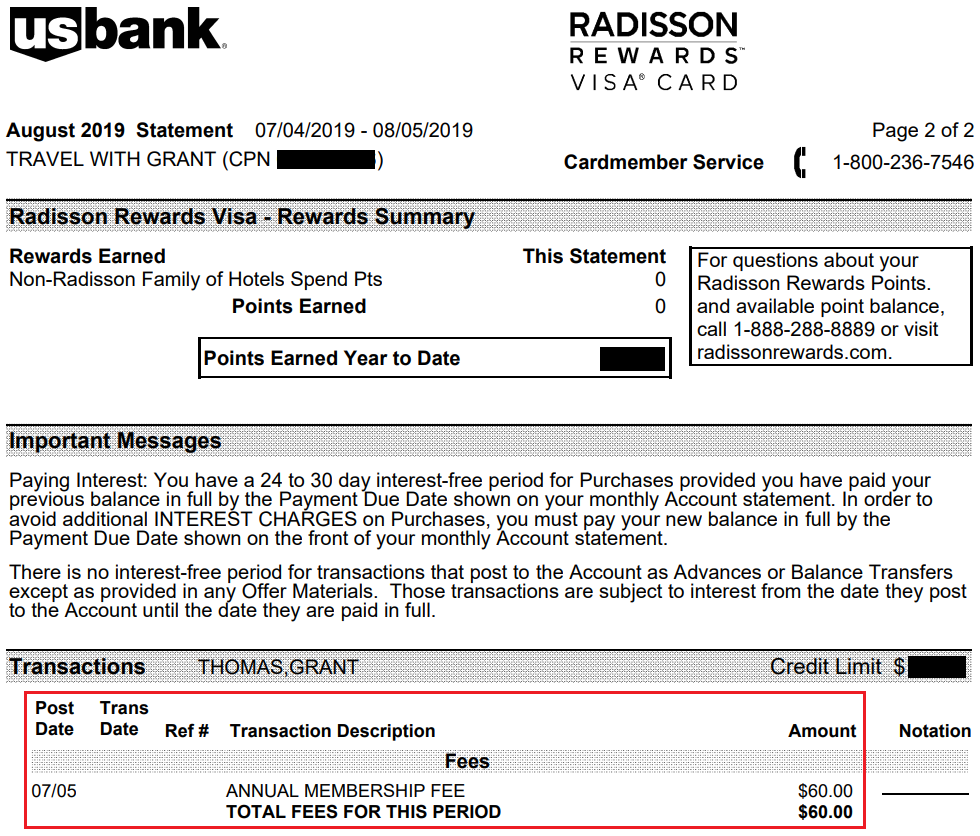

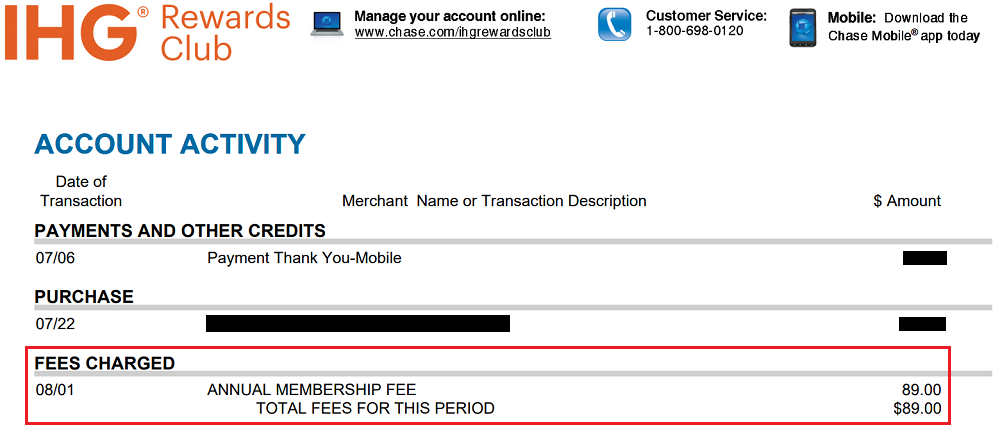

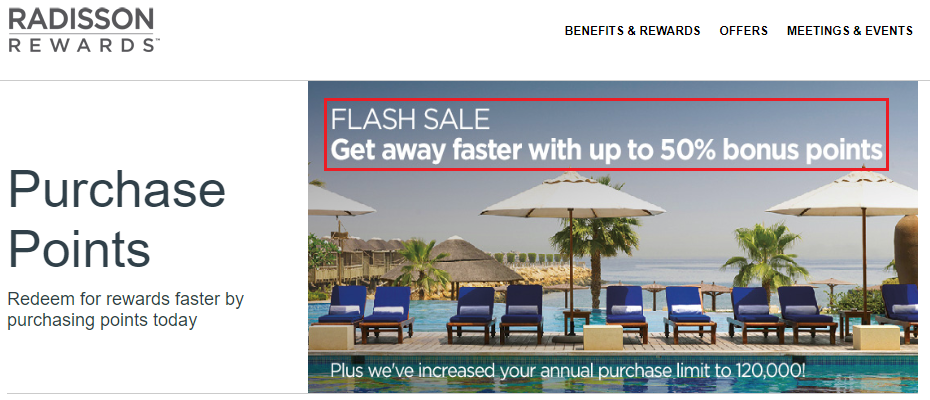

Good morning everyone, I hope you had a great weekend. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit cards to make sure they still deserve a spot in my wallet (or credit card drawer). For today’s post, I will review my US Bank Radisson Rewards Business Credit Card (no longer available to new cardholders) which just charged me the $60 annual fee. The only reason I keep this credit card year after year is the 40,000 anniversary Radisson Rewards Points. I am basically buying 40,000 Radisson Rewards Points for $60, which is 0.15 cents per point (CPP). I probably value Radisson Rewards Points at 0.4-0.5 CPP, so I have no problem paying the annual fee every year.

Even though I planned on keeping this credit card, I called US Bank to ask if there were any retention offers available. After reviewing my account, the rep first said she could cut my interest rate in half. I politely declined that offer and said last year I was offered Radisson Rewards Points to keep the credit card open – was that offer still available? The rep said yes, but it was only for 2,500 Radisson Rewards Points. I told her that was better than nothing and accepted the offer. The rep said I should see the 2,500 Radisson Rewards Points on my next statement.