Good morning everyone, TGI Friday! Earlier this week, I wrote My Upcoming App-O-Rama Credit Card Strategy – I need your Feedback! I really appreciate all the great feedback you guys gave me and I did my best to incorporate that advice into my App-O-Rama strategy. Last week, my “good” “friend” Julian (aka Devil’s Advocate) over at Travel Codex wrote this post: A New and Better Way To App-O-Rama. In that post, he describes his “Elongated App-O-Rama” strategy where he applies for several cards over a period of days, instead of applying for several cards within minutes of each other (like any sane person would do). Like any good friend, I listened to his advice and did exactly what he said I adamantly disagreed with his thought process and continued with my App-O-Rama strategy as before.

The one piece of advice that was super helpful to me was knowing which credit card company pulls from which credit bureau. Luckily, my friend Emery has credit monitoring services from all 3 credit bureaus and he told me which credit bureau each credit card company pulled from. Depending on your state, the information will differ, but since we are both in California, the data is reliable:

- US Bank – TransUnion

- Barclays – TransUnion

- Citi – Experian

- Bank of America – Experian

- Comenity – ?

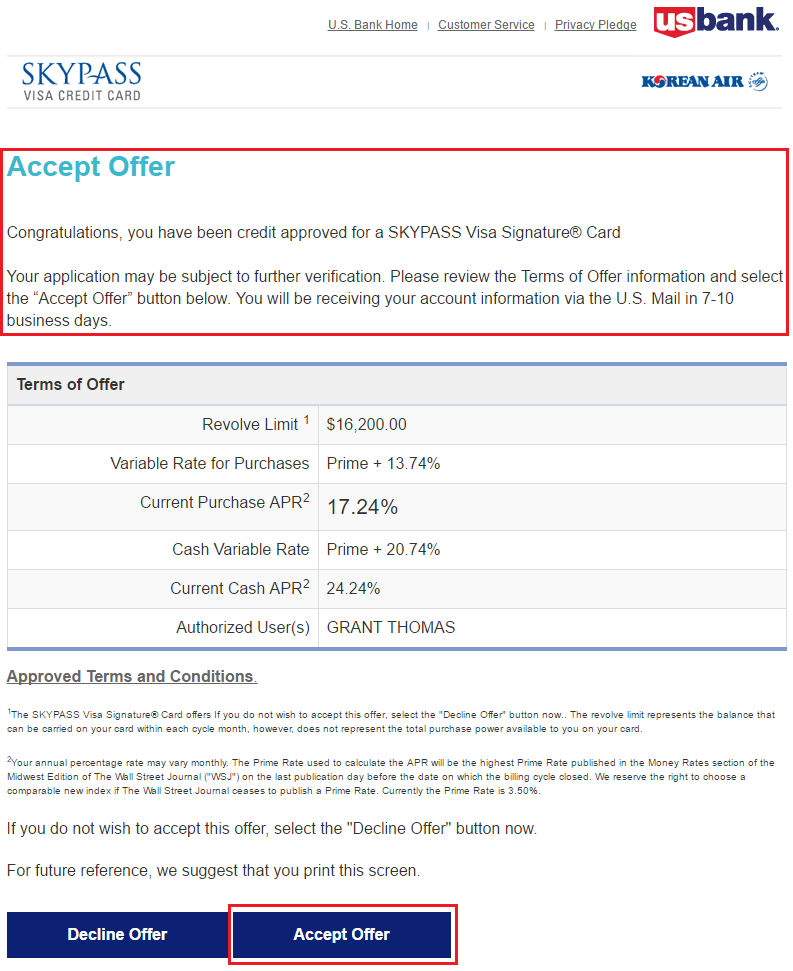

Since US Bank and Barclays both pull from TransUnion, I decided to apply for both the US Bank Korean Air SkyPass Credit Card and the Barclays Lufthansa Miles & More World Elite MasterCard at the same time. As luck would have it, I was instantly approved for the targeted US Bank Korean Air SkyPass Credit Card and given a $16,200 credit line. Woo hoo!

Sign up bonus details:

- 40,000 Korean Air Miles (worth $600, valuing Korean Air Miles at 1.5 CPM)

- $2,500 spending in 3 months

- $89 annual fee

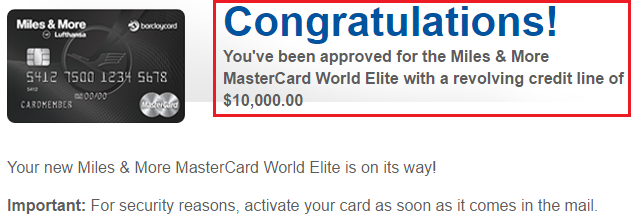

In even more amazing news, I was finally approved for my first Barclays credit card… ever! I was 0 for 6 up until that point, missing out on several US Airways, Arrival+, and Lufthansa credit card offers in the past. The streak is broken and I am a proud owner of a Barclays Lufthansa Miles & More World Elite MasterCard and given a $10,000 credit line. Woo hoo, 2 for 2 at this point!

Sign up bonus details:

- 50,000 Lufthansa Miles (worth $750, valuing Lufthansa Miles at 1.5 CPM)

- $5,000 spending in 3 months

- $89 annual fee

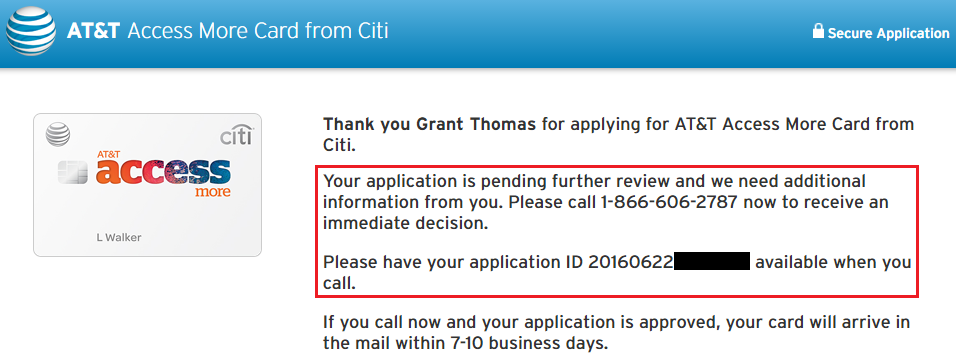

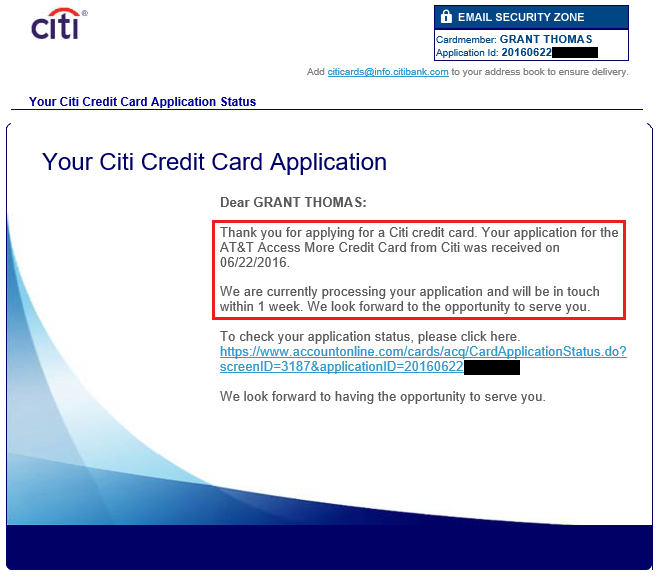

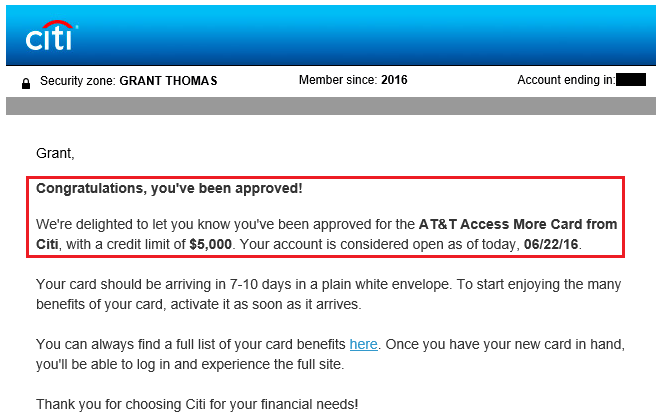

Since Citi and Bank of America both pull from Experian, I decided to apply for both the Citi AT&T Access More MasterCard and the Bank of America Amtrak Guest Rewards World MasterCard at the same time. I received a pending decision from Citi which is usual since I have so many Citi credit cards already: Forward, Premier, Prestige, Double Cash, 2 Hilton HHonors Reserve, AA Platinum, and AA Platinum Business. I called the below reconsideration department number (1-866-606-2787) and gave them the application ID number. I also received the same info by email from Citi.

After speaking to the rep for a few minutes, she was able to approve the card by moving some credit line from 2 other Citi credit cards. The new card has a $5,000 credit line. Woo hoo, 3 for 3!

Sign up bonus details:

- $650 phone credit (worth $650 toward a new iPhone)

- $2,000 spending in 3 months

- $95 annual fee

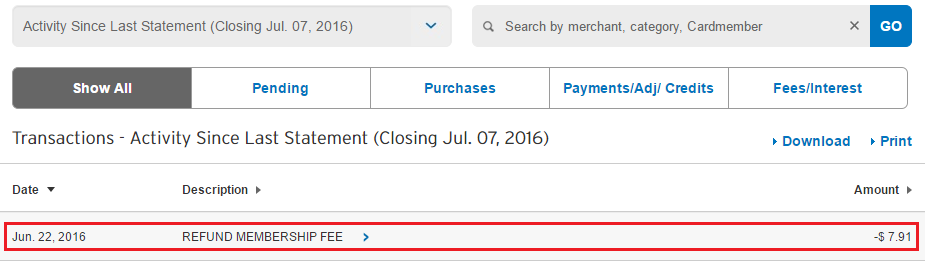

In the process of being approved for the Citi AT&T Access More MasterCard, I moved the full $2,000 credit line from my Citi American Airlines Platinum Credit Card and closed the card. The annual fee was set to be billed next month and I wasn’t given a retention offer last time I called, so closing the card was the right decision. The following day, I spotted a $7.91 credit balance on the card for a prorated annual fee refund. I called Citi to transfer that credit balance to my Citi Forward Credit Card and removed the card from my online account.

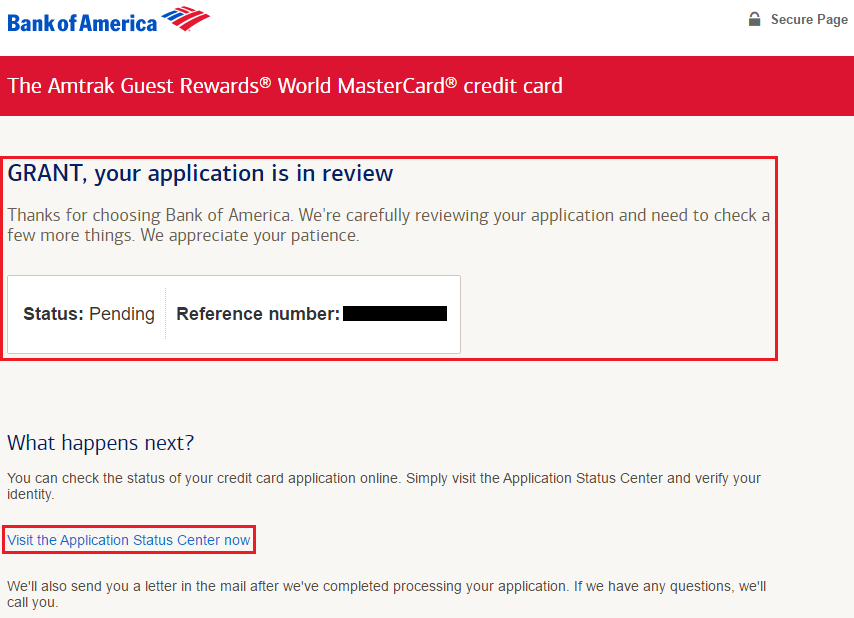

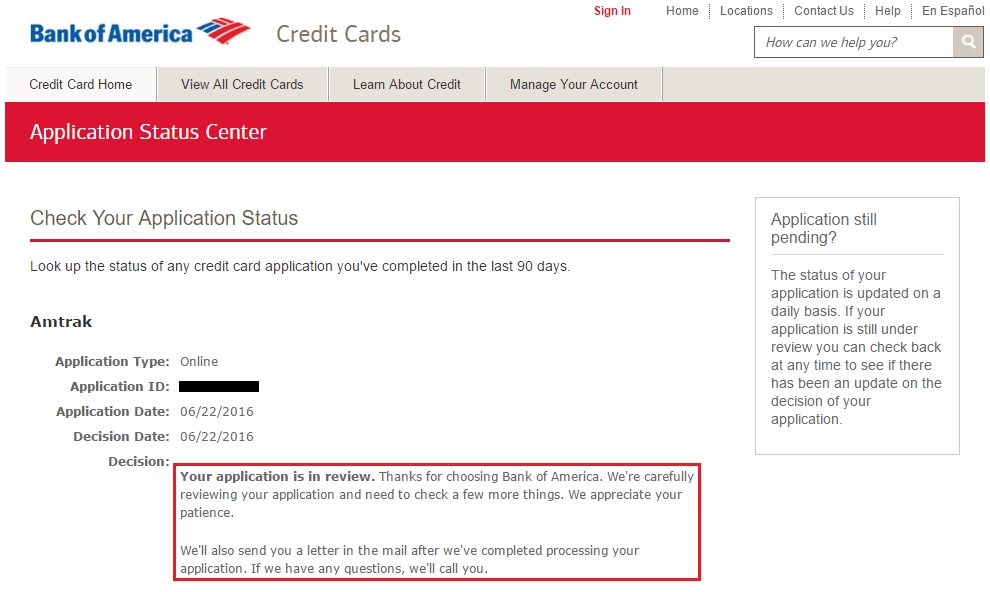

Over at Bank of America, I received a pending decision on my Bank of America Amtrak Guest Rewards World MasterCard application. I clicked the Application Status Center link to see if there was any more information about the application.

Nothing special here, so I called the Bank of America reconsideration department and spoke to a nice rep. He put me on hold for 2 minutes and then congratulated me on being approved for the credit card with a $12,000 credit line. Woo hoo, 4 for 4 now!

Nothing special here, so I called the Bank of America reconsideration department and spoke to a nice rep. He put me on hold for 2 minutes and then congratulated me on being approved for the credit card with a $12,000 credit line. Woo hoo, 4 for 4 now!

- 20,000 Amtrak Points (worth $580, valuing Amtrak Points at 2.9 CPP)

- $1,000 spending in 3 months

- $79 annual fee

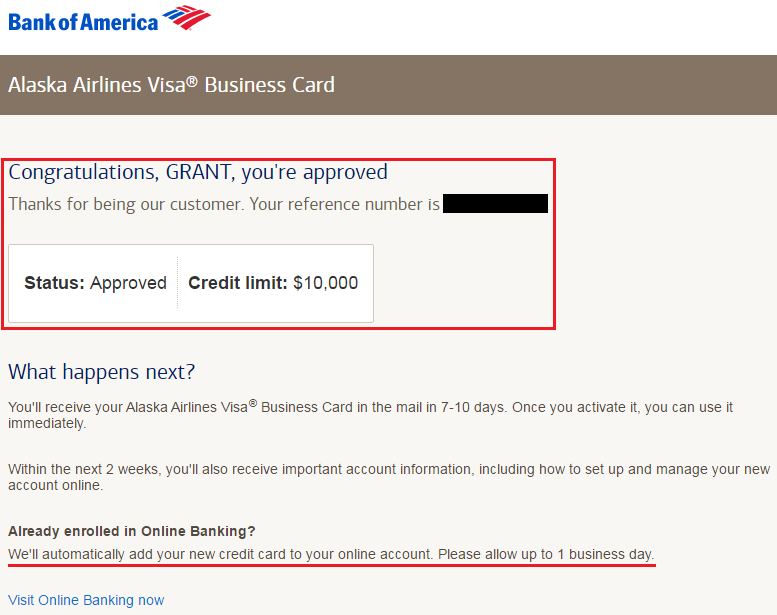

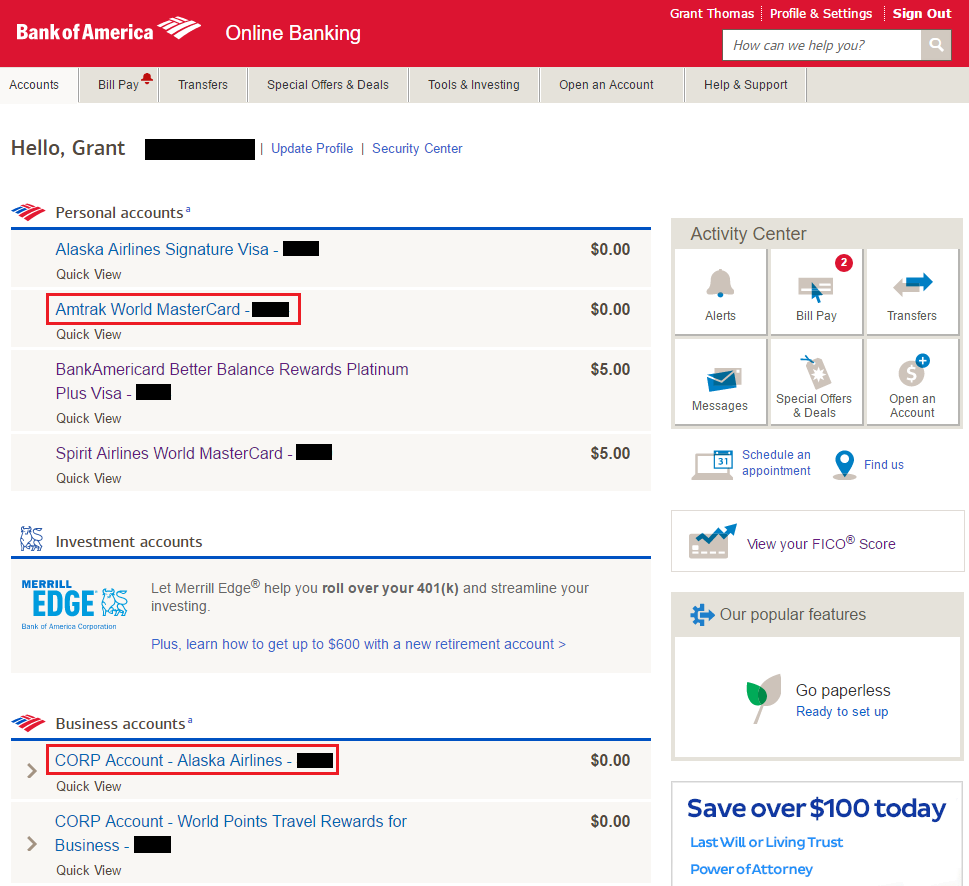

After being approved for the Bank of America Amtrak Guest Rewards World MasterCard, I decided to push my luck and apply for the Bank of America Alaska Airlines Visa Business Credit Card. I used my Travel with Grant EIN and was instantly approved with a $10,000 credit line. Woo hoo, 5 for 5! Bank of America automatically adds your new credit cards to your online account.

My 2 new Bank of America credit cards are already live in my Bank of America online account.

Sign up bonus details:

- 30,000 Alaska Airlines Miles (worth $450, valuing Alaska Airlines Miles at 1.5 CPM)

- $1,000 spending in 3 months

- $75 annual fee

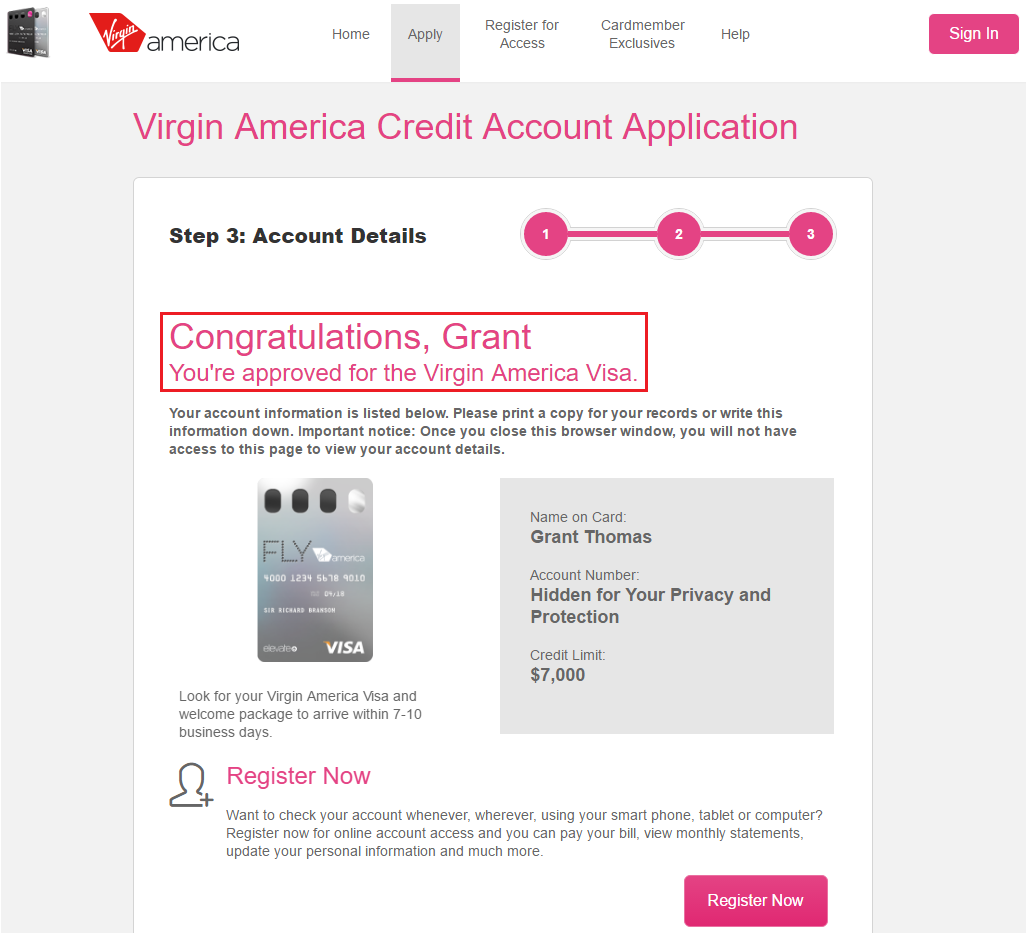

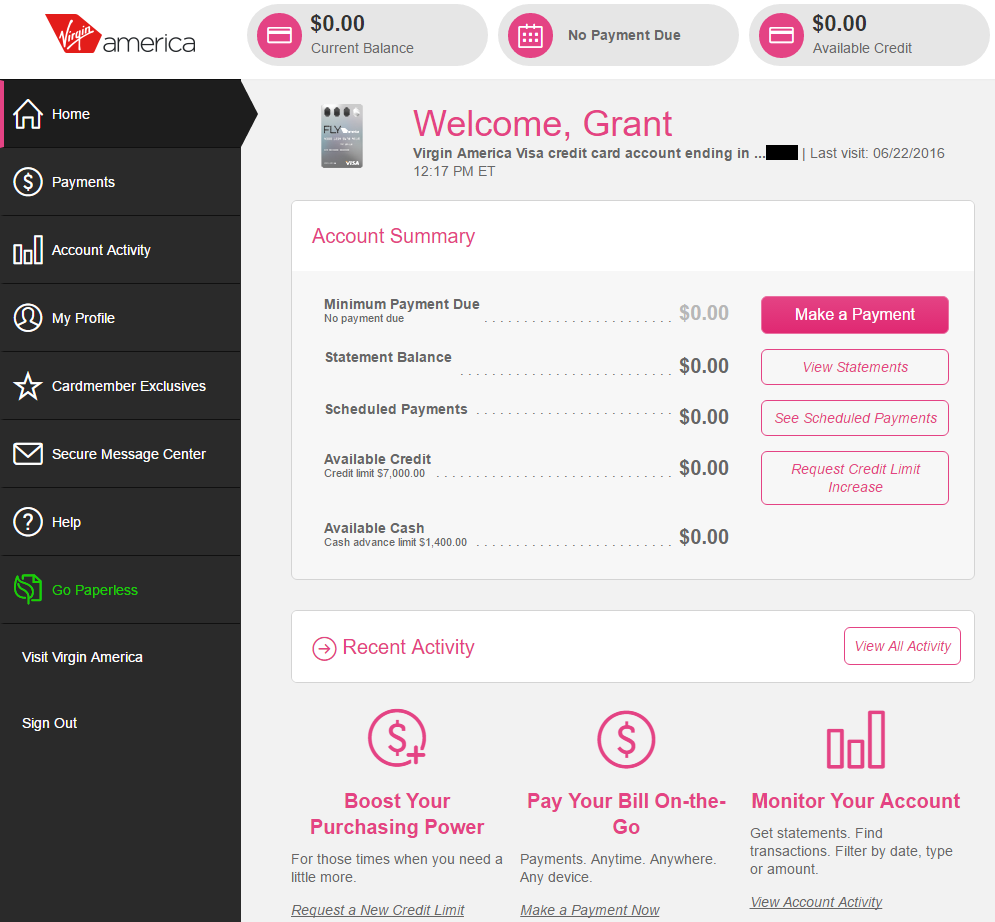

Last but not least, I decided to apply for the Comenity Virgin America Premium Visa Signature Credit Card. I’m not sure what credit bureau Comenity uses, but I applied and was instantly approved with a $7,000 credit line. Woo hoo, a perfect 6 for 6!

Sign up bonus details:

- 15,000 Virgin America Miles (worth $330, valuing Virgin America Miles at 2.2 CPM)

- $1,000 spending in 3 months

- $149 annual fee

By the way. I was able to set up my Comenity online banking account and the layout is pretty cool.

Here are all the sign up bonuses from this App-O-Rama:

- 40,000 Korean Air Miles

- 50,000 Lufthansa Miles

- $650 AT&T phone credit

- 20,000 Amtrak Points

- 30,000 Alaska Airlines Miles

- 15,000 Virgin America Miles

Based on the values assigned above, these 6 credit cards have a combined sign up bonus value of $3,360. Unfortunately, the combined annual fees from these 6 credit cards is $567. To meet all the sign up bonuses, I need to complete $12,500 in minimum spending in 3 months, or ~$4,167 in spending per month.

If you have any questions, please leave a comment below. Have a great day everyone!

P.S. If you are considering applying for any new credit cards, please check out the credit cards I have available. Thank you for your support and good luck on your application!

Congrats. What is your approximate average age of accounts and on which bureau are most of your hard inquiries in a 12 and 24 month period? I think I’m up to 21 on Experian in two years and so far no issue on getting approvals.

My average age of accounts is 2 years 10 months. But my oldest account is 19 years, I’m an authorized user on my parents’ cards. Since I live in California, I believe most of the inquiries go to Experian.

nice! if experian file is frozen, will CC co. like BoA & Citi pull another to review or they may turn down / pending?

That depends, you may be able to pull from a different credit bureau, or your application may be denied entirely.

Dan/Grant – I froze EQ and EX and BofA pulled from TU for my Alaska personal app. BofA already pulled TU for the biz app. I’m in CA. YMMV.

Thanks for the datapoint, MD. Glad your BofA apps went through fine.

Sweet

Super sweet!

Hi Grant: will you share with us your plan for making the minimum spends?

I don’t do much MS anymore, but I can do $3200/month with my Nationwide Visa Buxx cards, then everyday spend should cover the rest. No secrets here.

Thanks!

You’re welcome. Have a great day, Kathy!

Grant, How do you liquidate funds from Nationwide VISa BUXX cards ? Can you load them with credit card ?

Thanks.

You can load the Nationwide Visa Buxx cards with credit card and unload at ATMs or by buying MOs.

Thank you

Pingback: Reminder: OC Travel Hackers Meetup on Saturday July 2 (12-2pm) at Tustin District In-N-Out | Travel with Grant

Pingback: Poll Question: Meet Minimum Spend or Redeem Citi Thank You Points? | Travel with Grant

Pingback: My Detailed Credit Card Activation Setup Routine & Checklist | Travel with Grant

Pingback: Bank of America Amtrak, Alaska Airlines Biz & Barclays Lufthansa Credit Card Art and Info | Travel with Grant

Pingback: Citi AT&T Access More, US Bank Korean Air & Comenity Virgin America Credit Card Art and InfoTravel with Grant | Travel with Grant

Are we living in the same world? What is Nationwide VISa BUXX cards. And unload at ATM or by buying MO’s. I gave up watching sports trying to figure out what you are talking about. Can you clue me in, very slowly. Is this code-speak 101?

Pingback: Manufactured Spending: Legal Credit Card Bonus Travel Hack? | Student Loan Hero

Pingback: Citi AT&T Access More Credit Card: 10,000 Bonus Thank You Points Post Before $95 Annual Fee