Good afternoon everyone, I hope you had a great weekend. I am excited to share that Laura and I are having a baby girl in August. With our upcoming Player 3 little bundle of joy, our travel plans will be on pause for a while, but I wanted to build up a big Alaska Airlines mileage balance so that when we take to the skies once more, we will have plenty of miles available.

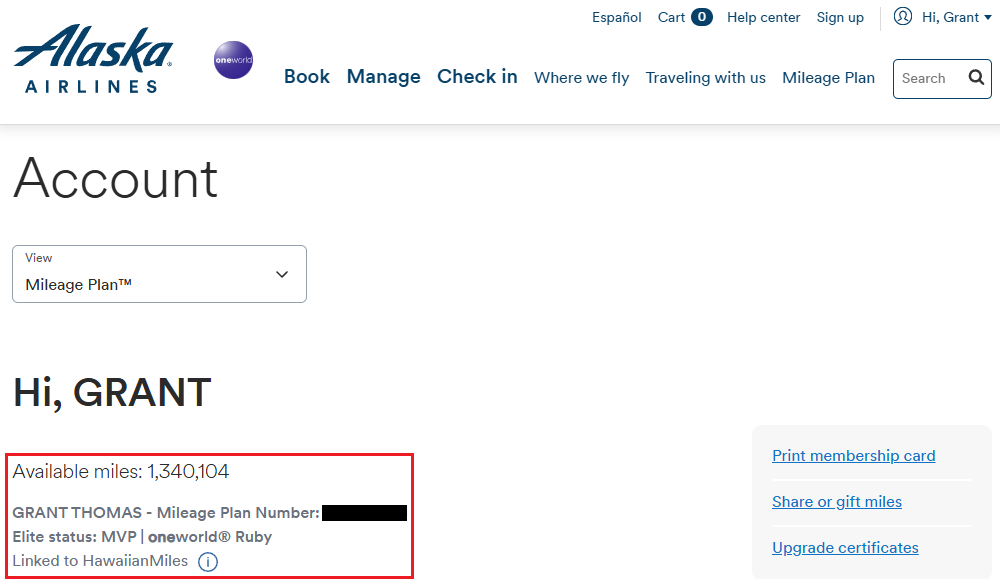

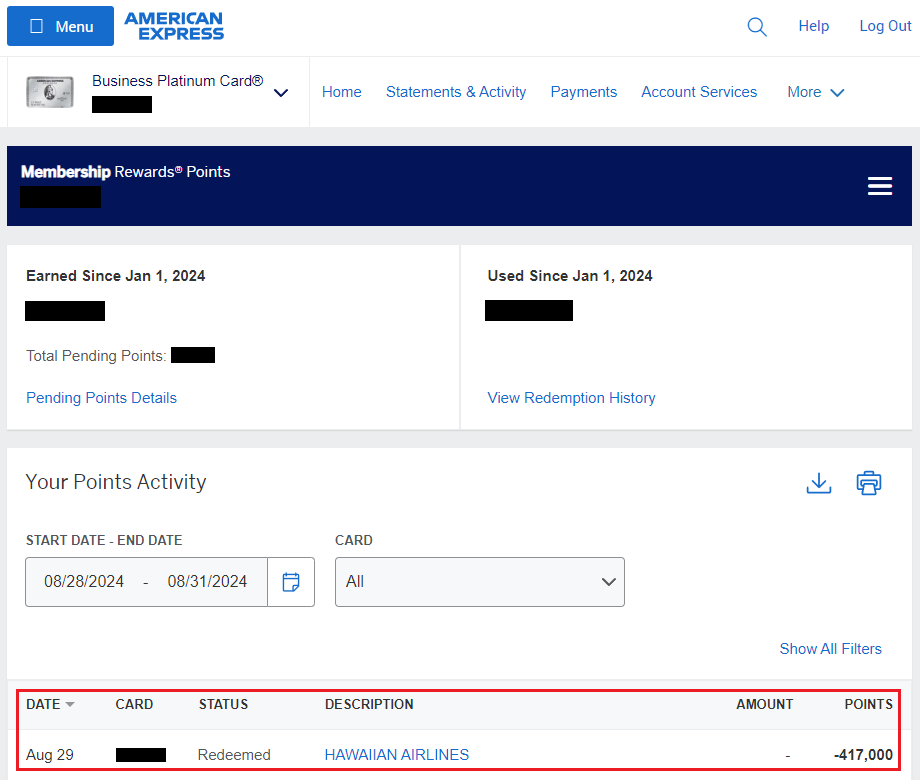

As of May 2025, I have 1.3 million Alaska Airlines miles in my account. We built up this balance in the last year by transferring lots of AMEX Membership Rewards Points to our Hawaiian Airlines accounts, applying for Barclays Hawaiian Airlines credit cards, and then by consolidating all our miles into my Alaska Airlines account. For a step by step guide on how to do that, please read How to Transfer, Combine, or Move Alaska Airlines and Hawaiian Airlines Miles (with Direct Links).

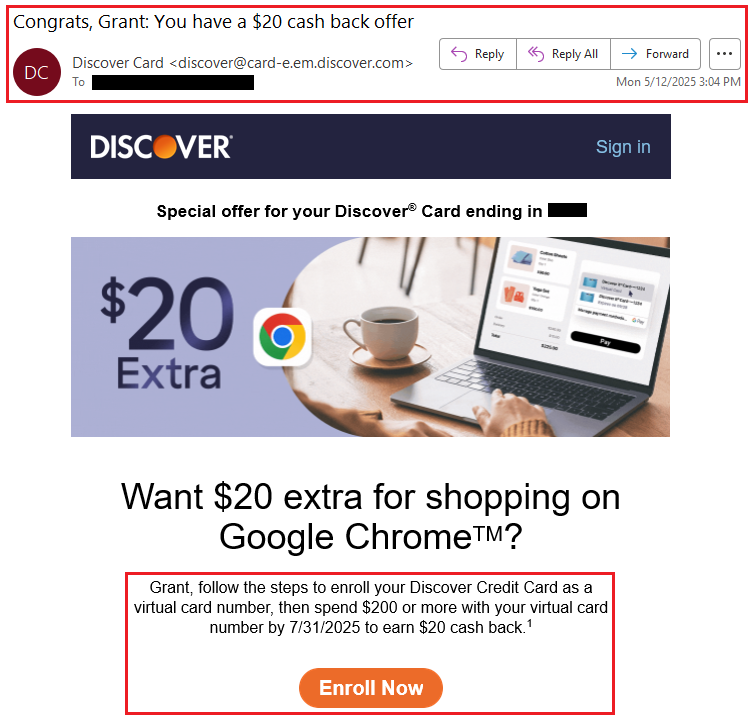

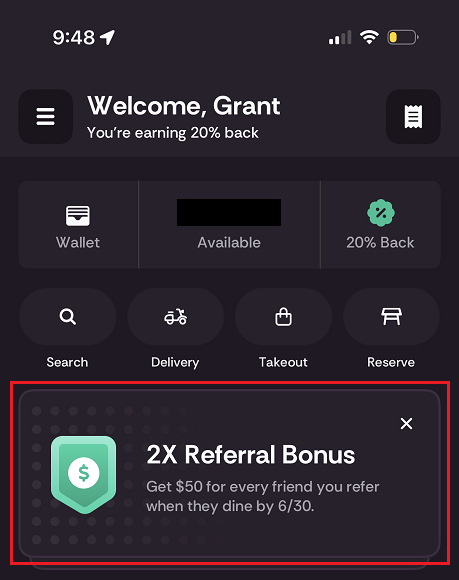

With all that said… Should I transfer all my AMEX Membership Rewards Points to Hawaiian Airlines? After reading this post, please let me know your thoughts.