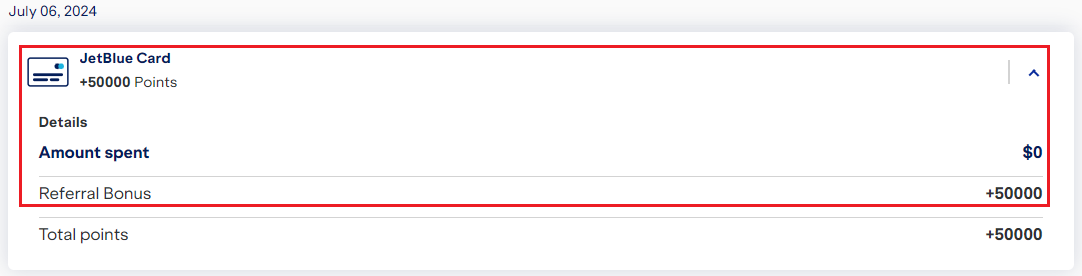

Updated 7/8/24 at 7:50am PT: The JetBlue referral points from the recent referral promo posted on my July statement. If you had any eligible referrals, you should see that on your July statement too.

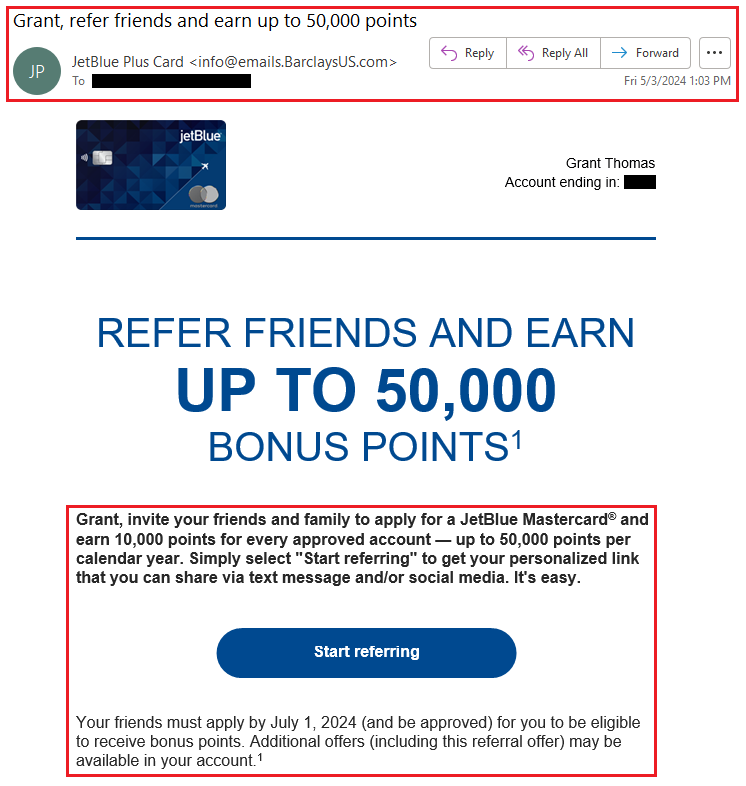

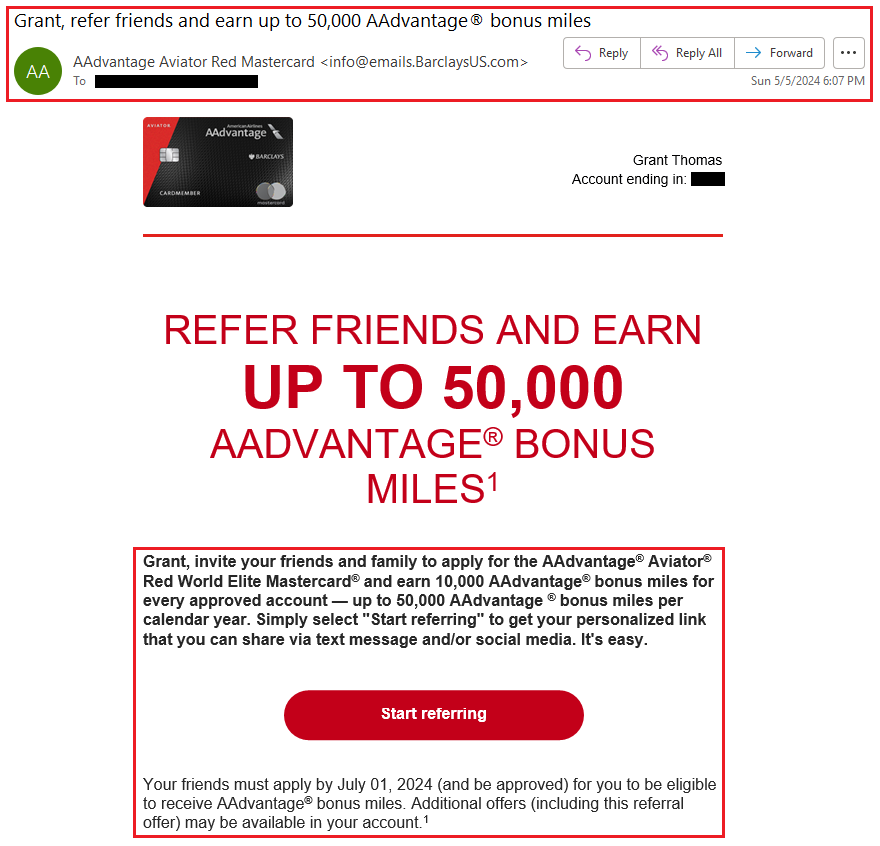

Good afternoon everyone, I hope your weekend is going well. Barclays sent out emails today to cardholders of the Barclays JetBlue Plus Credit Card (referral link) announcing a new referral offer where you can earn 10,000 JetBlue TrueBlue Points per referral, up to 50,000 points per calendar year. If you have this credit card, check your email for this offer (it may be targeted). If you didn’t receive the email, you can still log into your Barclays online account and see if you are eligible for this referral offer. If you want to share your JetBlue Plus Credit Card referral link, please post your referral link in the comments section for other readers to use.