Good morning everyone, I hope you all has a great weekend. A few weeks ago, I applied for 8 new credit cards during my App-O-Rama. Here are the 8 credit cards and sign up bonuses that I applied for (not in this particular order). Unfortunately, my App-O-Rama skills are not as good as they used to be and I was (ultimately) declined for most of these credit cards.

- Bank of America Alaska Airlines Visa Signature Credit Card: 30,000 AS Miles + $100 statement credit after spending $1,000 in 3 months ($75 annual fee)

- Bank of America Virgin Atlantic Credit Card: 75,000 VA Miles after spending $12,000 in 6 months ($90 annual fee)

- Bank of America Amtrak Rewards Credit Card: 30,000 Amtrak Points after spending $1,000 in 3 months ($79 annual fee)

- US Bank Altitude Reserve Credit Card: 50,000 FlexPoints ($750 in travel credit) after spending $4,500 in 3 months ($400 annual fee)

- Wells Fargo Visa Signature Credit Card: 20,000 Go Far Reward Points after spending $1,000 in 3 months ($0 annual fee)

- First Bankcard Best Western Credit Card: 50,000 Points after spending $1,000 in 3 months ($59 annual fee, first year waived)

- Synchrony Bank Cathay Pacific Credit Card: 50,000 CX Miles after spending $2,500 in 3 months ($95 annual fee)

- Barclays Wyndham Rewards Credit Card: 45,000 Wyndham Points (3 free nights) after spending $2,000 in 3 months ($75 annual fee)

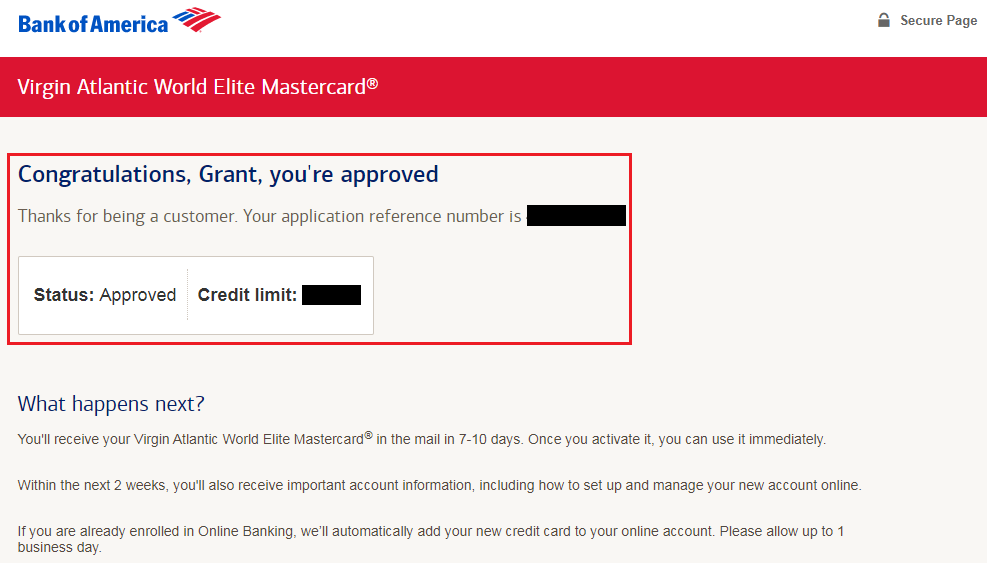

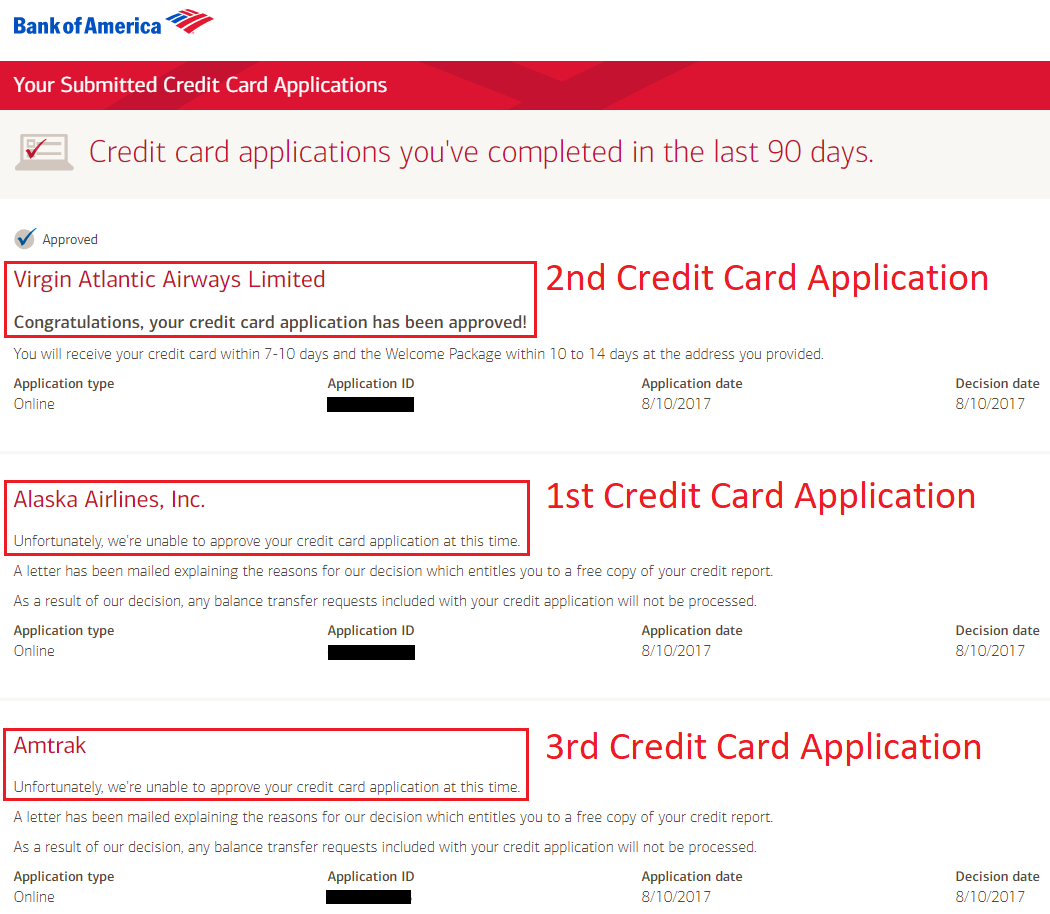

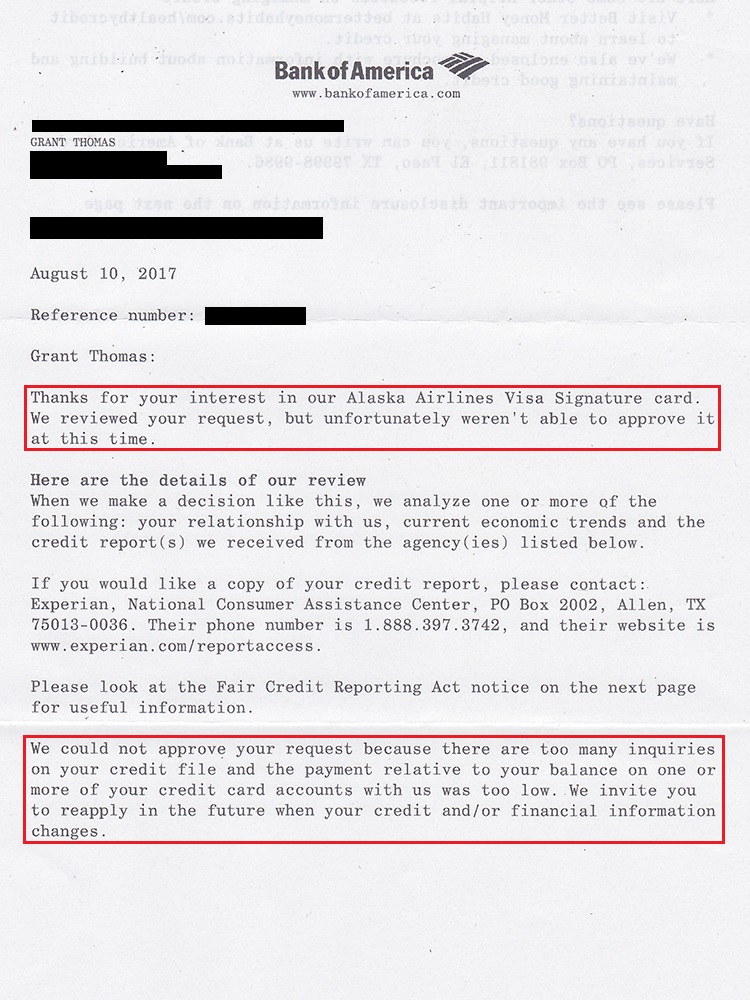

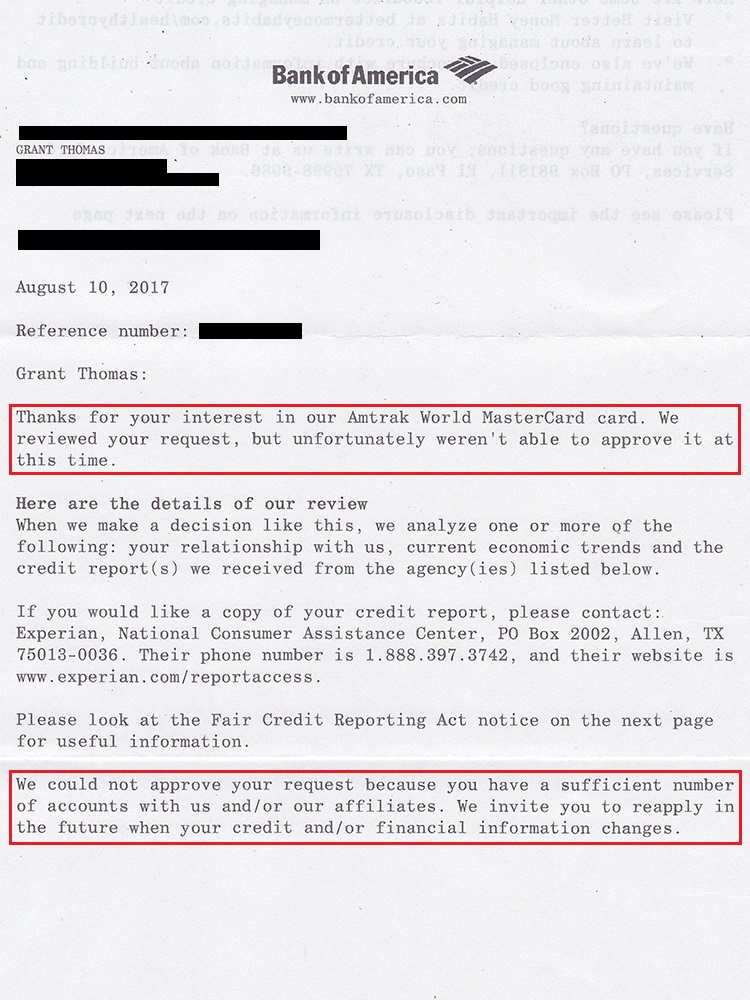

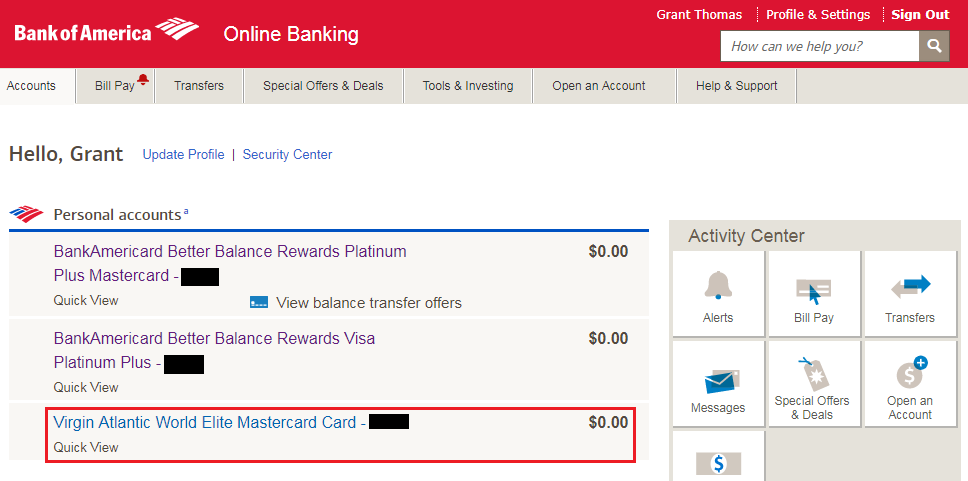

Long story short, I applied for 3 Bank of America credit cards, starting with the Bank of America Alaska Airlines Visa Signature Credit Card. I recently closed my previous Bank of America Alaska Airlines Visa Signature Credit Card a few weeks ago, so I was ready to apply again and earn more Alaska Airlines miles. Unfortunately, my application went to pending. Since I was not immediately declined, I decided to apply for a Bank of America Virgin Atlantic Credit Card. Surprisingly, I was instantly approved for that credit card with a pretty small credit limit. With that success, I decided to apply for a Bank of America Amtrak Rewards Credit Card. Unfortunately, that application went to pending as well. 1 out of 3 instant approvals was not bad. I was hopeful that the 2 pending applications could be approved with a short reconsideration call.

A few days later, I checked the status of my Bank of America credit card applications and only my Virgin Atlantic credit card application was approved, the two other credit card applications were declined. It was strange that my second credit card application was approved, but the first and third application were declined. But that is Bank of America for you.

Here are my two credit card declined letters from Bank of America. It is also funny that the reasons for the declined credit card applications differ.

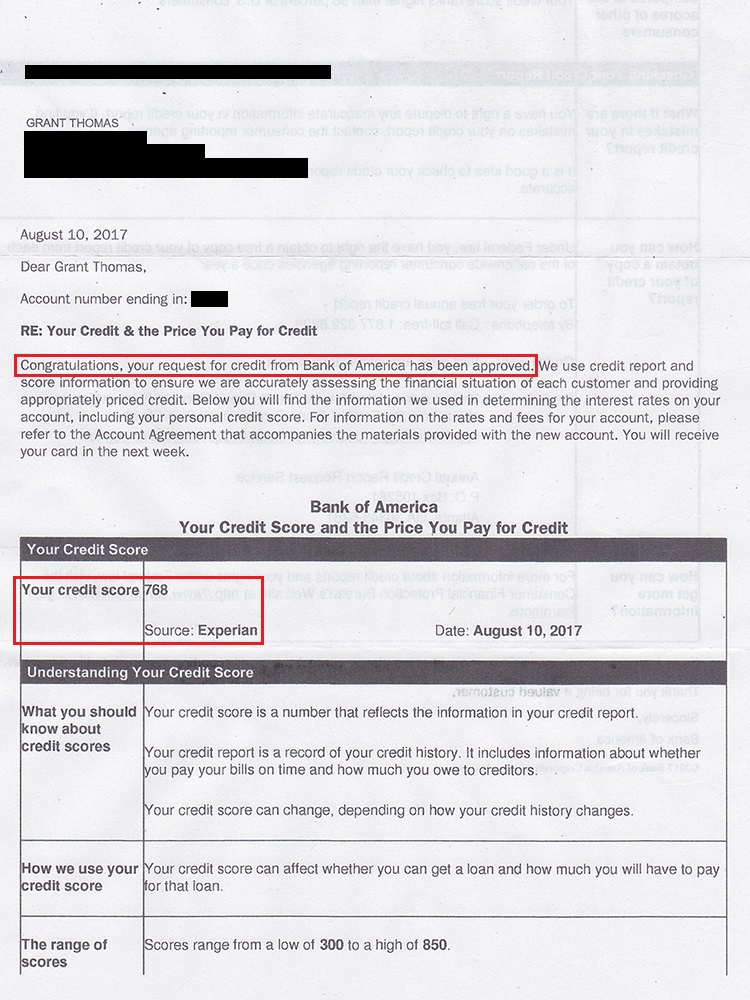

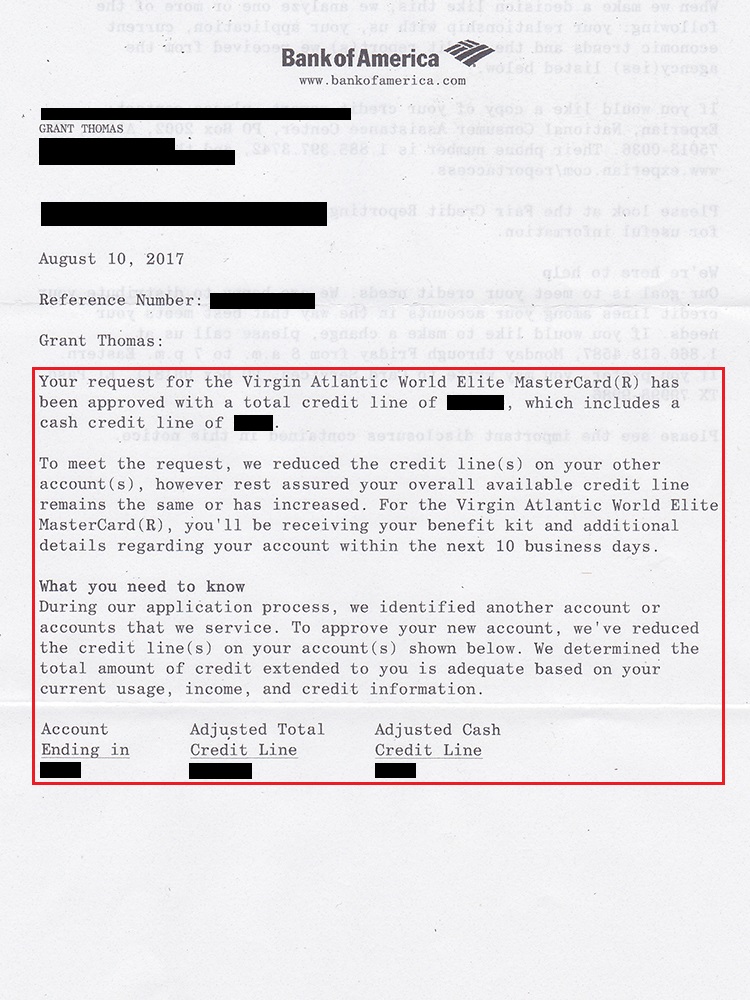

Here is my Virgin Atlantic credit card approval letter. I received another letter from Bank of America stating that they had to move credit from one of my other Bank of America credit cards in order to approve me for the Virgin Atlantic credit card.

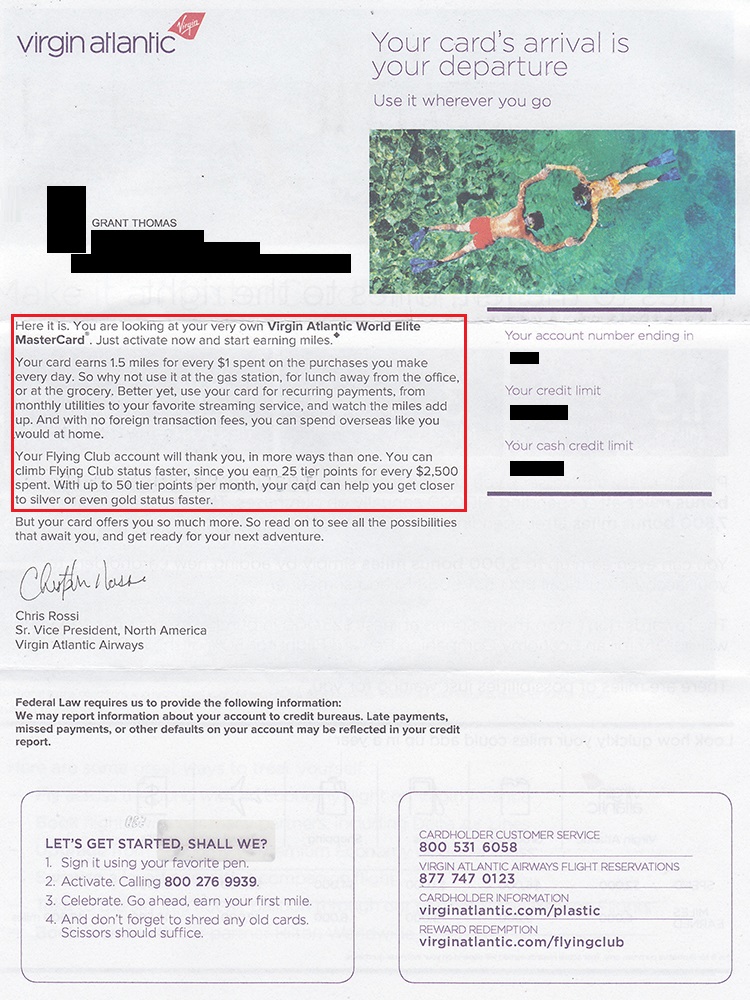

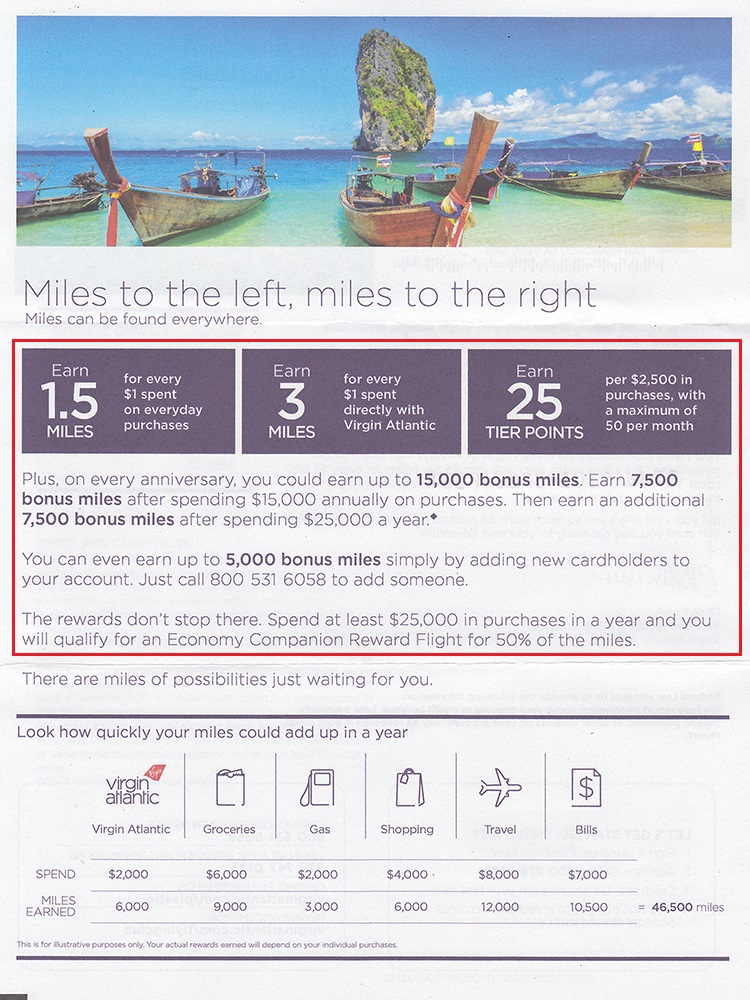

Here is the Virgin Atlantic credit card welcome letter.

Here is the front and back of my new Bank of America Virgin Atlantic Credit Card.

After activating the new credit card, the credit card automatically showed up in my Bank of America online account.

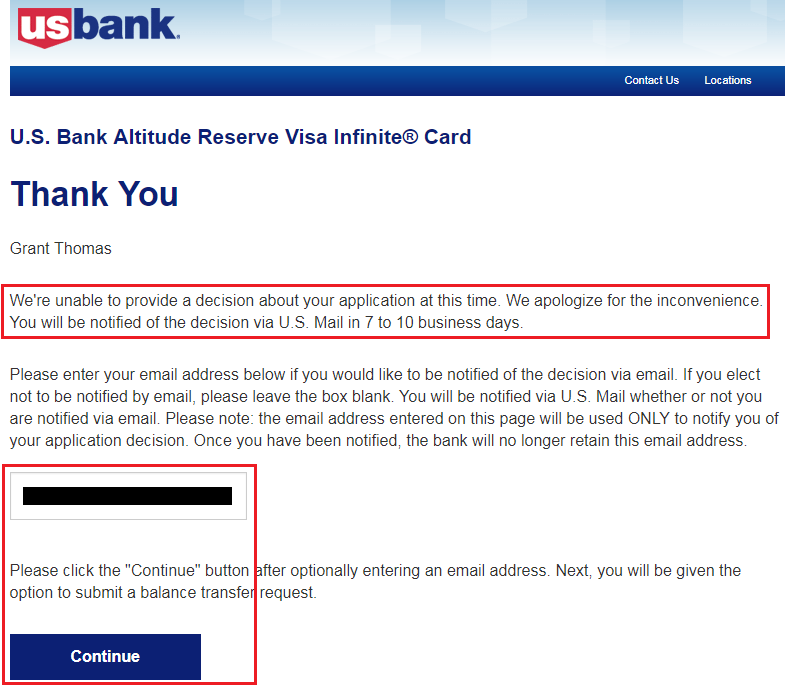

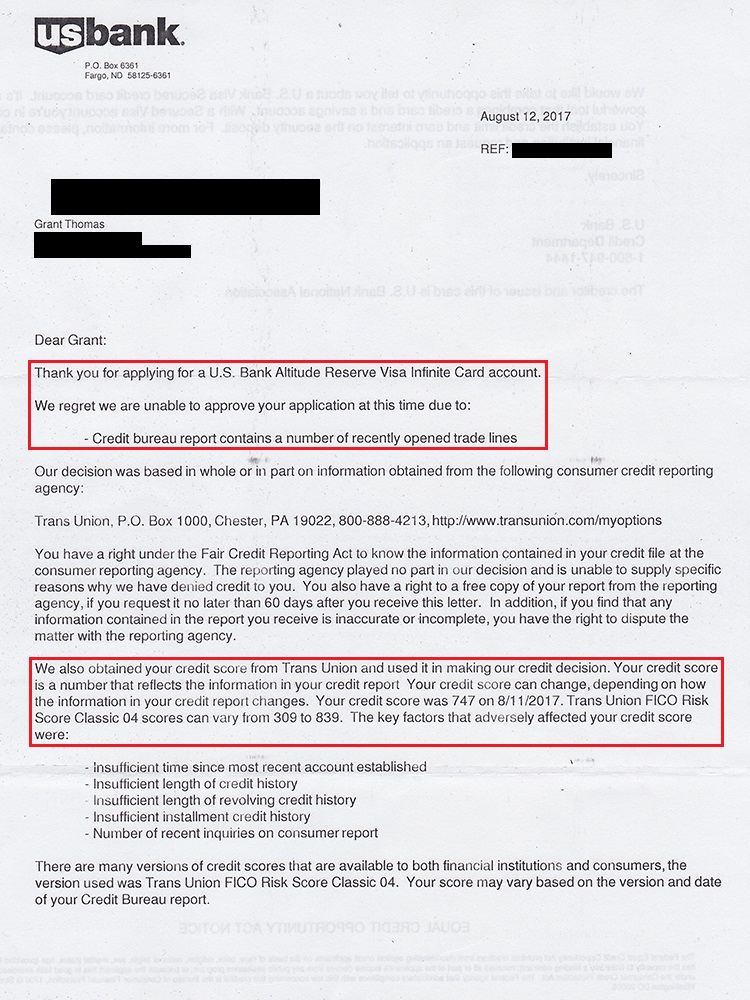

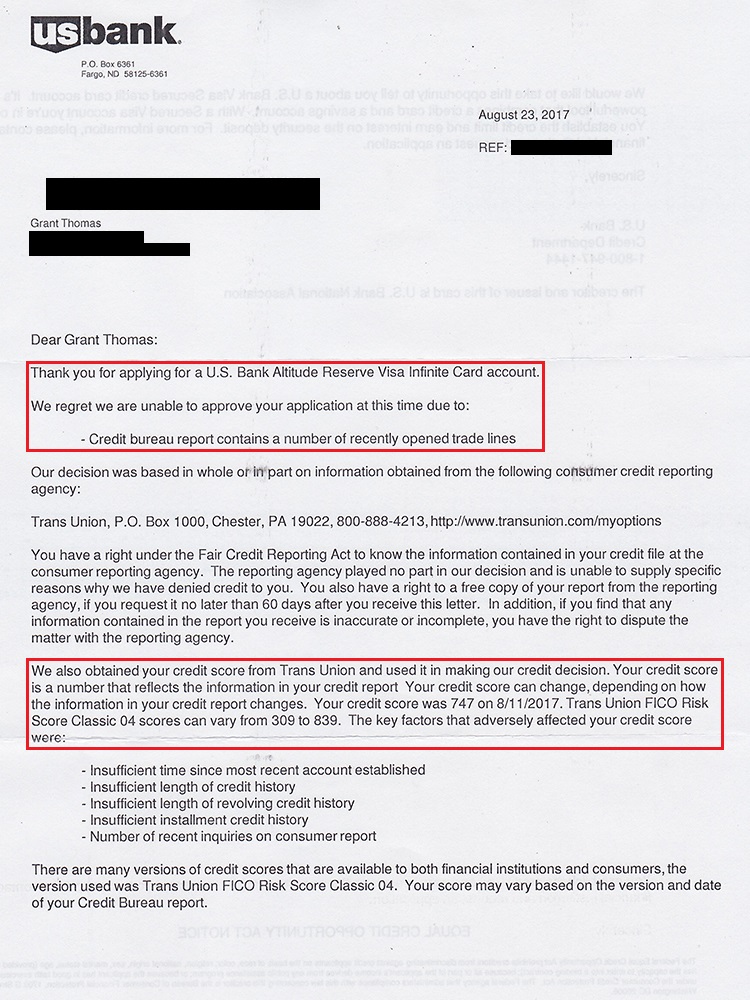

Moving on, I also applied for a US Bank Altitude Reserve Credit Card. Unfortunately, I got a pending decision on that application too.

A few days later, I received the denial letter from US Bank. I then called the US Bank reconsideration department and asked if they would reconsider my application if I moved some of my credit from my other US Bank credit cards. I have 2 other US Bank FlexPerks credit cards, so I would be willing to move credit from those credit cards. Unfortunately, that plan didn’t work either and I received the same denial letter a few days later. I plan on redeeming my 20,000+ US Bank FlexPoints for a ~$400 airline ticket before the December 31 devaluation. I will try again for this credit card in a few months.

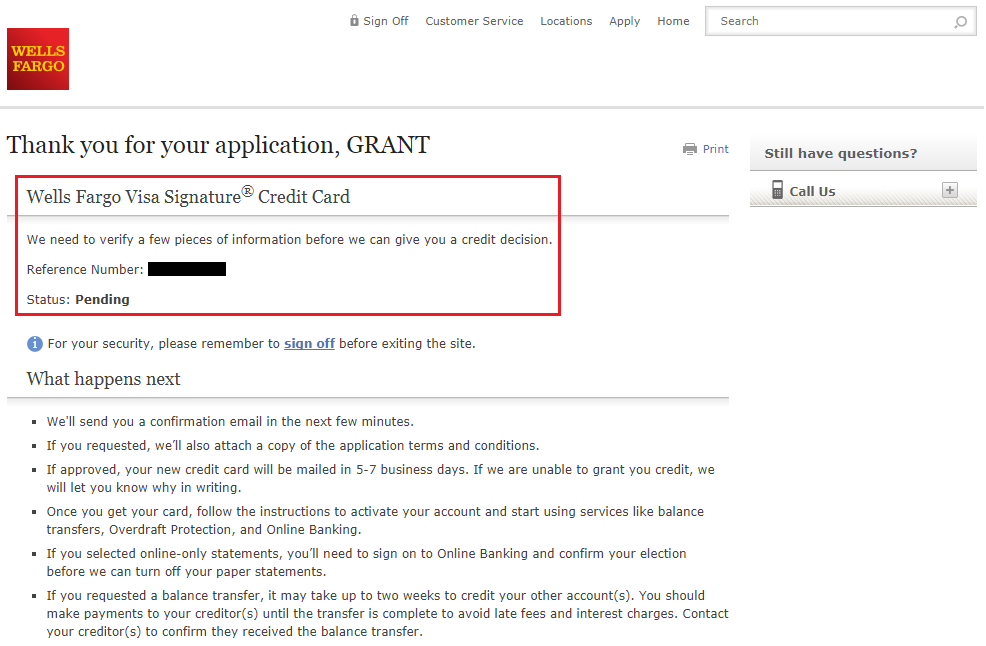

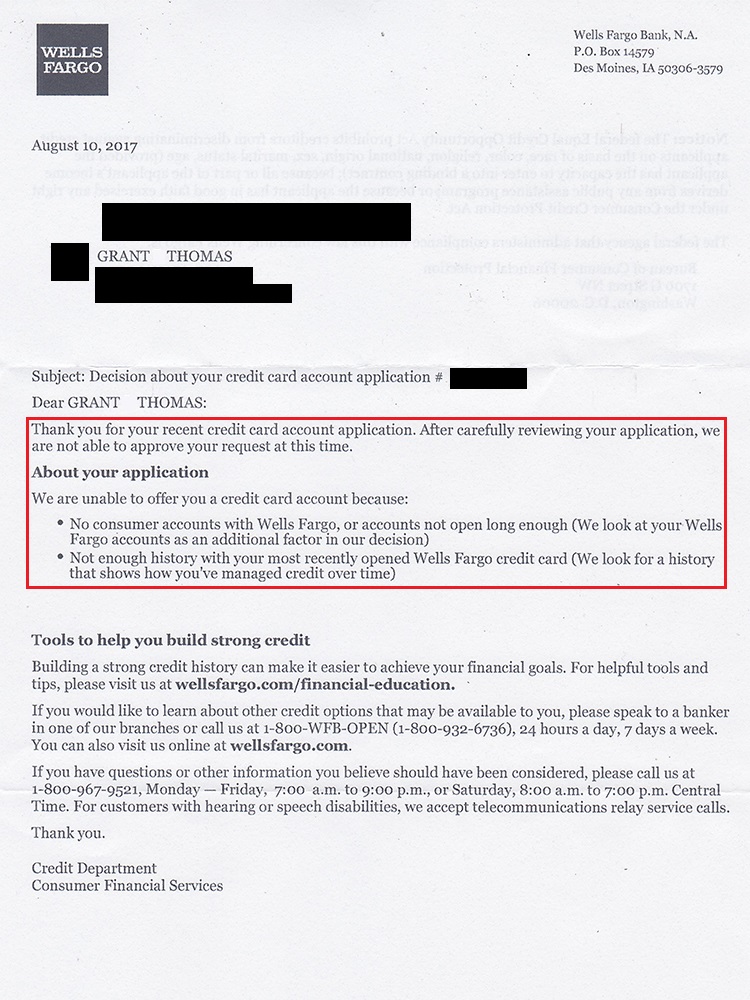

I also applied for a Wells Fargo Visa Signature Credit Card and received another pending decision. A few days later, I received a denial letter from Wells Fargo. I called the Wells Fargo reconsideration number and asked if they could reconsider my application if I moved credit from my other Wells Fargo credit card. Unfortunately, that option was turned down and I gave up on getting a second Wells Fargo credit card.

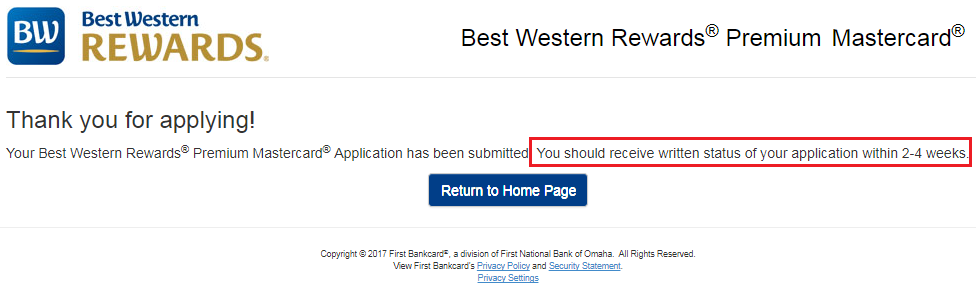

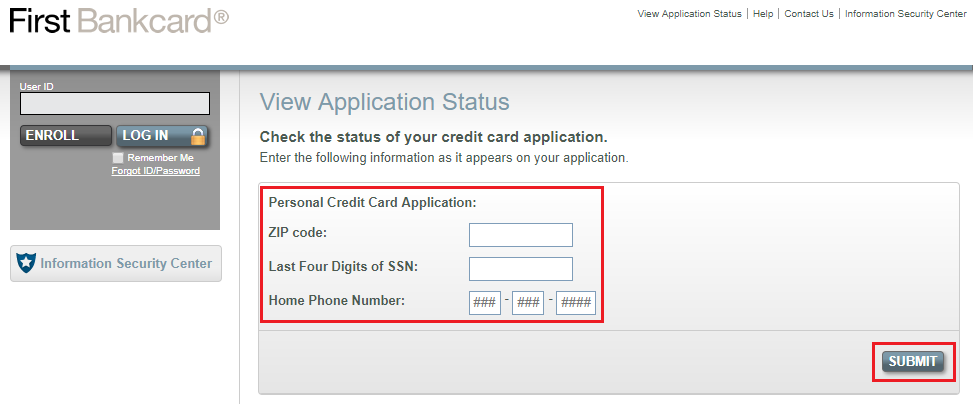

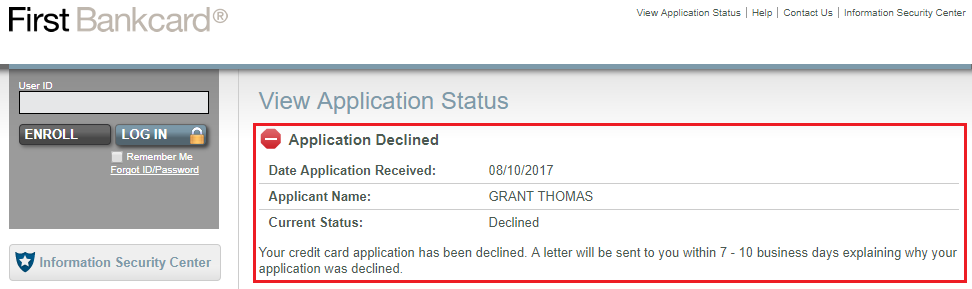

I also applied for a First Bankcard Best Western Credit Card. I want to get a credit card for every hotel chain, so that when I travel, I have as many hotel options as possible. Unfortunately, my application went pending. A few days later, I received an email regarding my credit card application status. That sounded like good news, so I clicked on the link to check the status of my credit card application.

I entered my personal information and clicked the Submit button. Unfortunately, I was declined for the Best Western credit card. What has my life come to?

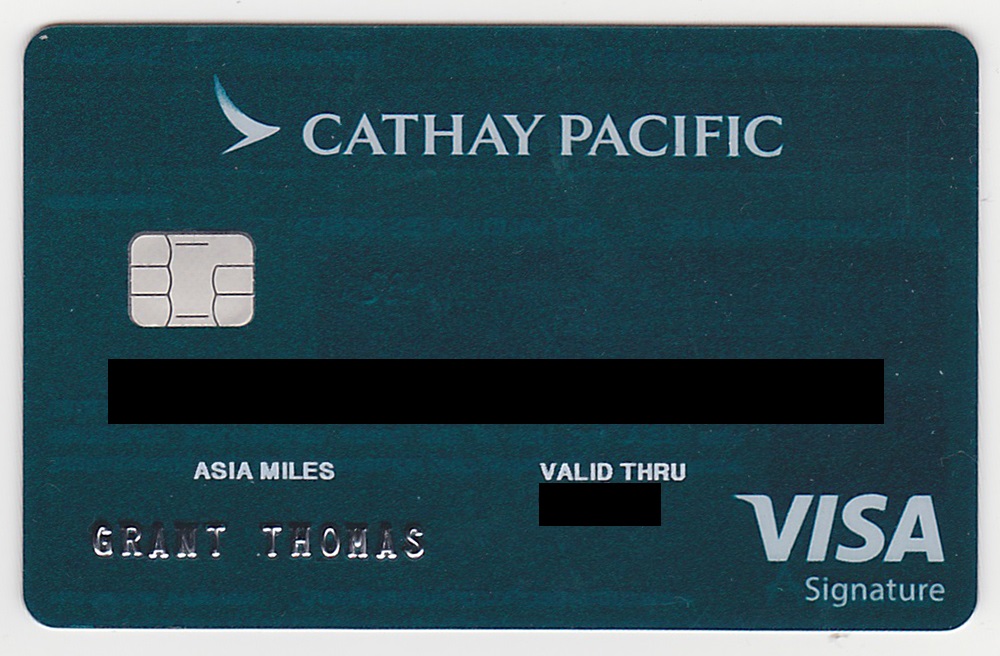

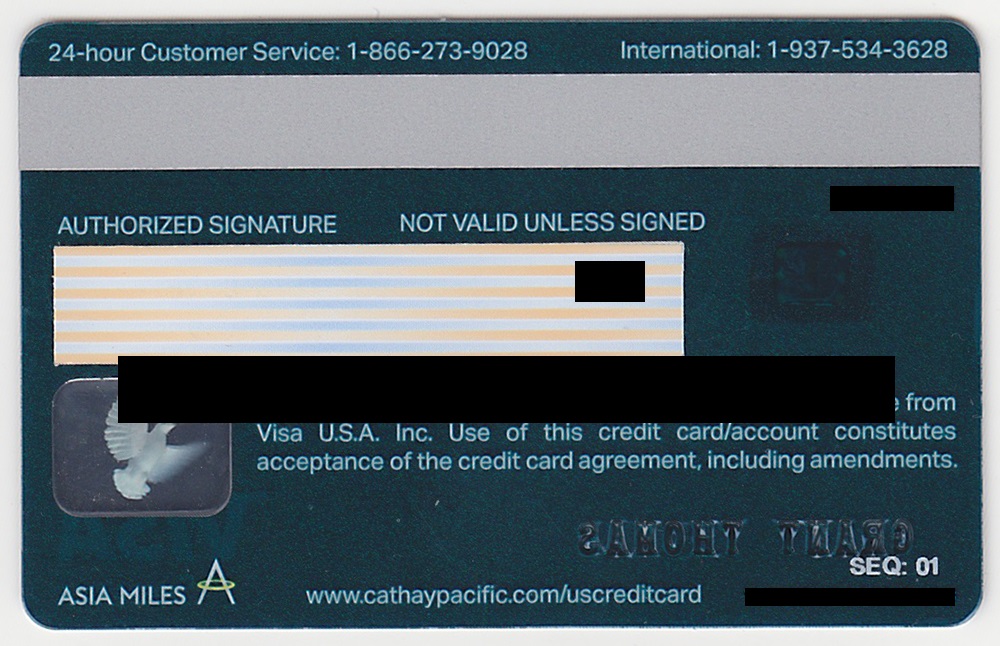

I also applied for the Synchrony Bank Cathay Pacific Credit Card. Luckily, I have good news about that application. I was approved and wrote this blog post: Cathay Pacific Visa Signature Credit Card Application Process, Card Design & Welcome Kit.

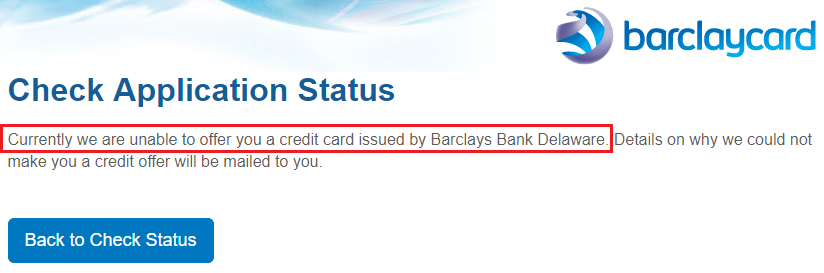

Last but not least, I also applied for the Barclays Wyndham Rewards Credit Card. That credit card application was interesting and worthy of it’s own blog post, so check back tomorrow to see the result of that credit card application.

If you have any questions about my App-O-Rama, please leave a comment below. Have a great day everyone!

Did you check the US Bank page to see if you were pre-approved for the Altitude? I’m curious how accurate it is since it is showing me as pre-approved. Also, how many Barclays cards did you have open and how large were the credit limits? When was the last time you applied for or closed a Barclay’s card?

I did not check with US Bank to see if I was approved for any credit cards. I had three open Barclays credit cards before applying for my fourth credit card. Credit lines were between $5,000 and $10,000 each. My last Barclays credit card application was three months ago, and I haven’t closed any Barclays credit cards in over a year.

What number did you call for BofA reconsideration?

I tried all of these Bank of America reconsideration phone numbers: https://www.doctorofcredit.com/credit-cards/credit-card-reconsideration-line-telephone-numbers/#Bank_of_America_Credit_Card_Reconsideration

Tough times for our hobby…

Sadly, yes :(

So how many credit inquiries did you have in the last 24 months?

And just how many credit card inquiries are “too many” for B of A? I had a friend with a 775 score he got turned down for the Spirit Airlines card. But then he applied for Barclay’s AA card and was approved for over $5000.

I want to apply for the Bank of America Premium Rewards but I want to get approved immediately. Right now I’m at 12/24. But in one more month I’ll be at 10/24 so I’ll apply at that time and get approved.

I probably have 20+ inquiries over the last 24 months. I had 3 other Bank of America CCs before this AOR. Good luck on your BofA Premium Rewards CC application :)

Curious, was this your lowest approval rate of all your A-O-Rs ?

Definitely. I usually go 6 for 7 or 4 for 5, but this is my lowest success rate to date. My last App-O-Rama in March was a little better: http://travelwithgrant.boardingarea.com/2017/04/06/whats-on-my-mind-tucson-orange-county-san-diego-and-my-march-app-o-rama-results/

shoulda tried for the biz boa AS. i had more luck with that one than personal of late.

I already have a BofA AS Biz CC, but I wanted a matching BofA AS personal CC :)

Dang! Those are brutal results. Nice to see a blogger post it though. My apps recently have also trended a lot more towards uncertainty and denials so some cards I don’t even apply for when I read lots of declined DP’s. I went for the new BOA anyway and – declined even after recon. I’m also like 30/24 so the options are slim. Maybe the forced slowdown for those of us who’ve been around awhile will help us Long-term be able to get better cards or qualify for chase 5/24 again. So slow though! I hate spending on my cc’s if there’s no sign-up bonus for it. Who wants 2-5pts/$1?!?!

I agree, when I am not working on meeting minimum spend, I am sad. Good luck to both of us on our next App-O-Rama :)

US Bank is brutal. I’ve been declined 4 times for AR. Recon did not help and neither did applying at branch which supposedly has different set of folks reviewing apps. Best part is they keep sending me pre-qualified for other cards. Their pre-qualification doesn’t mean much.

US Bank likes to toy with us travel hackers and our beloved credit card rewards. How many other US Bank credit cards do you have? I have 6 other US Bank credit cards.

I’ve had 4 + checking. I recently threw away 2 FP cards but that didn’t help either lol. Funny thing is I would not churn this card and I would even buy a Samsung device for this card.

Haha, I think even if you had 0 US Bank credit cards, you might still be out of luck getting approved :(

Hi Grant! Hope you’re well.

I would tread very lightly with USB since you have existing accts. They shutdown all of my cards just for reconning. Brutal is an understatement.

https://www.flyertalk.com/forum/28243997-post117.html

Oh dang, that is rough. I’ll be very careful.

Thanks for the App-o-rama insight…seems the approach is throttled with all the changes credit card issuers have implemented #goodolddays…but I’ve got couple Qs…1)do you know the approval rate of your previous App-o-ramas??? 2)how much does Other Banking Product Relationships (Direct Deposit w/100k+ Income, Mortgage, HELOC, Auto Loan, etc.) affect your ability to get approved??? Another good post Grant

I don’t have an exact number for you, but I am usually in the 70-90% approval rate on previous App-O-Ramas.

I don’t think having other banking products makes much difference, unless you apply in branch with certain bankers.

Pingback: Delta Diamonds, Midwest Breweries, Spirit & World of Hyatt CEOs, Thought Leader Twitter Fights - TravelBloggerBuzz

why havent you posted the barclaycard update

Because I am slow :(

I have it in draft mode though :)

Pingback: App-O-Rama Update: Did I Get Approved for the Barclays Wyndham Rewards Credit Card?

Pingback: Redeeming Abandoned Credit Card Rewards For Increased Returns

Hi Grant,

First and foremost, I appreciate your blog and I admire what you do. Im very new to this AOR thing and im very much interested in applying for rewards CCs. At the moment i hv only 3 inquires with 3 CCs. Cap1 platinum, Cap1 business spark, and NFCU rewards. I just became aware of being able to apply for multiple CCs with one pull but, i dont know where to start and how to do it. I am aware of the Chase rule as well (5/24) so, i was thinking that my next applying opportunity should be with them. If the time permits, will you please explain to me how to apply for multiple CCs with only 1 ding to my credt? Thank you…

Hi John, do you know when you applied for those 3 credit cards? If you applied more than 2 years ago, that won’t affect your 5/24 score. Also, combining credit pulls only applies when you apply for multiple cards from the same bank. If you apply for multiple cards from different banks, your credit pulls will not be combined.