Good afternoon everyone. As part of my “Keep, Cancel or Convert?” series, I like to evaluate and reevaluate credit (and charge) cards to make sure they still deserve a spot in my wallet. Last month, the $595 annual fee posted on my American Express Business Platinum Charge Card. I have read a few recent blog posts about whether to keep or cancel the AMEX Platinum Card (from Frequent Miler and Your Mileage May Vary), so I wanted to share my view on this card.

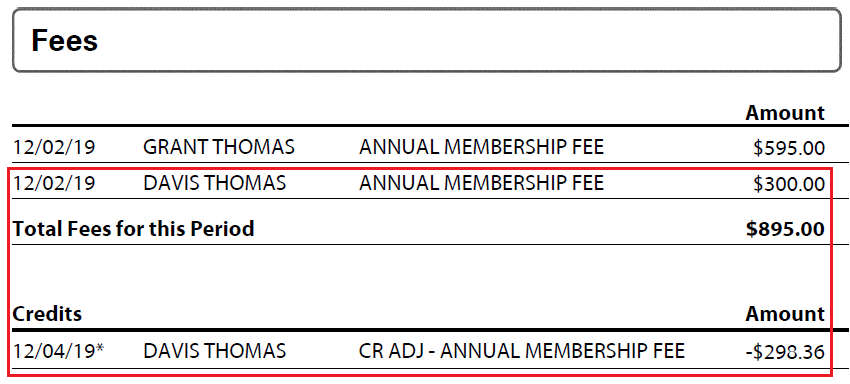

First things first, I added my brother as an authorized user so he could access the Centurion Lounges, Escape Lounges, and Priority Pass Lounges (no more restaurants). He used the card a few times, but he decided that the $300 annual fee was not worth it to him. My statement closed on December 2, I called AMEX on December 2 or 3, and said I would like to downgrade my brother’s AMEX Business Platinum to a no annual fee AMEX Business Green (which comes with no perks, other than the $100 Global Entry credit). AMEX processed the downgrade request right away, but did not provide a full refund (I was charged $1.64 for those 2 days). Seems kind of petty to me, but let’s see if I decided to keep, cancel, or convert my AMEX Business Platinum.

I logged into my American Express online account and went to the benefits page for my AMEX Business Platinum. I will go through the top 12 “benefits” and assign a value to each item:

- Shop Dell with Business Platinum: $200 statement credit to shop at Dell ($100 for the first 6 months and another $100 for the last 6 months). Dell sells a lot of third party electronics that are around $100, so I usually wait for a cash back shopping portal to offer bonus cash back at Dell, then I make the $100 purchase. I then sell the item on eBay for around $95 before shipping and eBay / PayPal fees. Conservatively, I make about $170 from this benefit.

- 1.5X Membership Rewards Points: You need to make a purchase of $5,000 or more to trigger the 1.5x, but I would rather use my American Express Blue Business Plus Credit Card to earn 2x on all purchases. This benefit has no value to me. AMEX should really change the benefit to 2.5x.

- Get 5X on Flights and Prepaid Hotels: For flights, I tend to use award miles, use Chase Ultimate Rewards Points or Citi Thank You Points, use the Visa Infinite Air Benefit, or use my Chase Sapphire Reserve Credit Card for the travel protections. For hotels, I tend to book directly on the hotel’s website and use a co-branded hotel credit card like the American Express Hilton Aspire Credit Card. This benefit has no value to me.

Here are the next 3 benefits:

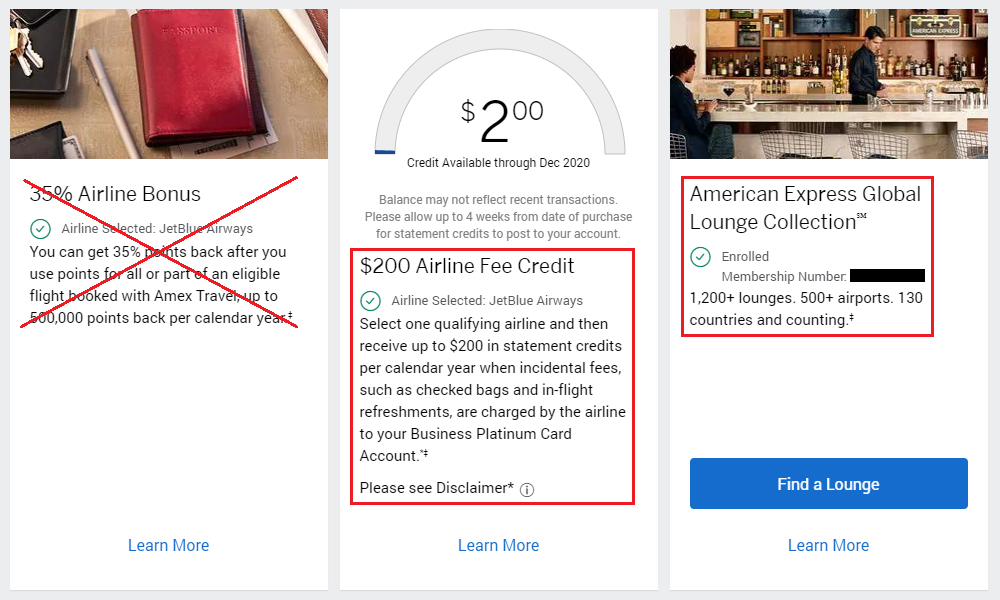

- 35% Airline Bonus: I only used this benefit once last year and it was a real pain. I wrote about My Disappointing Experience with AMEX Business Platinum 35% Membership Rewards Point Rebate. The whole process took a really long time and is not worth the headache to me. This benefit has no value to me.

- $200 Airline Fee Credit: AMEX has made it harder to use this benefit, since airline gift cards will no longer trigger the credit, but I was able to pay for 2 “Even More Space” seats on an upcoming SFO-BOS JetBlue flight that cost $198 total. I value this benefit at 75% of face value, so this benefit is worth $150 to me.

- American Express Global Lounge Collection: I work in San Francisco, so when I fly, I can swing by the SFO Centurion Lounge or the OAK Escape Lounge before my flights. I also have access to Delta Sky Club Lounges when I fly on Delta. I also get access to Priority Pass (lounges only), but I have a much better Priority Pass Membership with my JPMorgan Chase Ritz Carlton. Putting a value on this unlimited lounge access is really tricky. I looked at all my trips from 2019 and added up the number of visits to each lounge and gave an estimate on how much value I got from each lounge visit: Centurion Lounges (11 visits @ $15/visit = $165), Escape Lounges (5 visits @ $10/visit = $50) and Delta Sky Club Lounges (2 visits @ $5/visit = $10). The total comes to $225. Roughly 50% of my Centurion Lounge visits and Escape Lounge visits were with my brother and wife, so 50% of $215 = $107.50. When I combine the $225 + $107.50, I get $332.50 in value from this benefit.

Here are the next 3 benefits:

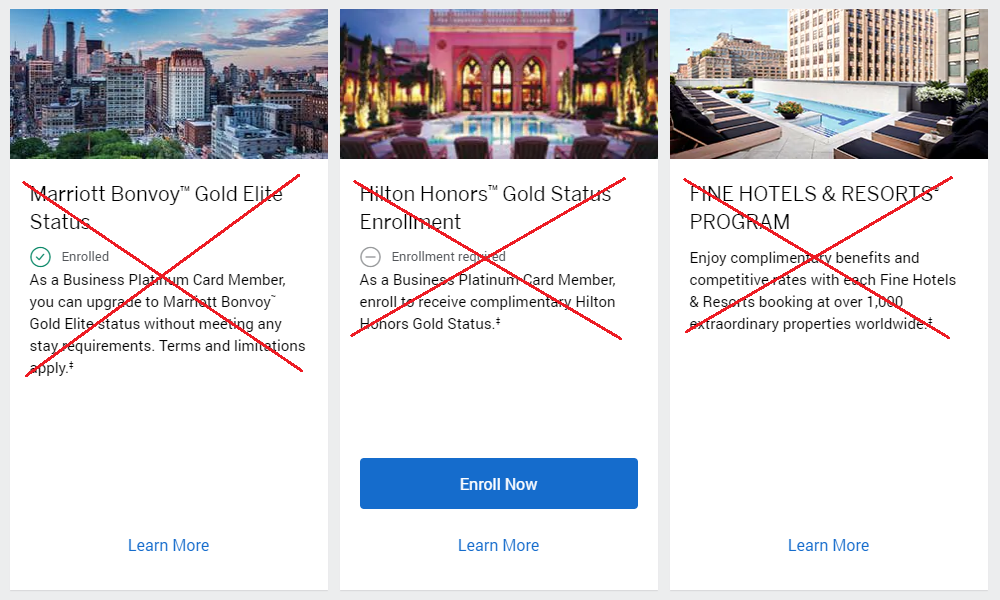

- Marriott Bonvoy Gold Elite Status: I get Marriott bonvoy Gold Elite Status for free from my JPMorgan Chase Ritz Carlton. This benefit has no value to me.

- Hilton Honors Gold Elite Status: I get Hilton Diamond Elite Status from my AMEX Hilton Aspire. This benefit has no value to me.

- Fine Hotels & Resorts Program: I have read about this benefit and know that a lot of people like the discounts and perks from this benefit, but I haven’t found a use for this benefit yet. This benefit has no value to me.

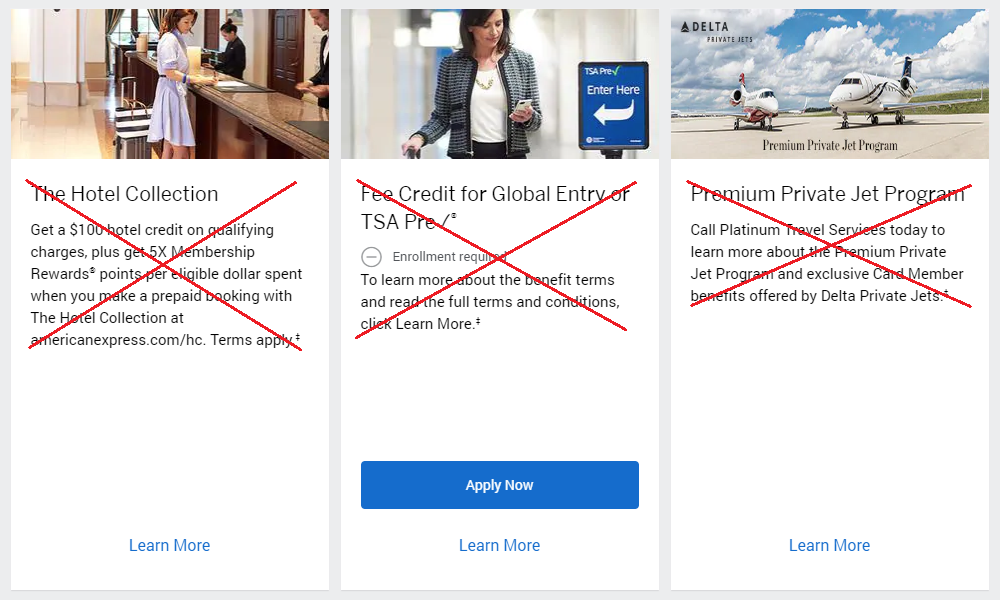

Here are the next 3 benefits:

- The Hotel Collection: I’m not really sure what this benefit is, but I have definitely not used it. This benefit has no value to me.

- Fee Credit for Global Entry or TSA PreCheck: I have several credit cards that provide this same benefit and I just renewed my Global Entry membership for another 5 years. This benefit has no value to me.

- Premium Private Jet Program: I am not rich or bougie enough to fly on premium jets. This benefit has no value to me.

There are several more benefits available, but they have no value to me either.

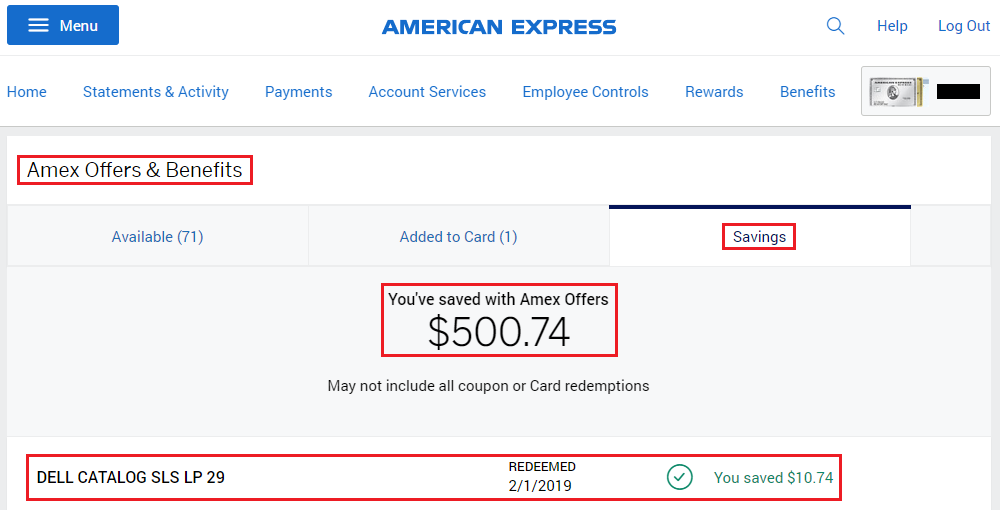

I then looked at how much I earned from AMEX Offers on my AMEX Business Platinum. I went to the AMEX Offers section and clicked the Savings tab. At the top of the section, it says I saved $500.74. This number is a lifetime total on my AMEX Business Platinum, not just from last year. I didn’t have to scroll very far to find the one and only AMEX Offer that I used on my AMEX Business Platinum last year. Last February, I earned $10.74 in cash back from a Dell AMEX Offer that provided 10% cash back.

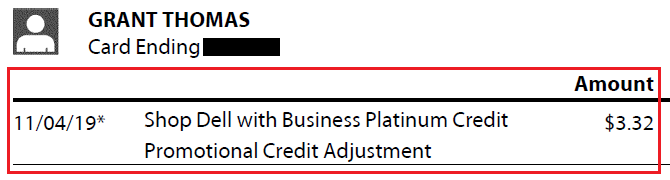

Unfortunately, I later received a bill from AMEX for $3.32 since I “gamed the system” by stacking the Dell AMEX Offer with the Shop Dell with Business Platinum benefit. This also felt very petty to me.

Let me add up the total value I earned/received in 2019 from my AMEX Business Platinum:

- Shop Dell with Business Platinum: $170

- $200 Airline Fee Credit: $150

- American Express Global Lounge Collection: $332.50

- AMEX Offers minus $3.32 Fees: $7.42

- Total of Benefits: $659.92

- Total minus $595 Annual Fee: $64.92

Wow, after all the calculations, I only came out positive by $65. I thought I got a lot more value out of my AMEX Business Platinum last year. I really wish AMEX would introduce a Centurion Lounge and Partner Lounges card for $250 annual fee, then I could just pay for the benefit that is most important to me. Do you agree or disagree with my calculations? Share your thoughts in the comments section. If you have any questions about the AMEX Business Platinum, please leave a comment below. Have a great day everyone!

So what are you going to do? Keep, cancel, or convert? Based on above math, I would cancel (which I plan to myself on the card when fee comes due in April). I’d rather not fork over a guaranteed outlay of $595 for a hypothetical $660 in potential future value.

Sorry, my conclusion was not very clear. I plan on keeping this card open. I really like the Centurion Lounges and Escape Lounges (it makes my trips more enjoyable). Another aspect that I did not write about, is that I earn referral bonuses from this card (I believe up to 55,000 Membership Rewards Points per year) and since this is a business card, I add it as a business expense on my taxes. I can definitely see your point of view. Maybe next year I will feel differently, I will reassess next year.

Grant, have u called & got a retenntion offer? a fee folks on FT posted that a 50k pts had been offered

I didn’t call in for a retention offer. I probably spent $500 or less on my AMEX Business Platinum and was more concerned about downgrading my brother’s authorized user card.

After you crunched the numbers, it seems logical to cancel the card. Doesnt seem like you’re getting much value on that card. Have you made up your mind about Sapphire Reserve? I’m going to cancel mine before the new annual fee hits. $550/year with no additional benefits for me doesnt make sense. I’m going to transfer all my points to my other chase card and keep that as a UR hub for now. I will open the Sapphire Reserve again if I qualify for the bonus points-60k or higher.

Even though I’m not getting exceptional value from my AMEX Business Platinum, I plan on keeping the card. I just love going to the Centurion Lounges before flights, it just makes my trips more enjoyable. Hard to put a value on that. I also plan on keeping the Chase Sapphire Reserve, even though I don’t love the new changes. Read my recent post about keeping the CSR: https://travelwithgrant.boardingarea.com/2020/01/09/my-chase-sapphire-reserve-credit-card-plan-for-2020/

Pingback: Keep, Cancel or Convert? US Bank Altitude Reserve Credit Card ($400 Annual Fee)

Can I convert my business platinum to personal platinum?

I do not think you can convert from a business CC to a personal CC, or vice versa. You would need to apply for the new CC.