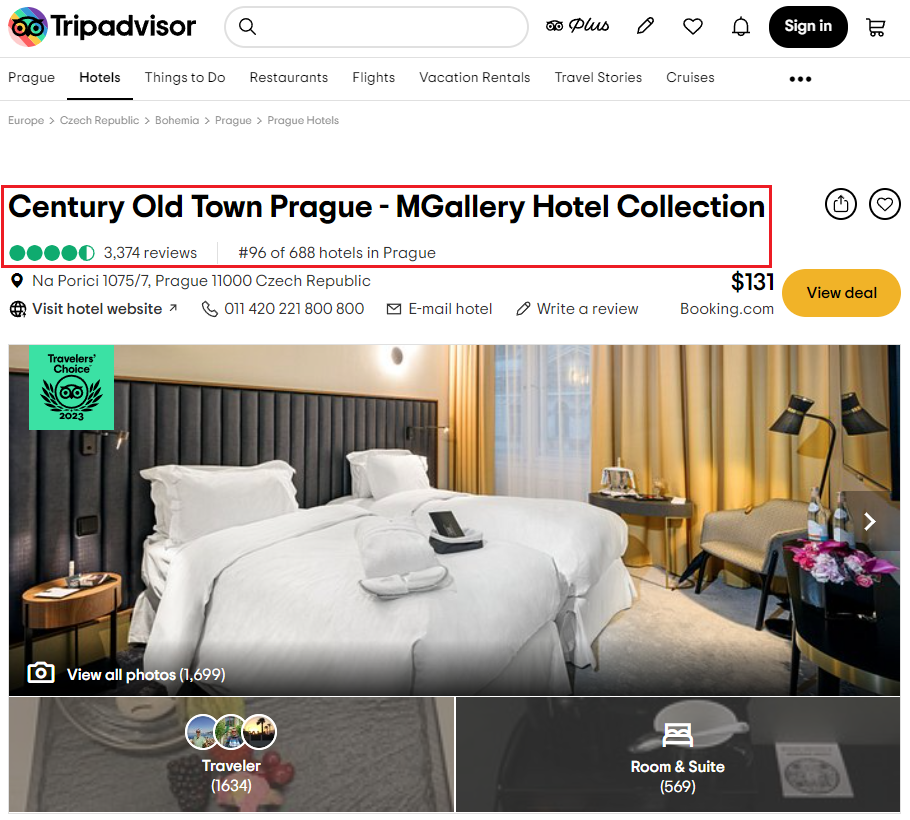

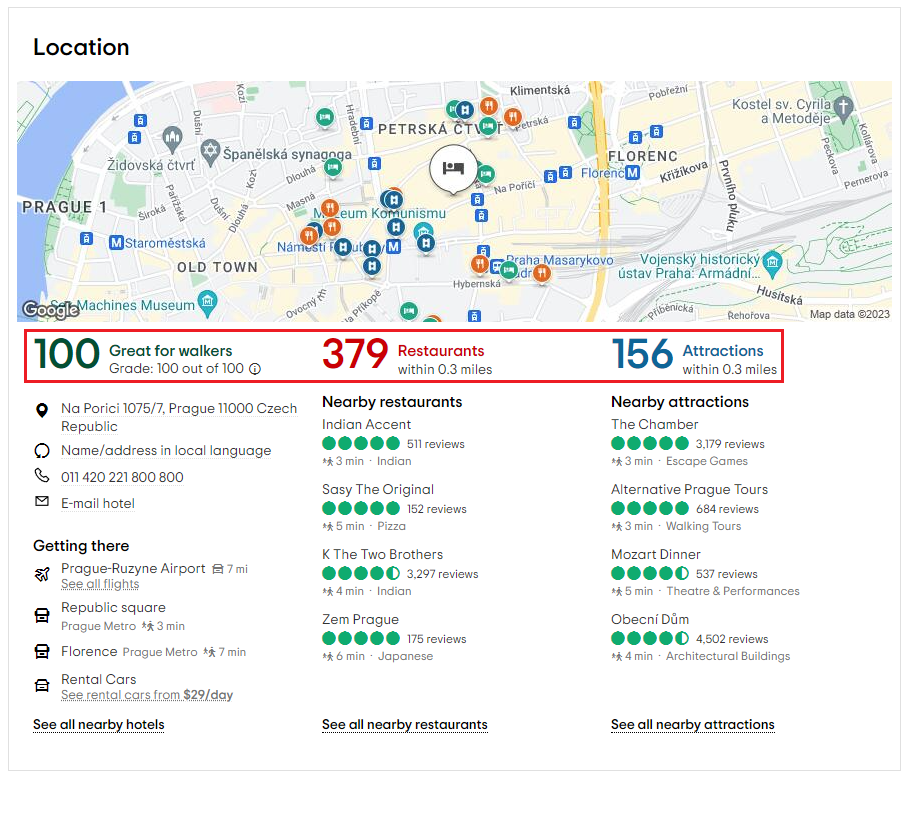

Good morning everyone, I hope your week is going well. 3 weeks ago, my wife and I decided to book a last minute trip to Europe this summer with stops in Prague (PRG), Copenhagen (CPH), and Amsterdam (AMS). When I was researching hotels in Prague, I heard many good things about Old Town Prague and wanted to stay there. There were several chain and independent hotels to choose from, so I checked TripAdvisor to see which hotels were highly rated. That is how I stumbled onto the Century Old Town Prague – MGallery Hotel Collection. It has great reviews, is in a great location, comes with free breakfast and wifi, and the price was right.