I’ve talked about US Bank FlexPerks a few times in the past:

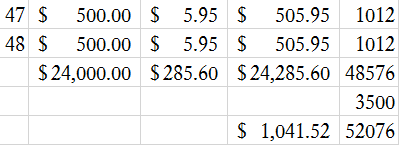

I *highly* recommend reading the post from May 11 that highlights my way of MSing FlexPerks. The brief run down is:

- 20,000 FlexPoints = up to $400 in travel

- To earn 20,000 FlexPoints, you need to spend $10,000 in grocery stores (2x on all grocery store purchases)

- $10,000 / $500 Gift Cards = 20 Gift Cards

- 20 Gift Cards x $5 activation fee = $100 out of pocket expense

- $400 in travel – $100 out of pocket expense = $300 “free travel money”

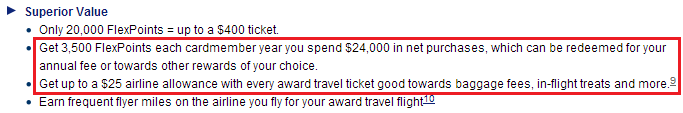

Some other interesting points of FlexPoints:

- Get 3,500 FlexPoints each cardmember year you spend $24,000 in net purchases, which can be redeemed for your annual fee or towards other rewards of your choice.

- Get up to a $25 airline allowance with every award travel ticket good towards baggage fees, in-flight treats and more. (Ohhh in-flight treats/food/drinks – After travel, just call Cardmember Services at 877-978-7446 to request a statement credit within 90 days of your award ticket travel flight.)

- Earn frequent flyer miles on the airline you fly for your award travel flight.

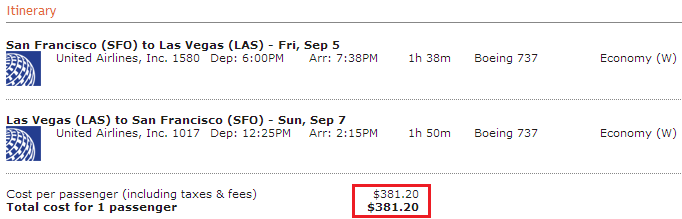

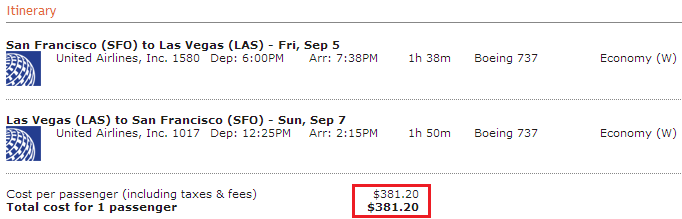

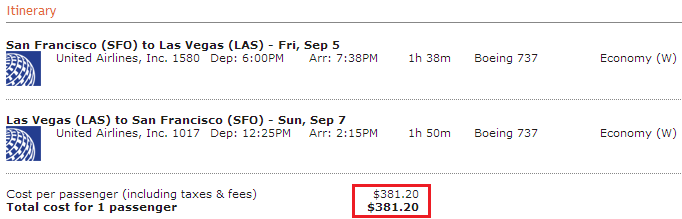

With that said, here is how to redeem US Bank FlexPerks for airfare. Find a flight you want that costs less than $400, but ideally as close to $400 as possible. 20,000 FlexPerks can be used on a $100 ticket, a $200 ticket, a $300 ticket, or a $399 ticket. All those tickets cost the same number of FlexPerks, so find the best flight and don’t worry about the cost. In the example below, I need to get from SFO to LAS for a bachelor party and need these specific flights. Southwest Airlines and Virgin America have flights at the same time that are both more expensive than the flight shown below.

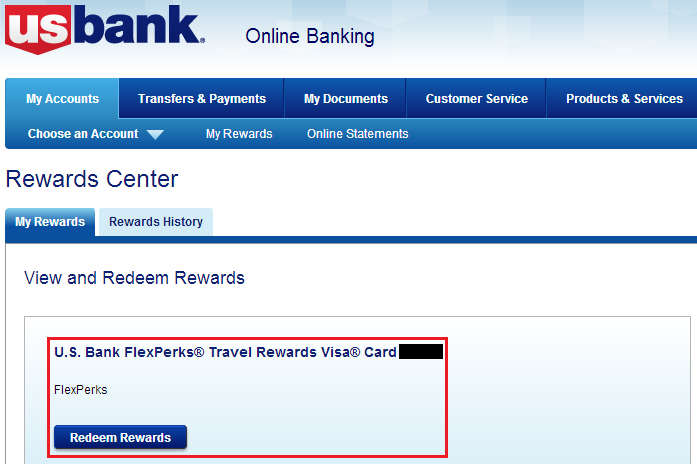

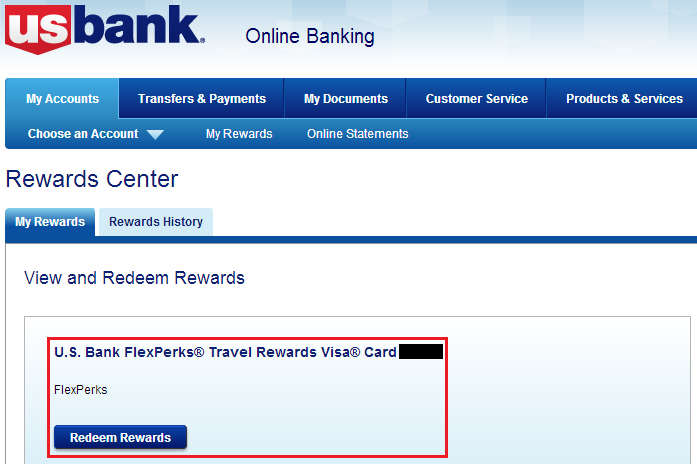

Log into your US Bank account and click on My Accounts and My Rewards.

Click Redeem Rewards under your Flexperks credit card.

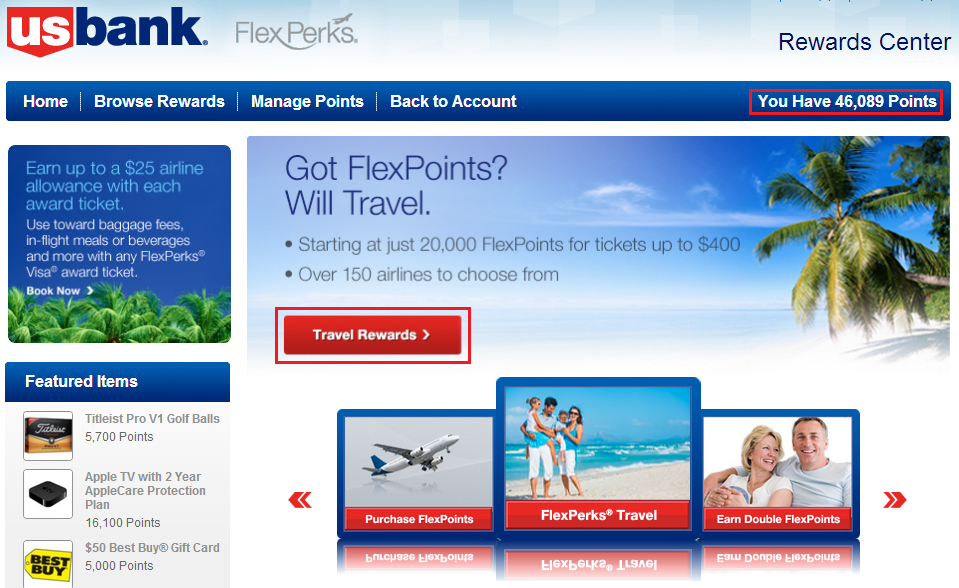

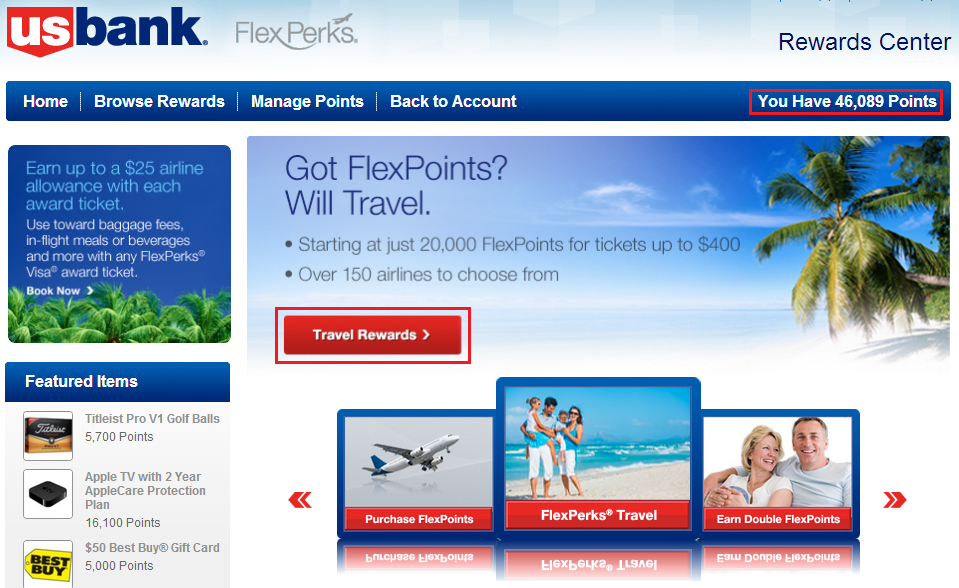

Click on Travel Rewards in the center of the screen. You will be able to see your current Flexperks balance in the upper right corner.

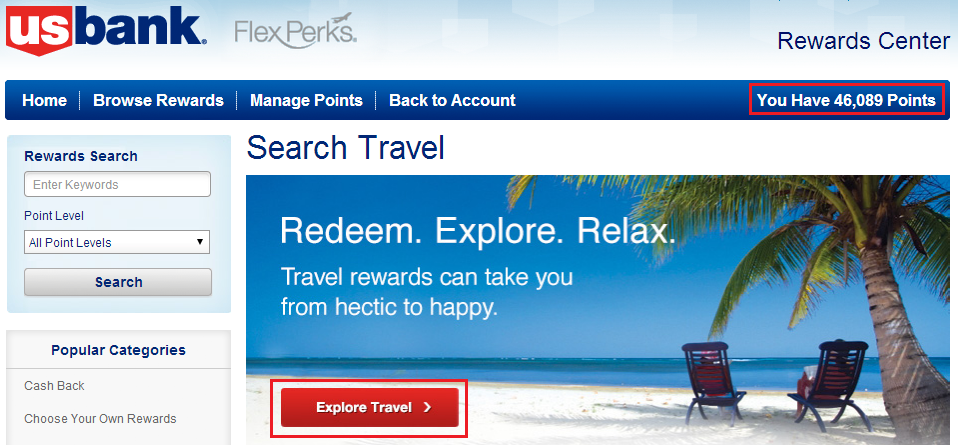

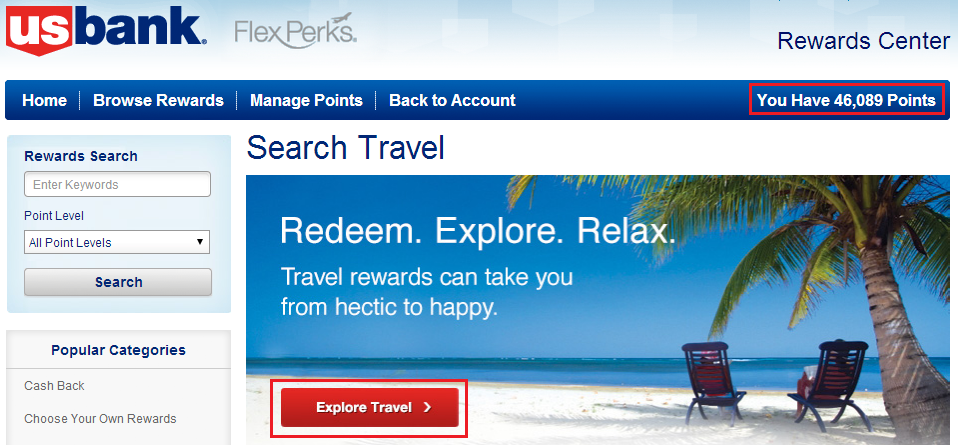

Click on Explore Travel in the center of the screen.

Remember, these are the flights, times, and flight numbers of the flights I want to book.

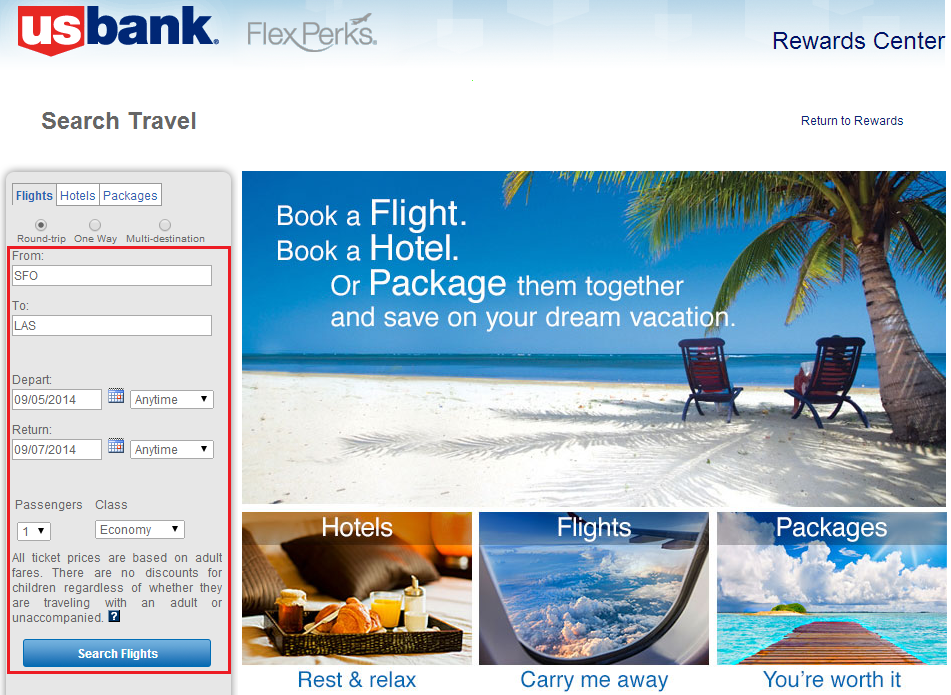

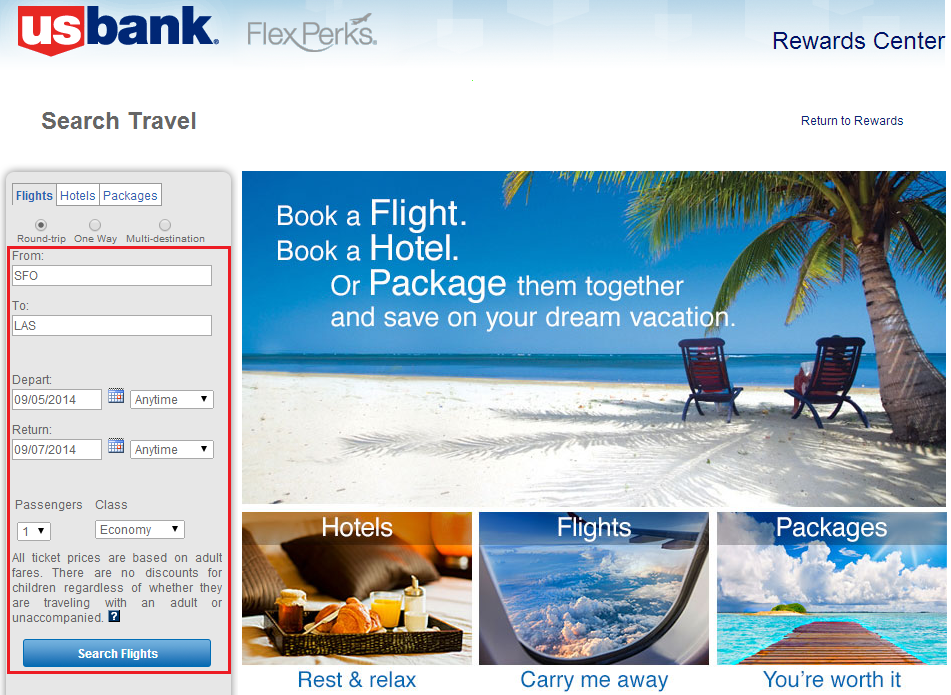

Enter your search terms into the search box. You can book round trips, one way trips, or multi-destination trips (great for 2 random one ways to maximize the value out of your Flexperks. Then click Search Flights at the bottom.

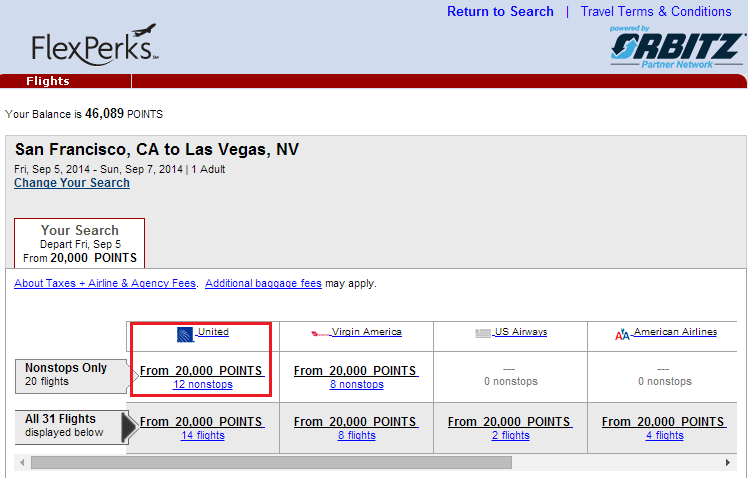

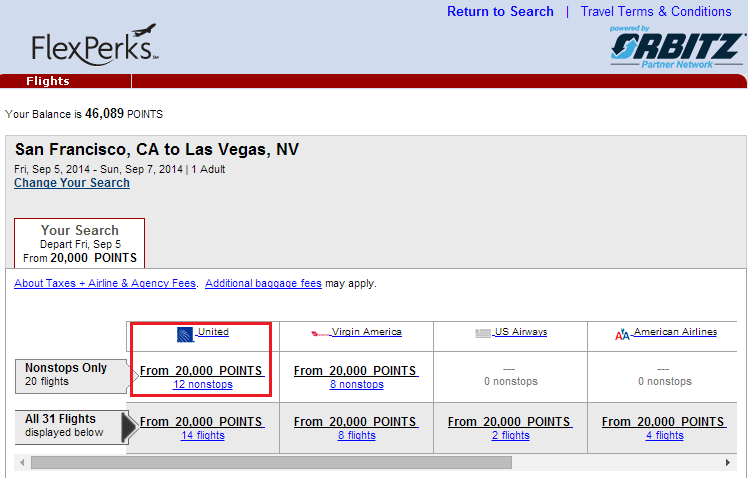

The Flexperks online portal is run by Orbitz, in case you were wondering. The search results are grouped by airline and number of stops. Click the box that corresponds with the flight you want to book. As you can see, almost all the flight options shown are at the 20,000 Flexperks level (cost of airfare is $400 and below).

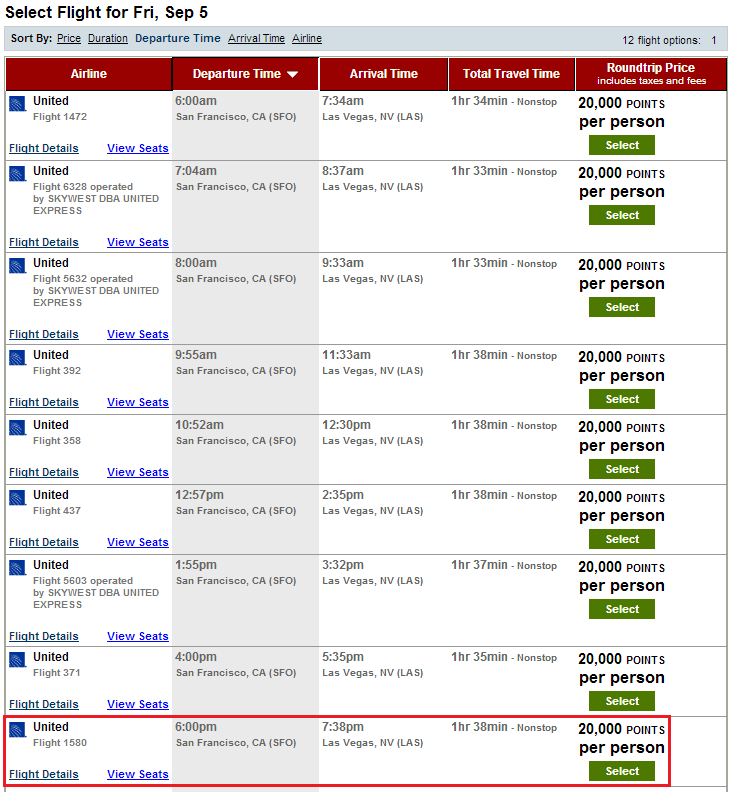

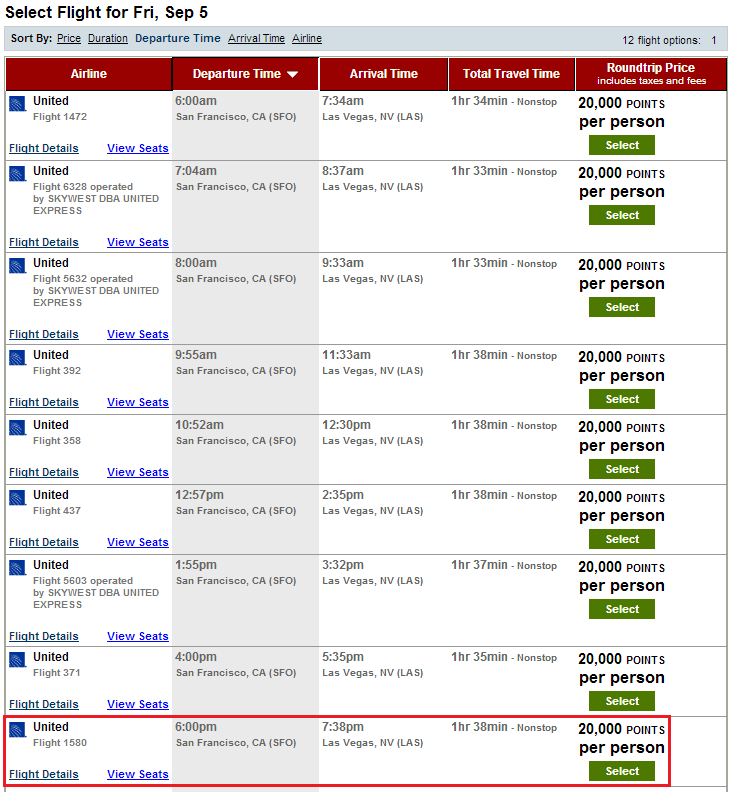

Find the outbound flight you want from the list of choices.

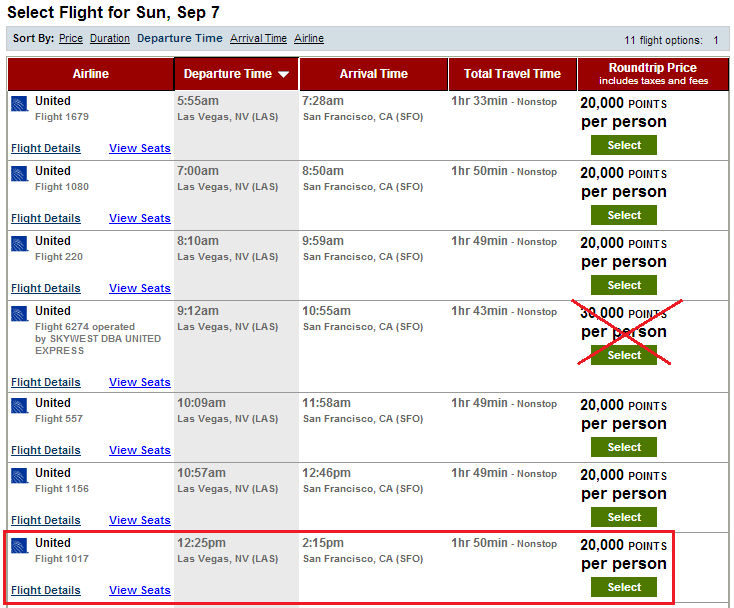

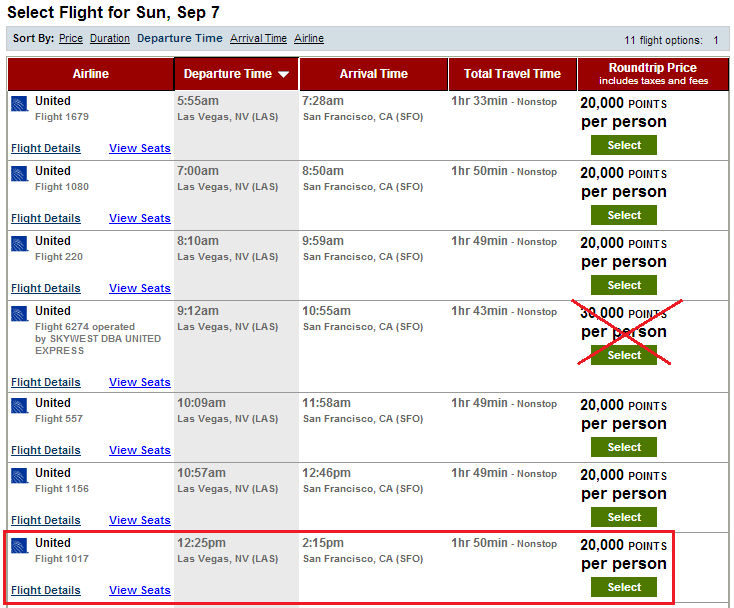

Then find the return flight you want from the list of choices. Hint: avoid clicking on any flight that is not 20,000 FlexPerks (see the big red X?).

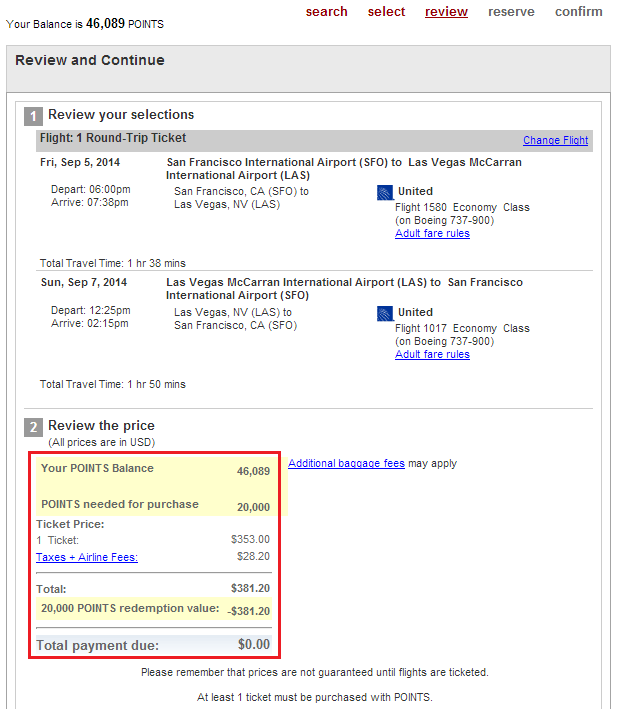

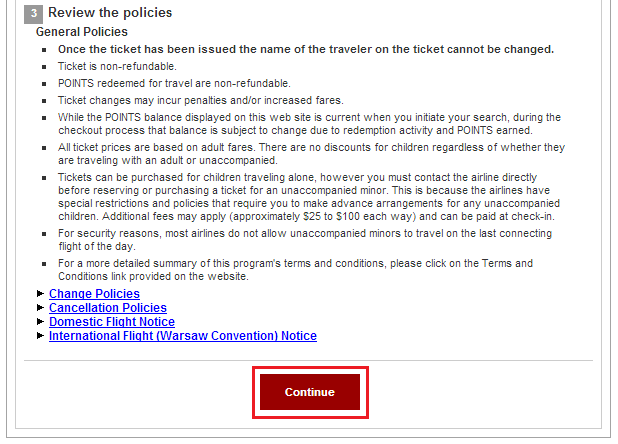

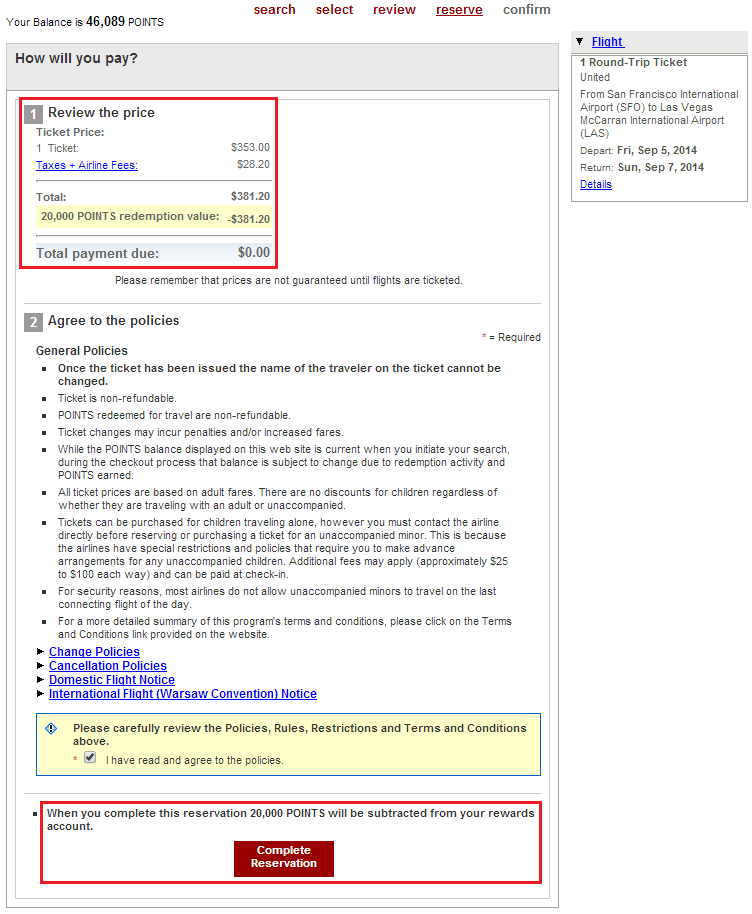

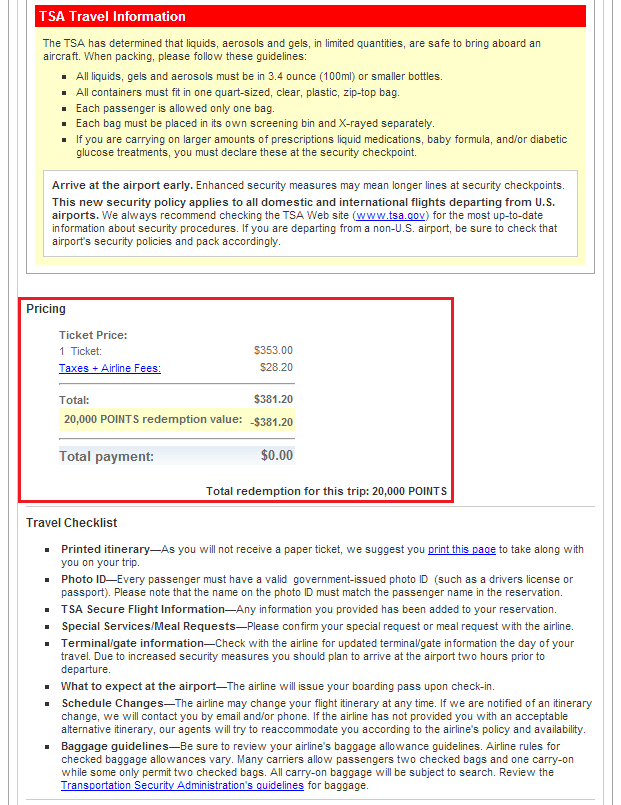

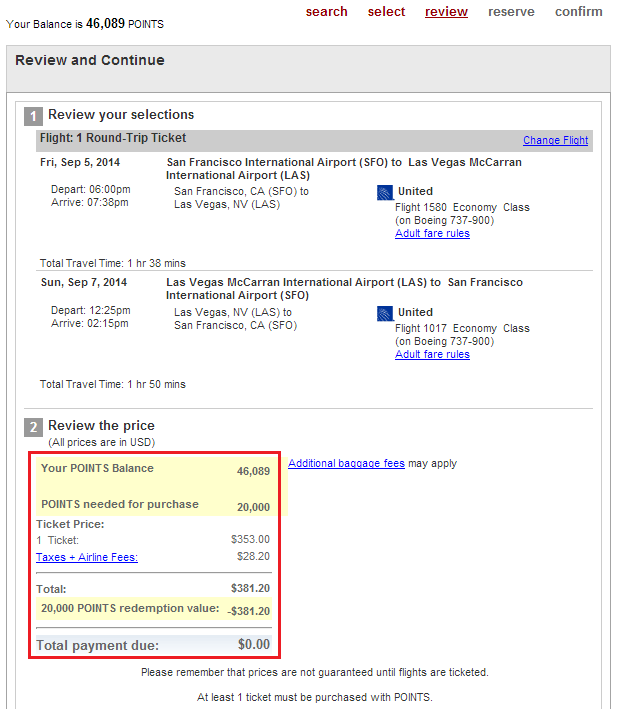

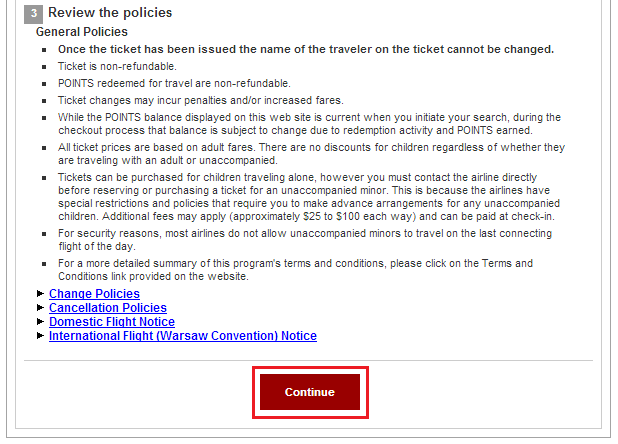

This page shows a preview of your flights as well as the number of Flexperks you will redeem for the itinerary. It is nice the FlexPerks pays for the whole flight including taxes and fees.

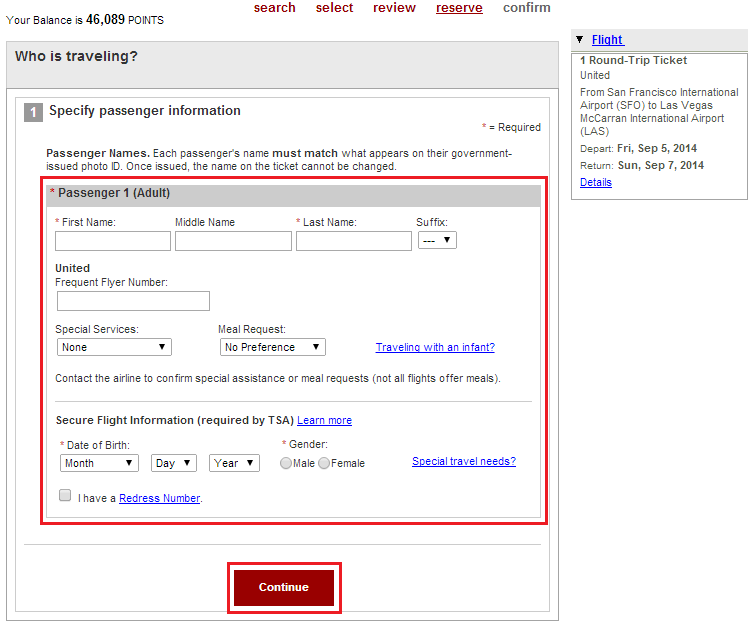

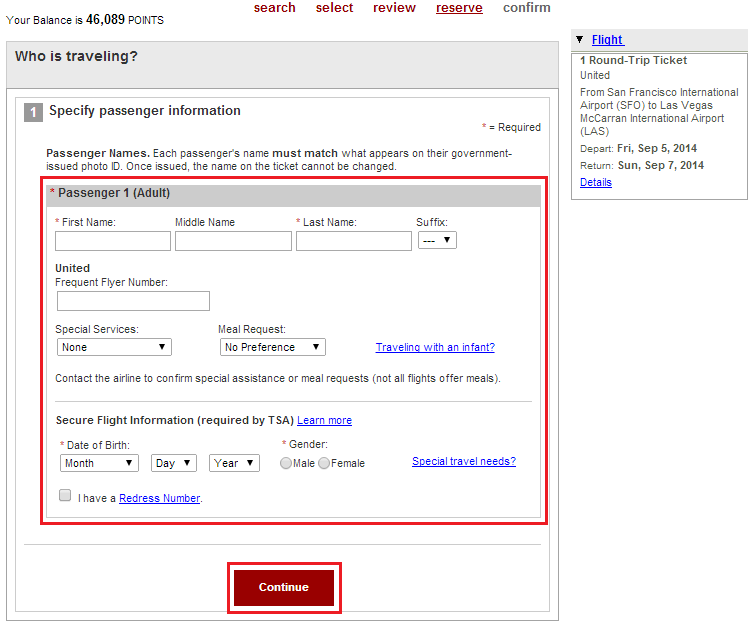

Enter the passenger’s personal information, frequent flyer account info (you can change/enter this info later), and click Continue.

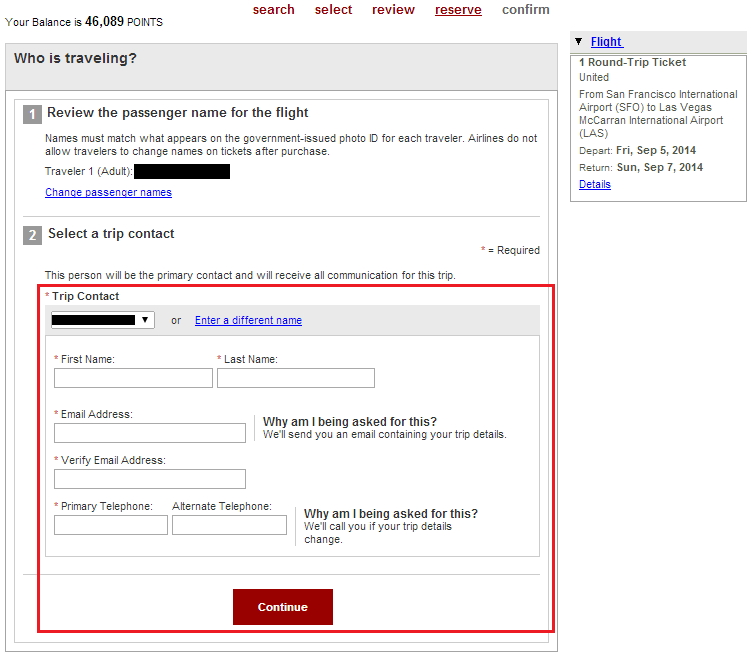

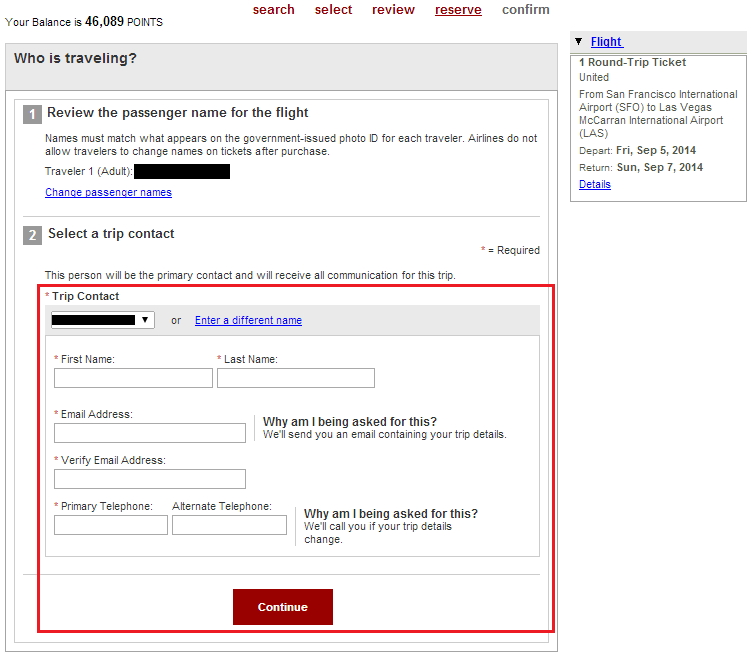

Enter the passenger’s contact information and click Continue.

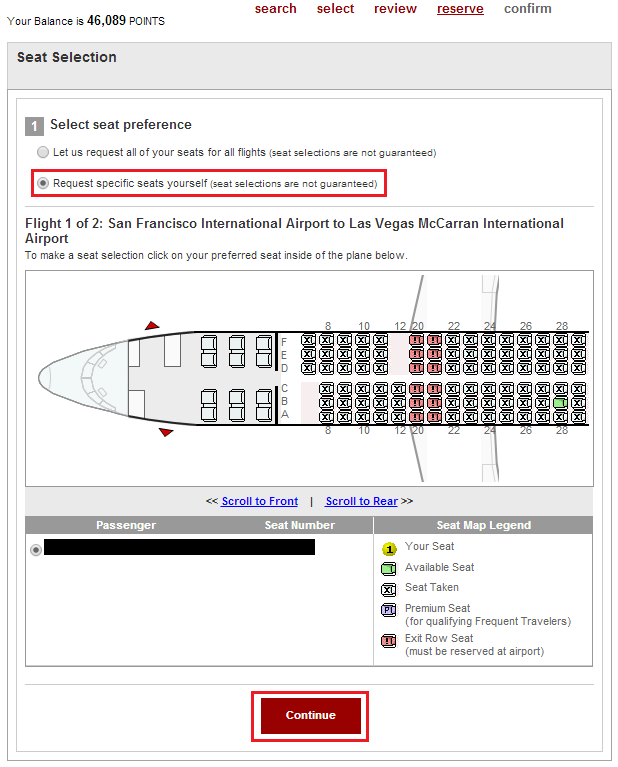

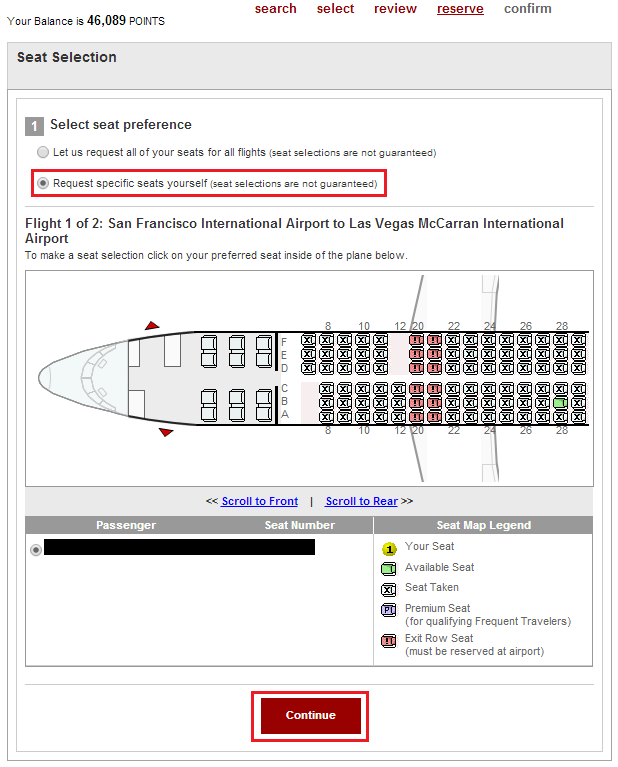

Pick your outbound and return seats then click Continue. If you have elite status with the airline, you may want to wait until after the flight is booked and make your seat selection from the airline’s website.

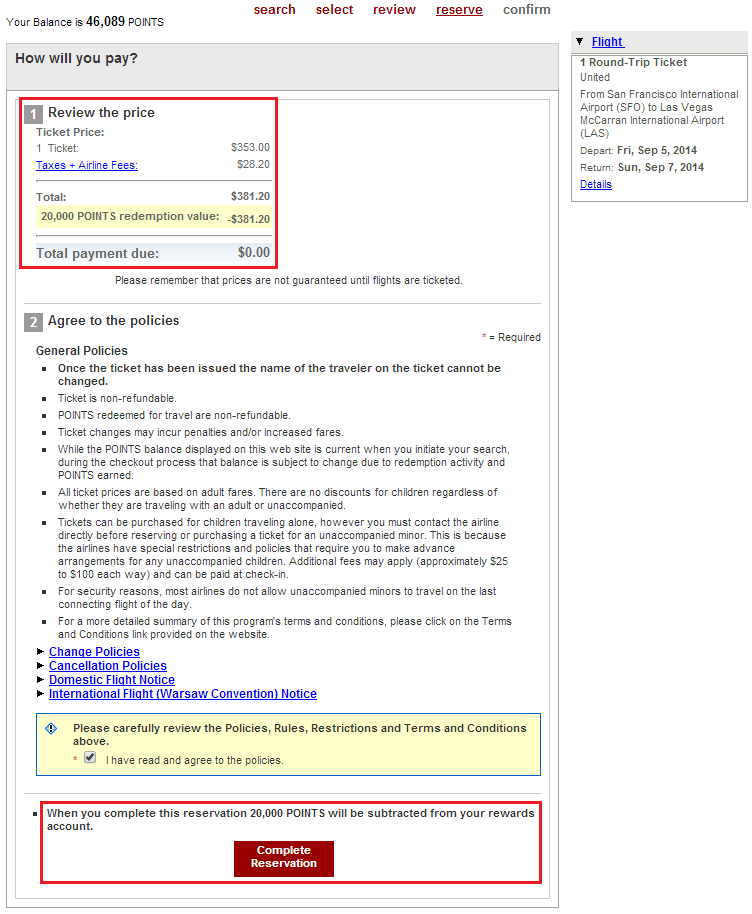

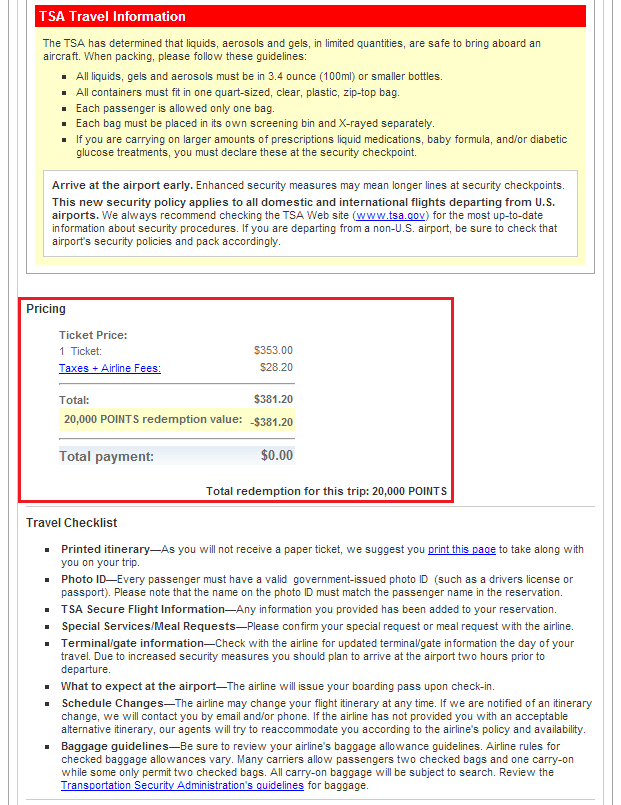

Preview the price of the ticket one last time and click Complete Reservation.

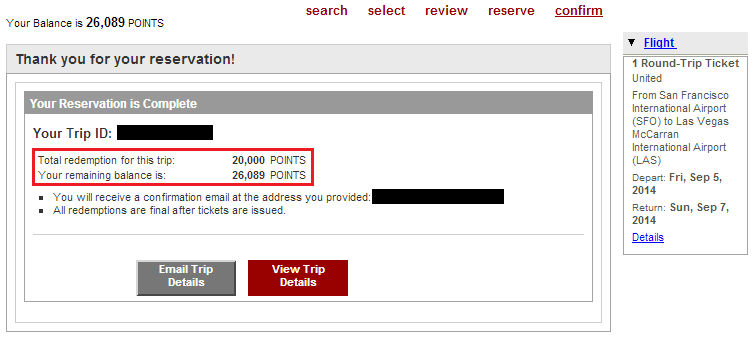

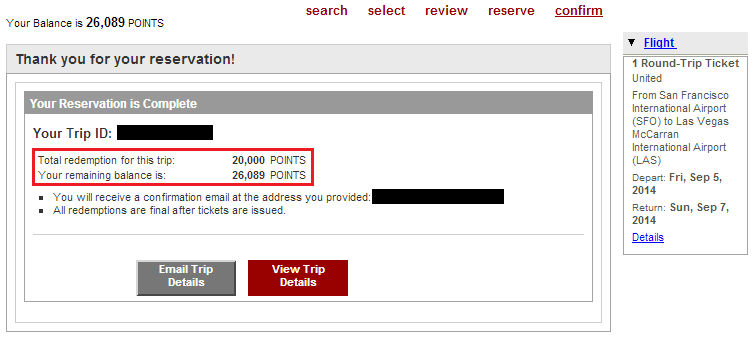

Your reservation is complete and your Flexperks balance will show your new balance. Click View Trip Details to view/print your itinerary.

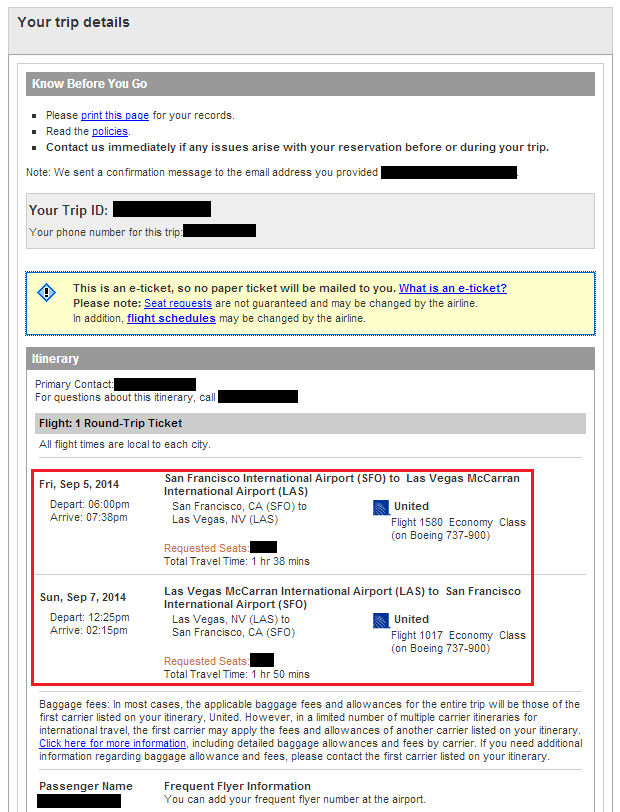

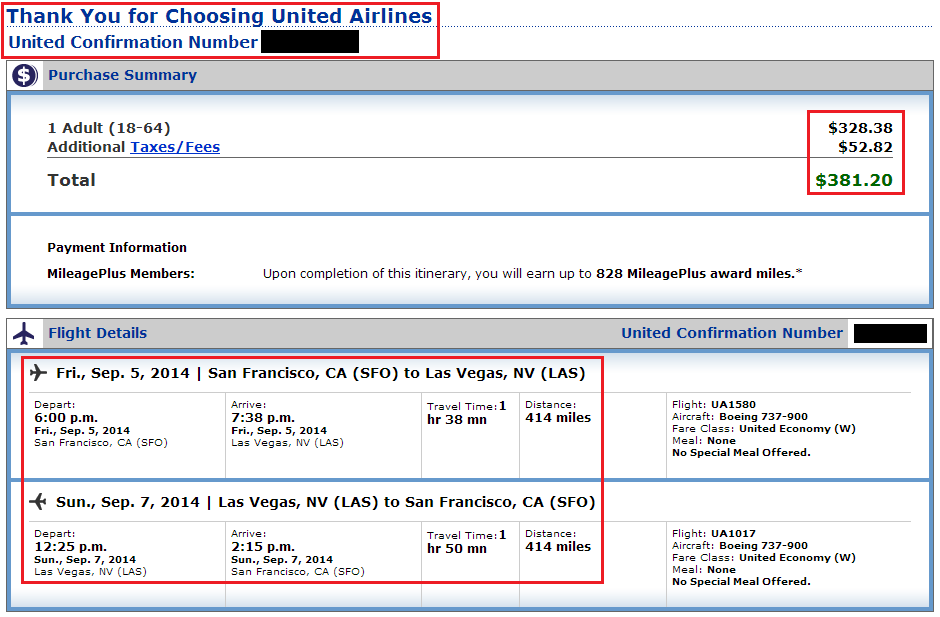

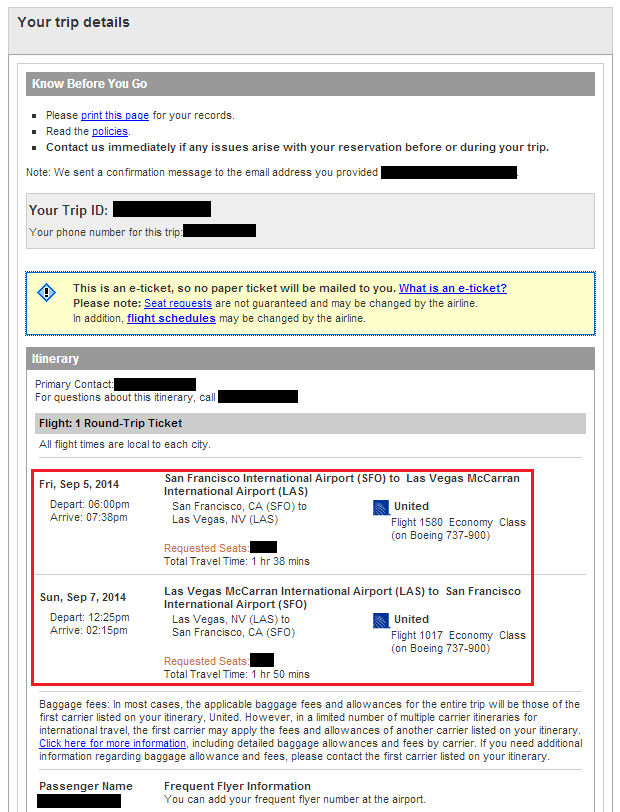

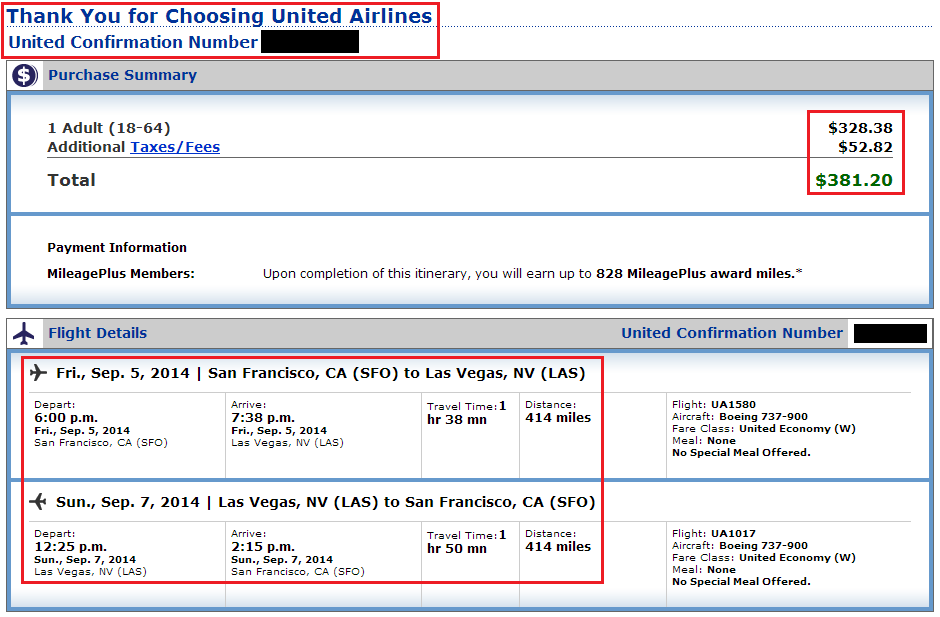

Here is your flight itinerary. Check your email for an email from FlexPerks. You will find the reservation number for the airline that can be used to view/change your reservation online.

I can find my reservation on United.com just by entering my United Confirmation Number. From here, you can change your seats, enter your TSA pre Check number, or change your frequent flyer account attached to the reservation.

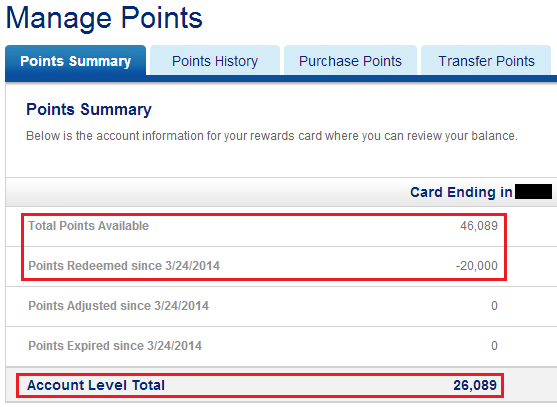

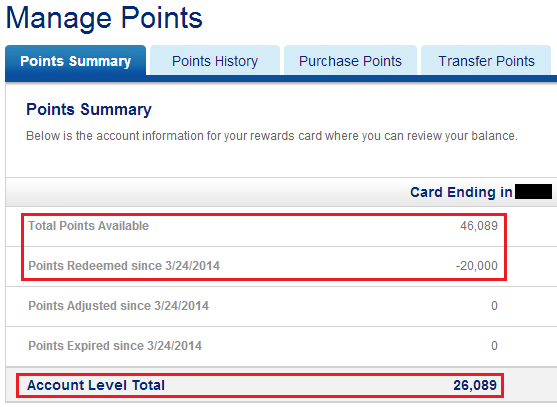

Back in your US Bank Flexperks account, you can view your Points Summary and remaining Flexperks balance.

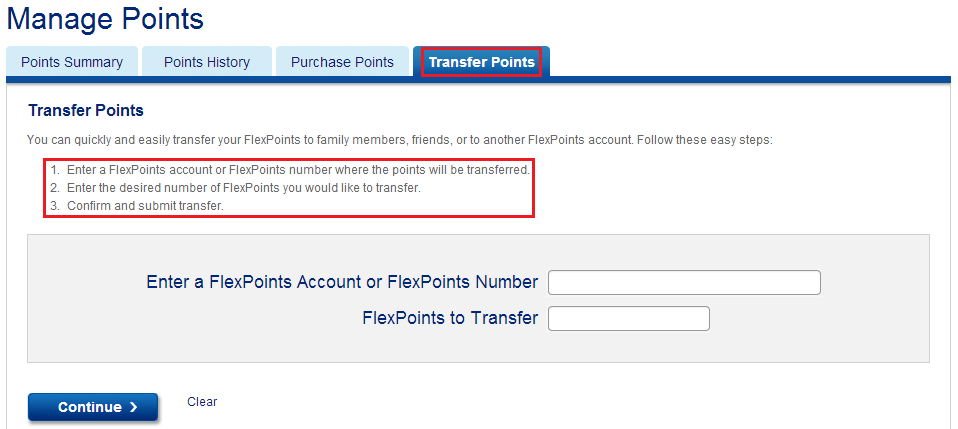

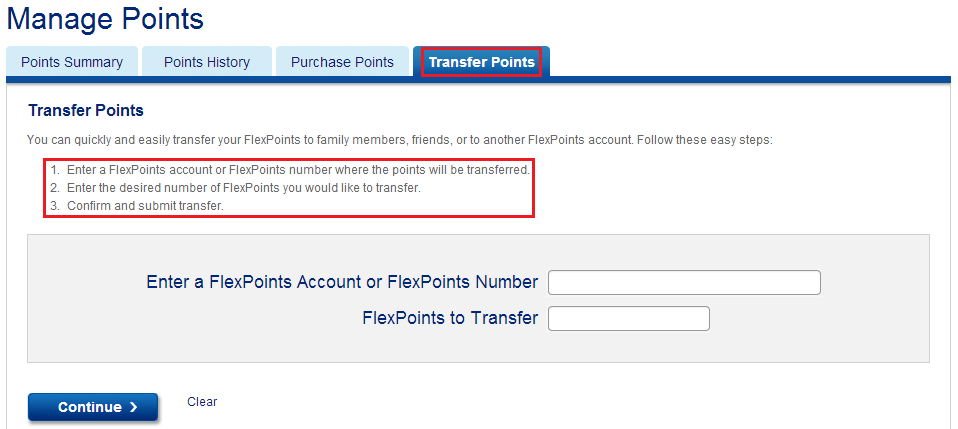

Also, you can transfer Flexperks to anyone with a Flexperks credit card account. If you need to purchase FlexPerks, you can do so online in 1,000 point increments for $20 each.

If you have any questions, please leave a comment below.