Republished on 5/18/25 since AMEX announced that American Express Membership Rewards Point transfers to Hawaii Airlines will end on June 30, 2025.

Good afternoon everyone, I hope your week is going well. In this post, I will show you how we moved Alaska Airlines Miles into Hawaiian Airlines Miles, transferred those miles between Hawaiian Airlines accounts, and then transferred those miles to Alaska Airlines. We wanted all of our miles to be in a single account (my Alaska Airlines account) to make award booking easier since we would book all of our award tickets from a single account. Transfers between Alaska Airlines and Hawaiian Airlines were free and instant. Here are the steps we did…

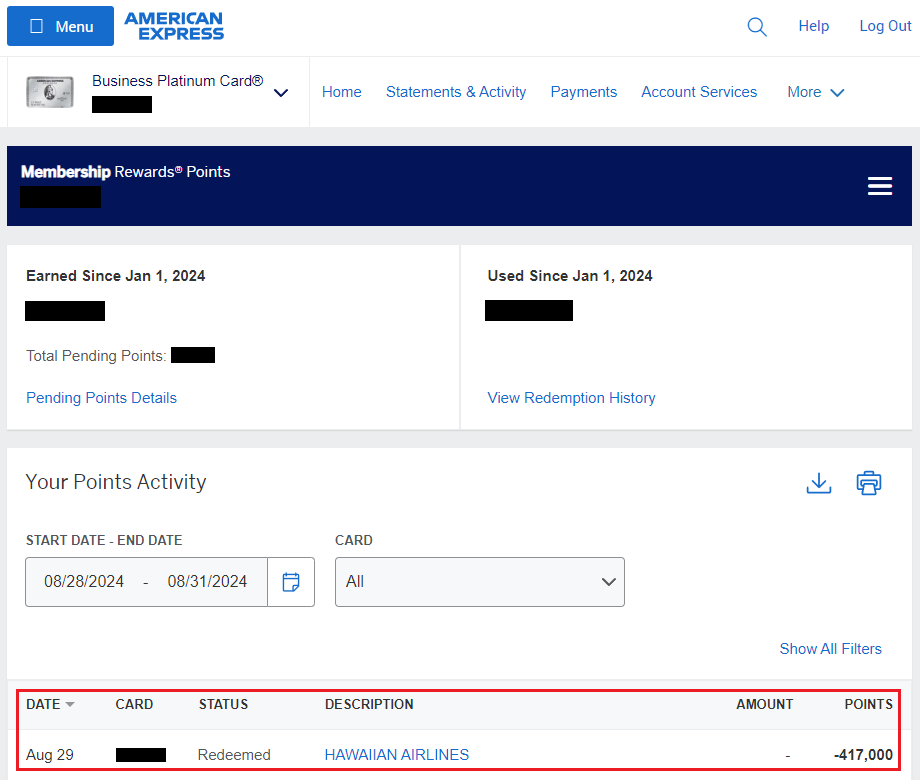

A few weeks ago, Laura and I transferred large chunks of American Express Membership Rewards Points into Hawaiian Airlines Miles when AMEX had a 20% transfer bonus to Hawaiian Airlines. I transferred 417K AMEX MR Points into 500K Hawaiian Airlines Miles on August 29.