Updated 11:20am PT on 7/22: I added the latest Alaska Airlines buy miles promo to the end of this post.

Good afternoon everyone. I was working on my Buy Miles & Points Page and found 10 offers ending in the next 2 months. Always check the math to make sure that buying miles & points makes sense for you. Do not buy miles & points speculatively unless you have a use in mind. With that said, here is a quick summary of the 10 buy miles/points promos ending in July and August:

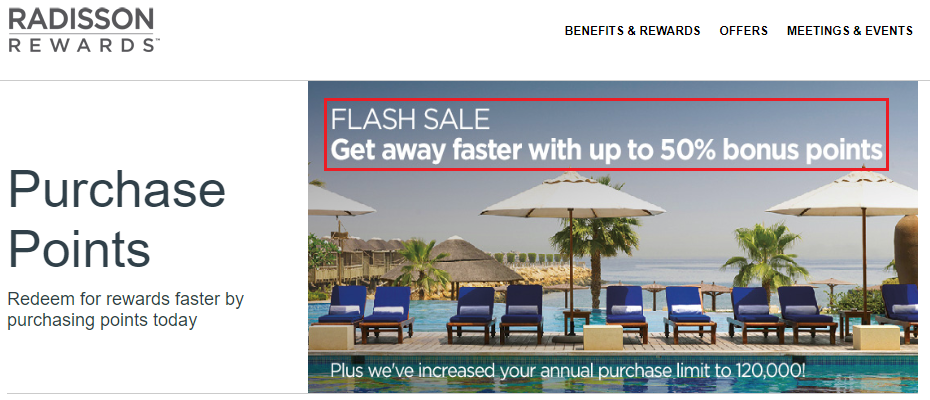

- Radisson Hotels – Buy Radisson Rewards Points with up to a 50% Bonus! (Offer expires July 28, 2019)

- Avianca Airlines – Buy Avianca Airlines LifeMiles with a 145% Bonus! (Offer expires July 31, 2019)

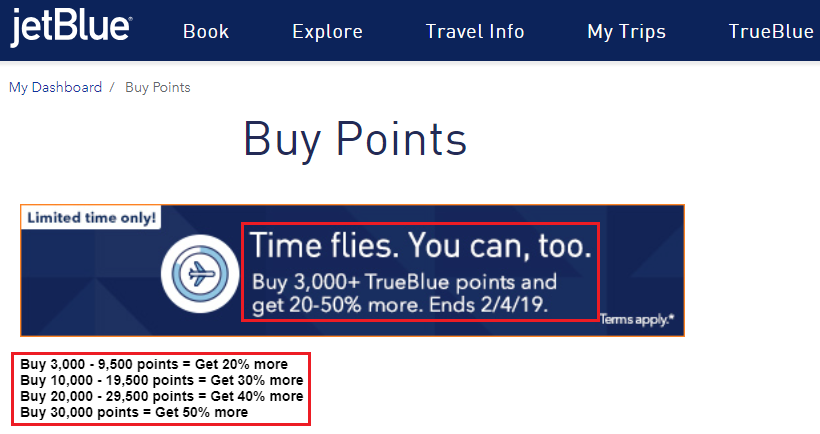

- JetBlue – Buy JetBlue TrueBlue Points with up to a 40% Discount! (Offer expires July 31, 2019)

- American Airlines – Buy American Airlines AAdvantage Miles with a 10% Discount + up to 100,000 Bonus Miles! (Offer expires August 2, 2019)

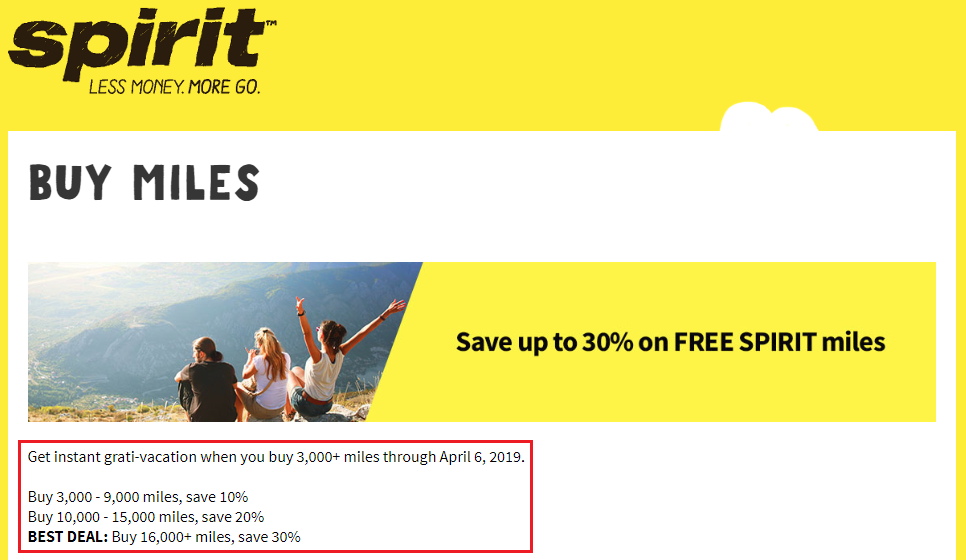

- Spirit Airlines – Buy Spirit Airlines Free Spirit Miles with up to a 40% Bonus! (Offer expires August 9, 2019)

- Air France / KLM – Buy Air France / KLM Flying Blue Miles with a 50% Bonus! (Offer expires August 11, 2019)

- Southwest Airlines – Buy Southwest Airlines Rapid Rewards Points with up to a 40% Discount! (Offer expires August 14, 2019)

- Choice Hotels – Buy Choice Hotels Rewards Points with a 25% Discount! (Offer expires August 22, 2019)

- IHG Hotels – Buy IHG Rewards Club Points with a 100% Bonus! (Offer expires August 23, 2019)

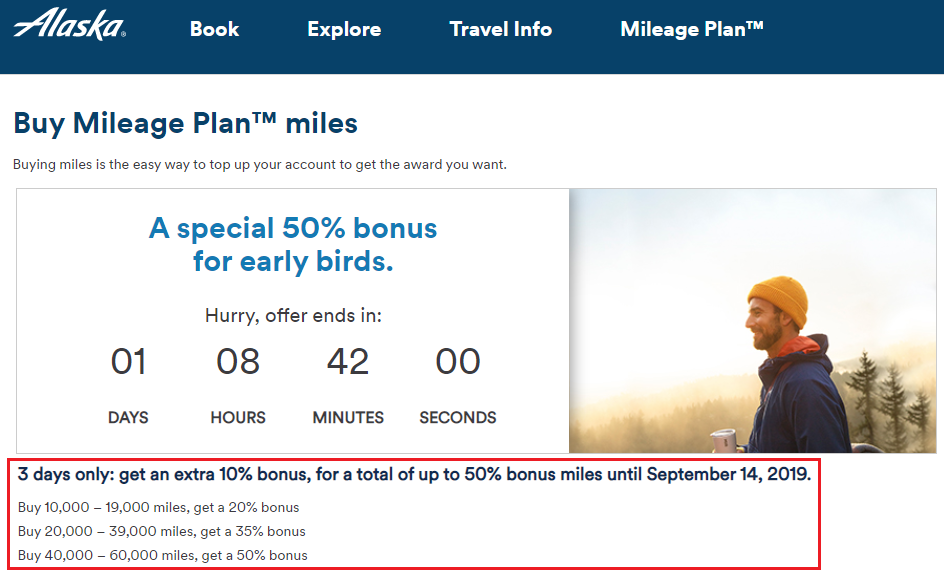

- Alaska Airlines – Buy Alaska Airlines with up to a 50% Bonus! (Offer expires August 30, 2019)

First up, Radisson Rewards is offering up to a 50% bonus, depending on the number of Radisson Rewards Points you purchase. This offer expires on July 28.

Continue reading →