Category Archives: Credit Cards

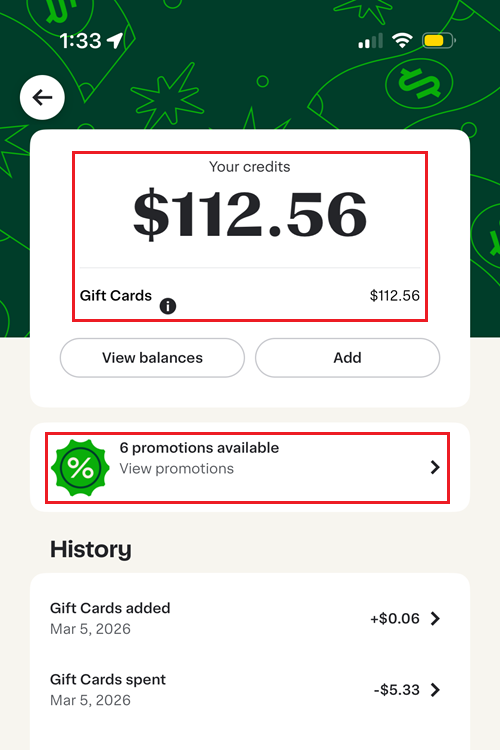

Maximize Instacart Savings with $10 / $20 Chase Credits & Discounted Gift Cards

Good afternoon everyone, I hope your weekend is going well. I’ve been a big fan of Instacart ever since Chase added $10 and $20 Instacart credits to many of their cobranded credit cards in May 2025. Before then, I had never used Instacart because I assumed the grocery prices were significantly higher than shopping in-store and I actually enjoyed going to my local grocery stores. Between my wife and I, we currently have 8 qualifying Chase cobranded credit cards, which provide $80 – $100 in Instacart credits each month. When you combine those credits with discounted Instacart gift cards, it becomes possible to have groceries delivered to your front door for a fraction of the normal cost.

Redeeming Wells Fargo Rewards Points: My Plan of Attack

Good afternoon everyone, happy Friday! This morning, I was looking at my Wells Fargo account and trying to decide what my long-term strategy (aka my plan of attack) should be for my stash of 62,320 Wells Fargo Rewards Points. If you were a former Bilt Card 1.0 member, then there is a good chance your card was converted to the no annual fee Wells Fargo Autograph Credit Card. I also currently have the $95 annual fee Wells Fargo Autograph Journey Credit Card. Before I share my strategy, let’s quickly review the bonus categories and transfer partners for the Wells Fargo Rewards program.

Continue reading

Breaking Up with My AMEX Coupon Book: No More Monthly, Quarterly, Semi-Annual, or Yearly Credits

Good afternoon everyone, I hope your week is going well. I recently read a great blog post on Frequent Miler about maximizing American Express credits and it made me realize that there are a ton of AMEX credits out there right now with various frequencies (monthly, quarterly, semi-annually, and yearly). After reading the blog post, I took a look at my current American Express credit card lineup and it hit me… I don’t have any of those credits anymore and I’m not sad about that.

Continue reading

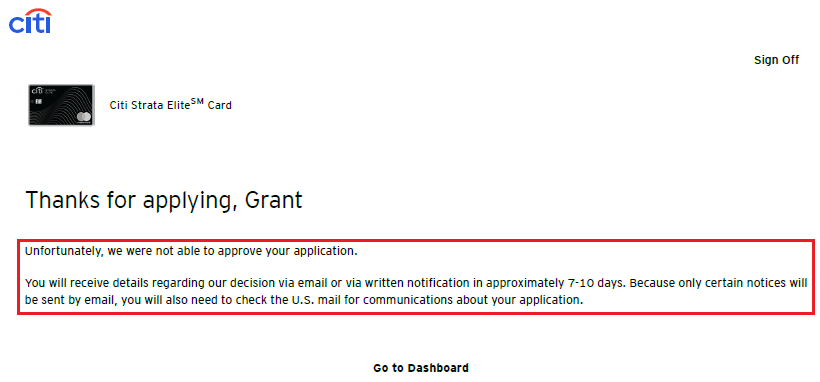

A Tale of Two Citi Strata Elite Credit Card Applications

Good afternoon everyone, I hope your week is going well. First, a quick nod to the bookworms and literary buffs who caught the reference to A Tale of Two Cities by Charles Dickens. Now let’s fast forward to this century. In mid-December, Laura and I both applied for the Citi Strata Elite Credit Card because we were hoping to triple dip the annual benefits ($300 Hotel Credit and $200 Splurge Credit) in December 2025, January 2026, and again in January 2027 before the $595 annual fee was due. Unfortunately, “it was the best of times, it was the worst of times” in terms of instant approvals.

The Results

My application: instant denial. Laura’s application: pending.

Don’t Let your Hilton Free Night Certificate Expire: Call to get a 2 Week Extension

Good afternoon everyone, happy Friday! Today I wanted to share a quick tip that might save you from losing a very valuable free night certificate. If you’ve ever earned a Hilton Free Night Certificate from a credit card, you know how valuable they can be toward a hotel stay. Unfortunately, those certificates also come with expiration dates and those dates may not line up with your travel plans. Recently, I had a Hilton Free Night Certificate that was set to expire on February 10. Instead of rushing to use it on a nearby hotel, I decided to call Hilton (1-800-446-6677) and see if there was anything they could do. After explaining the situation, the rep offered to extend my existing certificate by 2 weeks.

To find your certificate and expiration date, log into your Hilton account, click your name in the top right corner, and scroll down to the Rewards section. You should see when your certificate is set to expire.